WHAT DO JAPANESE STOCKS AND US SMALL BUSINESS HAVE IN COMMON?

Author: Chris Wood

This writer’s main candidates for the areas to blow up if there is a recession in the US as a consequence of monetary tightening remain private equity and private credit for reasons outlined here previously (see With Bank Lending On The Decline, Why Aren’t We In a Recession Already?, 24 December 2023).

Still one area where private equity operators have been making hay in recent years and where there has remained relatively easy pickings is Japan.

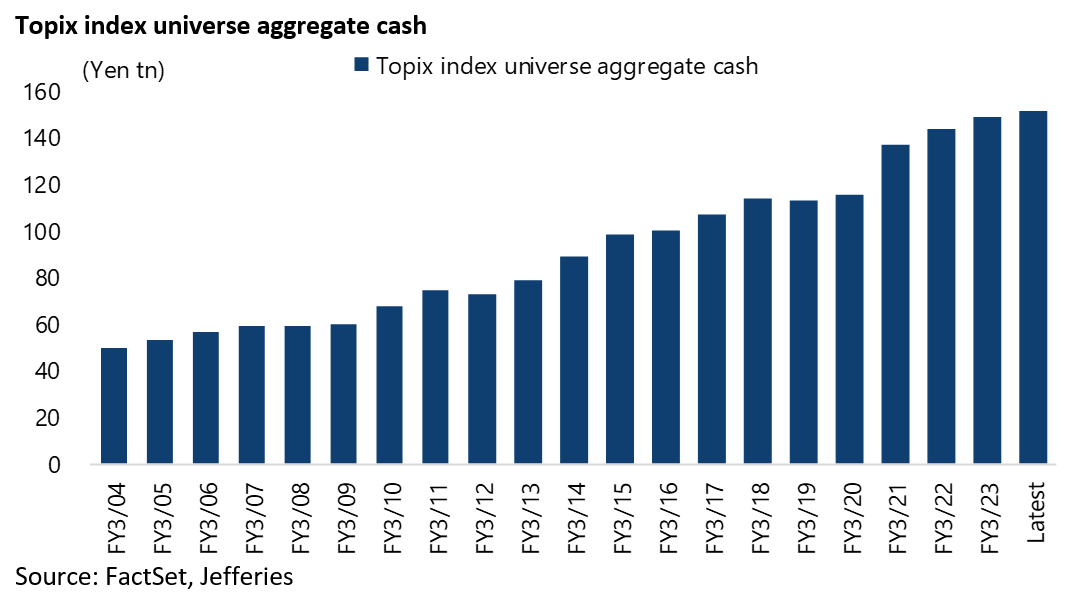

That is because of the excess cash sitting on Japanese corporate balance sheets and the obvious continuing opportunities for restructuring in terms of selling down both cross shareholdings and non-core subsidiaries.

Indeed in some ways the opportunities are similar, though perhaps more attractive given the still ultra-low cost of yen financing, to what triggered the original leveraged buyout boom in America back in the 1980s.

If the prominent private equity franchises have already been active in Japan in recent years with growing success, as have activists, the whole move to embrace corporate governance reform has of late received official sponsorship with the Tokyo Stock Exchange’s “name and shame” campaign to threaten Japanese corporates with delisting if they do not meet certain criteria by March 2026.

By way of background, the TSE set up in April 2022 a new market structure, reorganizing listed stocks into three segments, the Prime top-tier section, the Standard section for mid-sized companies with easier listing requirements and the Growth section for younger companies.

The TSE plans to end the transition period for its market realignment in March 2025, by when the transitional measures of relaxed “continued listing criteria” for existing listed companies will be terminated.

Companies that do not meet the listing requirements after the transition period ends will be delisted six months after a one-year improvement period.

Management Turnover is Happening Now, Then Comes Real Corporate Change

Meanwhile the rising pressure on corporates to change behaviour is also illustrated by the growing number of management buyouts, a topic discussed in the Financial Times late last year (see Financial Times article: “Japan turns to management buyouts amid activist heat”, 20 November 2023).

Thus, there were 25 management buyout announcements in 2023 with a record combined value of US$8.4bn, according to Bloomberg.

As the article correctly noted, such transactions are driven primarily by defensive considerations.

For an MBO removes the pressure from the likes of the TSE on management to sell non-core shareholdings to others.

It is also the case that minority shareholders are not so well protected in Japan.

The other factor triggering a greater sense of urgency in doing MBOs is the perception that ultra-cheap yen financing may not be available forever.

This raises the subject of the Bank of Japan’s continuing ultra-cautious approach to monetary easing.

With inflationary pressures still clearly visible, as reflected in the latest data, the consensus in Japan, as reflected in the money markets, is that negative rates will be gone by April 2024.

Japan core CPI inflation, excluding fresh food, was still 2.5% YoY in November, the 20th consecutive month above the 2% target.

Life Insurers Starting to Buy Long Dated Japanese Debt but Its Still Early

Meanwhile, legacy of the BoJ’s ultra-easy policy since former governor Haruhiko Kuroda’s appointment in early 2013 is the impoverishment of Japanese households in US dollar terms.

Japan’s GDP per capita in US dollar terms has collapsed from US$49,175 in 2012 to US$33,854 in 2022, or only slightly above Korea’s US$32,418.

