With Credit Conditions Easing, How Can a Hard Landing Still be on the Table?

Author: Chris Wood

The bond market has staged a big rally of late helped by growing confidence that the US monetary cycle is over in the sense of no more rate hikes, a view shared by this writer.

Still while the current view of most economists is that the US will avoid a recession next year, the base case here remains that of a recession.

The above outlook should be positive for Treasury bonds.

Still there remains the question, discussed here previously (see A Treasury Maturity Wall Is Coming, Is Your Portfolio Ready?, 1 November 2023), of whether the Treasury bond sell-off last quarter was driven primarily by supply-side concerns as opposed to the “higher for longer” narrative.

If the former explanation was the chief driver of Treasury bond weakness, it is also the context where the role played by Treasury bonds as collateral for the system will also start to be questioned.

On this point, the growing risks associated with excessive reliance on government bonds as collateral were discussed in a highly recommended BIS paper published earlier this year (see BIS article: “Collateral damage” by Claudio Borio, Stijn Claessens, Andreas Schrimpf, and Nikola Tarashev, 11 July 2023).

The paper noted that a “seismic shift’’ has taken place in the financial system in recent years in the sense that the use of collateral, notably in the form of government securities, has become “ubiquitous” as opposed to the old practice of basing collateral on borrowers’ cash flows.

To quote from the paper directly, “Of particular concern today, an adverse shock to the value of government paper used as collateral could trigger destabilising dynamics, including a temporary loss of its safe haven status”.

The BIS report goes on to argue that excessive reliance on government bonds as collateral can “reduce incentives to screen and monitor borrowers” while raising aggregate leverage.

It also notes that the widespread use of government paper as collateral raises liquidity risks in the event of a risk-off event.

This in turn raises the issue of the declining liquidity in the Treasury bond market which Fed officials have been warning about in recent months.

Such an outcome, where the “risk free” status of Treasury bonds is questioned, even if only temporarily, may seem to many an extreme event.

But in this writer’s view it is no longer far-fetched to think about, as is also evidenced by the fact that such a paper has been published by the BIS.

Even with the Recent Rally in Bonds, Don't Forget We are Still in a Bond Bear Market

Meanwhile, the near-term impact of the still anticipated Fed fudging of its 2% inflation target would confirm that Treasury bonds, and most likely all other G7 government bonds, are in bear markets, as has been this writer’s view since early 2020 in response to the Fed monetary expansion triggered by Covid.

The bear market view of Treasury bonds is also supported by the breaking of the trend line in the long-term chart of the ten-year Treasury bond yield going back to the beginning of the 1980s.

As for the continuing risks of a US downturn, and the related threat to equity valuations, one key issue remains the growing credit risks in the formerly booming world of private equity and private lending.

This issue will not be elaborated on again here save to note again the critical point, namely that all the players in this essentially unregulated “alternative” world are incentivised to delay price discovery for as long as possible.

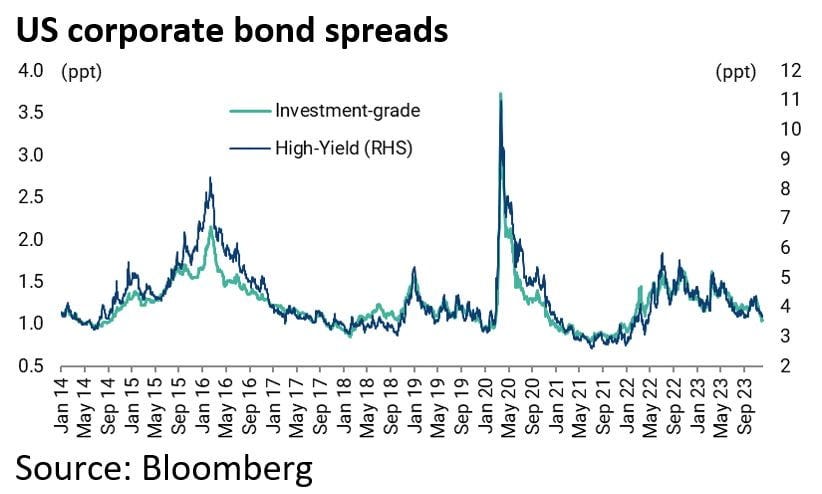

Corporate Bond Spreads Don't Reflect Financial Stresses Under the Surface

Meanwhile, there is other evidence accumulating of growing stresses even as corporate bond spreads have remained relatively well-behaved because most large American corporates took advantage of the ultra-low bond yields in recent years to term out their debt.

A research paper published by Federal Reserve economists in June, for example, concluded that a significant 37% of nonfinancial companies in America are in financial distress, with financial distress defined as “close to default” (see FEDS Note: “Distressed Firms and the Large Effects of Monetary Policy Tightenings” by Fed economists Ander Perez-Orive and Yannick Timmer, 23 June 2023).

This analysis is based on a sample of US nonfinancial companies covered by Compustat on a quarterly basis since 1990.

The authors estimate that the sample size accounts for around one-third of total US nongovernment sector employment.

The Compustat database, a product of S&P Global Market Intelligence, covers around 10,000 US companies.

As a result, the authors conclude that the recent monetary tightening is likely to have a bigger effect on investment, employment, and aggregate demand than most tightening cycles since the late 1970s and that these effects will likely become “most noticeable” in 2023 and 2024 given the usual lags in terms of the impact of monetary policy.

