While Tariffs Bite, Inflation and International Stocks Will Keep Rising

Author: Chris Wood

The attention continues to shift from DOGE to the tariff threat and deteriorating US economic data.

It is worth listing a few of the negative data points again.

The Atlanta Fed’s GDPNow model now has the economy having contracted by an annualised 2.2% last quarter.

while the Michigan consumer sentiment index has fallen to its second lowest reading on record.

The University of Michigan Consumer Sentiment Index declined by 6.2 points or 11% from 57 in March to 50.8 in early April, according to the preliminary reading published on 11 April.

The index has now declined by 23.2 points or 31% from the recent high of 74 in December.

There has also been a bad stagflationary ISM Manufacturing data point, in terms of both weakening activity and a higher prices-paid component.

The ISM Manufacturing PMI fell from 50.3 in February to 49.0 in March with the new orders sub-index falling by 3.4 points from 48.6 to 45.2.

This followed a 6.5-point decline in February which was the first decline in the new orders index since August 2024 and the biggest monthly contraction since April 2020 at the beginning of Covid.

As for the prices paid sub-index, it rose by 7.0 points to 69.4 in March, the highest level since June 2022. This followed a 7.5-point increase in February which was the biggest monthly increase since January 2024.

For Stocks, Rising Expectations of Interest Rate Cuts Aren't Offsetting Bad Economic Data.

So far, bad news on the economy has not been good news for the stock market, in terms of renewed hopes of Fed easing, with both Big Tech and the broader small-cap Russell 2000 index continuing to correct on slower growth concerns.

The “Magnificent-7 Index” has declined by 24.7% since the start of the year, while the Russell 2000 Index is down 17.5%

