When it Comes to India - Always Buy the Dip

Author: Chris Wood

This writer arrived in Delhi of late to see the Indian capital lit up like a wedding cake in the immediate aftermath of the G20 Summit which concluded in mid-September.

The event was a triumph for the global status of Indian Prime Minister Narendra Modi in the sense that there was an agreement on a statement on Ukraine which massively diluted the anti-Russia stance taken by the G7 following the invasion of Ukraine in late February 2022.

The reference to “Russia aggression” in last year’s G20 Summit in Bali was dropped. Both Russia and China vetoed that language (see Financial Times article: “Western nations accept ‘climbdown’ on Ukraine to salvage G20’s relevance”, 11 September 2023).

This time the G20 statement (which includes a Russian vote) refers only to the “war in Ukraine”. The statement also called for “a comprehensive, just, and durable peace in Ukraine” without explicitly linking that demand to the issue of Ukraine’s territorial integrity.

The above suggests the extent to which the G7 wants to get the so-called “Global South” back onside given the far more nuanced view taken of events in Ukraine by developing countries than the narrative coming out of Washington, London and Brussels.

It is also likely in Washington’s interest to project Modi as the leading spokesman for the Global South as opposed to China.

Similarly, the formal announcement at the G20 meeting of an India-Middle East-Europe Economic Corridor (IMEC) linking India with the Gulf and Europe should be seen as a counterpart to China’s Belt and Road Initiative.

That said, Modi and India still also have a foot in both camps given India’s membership of BRICS.

Similarly, while India, as a major importer of energy related products, has different interests from other prominent members or invited members of the BRICS group, it is also of note that on the day following the end of the G20 Summit there was a one-day summit in Delhi with Saudi Crown Prince Mohammed bin Salman (MBS).

This reflects the dramatically increased economic ties between India and the Gulf countries since Modi’s arrival in power in May 2014.

India’s total trade with Gulf countries has risen from US$97bn in FY16 to US$185bn in FY23 ended 31 March.

It also conflicts with the clichéd notion of Modi, still portrayed by elements in the Western medias as a Hindu rationalist with an anti-Islamist agenda.

India Stock Market Near All-Time Highs, But is it Overvalued?

Meanwhile if Modi’s diplomatic triumph was the story of the hour, India’s financial media has focused of late on the Nifty Index reaching 20,000 for the first time.

Still if the major Indian stock market indices have of late been trading at all-time highs, the real action this year has been in the mid-cap stocks where gains have been much greater but where valuations are more extended.

The Nifty MidCap 100 Index has risen by 30% so far in 2023, compared with an 8% gain in the Nifty Index.

As a result, the MidCap index now trades at 24.6x 12-month forward earnings, compared with 18.6x for the Nifty.

This move has been driven by a renewed pickup in domestic fund flows.

Domestic equity mutual funds’ net inflows have risen to Rs290bn in August, the highest level since March 2022, and were Rs255bn in October.

In this respect, there may be room for more of a correction in the mid-cap area.

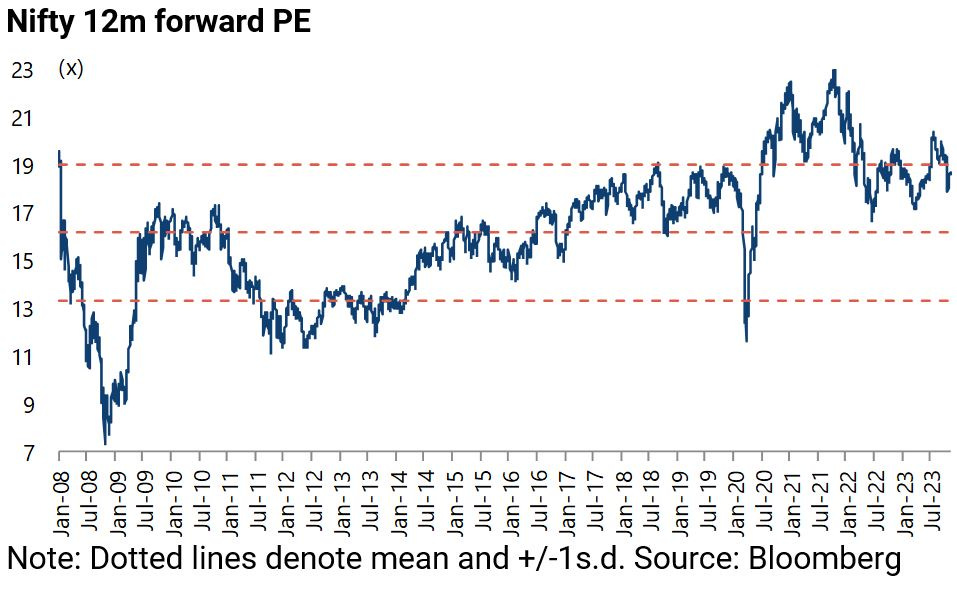

Still, by historical India standards, valuations for the big cap stocks are not particularly extended.

