Why Taiwan Should be In Your Portfolio

The Power of an AI Boom

Author: Chris Wood

The chart below shows that the Nvidia share price and Taiwan’s outperformance relative to the MSCI Asia Pacific ex-Japan Index have looked of late like Siamese twins. That is for a good reason.

For there has been mounting evidence of a new tech boom based on the AI story for the island economy.

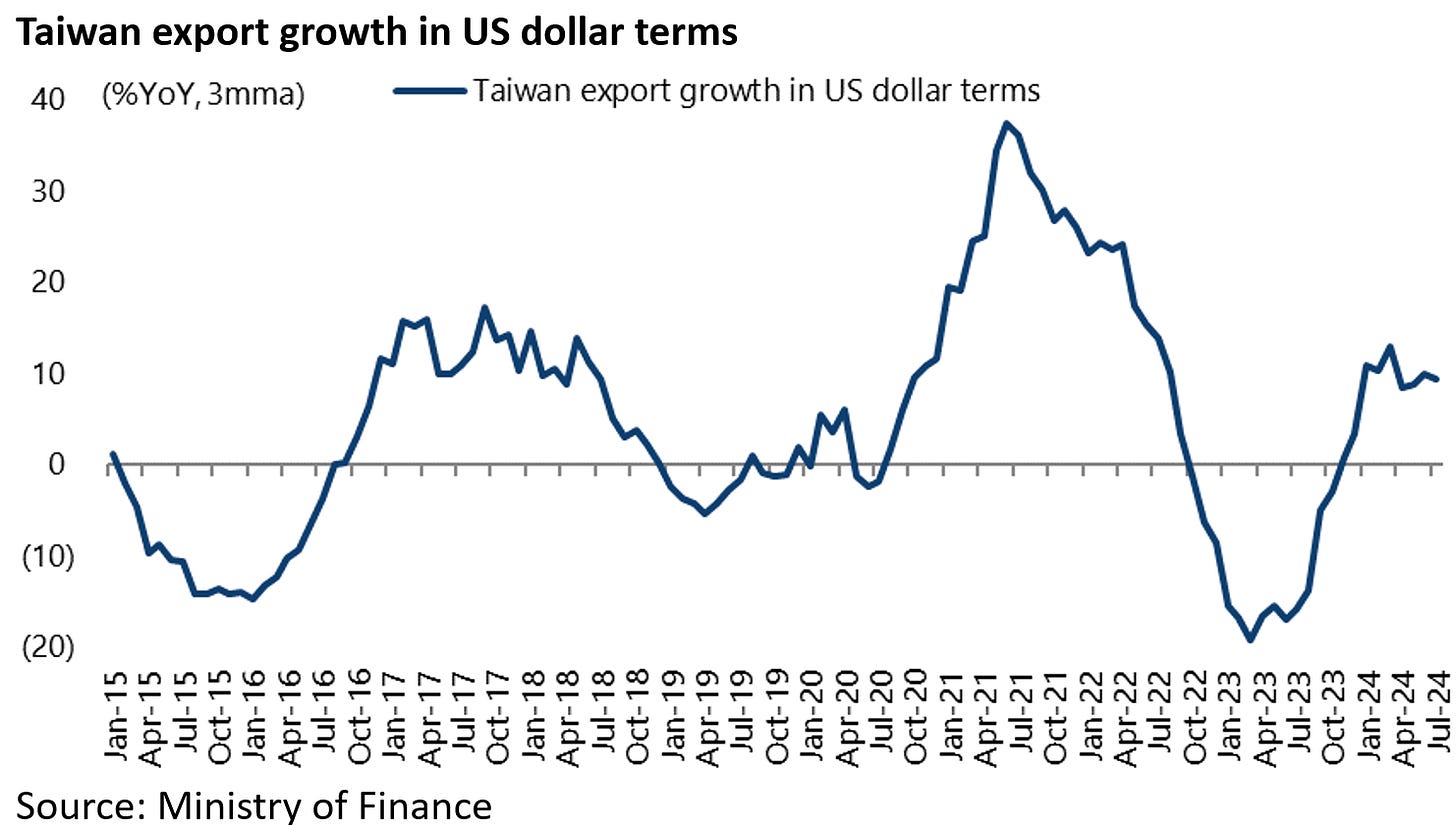

Taiwan exports rose by 10% YoY in US dollar terms in the first seven months of 2024.

While real GDP growth expanded by 6.63% YoY in 1Q24 and 5.06% YoY in 2Q24.

AI Story Still in the Early Stages

The view remains that the AI story is still in its early stages in terms of the ability of Taiwan’s ever flexible technology sector to supply the next big thing.

TSMC expects its AI-related revenues to grow by more than 50% this year as it benefits from AI-driven data centre and edge computing demand.

“Edge AI”, a term this writer first heard when visiting Taiwan last November, refers to AI applications on devices such as smartphones and personal computers, which is expected in due course to trigger replacement demand of high-end handsets at prices, say, above the US$900 category.

