What if Chinese AI Stocks are the Better Value

Author: Chris Wood

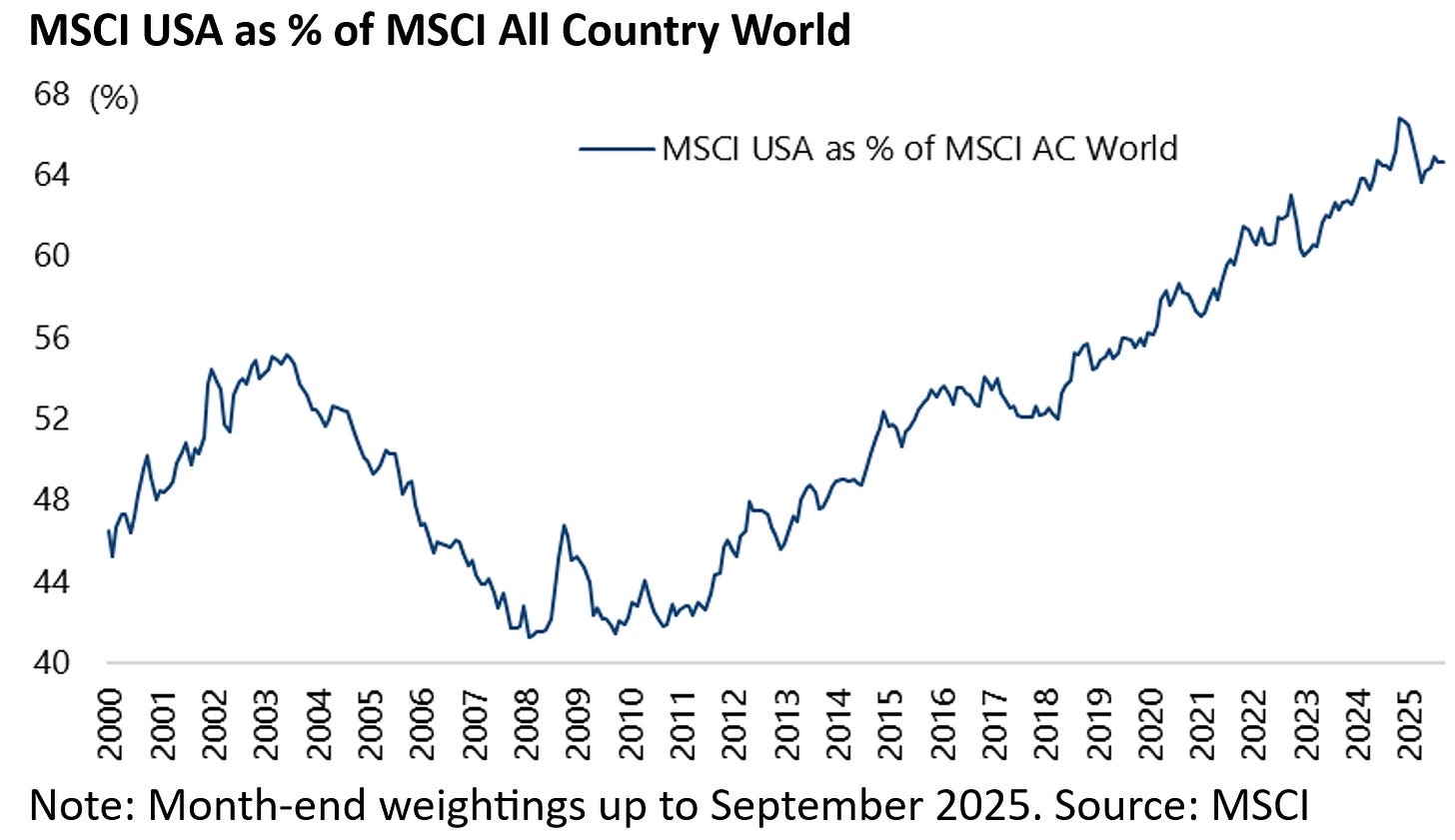

The view here has been that the US made an all time peak as a percentage of world stock market capitalisation, as measured by MSCI All Country World, on 24 December last year.

This was still the case as at the end of last quarter. MSCI USA’s share of MSCI AC World peaked at 67.2% on 24 December 2024 and was 64.7% at the end of 3Q25.

