Own the AI Picks and Shovels, Not the Models

Author: Chris Wood

With the US stock market’s dramatic decline in recent days triggered by the 2 April tariff announcement, the base case remains that the Federal Reserve will fudge the inflation target, and that US inflation will settle structurally higher post pandemic.

This looks ever more likely following recent inflation data.

US inflation on a YoY basis remains significantly above the 2% target on both major measures.

Headline CPI inflation and core PCE inflation were both 2.8% YoY in February.

Indeed CPI inflation bottomed on a year on year basis last September at 2.4% YoY, while core PCE inflation bottomed last June at 2.6% YoY.

The money markets are still assuming renewed easing later this year, as is this writer, even if this week’s payroll data has further confirmed a Fed on hold.

The Fed funds futures now expect 95bp of rate cut by the end of 2025 with the first cut in June.

Meanwhile, Friday’s payroll data was more or less neutral in its impact.

US nonfarm payrolls increased by 228,000 in March, compared with consensus expectations of 140,000, while the increase in the previous two months has been revised down by 48,000.

Government and healthcare/social assistance sectors have accounted for 62% of the job gains in the 12 months to March.

Hyperscaler CAPEX is Showing No Signs of Slowing So Far

Meanwhile, there is growing negative focus on the gargantuan amounts being spent by the hyperscalers on the AI arms race.

In this respect the initial reaction to DeepSeek, namely that the hyperscalers would spend less, has been for now at least abandoned.

Based on the guidance provided by the companies in the latest quarterly earnings season, they are now on course to invest US$320bn in capex this year, up from US$230bn last year.

Another issue is the breakdown of where that capex is being spent, in terms of semiconductors or data centers for example.

In terms of the macro data, the chart below shows a spike in the private construction of data centers, which is part of the “office” category.

Thus, private construction spending for data centers has risen by an annualised 51% over the past two years from a seasonally adjusted annual rate of US$14.3bn in December 2022 to US$34.75bn in February 2025.

As a result, it now accounts for 39% of private office construction, up from 17% in December 2022.

This compares with an annualised US$234bn spent on private construction of factories in February, of which US$123bn or 53% were for the computer, electronics and electrical manufacturing sector.

Extending Depreciation Schedules to Support Free Cash Flow

Returning to the hyperscalers, a further relevant issue is how this spending is accounted for in terms of depreciation schedules and the like.

Given the aggressive accounting standards often employed in America, this writer’s base case is that the hyperscalers will be in no hurry to pay for it.

This means the impact on free cash flow generation can be delayed.

On this point, Meta extended in January the expected life of its servers and network assets by six months to five and a half years, which will reduce its 2025 depreciation expenses by approximately US$2.9bn.

This compares with the expected server and network equipment life of six years for Microsoft, Google and Amazon.

Still the example of Meta, when its share price reacted very negatively to the deterioration in free cash flow triggered by its investment in the Metaverse back in 2022, shows that these stocks will remain very sensitive to the deterioration in free cash flow which is the natural consequence of the AI arms race.

Clearly, the hyperscalers have in reality no choice but to engage in the arms race given both the commercial opportunity presented by the hopes for so-called generative AI and, perhaps even more importantly, the disruption threat posed by it.

But that does not mean that every Big Tech incumbent will win.

In fact, it would be astonishing if at least some of the incumbents are not disrupted.

The reality is that these companies are all converging on the same area, while draining their former “moats” in terms of the cash being spent.

Meanwhile, the fundamental implication of the DeepSeek moment is that so-called “large language models” for AI “learning” are becoming commoditised.

Own the AI Picks and Shovels, Not the Model Providers

All of the above is why this writer would continue to prefer to own the AI picks and shovels plays than those spending on the capex.

In Asia the story is somewhat different because the Chinese AI-related companies are so much cheaper.

Still share prices are rising.

