What is the Right Tariff Rate for China?

Author: Chris Wood

The IMF-World Bank Spring meeting talking shop in Washington in late April served a highly useful function.

It provided the venue for Treasury Secretary Scott Bessent and China’s Finance Minister Lan Fo’an to meet in the basement of the IMF headquarters to secure the sharp reduction in threatened tariffs, which markets have been celebrating ever since Donald Trump did the original U-turn on his tariff agenda one week after “Liberation Day” when he announced on 9 April a 90-day pause on the so-called reciprocal tariffs.

That pause expires on 9 July for most countries and on 12 August for China as a result of the meeting in Geneva in mid-May between Bessent and Chinese Vice Premier He Lifeng.

That means uncertainty on the tariff front still lingers.

But most investors are now assuming that the base case is that tariffs end up at a maximum 10% across the board in terms of new tariffs, way down from the originally proposed up to 50% on Liberation Day.

True, the formal tariff on China is still around 40%, but that includes 20% related to the fentanyl issue and about 10% left over from the first Trump administration.

The base case is that the 20% will be negotiated away on some declared progress on fentanyl in another future deal with China, with Bessent mentioning “purchase agreements” in the Geneva press conference in mid-May.

This would mark a return to the approach taken in the trade deal with China signed in January 2020 when Beijing committed to buying a certain amount of American goods, such as soybeans.

Still the really positive and substantive outcome would be to allow China to set up manufacturing facilities in America in areas such as batteries and EVs, as previously discussed here (see While Tariffs Bite, Inflation and International Stocks Will Keep Rising, 24 April 2025).

This would turn a negative into a positive from a China standpoint if the likes of a CATL or BYD set up production in America.

It would also be a clear win for Donald Trump’s reindustrialization of America strategy, as he has consistently stated that the aim of his threatened tariffs is to incentivize companies to move production to America.

Such an approach would not please the national security lobby, but Trump, in this writer’s continuing view, is not always driven by that agenda.

Recession Risk Continues to Fall

Meanwhile, the risks of a US recession have clearly been significantly reduced by the de-escalation of the trade war, as has the risk of a related deterioration in the labour market.

This is why money markets ae now discounting only 49bp of Fed rate cuts this year, down from 102bp at the end of April, with the first rate cut now pushed back to September.

On this point, the latest Challenger job cut report showed a reduction in job losses in April and May after the big surge in March, driven by the DOGE-triggered layoffs in the public sector.

Thus, US-based employers announced 105,441 of job cuts in April and 93,816 in May, down 66% from 275,240 in March, which was the highest level since May 2020.

The Government sector accounted for 216,915 or 79% of the job cuts in March but only 2,600 or 3% of the cuts in May.

Still it also should be noted that the tariff agenda has not been abandoned altogether.

The presumed base case of 10% tariffs across the board, is still the highest level of tariffs since 1943.

This is not a positive, even though it is way less than previously feared.

While the average effective tariff rate today is running at an estimated 15.8%, the highest level since 1936, according to nonpartisan policy research center The Budget Lab at Yale.

The Budget Lab also estimates that the average US household will pay US$2,000 more for products this year than in 2024.

On this point, Fed Governor Adriana Kugler in a speech in May cited a Dallas Fed survey of Texas business executives carried out on 15-23 April that found that 55% of respondents still plan to pass on tariff-related cost increases to customers.

Of those expecting to pass on costs, 26% expect to pass through the higher tariff cost upon the announcement of tariffs, while another 63.5% expect this pass-through to occur within the first three months after the tariffs take effect.

The Tariff War is Serving as Justification for the World's Continued Move Away from the Dollar

Meanwhile, the whole Trump-triggered tariff saga will have served as a further incentive for countries from China down to continue to do what they were doing anyway — that is, to pursue trade deals and related opportunities elsewhere.

In this respect, the ongoing pattern is for more and more trade to be done outside the US dollar, as reflected in the PBOC’s swap arrangements with a growing number of central banks.