This is probably the main reason why Apple has rallied of late, up 38% since mid-April, beyond the fact that this was the Big Tech stock investors had been most underweight given its lack of revenue growth in recent quarters.

Apple’s quarterly revenue rose by 4.9% YoY to US$85.8bn in the quarter ended 29 June following a 4.3% YoY decline in the previous quarter, while annualised revenue has declined by 2.2% from a peak of US$394.3bn in the four quarters to 24 September 2022 to US$385.6bn in the four quarters to 29 June.

Foreign investors have bought a net NT$69bn of TSMC shares so this year.

The stock now accounts for a record 51.4% of the MSCI Taiwan Index.

Are Taiwan Tech Stocks Still Cheap After This Year's Run?

Meanwhile, the AI theme was the highlight of this year’s Computex conference held in Taipei in early June at which Nvidia founder and CEO Jensen Huang proclaimed a new industrial revolution based on the AI thematic.

From a valuation standpoint, Taiwan’s tech sector is now on 18.4x consensus forecast one-year forward earnings assuming 29% growth in 2024 based on consensus data.

This compares with a 10-year average forward PE of 14.7x.

As for TSMC, despite having risen by 64% year-to-date, the stock still looks cheap at least relative to comparable American equity valuations, trading at 19.8x consensus one-year forward earnings with a 27.6% forecast RoE amidst growing evidence that it can command higher prices in more advanced nodes.

Interestingly, one technical issue for many investment funds is that they have already reached their maximum holdings in TSMC since such funds are often not allowed to have more than 10% invested in one stock.

This is causing money to rotate to other related plays such as Hon Hai which is still trading at only 13.5x forward earnings after rising by 78% year-to-date.

From an index basis TSMC now accounts for 11.2% of the MSCI AC Asia ex-Japan Index and for 9.8% of the MSCI Emerging Markets Index.

The result is that most funds managed against these benchmarks are forced to be underweight given the 10% maximum holding.

As Semis Go, So Goes Taiwan

From a macro standpoint, the gearing of Taiwan’s economy to semiconductors remains hard to exaggerate.

Exports of integrated circuits totaled US$160bn in the 12 months to July, or 20.7% of Taiwan’s nominal GDP.

This represents a 28% market share of global semiconductor sales, though down from a peak of 33.5% in the 12 months to May 2023.

That could well prove a historic peak given the political pressure on TSMC to move production offshore. TSMC reportedly expects offshore capacity to account for about 20% total production capacity by 2030.

As for the domestic economy, Taiwan’s recent capex cycle, in terms of relocating production back from mainland China, appears to have peaked out with real gross fixed capital formation rising by only 0.8% YoY in 1H24 after declining by 8.2% in 2023.

The annualised gross fixed capital formation to nominal GDP ratio has now declined from a peak of 28.4% in 1Q23 to 24.6% in 2Q24, the lowest level since 1Q21.

While the manufacturing sector’s purchases of fixed assets fell by 25.7% YoY in 1Q24 and were down 24.6% YoY in 2023.

The Taiwan Supply Chain is Shifting Away From China

If reshoring looks to have peaked, there is mounting evidence of supply chains shifting away from China.

Taiwan companies invested more in Southeast Asia than in China in 2023 for the first time since 1992.

Taiwan’s outward investment to mainland China declined from US$5.05bn in 2022 to US$3.04bn in 2023 and US$3.07bn in the first seven months of this year.

By contrast, outbound investment to Asean rose from US$4.73bn in 2022 to US$5.23bn in 2023 and US$7.1bn in January-July 2024.

China (including Hong Kong) accounted for 30.9% of Taiwan’s exports in the first seven months of this year, the lowest level in 23 years.

This compares with an average share of 40% between 2006 and 2019.

Exports to China and Hong Kong declined by 3.9% YoY to US$81.8bn in January-July 2024 with exports of semiconductors and electronic components particularly weak, a decline which also reflects continuing American restrictions on selling advanced semiconductors to China.

Electronics exports to China/HK declined by 8.6% YoY to US$49.6bn in January-July.

By contrast, in the same period exports to the US rose by 62% YoY to US$63.6bn and to Asean by 19% YoY to US$48.7bn.

Political Tensions Simmering For Now

Meanwhile, on the Cross-Strait issue and related political tensions, the past quarter saw the inauguration in May of new Taiwan DPP President Lai Ching-te.

In his inauguration speech Lai called on China to “cease their political and military intimidation against” the island.

Beijing reacted by removing less than two weeks after the speech longstanding preferential tariffs on 134 imports from Taiwan.

Meanwhile, Lai’s popularity has declined significantly since the inauguration, with his approval rating down from 58% in May to 46.7% in August, according to Taiwan Public Opinion Foundation’s latest poll released on 20 August.

This reflects the lack of a honeymoon period given this is the DPP’s third term in power.