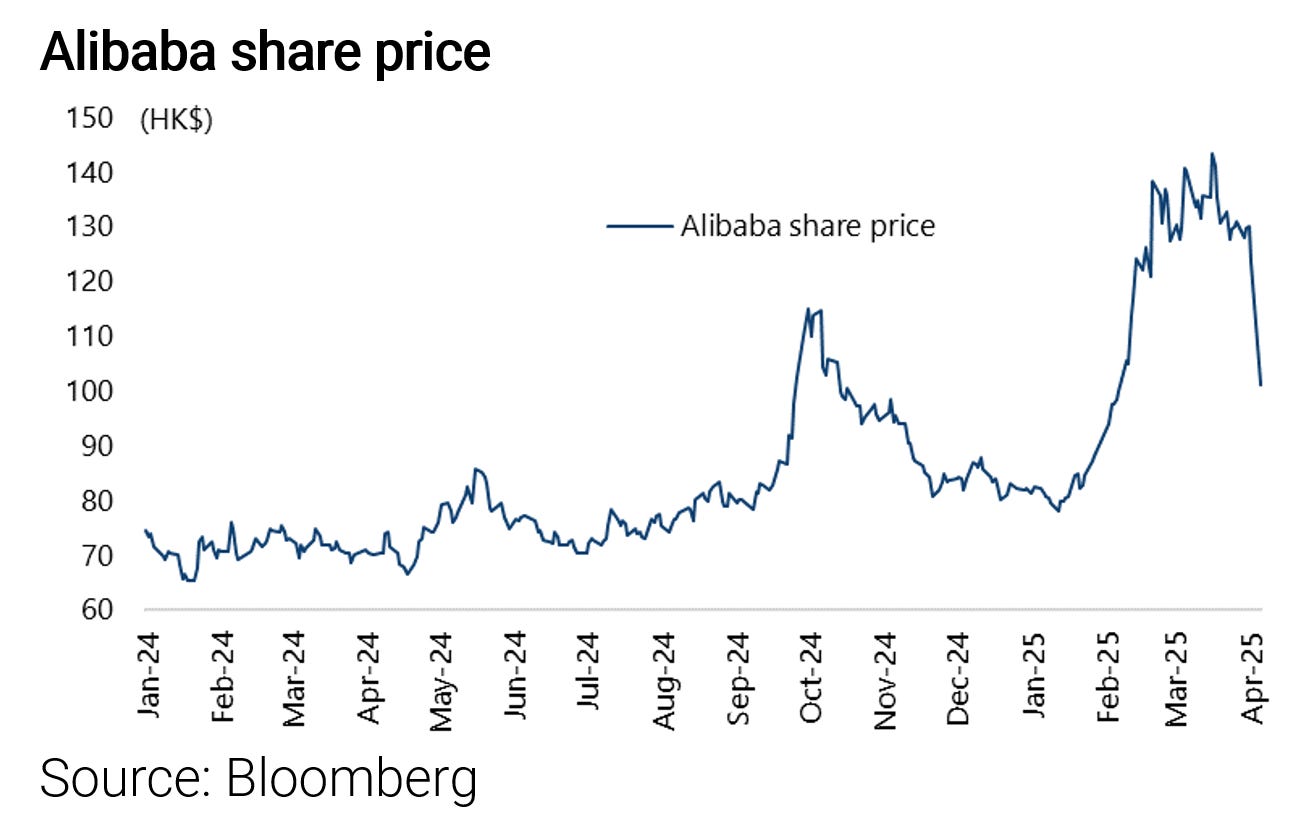

Alibaba is up by 23% since the DeepSeek news in late January even after the correction of recent days.

Hyperscaler Weighting in the World Indexes Has Peaked in Our View

Meanwhile it is increasingly looking like the 15.4% of MSCI All Country World represented by the four major hyperscalers and Nvidia in late December represented a historical peak (11.1% if Nvidia is excluded).

In fact, this will be the base case of this writer until proven wrong.

It is now 13.0%, or 9.8% if Nvidia is excluded.

For related reasons the base case is also that the US made an all-time peak as a share of world stock market capitalization on 24 December last year when it represented 67.2% of MSCI All Country World as previously discussed here (see “Why The Failure of DOGE is Our Base Case”, 11 February 2025).

It is now 63.1%.