Why The Time Has Come to Overweight International Stocks

Author: Chris Wood

Whatever the exact trigger, the extraordinarily recent sharp appreciation of Taiwan’s currency, the NT dollar, is perhaps the clearest signal yet that the US dollar has put in a major peak and that Asian currencies have commenced an era of sustained appreciation.

The NT dollar appreciated by 7.8% against the US dollar in the week to 5 May and is now up 10.6% year to date.

This writer has long argued that Taiwan is the supreme mercantilist in Asia.

Prior to May its real effective exchange rate had declined by 28% since the start of 1994, despite an average current account surplus over the past ten years of 13.3% of GDP.

The current account surplus has risen from a low of 1.1% of GDP in 1998 to an annualised 14% of GDP in the four quarters to 1Q25.

This policy was driven primarily by the Taiwan central bank’s longstanding goal to protect traditional export sectors such as steel and petrochemicals rather than the likes of TSMC.

Other Asian Currencies Are Beating the Dollar As Well

Meanwhile, staying on to the Asian currency revaluation theme, other regional currencies have appreciated in the NT dollar’s wake.

If the Taiwan currency is at its highest level since June 2022, the Korean won is up 8.0% against the US dollar year to date.

As for the Singapore dollar, Asia’s nearest equivalent to the Swiss franc, it is up 6.5% year to date and looks poised for a potential breakout on the chart.

All this is a reason for global investors, be they equity or fixed-income orientated, to allocate more money to the Asian region even if currency appreciation is not great for export stocks.

It is also another reason to reduce holdings of US Treasury bonds, if America’s extreme fiscal deterioration and the message of Chairman of the Council of Economic Advisers Stephen Miran’s paper last November was not enough reason as previously discussed here (see Grizzle article: “Mar-A-Lago Accord Deep Dive: Implications and Risks”, 29 April 2025).

The 7.8% appreciation of the Taiwan currency in early May certainly wipes out any benefit from holding higher bond yields in the US, as Taiwan’s life insurance companies have reportedly found out to their cost (see Bloomberg article: “Taiwan Life Insurers’ $700 Billion Bet on the US Is Backfiring”, 11 June 2025).

The US Budget is on Very Shaky Ground

Meanwhile the latest update on fiscal deterioration in the US, which owners of Treasury bonds should be aware of, is that net interest payments and entitlements were still running at 93% of total federal government receipts in the 12 months to May, the latest data available.

The action in the foreign exchange market should also silence, for now at least, those talking heads continuing to call for renminbi devaluation.

The renminbi has risen by 1.6% against the US dollar year to date.

This writer remains of the view that the Chinese currency is much more likely to appreciate than depreciate against the US dollar in coming years.

Indeed this is a reason for global investors to have exposure to both Chinese equities and government bonds.

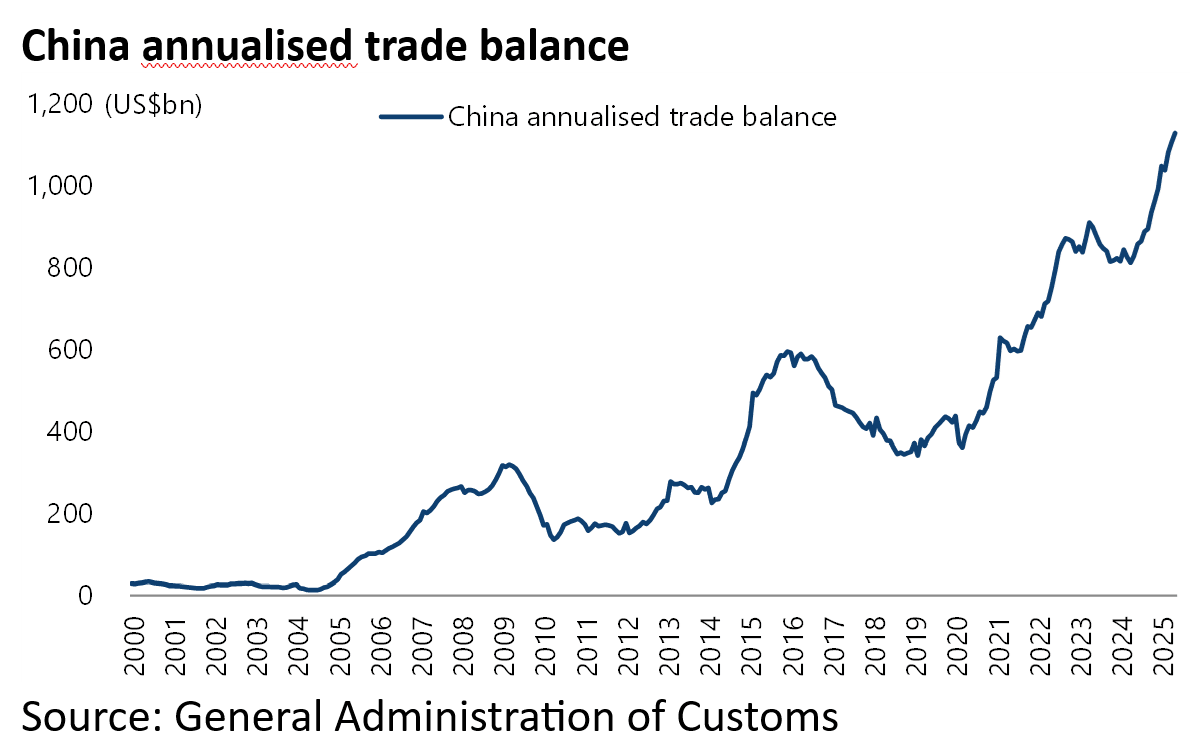

Meanwhile, the predictions of China currency devaluation have continued to look odd in the context of a China trade surplus which reached a record annualised US$1.13tn in the 12 months to May, even allowing for a 34.5% YoY plunge in China exports to the US in May.

Hong Kong Looks Interesting, Driven by a Potential Property Turnaround

The other interesting Asia-related action of late has been upward pressure on the Hong Kong dollar in the context of the territory’s longstanding US dollar peg.

Based on the territory’s currency board system upward pressure on the currency leads to a decline in local interest rates.

As a result, the 1-month Hibor has declined by 347bp to 0.60% since 29 April.

In such a system, if the currency cannot appreciate, the upward pressure goes on to local asset prices.

This has increased the odds that Hong Kong residential property may be on the point of bottoming, since rising rents mean the rental yields have of late converged with mortgage finance costs.

With mass market rents rising by 6.7% YoY in May, the gross rental yield is now 3.7%, compared with a mortgage rate of 2.7%.

Meanwhile, Hong Kong residential property prices, as measured by the Centa-City Leading Index, are down by 29.1% since peaking in August 2021, the biggest decline in prices since the protracted downturn which followed the Asian Crisis nearly 30 years ago.

We Still Like US Stocks While US Bonds Should be Avoided

If US fiscal deterioration is one among several reasons why this writer maintains the view that long-term US Treasury bonds are in a structural bear market, the view that the US dollar has entered a long-term downtrend is a positive for the many US companies with large overseas sales.

As such, it should be made clear that a much more long-term constructive view is taken here of US equities relative to Treasuries.

Still, that does not undermine the base case here, namely that the US has made an all-time peak as a percentage of MSCI All Country World Index

A key part of this view is the anticipated long-term depreciation of the American currency.

It is also now the case that the chart of MSCI AC World ex-US has now broken out of a trading range in place since 2007.

Just short the $ against whatever ccy you want. No need to buy crappy companies stock, particularly those weighed down by socialist bureaucracies. Don’t over complicate things.