Betting on Lower Interest Rates?

Will it be Inflation or Employment That Drives the First Interest Rate Cut?

Author: Chris Wood

Federal Reserve statements and press conferences are probably more over analysed and commented upon than any other area of the financial markets.

Still it is worth noting that in Jerome Powell’s post-FOMC press conference in March the Fed chairman mentioned no less than eight times in the press conference, and five times in the first five minutes, that the 2% inflation target will be reached “over time”.

This emphasis on the phrase “over time” does suggest a soft removal of the 2% target or, at least, an elongated timeline to get there.

This certainly supports this writer’s continuing base case, namely that the Fed will prioritise the employment mandate over the inflation mandate in a presidential election year. Indeed it would probably do so even if it was not an election year.

It is also the case that last week’s inflation data was not as good as the markets’ positive reaction.

Rather it represented relief that, after three months of bad data, there was a slight improvement.

Thus, April US CPI data came in broadly in line with consensus expectations for the first time this year.

Headline CPI rose by 0.3% MoM and 3.4% YoY in April, down from 3.5% YoY in March.

While core CPI increased by 0.3% MoM and 3.6% YoY, down from 3.8% YoY in March.

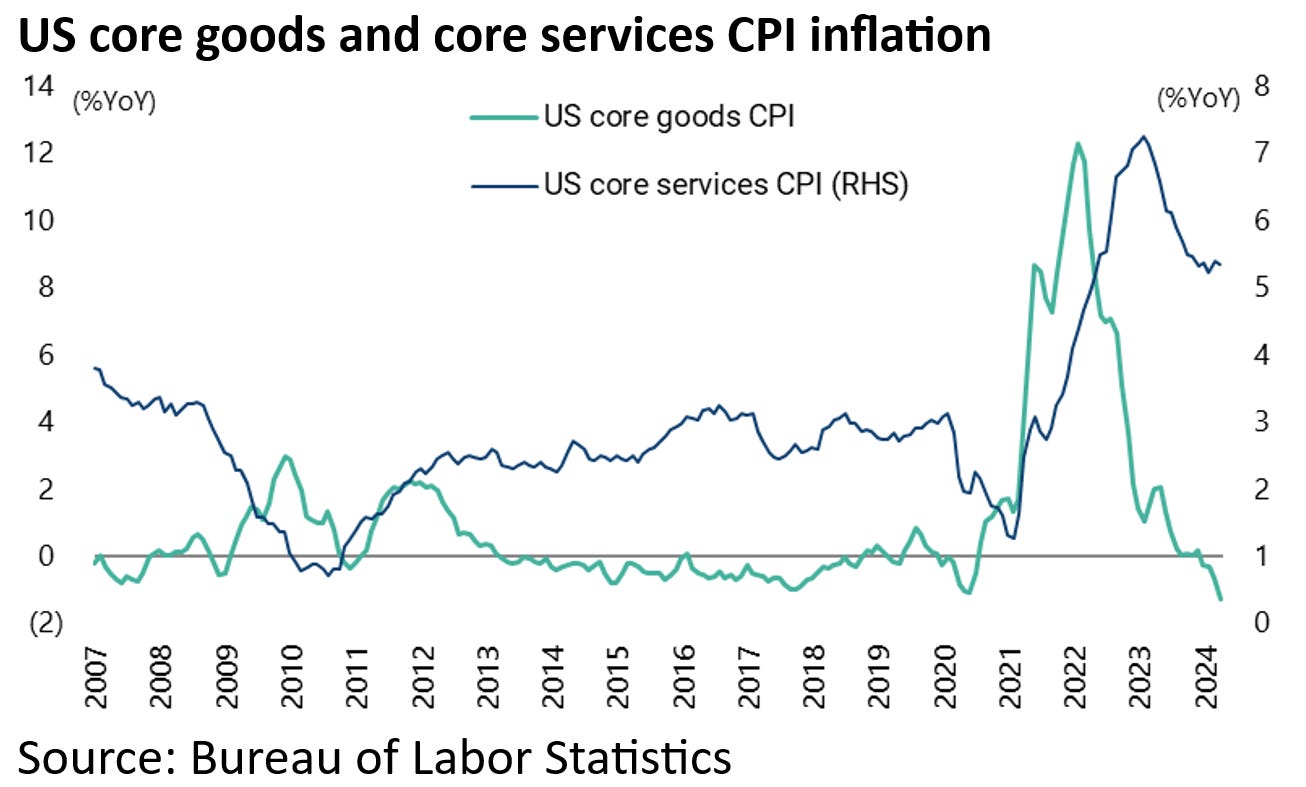

Still service sector inflation remains sticky.

Core services CPI was up 5.3% YoY, though down from 5.4% YoY in March.

As for so-called “supercore” inflation, measured as core services CPI excluding housing, it rose from 4.8% YoY in March to 4.9% YoY in April and is still up 6.3% on a three-month annualised basis.

Whats the Deal with Sticky Housing Costs?

As for the vexed issue of housing costs, “shelter” still accounts for a significant 45.4% of core CPI.

On this point, rental inflation, otherwise known as “shelter”, recorded in the official CPI data lags about 12 months behind the actual changes in the costs of new leases as measured by the Zillow observed rent index.

Zillow observed rent inflation peaked at 15.9% YoY in February 2022 and has since declined to 3.6% YoY in April.