The view has also been that this forecast is most likely to be wrong if the hyperscalers prove to be successful at monetising their colossal investment spending in the ongoing AI capex arms race.

Given the way the relevant stocks have been rallying on surging capex announcements of late, it now has to be wondered whether this writer could be wrong in the near term even if the base case proves to be right in the sense that the ongoing AI capex arms race leads to a massive investment bust which, as discussed here previously (Two Years is Too Long…The AI Conundrum, 25 February 2025), will make the 2000-2002 Nasdaq bust look like a sideshow.

There have been plenty of examples of the euphoria of late, including growing evidence of what could be described as circular deal making, most of which involve OpenAI.

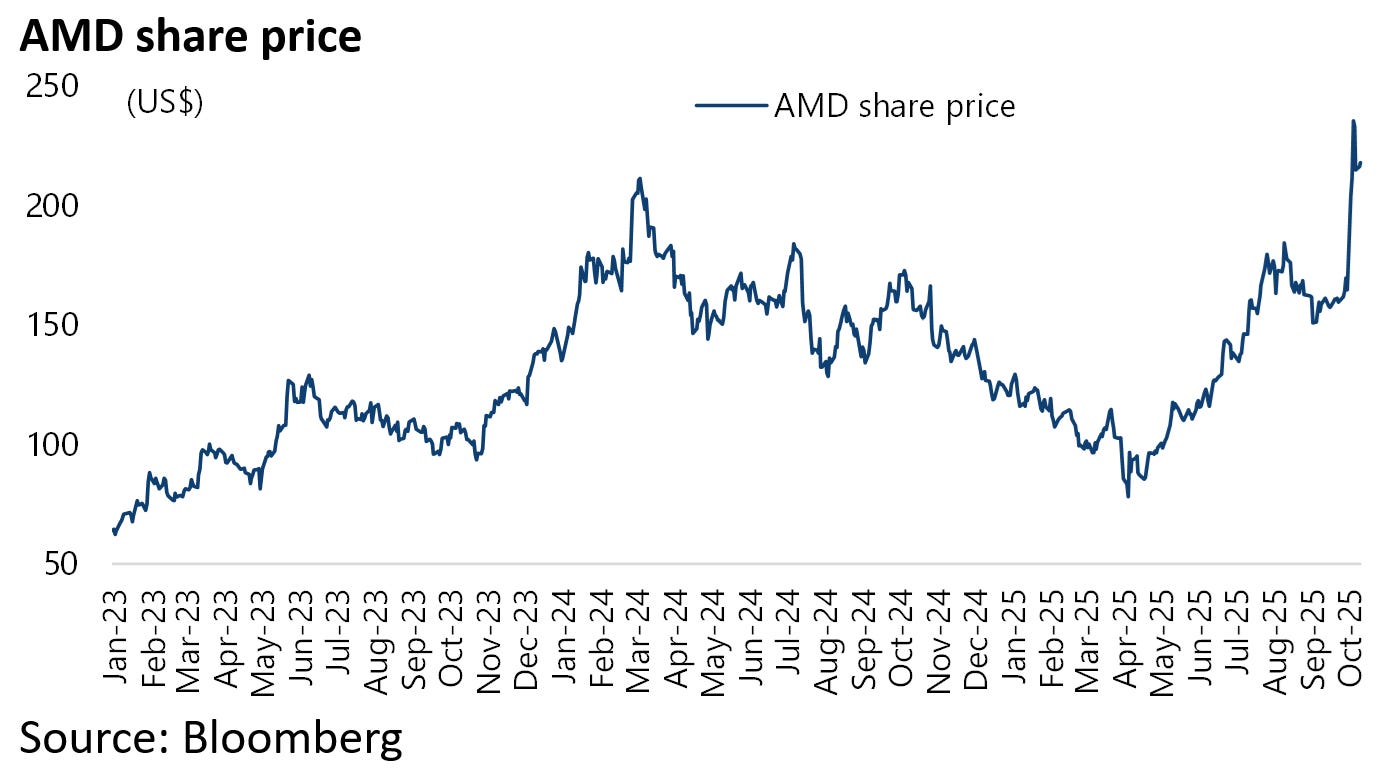

One recent example of the mania was the 23.7% rise in the share price of AMD on 6 October as a result of OpenAI’s commitment to buy six gigawatts worth of AMD chips.

