Why Inflation Could Overshoot to the Downside in 2023

The chart below highlights why investors have growing confidence that US inflation has peaked, which is also why monetary tightening expectations, peaked on the day after Jerome Powell gave his “Volcker wannabe” press conference following the FOMC meeting on 2 November.

Since then the so-called “terminal rate” anticipated by money market futures has declined from 5.15% to 4.92%.

FED FUNDS FUTURES IMPLIED RATE FOR JUNE 2023 FOMC MEETING

Source: Bloomberg

As for the latest December CPI data, US CPI came in at 6.5% YoY in December, in line with consensus expectations. Core goods CPI declined further to 2.1% YoY in December, the lowest level since March 2021.

Still, it is not all positive.

US CPI AND CORE CPI INFLATION

Source: Bureau of Labor Statistics

Core services CPI rose to 7.0% YoY in December, the highest level since August 1982, while 18 of the 36 main categories of CPI saw inflation accelerate in December compared with 13 in November.

US CORE GOODS AND CORE SERVICES CPI INFLATION

Source: Bureau of Labor Statistics

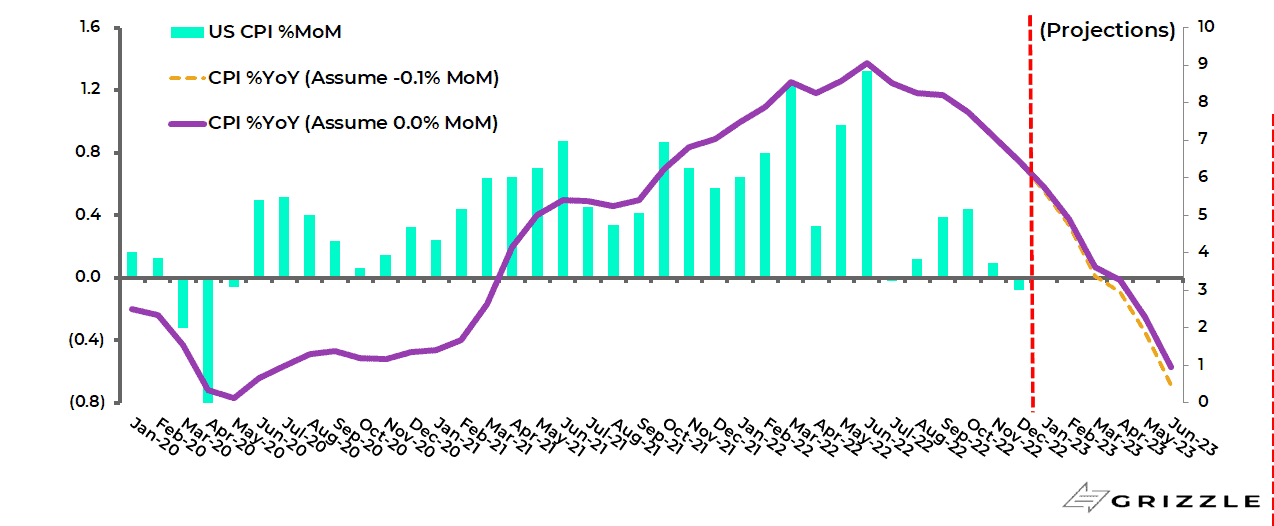

Importantly, the base effect is very favourable for the next six months to June.

Headline CPI averaged 0.8% MoM in the period between December 2021 and May 2022 and peaked at 1.3% MoM in June 2022.

So, hypothetically, if headline CPI rises by 0% MoM between now and June it will be “only” 2.3% YoY in May 2023 and 0.9% YoY in June.

A 0.1% MoM decline for the next six months (i.e. the same as happened in December) will take CPI to 1.9% YoY in May and 0.5% YoY in June.

US CPI INFLATION PROJECTION ASSUMING 0.0%MOM AND -0.1%MOM GOING FORWARD

Source: Bureau of Labor Statistics

The above means this writer will be surprised if the Fed raises the federal funds rate by more than 25bp at its next meeting on 1 February from its current level.

The base case is also that it will not get to 5% in this tightening cycle.

Meanwhile the Fed will be happy to see five-year five-year forward inflation expectations remain well-behaved in the context of a rallying Treasury bond market.