By contrast, shelter peaked at 8.2% YoY in March 2023 and was 5.5% YoY in April.

Still, as the chart below shows, the costs of new leases measured by the Zillow index rose significantly faster than the official shelter CPI in the period between 2021 and 2022 while the shelter CPI inflation has only started to play catch-up since the beginning of last year.

Indeed the following chart, which shows the increase in observed rents since the onset of the pandemic relative to the increase in shelter over the same period, shows that the official shelter CPI data is still understating the actual rental costs, as measured by the Zillow index, by 7.4%.

Thus, the Zillow rent index has risen by 31.5% since February 2020 while shelter is up 22.4% over the same period.

The conclusion is that “shelter” is coming down but the “landing” may take longer than anticipated by many.

The good news for the Fed is that core goods CPI is running at a negative 1.3% YoY. But core services are 61% of headline CPI, whereas core goods are only 18.6% and food and energy 20.4%.

The Fed: Reading Between The Lines

Meanwhile, the Fed remains as deliberately vague as ever as to exactly which inflation measure it is targeting as regards the 2%.

As for the US labour market, April’s employment data has also been viewed as doveish.

First, a large part of the job gains remains in the government and health care sectors which, as noted by the Wall Street Journal in a recommended editorial earlier this month, is in large part a function of America’s continuing huge fiscal deficits and the resulting surge in transfer payments (see Wall Street Journal article: “The Government-Spending Jobs Boom”, 4 May 2024).

US nonfarm payrolls increased by 175,000 in April, compared with consensus expectations of 240,000. While employments in the government, healthcare and social assistance sectors increased by a combined 95,000 jobs in April, accounting for 54% of the increase in nonfarm payrolls.

The other important data point is that average hourly earnings growth slowed to 3.9% YoY in April, the lowest level since May 2021.

Meanwhile the reality is that the Fed would now probably welcome some softening in the labour market to give it an excuse to resume easing well before the presidential election.