A notable feature of the deal, different from the Nvidia commitment to invest US$100bn in OpenAI announced two weeks ago, is that AMD is giving OpenAI warrants entitling it to 10% of the company if OpenAI meets certain targets.

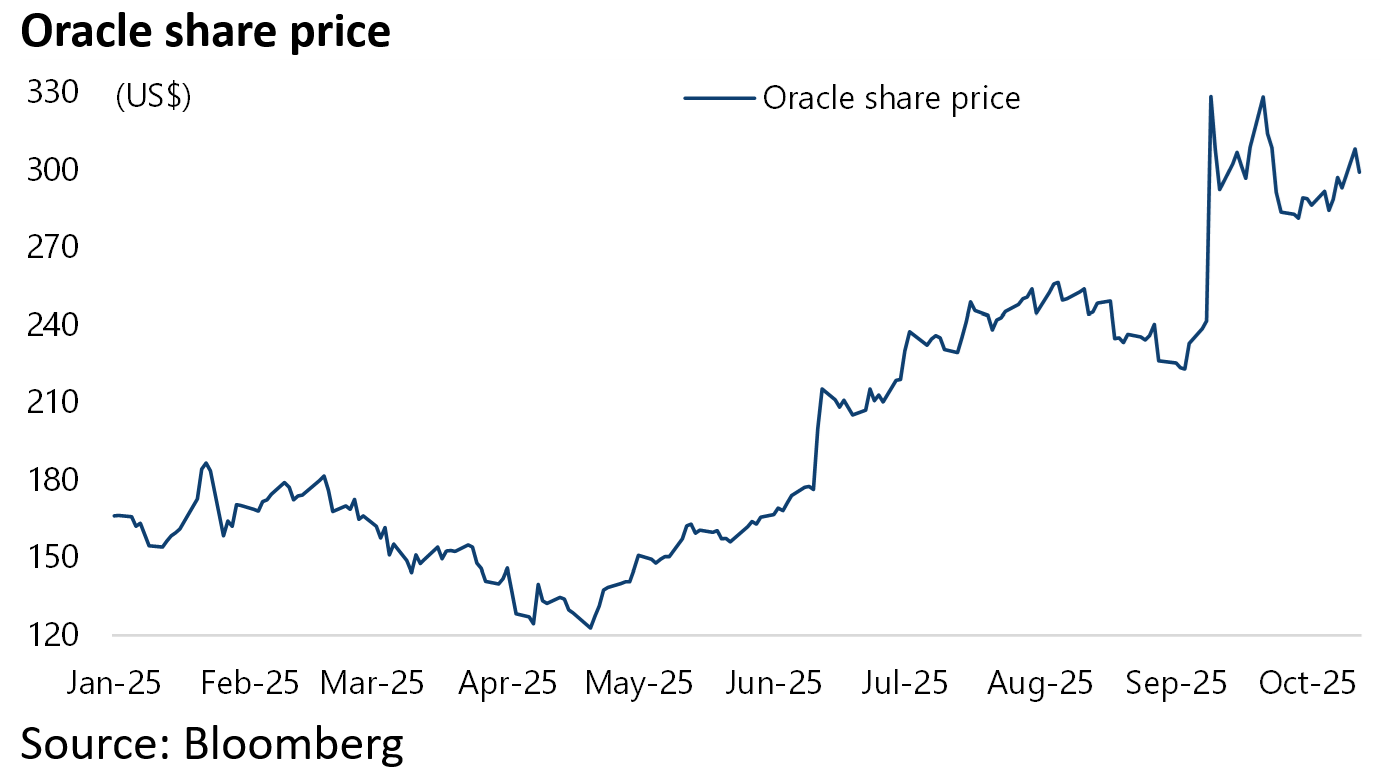

Another example was the euphoric market reaction to Oracle’s earnings report in early September.

The company shares rose nearly 40% in a day, or by US$255bn, after Oracle said it had increased its outstanding contracted revenues not yet realised by 359% YoY to US$455bn in 1QFY26 ended 31 August.

One day later Oracle confirmed where a large part of this increase came from when it announced it had signed a US$300bn deal to provide OpenAI with computing power over a five-year period.

The interesting point is that OpenAI is currently losing about US$1bn a month and generating around US$10bn in annual revenues.

The company has also told investors it will burn US$115bn in cash by 2029. In the context of these numbers, the scale of the OpenAI-Oracle contract looks ambitious in the extreme.

Such deals seem to be as much about financial engineering as exploring new frontiers in tech.