The PBOC has so far signed bilateral currency swap agreements with more than 40 foreign central banks or monetary authorities, with 32 agreements currently in force with a total scale of about Rmb4.5tn.

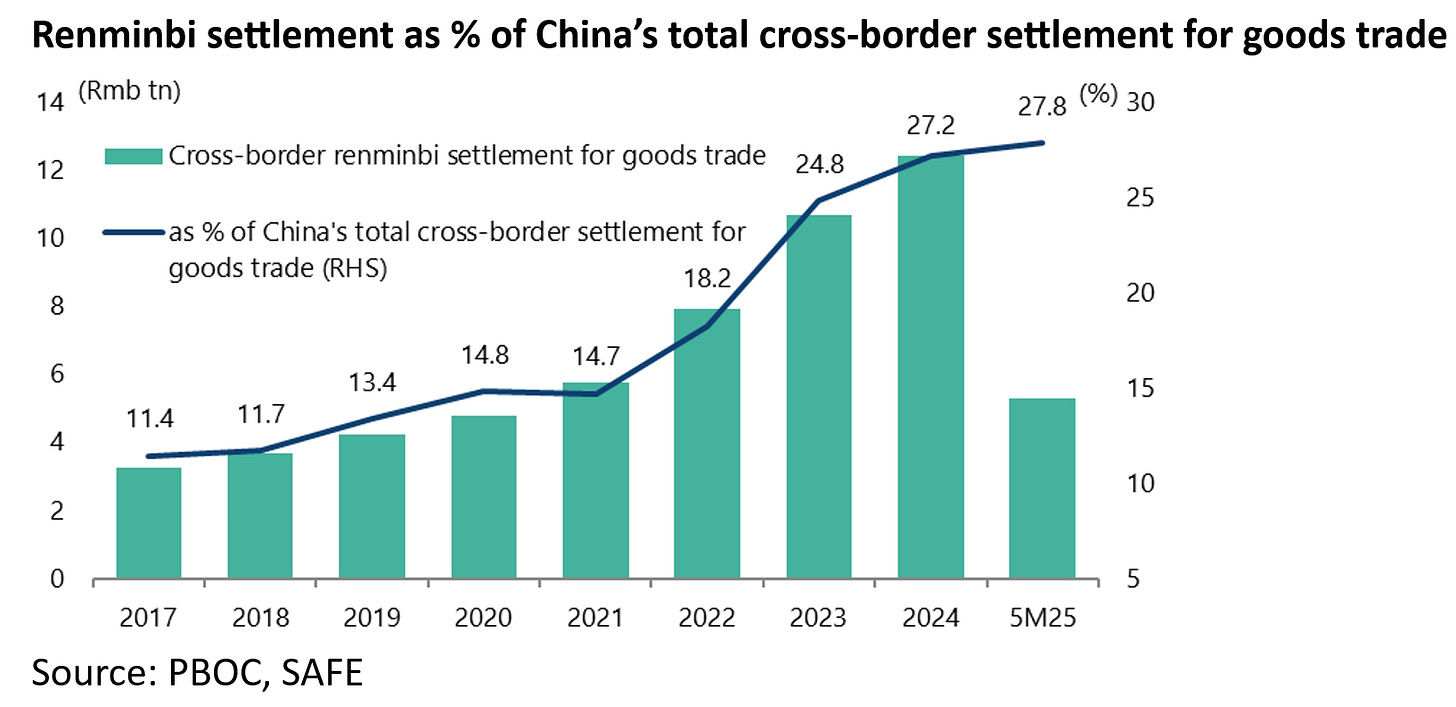

On a related point, data from the PBOC and the State Administration of Foreign Exchange (SAFE) shows that China’s cross-border goods trade settlement in renminbi totaled Rmb5.27tn in the first five months of 2025, accounting for 27.8% of China’s total cross-border settlement for goods trade, up from 14.7% in 2021.