The Sahm Recession Rule is Flashing a Warning Across a Third of the US

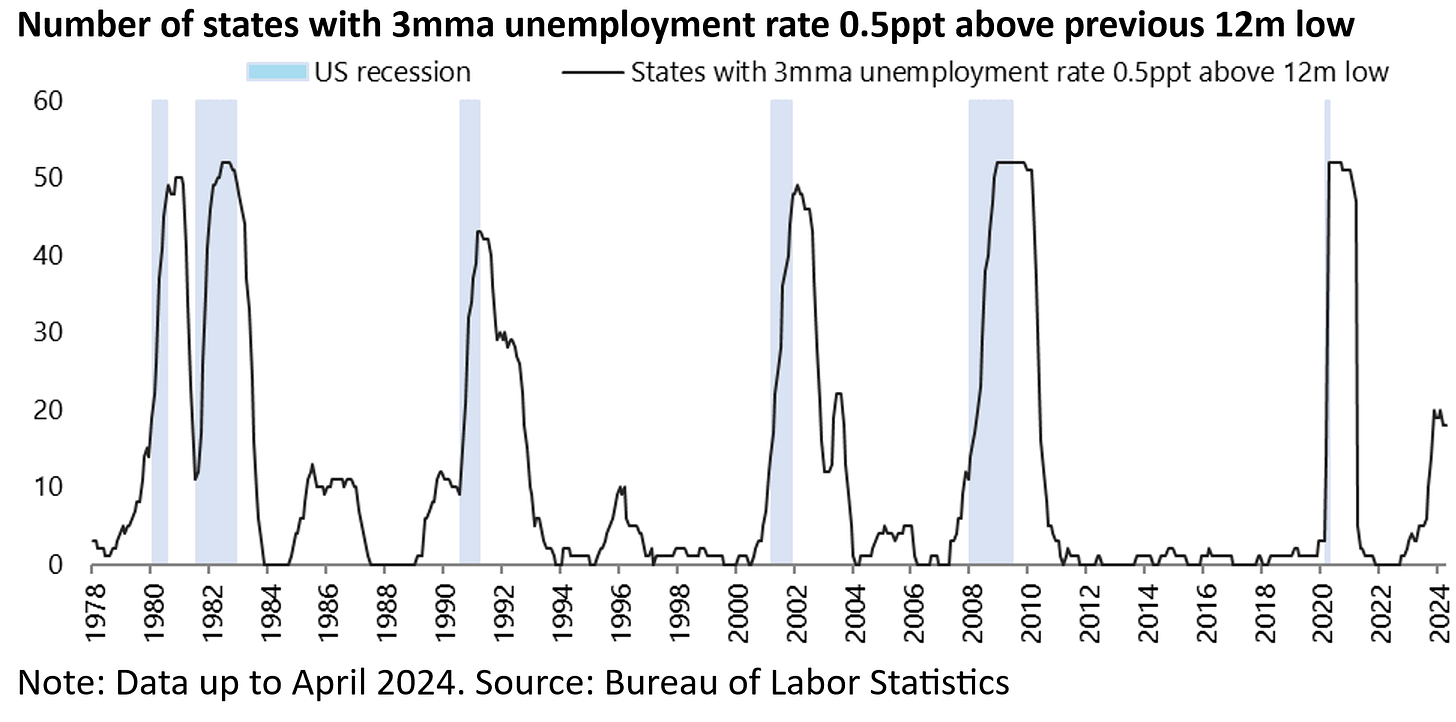

Staying on the labour market, it is also interesting to note that 18 US states have now registered increases in unemployment sizeable enough to trigger the so-called Sahm recession rule conceived by a former Fed economist Claudia Sahm, up from three states a year ago.

This rule states that a recession will occur when the three-month moving average of the US unemployment rate rises by a half percentage point or more relative to its low during the previous 12 months.

But for this rule to apply nationally, the three-month average unemployment rate would have to rise above 4%.

It was 3.87% in April or 0.37 percentage point above the 12-month low.

It is also worth highlighting that it is the case, historically, that once unemployment starts rising, it usually increases quickly, as reflected in the chart below.

In this cycle, this dynamic could be all the more pronounced if there is a sudden discarding of the labour hoarding mentality which has been a feature of the post pandemic period.

If mortgage rates drop even a little, their effect on the shelter CPI component is going to stop it from declining. Any drop in mortgage rates is being met by a surge in buying (increased affordability) with no corresponding surge in selling (mortgage rate still significantly higher than existing locked in mortgages). There's a significant lag involved, but house prices do effect people's impression of what they can collect in rent (shelter CPI component).