Then there is the most recent guidance by Meta.

It has said that it plans to invest about US$100bn next year, or more than half of its expected revenue for this year.

Meta revenues were up 19% YoY in the first six months of this year to US$89.8bn.

Another way of looking at this is that Meta’s forecast capital spending for this year, namely US$66-72bn, is about the same as its consensus forecast profits of US$73bn though clearly generous depreciation schedules mean that the accounting for this capex can be stretched out over a period of five years.

And these have become more generous as a result of the recently passed OBBBA as previously discussed here (see Stablecoins, Bonds & Hyperscalers Oh My!, 24 July 2025).

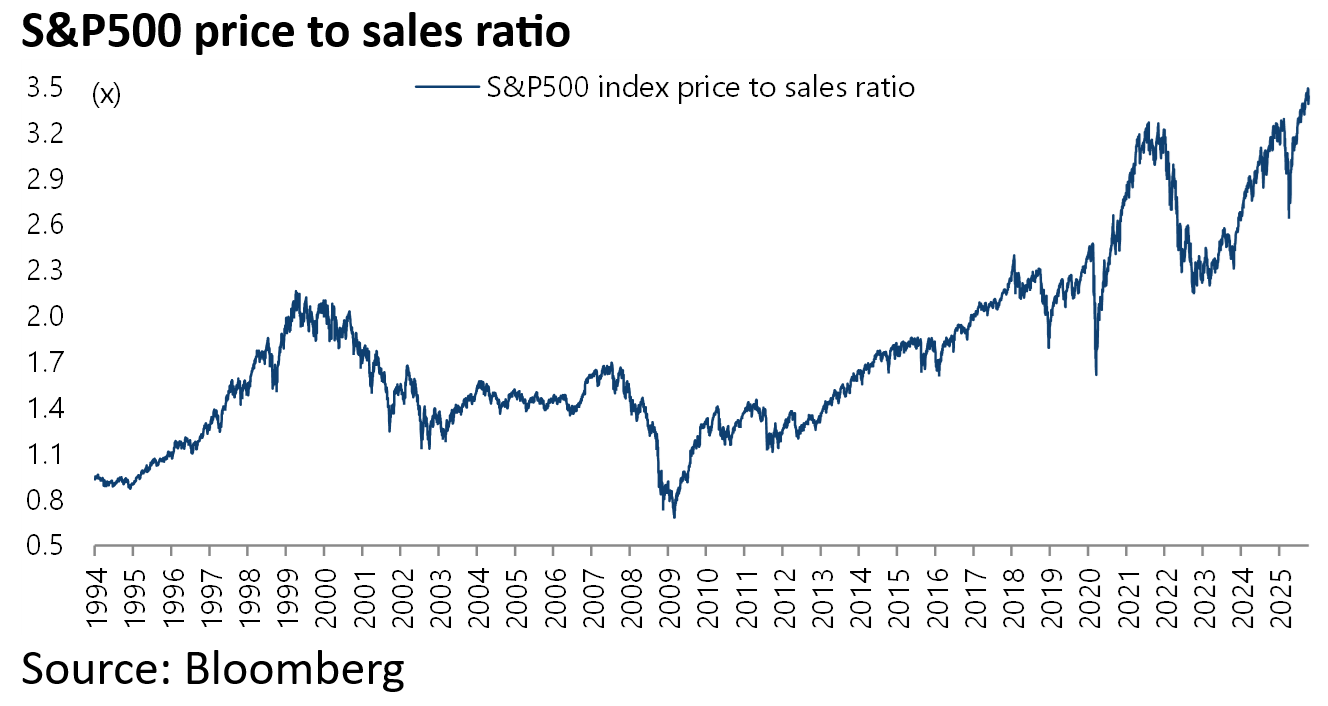

Valuations are Clearly Stretched

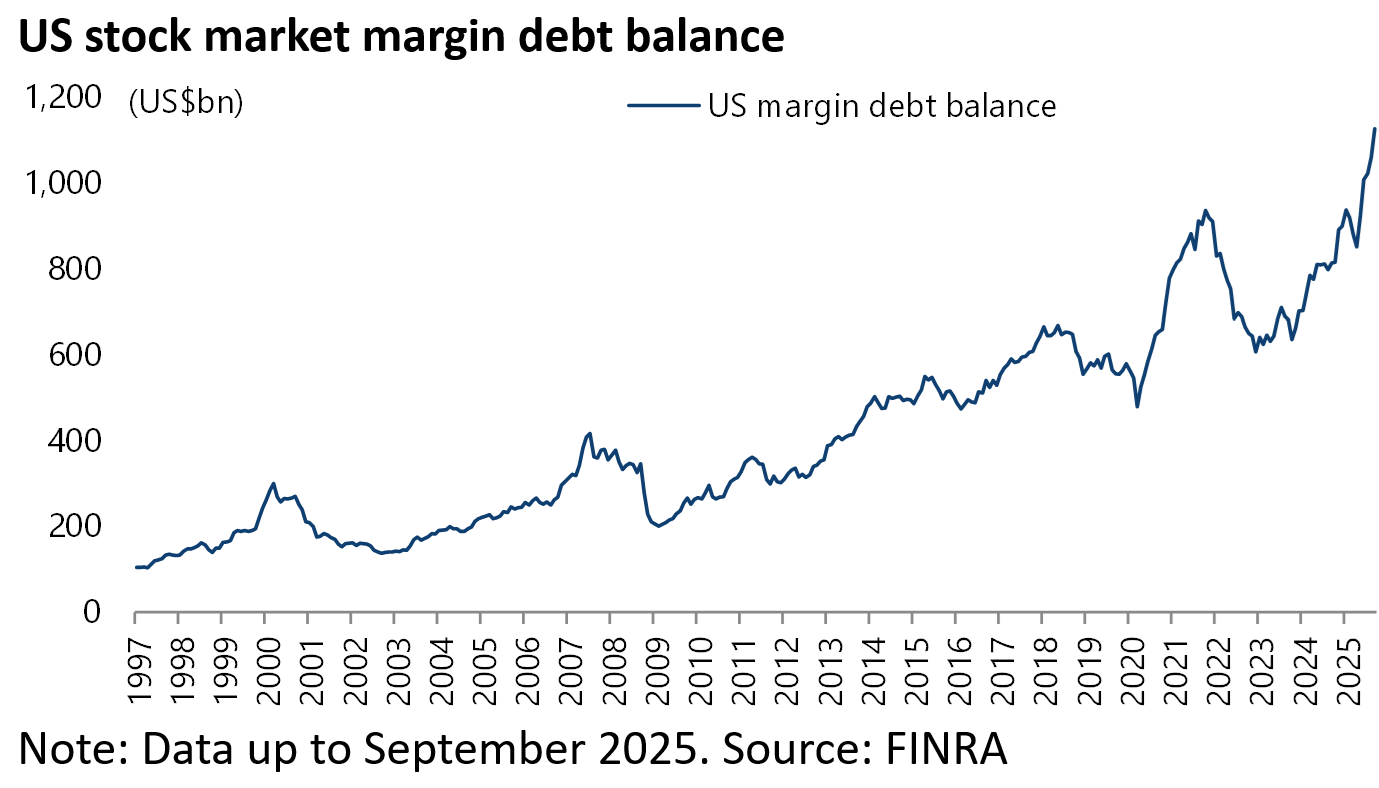

Meanwhile, it is worth highlighting that the S&P500 price to sales ratio reached a new record high of 3.49x in early October as did stock market margin debt. The S&P500 price to sales ratio has risen from a recent low of 2.65x in early April to a record high of 3.49x on 8 October and is now 3.43x.

While US stock market margin debt rose by 39% YoY to a record high of US$1.13tn at the end of September.

The capex spending plans of Meta are seemingly triggered by chairman Mark Zuckerberg’s stated goal of pursuing “superintelligence”.

This writer’s base case remains, as discussed here previously, that so-called AGI is still several years away (see The Stock Market is Eating The Economy, 27 August 2025).

Meanwhile Meta’s improving results, with revenues up 22% YoY and profits up 36% YoY in 2Q25, reflect improvements in advertising efficiency and related improved personalization of content.

But this is the result of earlier investment in a different form of AI, not the generative kind.

What do Students and Professors Have to Say About Artificial General Intelligence (AGI)?

The pursuit of AGI by the four hyperscalers, with an estimated US$350bn to be spent this year and perhaps more than US$400bn next year based on the latest guidance and consensus estimates, reflects the continuing reality that the new technology represents not only the next big growth story but also the next big source of disruptive threat.