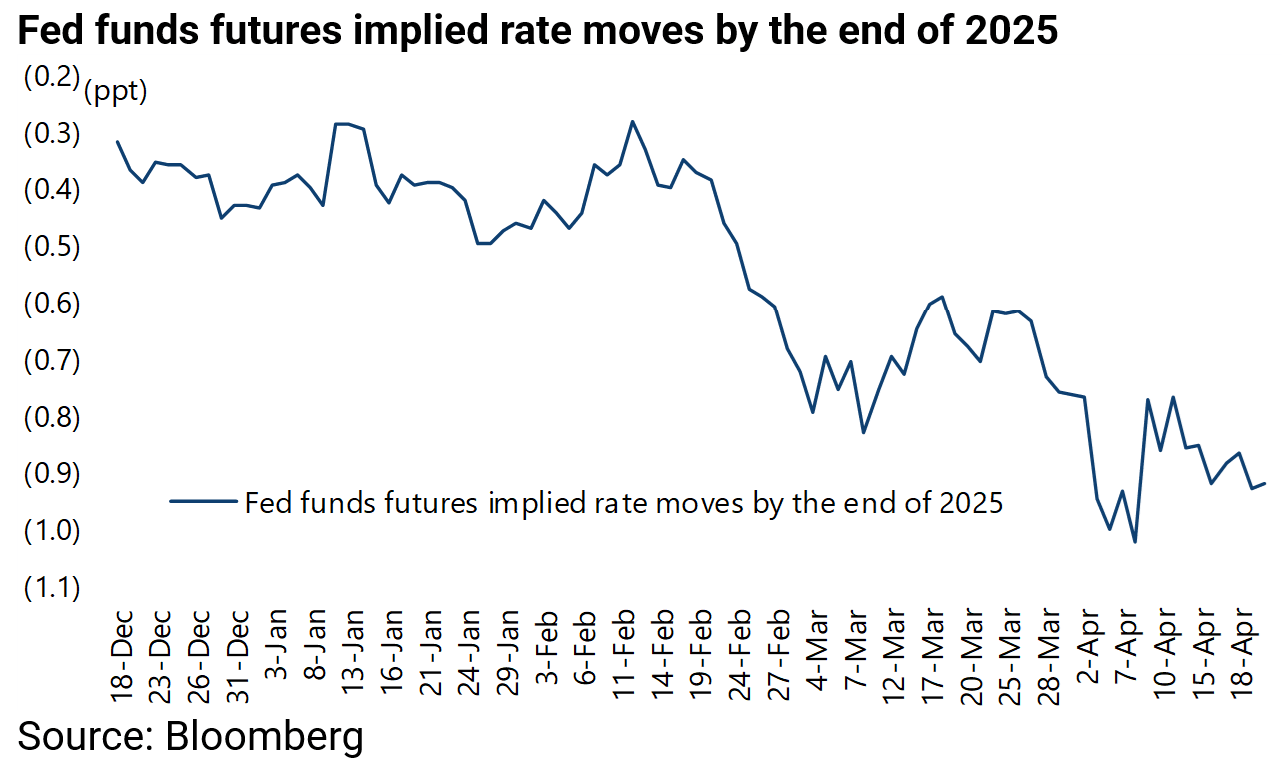

Still, it has not required many weak data points for markets to start pricing in renewed near-term Fed easing, with the end of quanto tightening also moved up the agenda.

Indeed, money markets are now discounting 92bp of Fed rate cuts by the end of 2025, up from only 28bp on 12 February, with the first cut expected in June.

In this respect, the base case of this writer is that the Fed has already fudged the 2% target and that the time for another Powell Pivot is approaching almost regardless of the next inflation data point. In this respect growth, or the lack of it, will likely be prioritised over inflation.

The US Dollar Has Peaked

Such an outcome should also be US dollar bearish. The base case remains that the US dollar peaked with Trump’s arrival in the White House, as was also the case in January 2017.

The US Dollar Index then peaked on 3 January 2017, prior to Trump’s inauguration on 20 January, and subsequently declined by 15% to a low in February 2018.

As for this year, the US dollar index peaked on 13 January and has since already declined by 11% to 98.1, having broken decisively below the psychological 100 level.

Meanwhile on-and-off-again news on the tariffs has only served to increase investor uncertainty.

For example, the Trump administration announced on 11 April that smartphones, computers, hard drives, flat-panel displays, memory chips and some other electronic devices will be exempted from the reciprocal tariffs.

But then Trump said in a post on his Truth Social platform on 13 April that he would launch a new national security trade investigation into semiconductors and the “whole electronics supply chain” which could lead to other new tariffs.

Indeed, the Commerce Department announced on 14 April in the Federal Register that it had begun investigating the impact on US national security of “imports of semiconductors and semiconductor manufacturing equipment”.

This writer has an old fashioned belief in free trade and globalisation.

But that is not the current zeitgeist.

Donald Trump is no intellectual but the intellectual case for his policies, including tariffs, for those interested was elaborated in a paper published last November by Stephen Miran who is now head of the Council of Economic Advisers (see Hudson Bay Capital report: “A User’s Guide to Restructuring the Global Trading System” by Stephen Miran, November 2024).

The simple investment point is that tariffs are bad news for the economy, and so bad news for stock markets, as is now only too clear from the US stock market’s reaction to “Liberation Day” on 2 April.

If the implementation of the tariffs means that markets have had no choice but to start to price in the impact in recent weeks, there also remains the reality that the tariffs could still end up being a negotiating tactic.

Certainly, a change in policy can happen at any time under the Donald.

Trump Will Do Some Kind of Deal With China

Meanwhile, China’s response to the dramatic increase in tariffs, now standing at 145%, has remained relatively restrained, with China only reacting to each escalation.

Meanwhile, Beijing continues to maintain the public line that China believes in the mutual benefits of free trade and globalization.

Meanwhile, if the US-China relationship looks increasingly tense, not all hopes should be abandoned of a deal between the two countries.

This writer’s attention was caught by a seemingly well sourced article in the New York Times published in late February which reported how Trump is interested in negotiating a broad deal with China which would extend beyond trade (see New York Times article: “Trump sees scope for a broader deal with China” by Ana Swanson, 22 February 2025).

Interestingly, the article quoted one diplomatic source as saying that one China offer could include “Chinese investments in the US that would create an estimated half a million jobs in industries like solar, electric vehicles and batteries”.

Still, the hopes of an improved relationship raised by the above article are seemingly in total contrast to a presidential memorandum issued by Trump on 21 February called “America First Investment Policy”.

This paper reads like it has been written by members of the National Security Lobby who are conspicuous by their absence from the second Trump administration but who were essentially running China policy in the Biden administration.