The five-year five-year forward inflation expectation rate remains below the critical 2.5% level, given the 2% inflation target, at 2.16%, while the 10-year Treasury bond yield has declined from a recent high of 4.34% in late October to 3.50%.

US 5-YEAR 5-YEAR FORWARD INFLATION EXPECTATION RATE AND 10-YEAR TREASURY BOND YIELD

Source: Federal Reserve Bank of St. Louis, Bloomberg

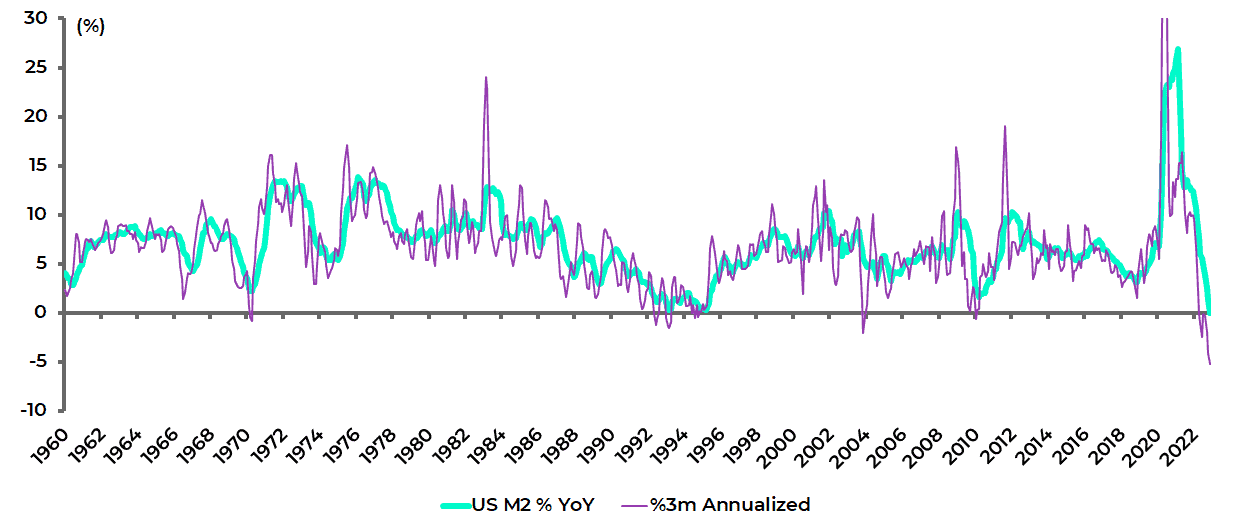

Meanwhile it is worth noting that Fed governors in their public comments, including Powell, continue to fail to discuss collapsing money supply growth – just as there was scant discussion about the explosion in broad money supply growth in the second quarter of 2020.

In this respect, the Fed’s continuing lack of focus on “money” means it is flying blind.

Meanwhile the plunge in M2 is becoming ever more dramatic.

US M2 has declined by an annualised 5.2% in the three months to November, the biggest three-month decline since the data series began in 1959.

US M2 GROWTH

Source: Federal Reserve

While on a year-on-year basis, M2 growth slowed from 26.9% YoY in February 2021 to 0.0% YoY in November, again the slowest growth rate since the data series began in 1959.