In that sense there is a genuine fear of being left behind (i.e. FOMO) if a decision is taken not to participate in the AI arms race; and these companies certainly have the cash flow to burn even if it means that they will no longer be “asset light” businesses which is one of the features which has made them so attractive to equity investors in the past many years.

In this respect, the one conspicuous opt out amongst Big Tech of the current AI capex binge is Apple.

Its forecast capital spending was only US$12bn in FY25 which ended 30 September. Still more spending is seemingly coming.

Apple CEO Tim Cook and Donald Trump jointly announced last quarter, following a meeting at the White House in August, that Apple will invest an additional US$100bn in the US.

Including the US$500bn investment pledged in February, Apple’s total commitment to invest in America is now US$600bn over the next four years!

This writer makes no pretense to be a technology expert let alone an expert on AI.

It must also be admitted that the widely hailed vision of AI, namely the emergence of all-purpose personalized agents running all aspects of an individual’s life, is viewed here as somewhat creepy.

But that does not mean that it will not be commercially successful, just as the practice of surveillance capitalism best exploited by Google and Facebook, as they were then known, has been similarly creepy albeit also extraordinarily lucrative.

Still the point for now seems to be that the large language models, the development of which on which so much is being spent including on the data centers to power them, are nowhere near achieving the AGI goal.

In this respect, this writer has made some inquiries of Generation Z students actually studying AI.

Their view, and apparently the view of their professors, is that large language models are actually not the path towards AGI, however much they are scaled up.

Indeed the perception of LLMs as reasoning machines is largely an illusion.

Instead they should be viewed as “advanced pattern matchers” that struggle with novel logic and true understanding.

Meanwhile, there is another practical problem with investing in large language models.

That is that, even if it is assumed that these models are everything that they are cracked up to be, the spending boom in the pursuit of so-called “scaling” is hitting a natural physical and economic wall as the models require more data and compute than is sustainably available.

That suggests that the prospects are for sharply diminishing returns where massive increases in cost yield only marginal improvements in performance, or what is otherwise known as the law of diminishing returns.

There is also the issue, at least in America, whether there is the power available to drive the data centers.