Thus, the memo ordered the use of “all necessary legal instruments” to curb Chinese affiliated investments in critical sectors.

It also describes the People’s Republic of China as an adversary and says, among other things, that the PRC is “increasingly exploiting United States capital to develop and modernize its military, intelligence and other security apparatuses”.

Given such contradictory signals it is no wonder that investors are confused while, more importantly, corporates will be delaying investment decisions amidst the prevailing uncertainty.

Still in spite of the current noise, this writer’s base case is that some sort of a deal will be done by Trump with China which will not be dictated by the National Security Lobby, if only because it is in Trump’s nature to make bilateral deals.

If such a deal is done against current expectations, it will make American fund managers much more willing to invest in Chinese equities since it will no longer be a career risk to do so since China will no longer be considered “uninvestable”.

China Stocks are Beating US "Exceptionalism" YTD

Meanwhile, Chinese stocks continue to trade reasonably well amidst the current noise.

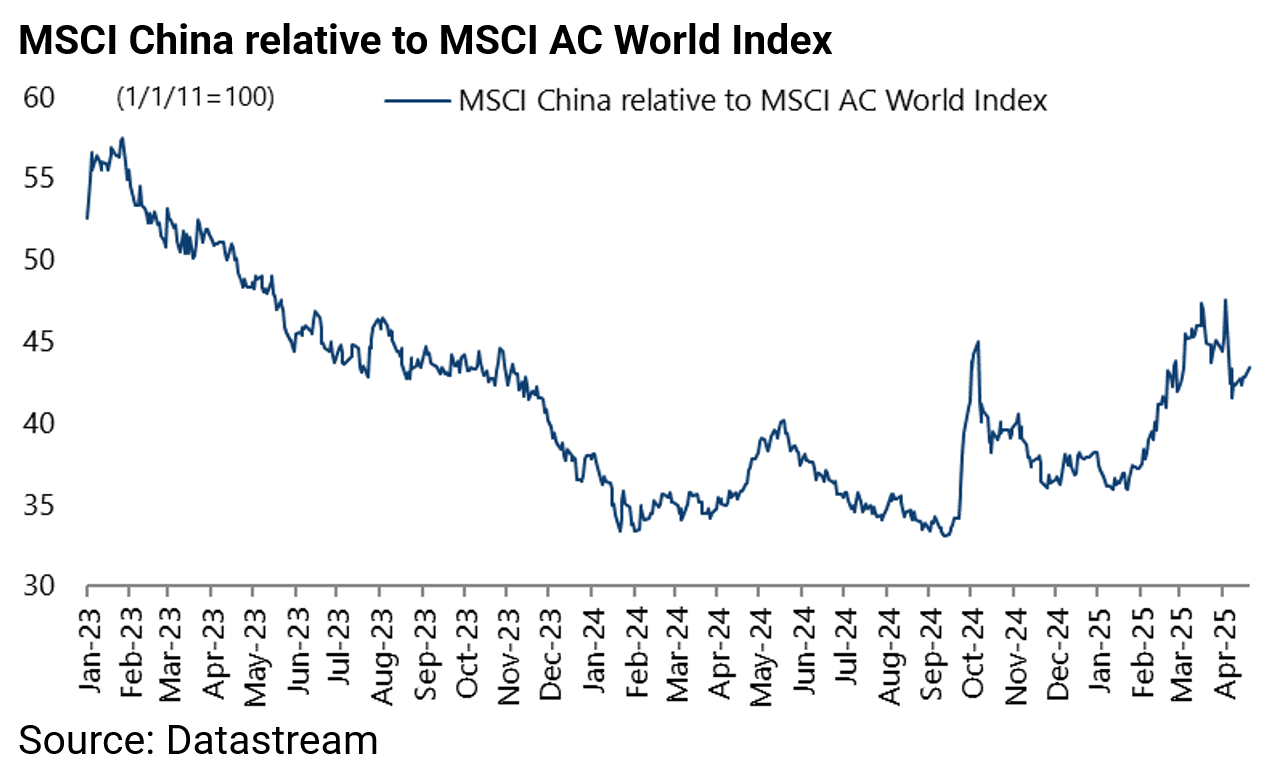

China is also outperforming year to date which creates its own form of pressure on active managers. MSCI China has risen by 5.7% in US dollar terms year-to-date, compared with a 6.9% decline in MSCI AC World, while it is still trading at “only” 10.5x 12-month forward earnings.