Global Funds are Still Significantly Underweight India

It is also the case that foreign investors are not as overweight India as might be thought given that it is now consensus that India is the long-term structural growth story in Asia, not China.

Indeed global funds, as opposed to global emerging market funds, barely own Indian stocks.

The above is why any pull back in India is a buying opportunity, amidst growing anecdotal evidence of an imminent capex cycle in terms of the rising amount of new private project announcements.

Thus, annualised new private project announcements rose by 75% YoY to a record Rs29.5tn in the four quarters ended 30 June and were up 48% YoY to Rs26.5tn in the four quarters ended 30 September.

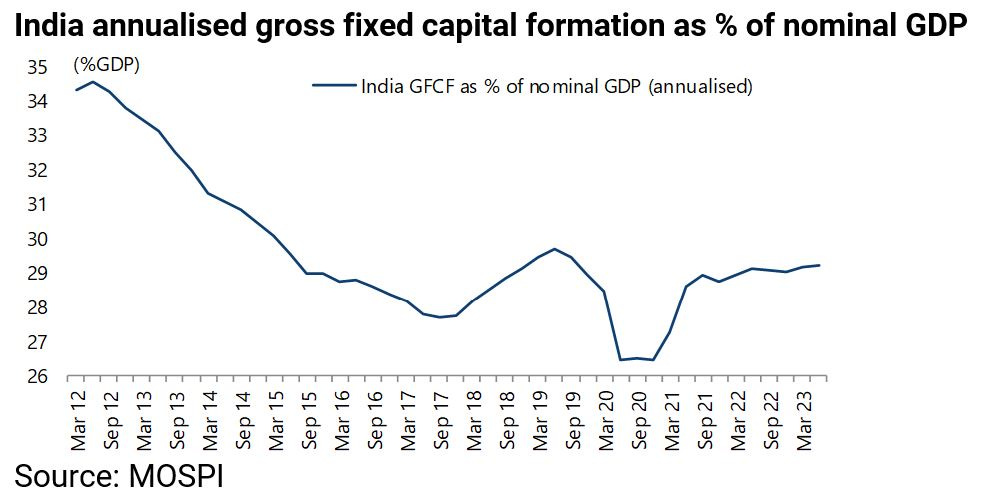

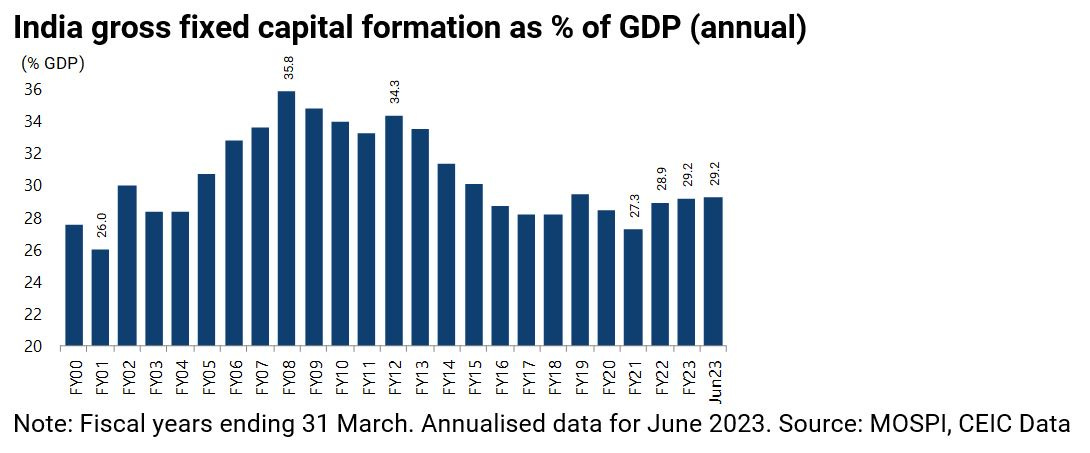

Meanwhile, the annualised gross fixed capital formation to GDP ratio has risen from a cyclical low in FY21 to a 15-quarter high of 29.2% in 1QFY24 ended 30 June.