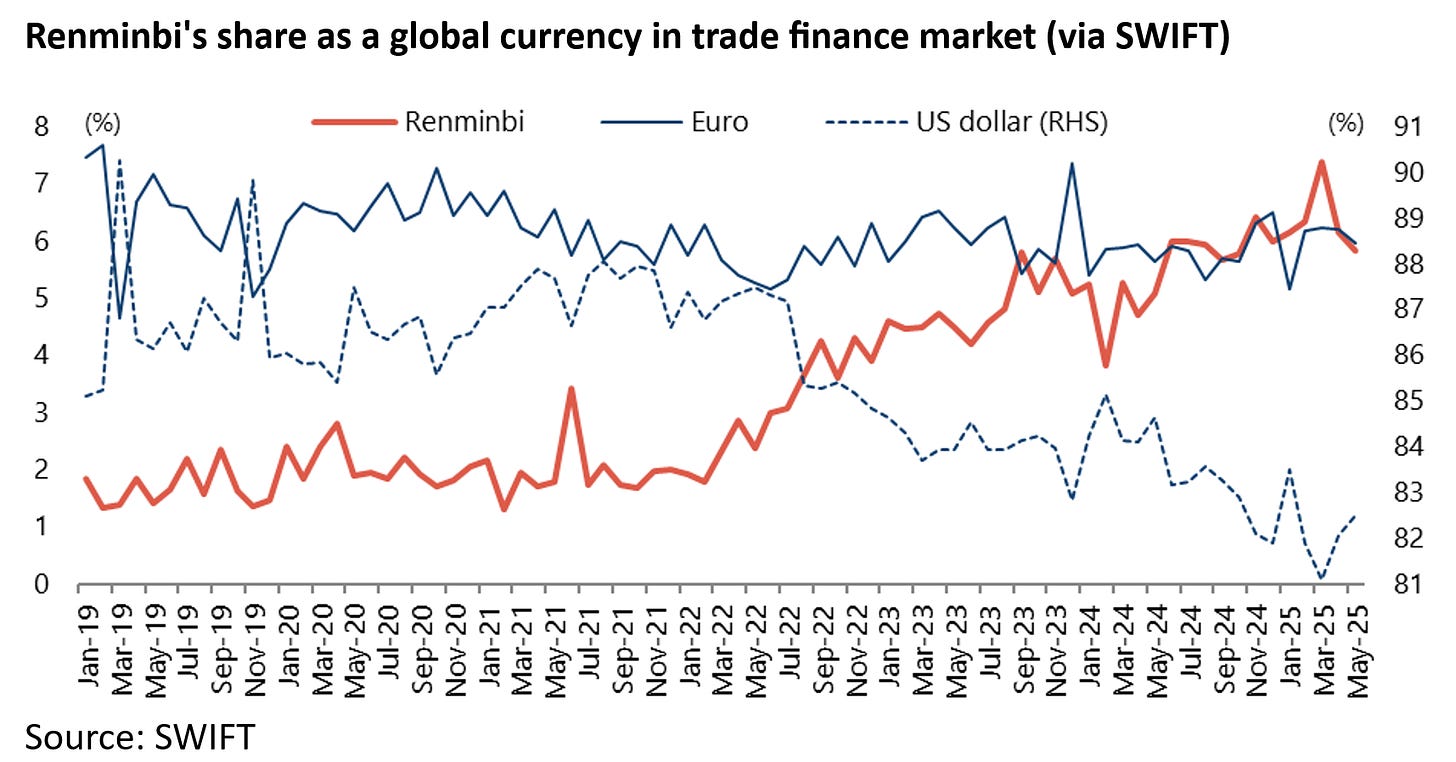

The renminbi’s share of global trade finance-related transactions via SWIFT also rose to a record 7.38% in March, surpassing the euro (6.23%) as the second most used currency after the US dollar, though it fell to 5.84% in May. while the US dollar’s share was 82.48% in May.

It is also the case that America as a share of total world imports is simply not as important as it used to be.

Thus, US imports accounted for 13.8% of total world imports in the 12 months to February, compared with a peak of 19.4% in the 12 months to March 2001.