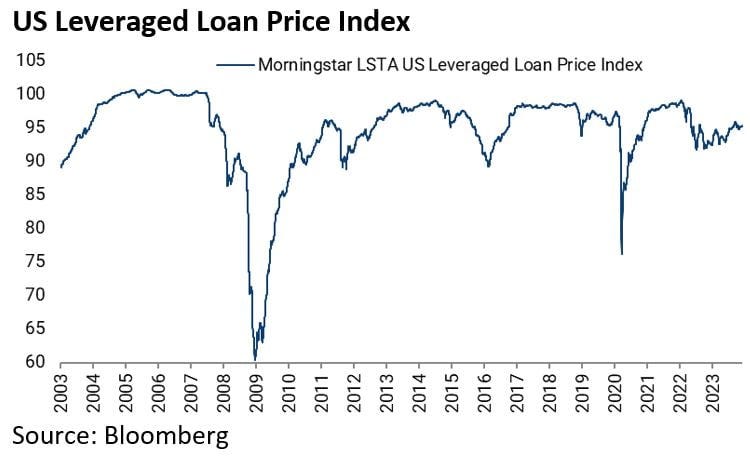

These are dramatic conclusions and certainly contrast with the seeming calm in US credit markets as reflected in a leveraged loan index, which is still trading only 5.2% off its all-time high reached in 2005.

Remember that leveraged loans are linked to Libor or the new benchmark secured overnight financing rate (SOFR) after Libor’s expiry on 30 June, and, as discussed here previously (see Canary, Meet Leveraged Loans, 29 March 2023), in most cases the interest rate risk in such loans has not been hedged.

Still, as long-term observers of financial markets, particularly credit markets, will appreciate a problem only becomes a problem for markets when it is recognized as one.

A Vocalized Inflation Fudge Could Trigger a Treasury Bond Selloff

Meanwhile, the anticipated Fed fudge of the 2% inflation target, in terms of the Fed prioritising its employment mandate over its inflation mandate in the event of clear evidence of labour market weakness, will then increase the chances dramatically that the US Treasury bond market will be vulnerable to a supply-related sell-off.

This is because the Fed’s credibility will be questioned while there will, at that point, be ever more mounting market focus on the rising debt-servicing costs of running America’s huge fiscal deficits at a time when it is extremely unlikely that there will be the political will to cut spending whichever political party is in power.

This is the context where it becomes more possible that Washington will end up resorting to Japanese-style yield curve control policies and related policies of financial repression.

It is also the context where it will become increasingly likely that the value of Treasury bonds as collateral for the system will start to be questioned.

In this respect, the above-mentioned BIS report could well prove to be prescient.

The other point to note about the BIS report is that it is primarily related to capital market risk.

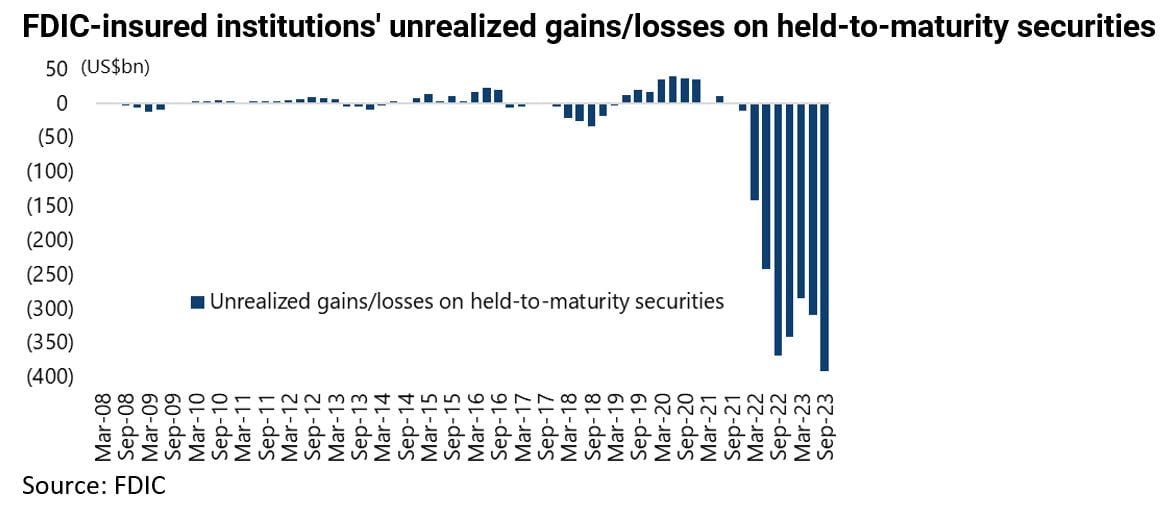

But the point about the excessive reliance on “risk free” Treasury bonds as collateral also applies to US commercial banks.

In this respect, the market is in danger of forgetting about the mounting losses on US commercial banks’ Treasury bond holdings which they do not have to mark to market so long as they hold them to maturity.

To be precise, if banks designate bonds as “held to maturity” securities, they are allowed to exclude unrealized losses on them from equity as long as they do not sell them.

These securities are reported on the balance sheet at the amortized cost.

In terms of the aggregate data, FDIC-insured commercial banks’ and savings institutions’ unrealized losses on held-to-maturity securities increased by 26% QoQ to US$390.5bn at the end of 3Q23, according to the FDIC.

At that time the 10-year Treasury bond yield was 4.57%. It is now 4.26%.