Reserve Bank of India data also shows that the total number and total costs of projects approved by banks/financial institutions, were up 36% and 87% YoY respectively in FY23 to 547 projects worth Rs2.7tn.

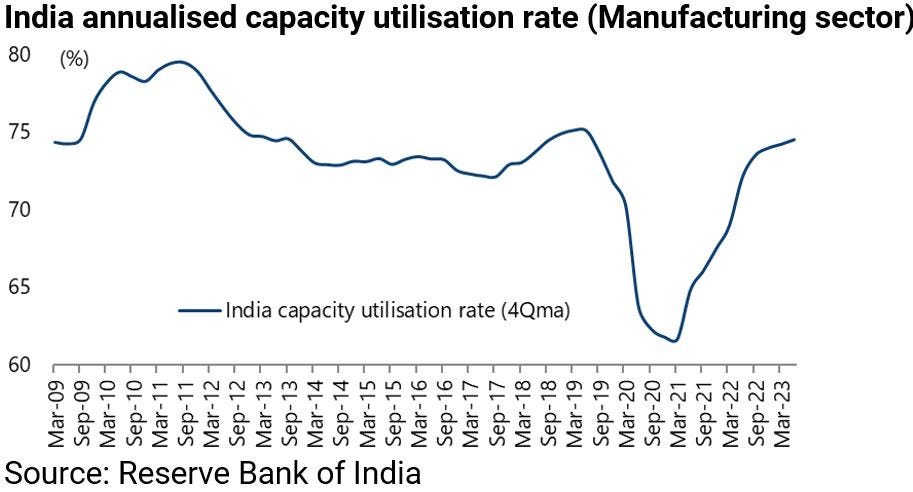

While annualised capacity utilisation is trending higher at 74.6% in June, near a 10-year high.

Private Sector Poised to Take Over Where the Government Left Off

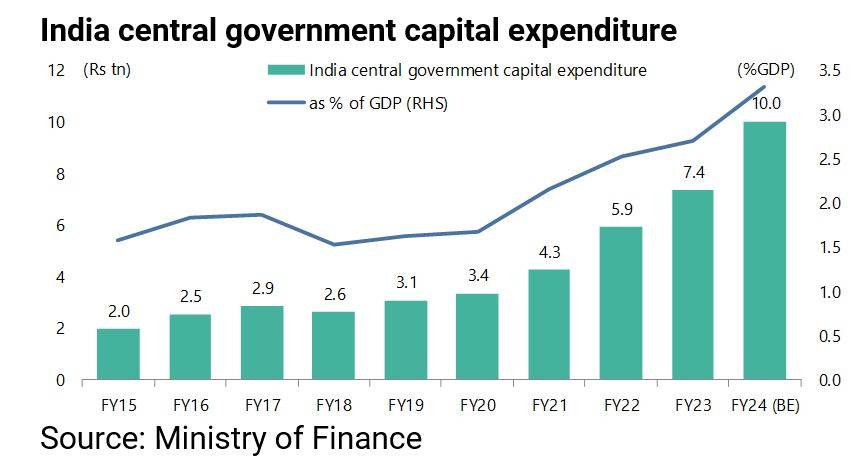

All this means that a deleveraged private sector is poised to take up the baton, to use the relay analogy, in terms of driving an investment cycle after the heavy lifting done by the central government in recent years when most of India’s fiscal deficit has been driven by the big increase in central government’s capex on infrastructure as opposed to transfer payments.

This is not a new story but it is one which is now leading to increased efficiencies in the economy.

As good an example as any since Modi came to power in 2014 has been the construction of roads.

The total length of national highways in India has increased from 91,287km at the end of FY14 to 145,155km at the end of FY23 ended 31 March.

Meanwhile, central government capital expenditure has risen from Rs2.6tn or 1.5% of GDP in FY18 to Rs7.4tn or 2.7% of GDP in FY23 and is budgeted to increase to Rs10tn or 3.3% of GDP this fiscal year.

With a longer term target to reduce the current forecast central government fiscal deficit from 5.9% of GDP this fiscal year to 4.5% by FY26, the government will be happy to see the private sector driving more of the investment cycle.

This should translate into investment becoming more of a driver of growth relative to consumption.

This would clearly be a very constructive development for India, most particularly as the last capex cycle peaked in FY08, whereas the opposite dynamic is clearly what is required in China, in terms of boosting consumption relative to investment.