Hong Kong Stocks are Doing Even Better

It is also the case that the Hong Kong-based Hang Seng China Enterprises Index (HSCEI, H shares) is outperforming mainland A shares by a wide margin.

The HSCEI has risen by 9% in renminbi terms year-to-date, compared with a 3.6% decline in the CSI 300 Index.

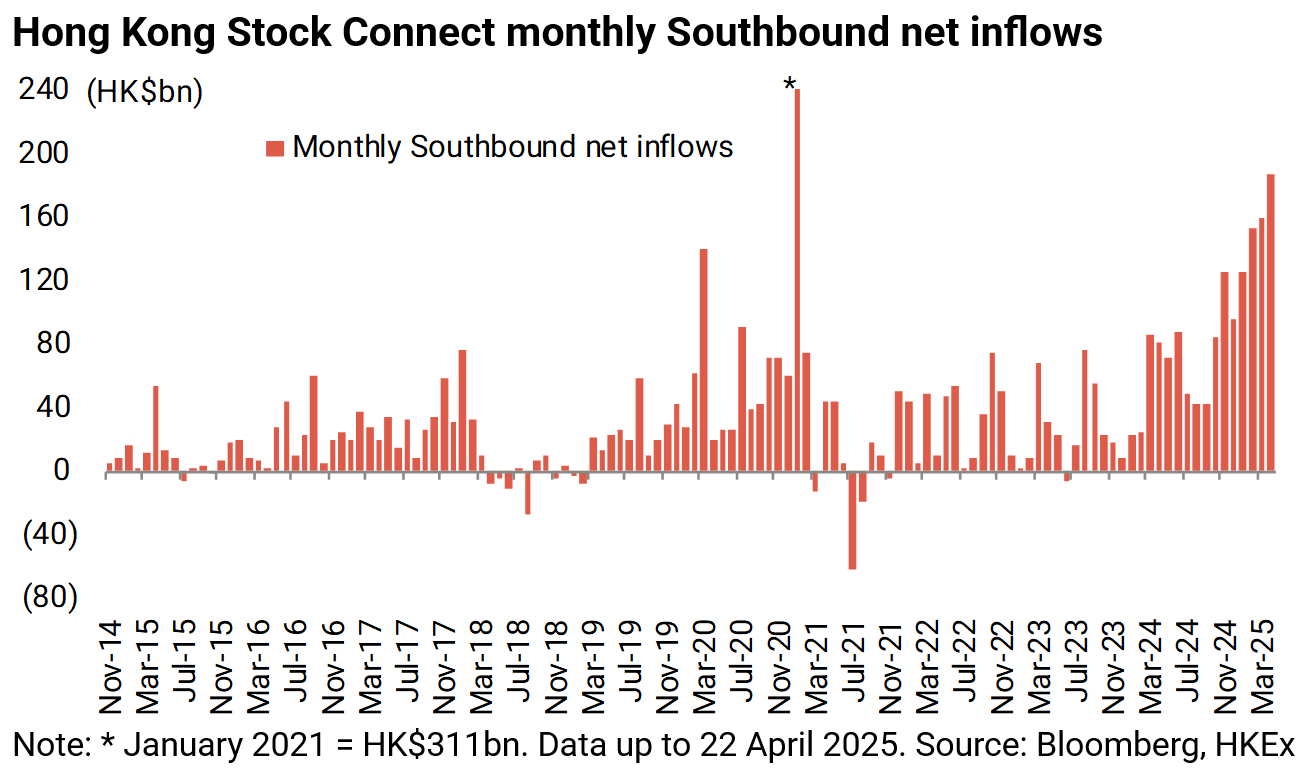

Hong Kong Stock Connect Southbound inflows, measuring flows going from the mainland to buy Hong Kong-quoted stocks, also continue to surge.

Southbound net inflows have risen from HK$42bn in September 2024 to HK$160bn in March, the biggest monthly net inflows since January 2021, and are HK$187bn so far in April.