AI Profits Continue to be Concentrated in Nvidia

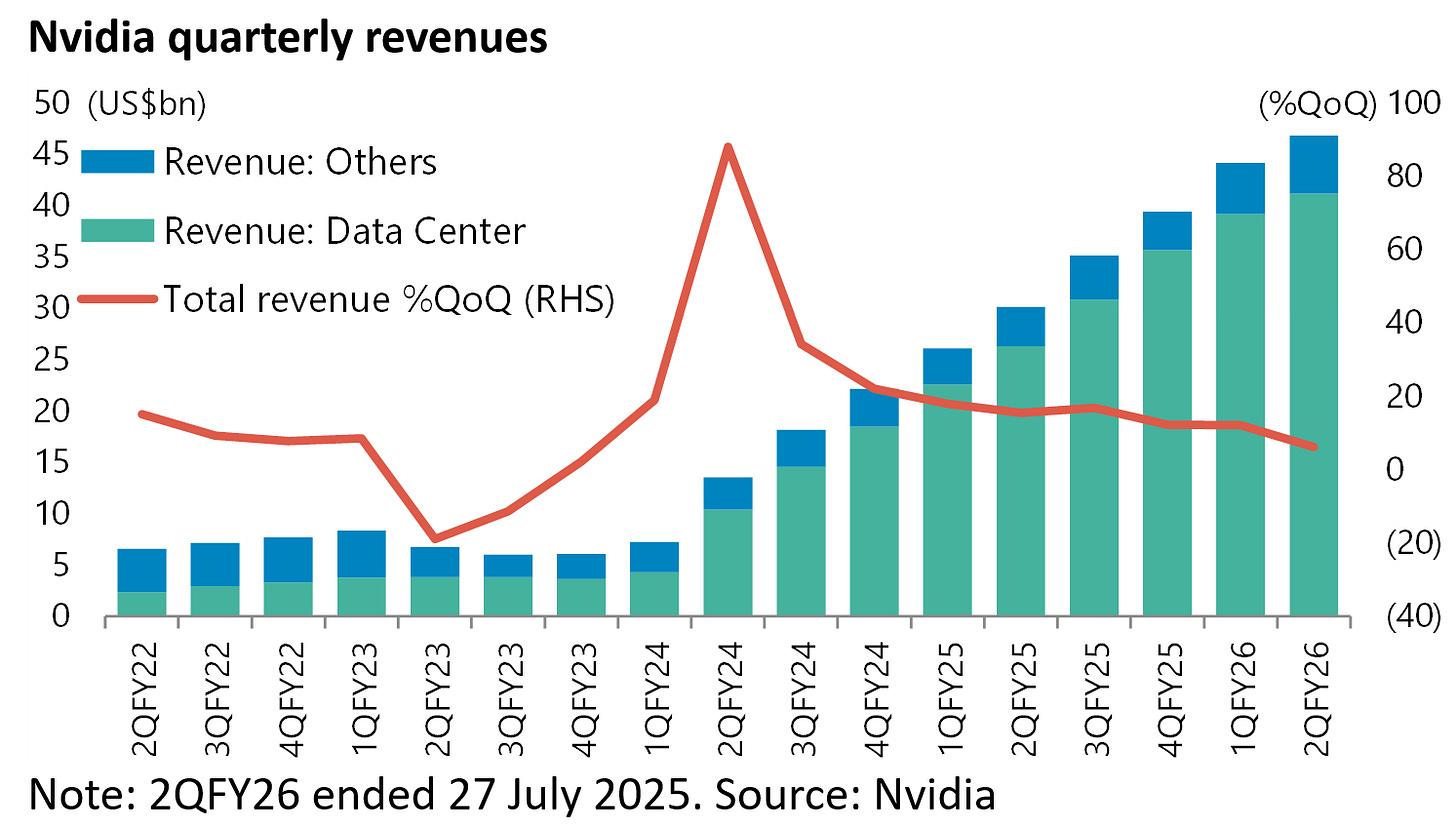

If all of the above is more or less the case, it becomes clearer than ever that the only entity currently making real money on so-called AGI is Nvidia.

In this respect, it is worth focusing again on some numbers and the extent to which the US stock market is geared to this phenomenon.

Thus, Nvidia’s quarterly revenues have surged almost eight-fold from US$6bn to US$47bn since the Microsoft investment in OpenAI announced in January 2023 triggered the AI capex arms race, even as Nvidia’s revenue growth on a quarter on quarter basis has, naturally, slowed from 88% QoQ in the quarter ended 30 July 2023 to 6% QoQ in 2QFY26 ended 27 July 2025 based on the law of large numbers.

We Favor Owning Chinese AI Stocks Due to Customer Concentration in the US and Expensive Energy

But this surging revenue growth is concentrated on a few customers.

This writer has seen estimates that 42% of Nvidia’s revenue in FY25 ended 26 January 2025 came from the four hyperscalers plus Tesla continuing to buy more GPUs.