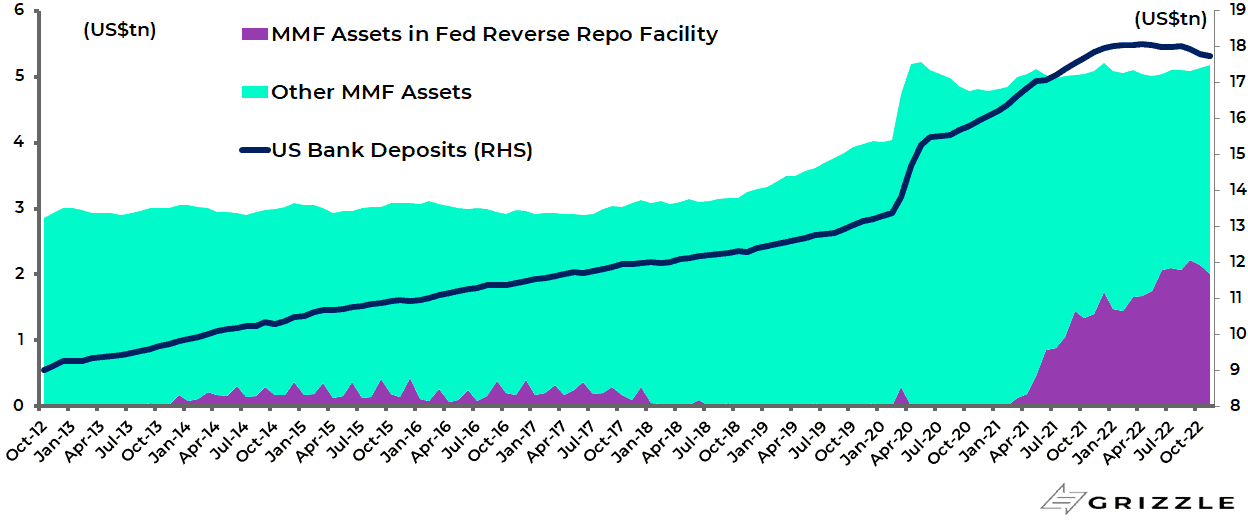

MONEY MOVING FROM SAVINGS TO MONEY MARKET FUNDS WILL DECREASE THE CREDIT MULTIPLIER EVEN FURTHER

One way that the liquidity situation could get worse, in terms of depressing the credit multiplier, if flows accelerate from bank deposits into higher yielding money market funds.

The average depositor was only earning 0.3% on his/her bank savings deposits and 1.07% on one-year deposits as of 19 December, according to the Federal Deposit Insurance Corporation (FDIC).

This raises the issue of the potential for savings to move from bank deposits to money market funds (MMFs) which offer on average a significantly higher deposit rate and now have a certain element of government guarantee following what happened in 2008 when a crisis in the commercial paper market caused a retail money market fund “to break the buck” for the first time ever.

As a consequence, many prime MMFs have been converted to government MMFs which invest in low-risk assets such as cash, government securities and repos.

Indeed the government MMF category now accounts for a dominant 78% of total money market fund assets, up from only 34% in 2014, according to the Securities and Exchange Commission.

The government MMFs now yield 3.53% or, a seemingly compelling 246bp above prevailing average one-year bank deposit rates.

It is further worth noting that the Fed launched its reverse repo (RRP) programme in 2013 which, crucially, MMFs have access to.

The MMFs have now invested US$2.0tn or 39% of their total assets in reverse repo agreements with the Fed, while the Fed now pays 4.3% on the overnight RRPs.

US MONEY MARKET FUND ASSETS AND BANK DEPOSITS

Source: Securities and Exchange Commission (SEC), Federal Reserve

Clearly, the significance of a potential flow of savings from commercial bank deposits to money market funds is that it would reduce the ability of the system to leverage up via the expansion of the credit multiplier.

So depositor inertia, or the lack of it, has now become a key issue in America as regards liquidity trends.

Certainly, money market funds now offer a competitive rate of return, most particularly when compared with the absolute declines suffered by both the S&P500 and the 10-year Treasury bond last year.

For example, the Fidelity Government MMF rose by 1.3% on a total-return basis last year, while the S&P500 and the Bloomberg US Long Treasury (10Y+) bond index were down 18.1% and 29.3% respectively.

S&P500, US LONG-TERM (10Y+) TREASURY BONDS AND GOVERNMENT MMF TOTAL-RETURN PERFORMANCE

Source: Bloomberg

The trend of deposit outflows into money market funds is evident from the weekly data on MMF assets from the Investment Company Institute and the Fed’s weekly data on bank deposits.

Thus, US bank deposits peaked at US$18.13tn in April 2022 and has since declined by US$354bn or 1.9% to US$17.78bn in the week ended 4 January, while US MMFs’ total assets have risen by US$336bn or 7.5% from US$4.47tn in April to US$4.81tn in the week ended 11 January.

US COMMERCIAL BANKS’ TOTAL DEPOSITS AND MONEY MARKET FUNDS’ ASSETS

Note: Weekly data. Source: Federal Reserve, Investment Company Institute, Bloomberg