When Will Local Buying Drive Japanese Stocks to New Highs?

Foreigners Can't Do Everything...

Author: Chris Wood

The pressure on Bank of Japan Governor Kazuo Ueda continues to rise, in terms of accelerating the long overdue normalisation of monetary policy.

Service sector inflation data has remained relatively high.

Services producer price inflation was 2.5% YoY in May, though down slightly from 2.7% YoY in April and a recent high of 2.8% YoY reached in November, which marked the fastest pace of service sector inflation since September 1991 if the periods affected by sales tax hikes are excluded.

The ten-year breakeven inflation rate has of late been running at its highest level in 11 years, while the five-year breakeven is even more elevated.

The 10-year breakeven, measured as the 10-year nominal JGB yield less the CPI-linked bond yield, rose to 1.708% on 27 June, the highest level since 2013, and is now 1.504%.

Meanwhile, the five-year breakeven inflation rate rose to 1.793% on 27 June and is now 1.556%.

All this is why more rate hikes are long overdue, with the next BoJ meeting scheduled for 30-31 July.

Investors are now expecting another 20bp of hikes in the overnight call rate by the end of this year based on the overweight index swaps.

The case for further tightening is even stronger if it is assumed, as is this writer’s longstanding view, that the more appropriate inflation target for Japan is 1%, not 2%, given the country’s lower trend growth rate courtesy of its demographics.

Remember that former BoJ Governor Haruhiko Kuroda insisted on 2% because he liked to say it was the “global standard”.

There is Potential for Quantitative Tightening

Meanwhile, a speech by BoJ Deputy Governor Shinichi Uchida on 27 May shows growing evidence of a change in thinking at the Japanese central bank.

Indeed, it reads almost like a declaration of victory against deflation.

At the end of his speech, titled “Price Dynamics in Japan over the Past 25 Years”, Uchida noted that, while there was still a big challenge to anchor inflation expectations to 2%, the end of the battle was in sight.

Indeed, he concluded the speech by stating “This time is different”.

The other issue is the potential for quantitative tightening in Japan.

On that point, former BoJ executive director Kenzo Yamamoto called in a speech in May for the swift enactment of a formal programme to reduce the balance of the Bank of Japan’s vast holdings of JGBs (see MNI Interview: “Ex-BoJ’s Yamamoto Urges Swift Asset Reductions”, 10 May 2024).

The reason for such a programme, he argued, is to reduce the risk of future pressure from the government on the central bank to buy bonds to finance yet more fiscal stimulus.

The BoJ policy meeting in June saw a first cautious move in this direction with Ueda stating that the central bank will announce in the 30-31 July meeting a detailed plan for reducing its JGB purchases over the next one to two years after “collecting views from market participants”.

He also said in the post-meeting press conference that the size of the reduction would be “meaningful”. The BoJ’s purchases are currently running at around Y6tn a month.

The BoJ owns an enormous 53% of outstanding JGBs, while its balance sheet has increased by nearly fivefold since early 2013 to Y754tn as of 10 July.

Ueda also said that there is a possibility the BoJ could decide to raise interest rates again in July, depending on economic data available at the time.

Foreign Investors are Driving the Japanese Stock Market, but This Could Change.

If the focus is on the BoJ, it is the case that the Japanese stock market remains primarily driven by foreign money, with foreign investors again net buyers last quarter.

They bought a net Y1.31tn last quarter, following net buying of Y3.01tn in 1Q24, and have bought a net Y313bn in the first two weeks of July.

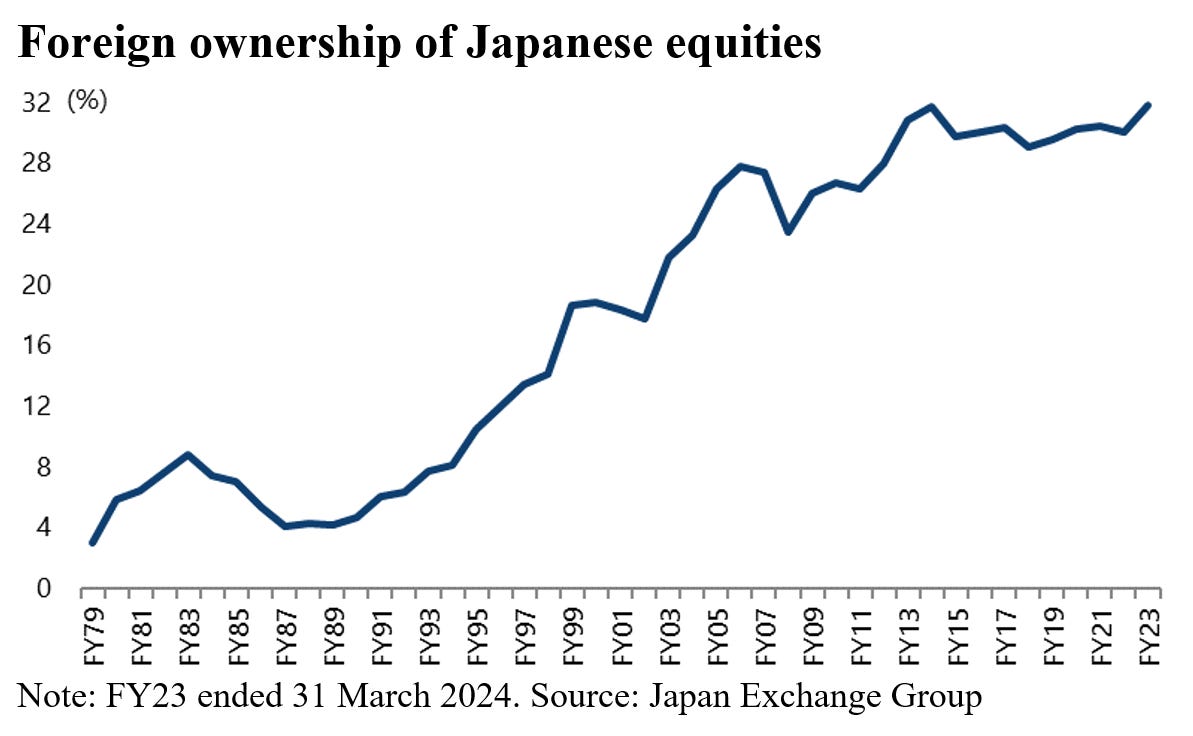

Foreigners now own 31.8% of the Japanese stock market, up from only 4% at the peak of The Bubble Economy in late 1989, since when Japanese domestic institutions have continued to reduce weightings to their own stock market.

Japan Institutions Aren't Buyers of Domestic Stocks Yet...

So, there has yet to be confirmation that Japanese institutions believe in their own stock market in terms of a reallocation out of yen fixed-income into Japanese equities.

Still, the reform of the tax-exempt Nippon Individual Savings Accounts (NISA), which kicked in from 1 January, has led to the anticipated increase in flows into these accounts.

The latest Japan Securities Dealers Association survey of 10 major traditional and online brokerages showed that domestic stocks accounted for 42% of the purchases via the new NISA program in the January-June period, compared with 54% for investment trust funds.

The survey also showed that purchases through NISA accounts totaled Y7.51tn in January-June, up fourfold from Y1.83tn in January-June 2023.Help Grizzle Research & Quant continue to provide a different take on markets. Consider becoming a free or paid subscriber.