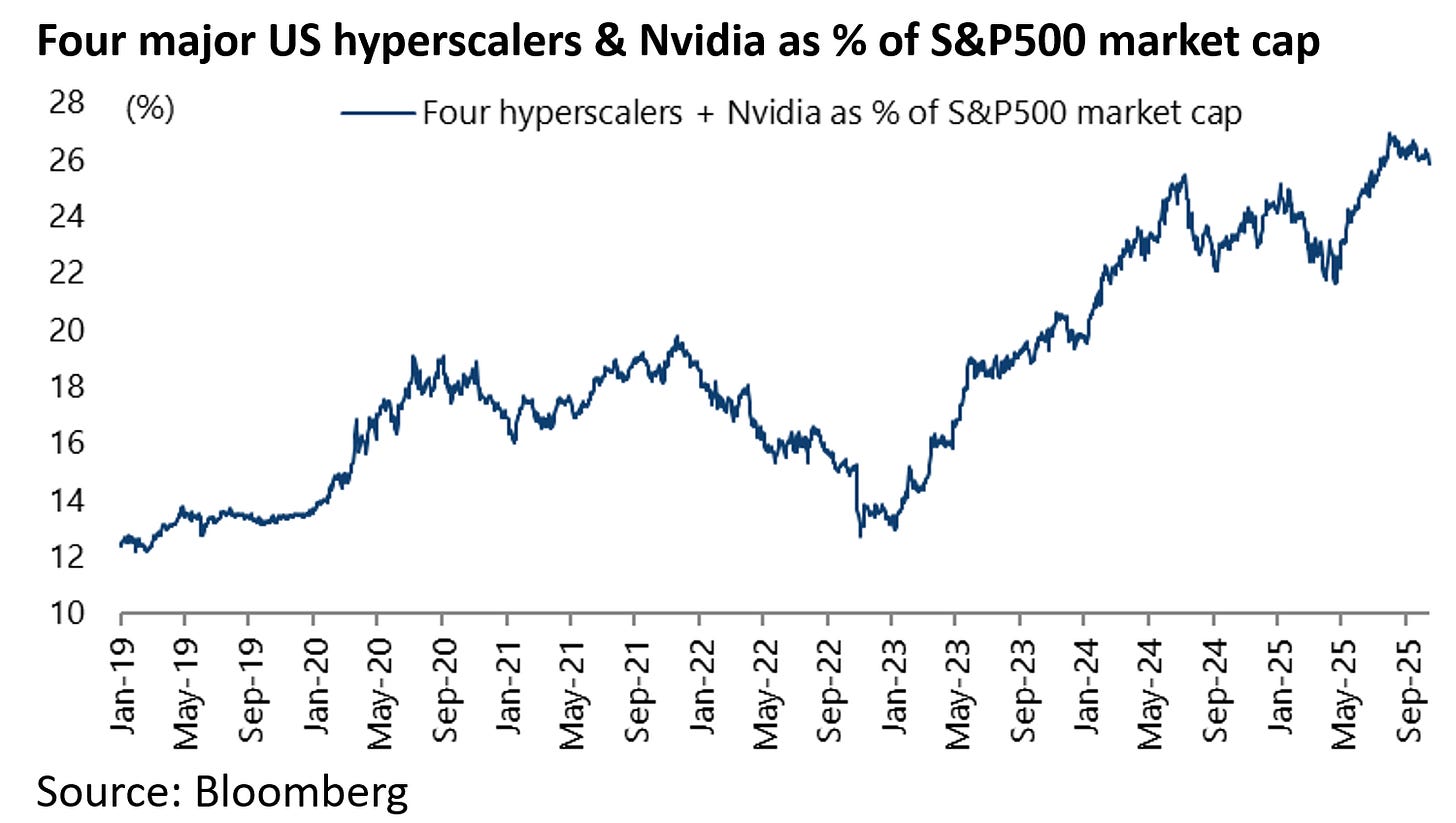

And it is this concentrated nexus which is driving the US stock market since the four hyperscalers combined with Nvidia now account for 26.1% of the S&P500 market capitalisation and an estimated 45% of the gains since the beginning of 2023 as at the end of last quarter.

Still if the projected capex spend give some idea of the scale of the bet these companies are making, it is also the case that they can seemingly afford to make this bet given the projected profits they will make this year.

The combined net income of the four major US hyperscalers is forecast to rise by 29% to US$406bn in 2025 based on consensus estimates.

Still it also gives an idea of the vulnerability of the US stock market if the value of this capex spend is ever questioned by investors, with the DeepSeek moment in late January providing a dress rehearsal, or conversely if the hyperscalers suddenly decide to stop spending out of their volition.

This writer, from an investment standpoint, remains much more comfortable with the intrinsically practical Chinese approach to AI which, as previously discussed here (see Key Takeaways From Our Recent Trip to Beijing, 6 August 2025), is focused on using the cheap open-source DeepSeek to come up with commercially viable practical applications rather than building the perfect large language model.

The Chinese also have seemingly limitless access to cheap energy in stark contrast to America.

Ever looked at SAIL. NZS recently bought it: https://substack.com/@thesmartmoneyreport/p-176981048

This is one of the most thought-provoking and contrarian takes on AI I've read! Your analysis of the circular deal making - AMD giving OpenAI warrants for 10% of the company, Oracle's $300B deal with OpenAI while OpenAI loses $1B/month - really exposes the financial engineering underlying the AI hype. The insight that LLMs are 'advanced pattern matchers' struggling with novel logic rather than reasoning machines is crucial and matches what I'm hearing from actual AI researchers. Your point about the four hyperscalers plus Nvidia accounting for 26.1% of S&P 500 market cap and 45% of gains since 2023 is staggering - that concentration risk is enourmous. What I find most compelling is the Chinese approach: using cheap open-source DeepSeek to build commercially viable applications rather than chasing the perfect LLM. The energy advantage is also massive - limitless cheap power vs US constraints. The S&P500 price/sales at record 3.49x combined with record margin debt of $1.13T suggests we're in classic bubble territory. Excellent contrarian analysis!