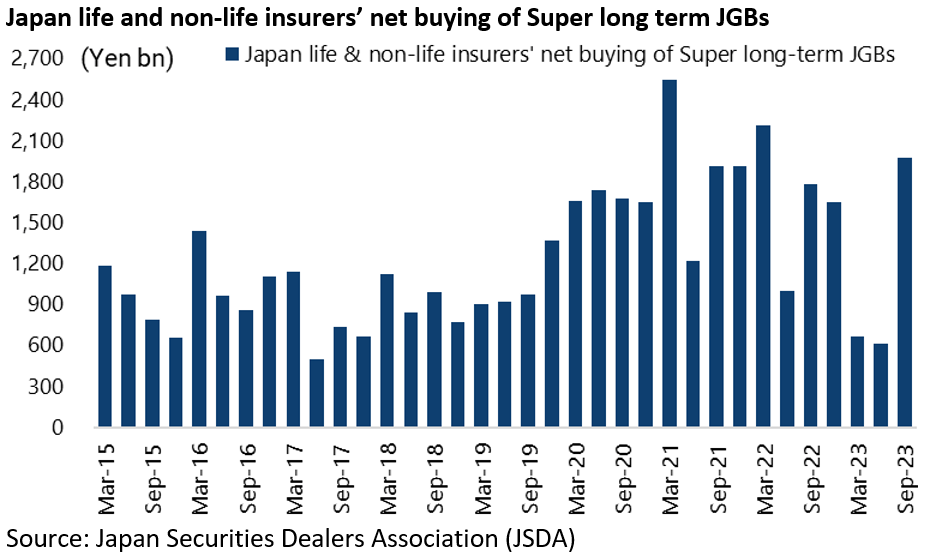

It is also interesting to note that Japanese life insurers increased their holdings of super long-term JGBs in the third quarter last year as yields approached levels where they can start to meet their asset liability requirements in yen terms (see Nikkei Asia article: “Japan life insurers turn away from US Treasurys for JGBs as rates rise”, 9 November 2023).

The Japan Securities Dealers Association data shows that life and non-life insurance companies bought a net Y1.974tn in super long-term (over 10-year) JGBs between July and September, up from Y612bn in 2Q23 and Y662bn in 1Q23.

Still, if this indicates a growing willingness to increase exposure to yen fixed income, as well as the emergence of a potential buyer of some of the Bank of Japan’s vast holdings of JGBs, it does not necessarily mean that Japanese life insurers are in a hurry to sell their large holdings of Treasury bonds and repatriate the funds raised.

One issue is that that could require taking a loss. And that depends on life insurers’ so-called “loss budget”.

Meanwhile, Japanese life insurance companies held Y103.55tn of foreign securities at the end of 3Q23, according to the Life Insurance Association of Japan.

It remains the case that it makes no sense for life insurers to buy US Treasuries with estimated hedging costs of around 5.6% more than wiping out any yield pickup.

Longer term, life insurers will aim to increase exposure to JGBs as long as the 10-year JGB yield is at 1%, 1.75-1.8% on the 20-year and 2% on the 30-year.

This is the level of yield which allows them to meet their asset-liability needs in yen terms without having to buy foreign bonds.

If You Own Japanese Stocks Should You Hedge Your Yen Exposure?

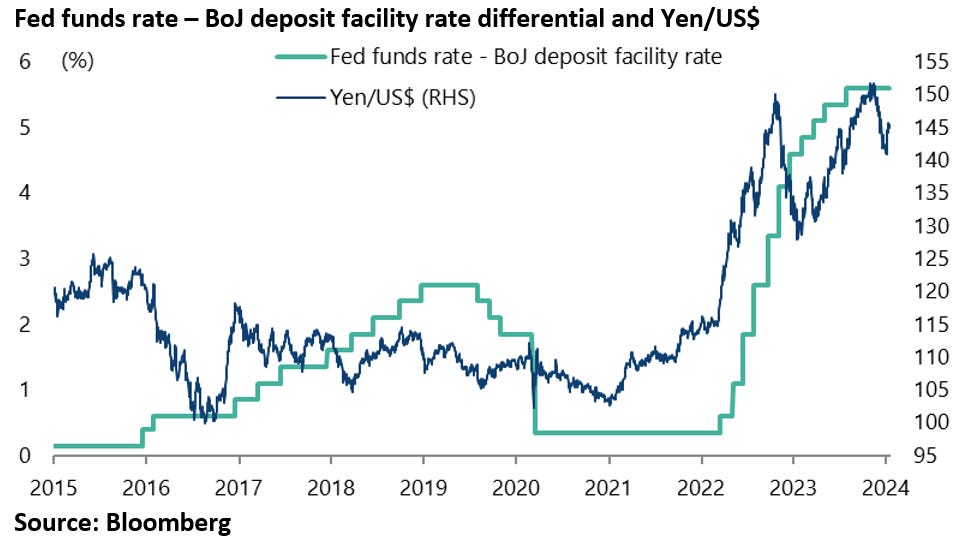

Meanwhile the tricky issue for foreign investors in Japanese equities remains whether to hedge the currency after the yen’s already precipitous decline in value.

The likelihood is that the rate differential with the dollar has peaked which suggests the yen has bottomed.

Meanwhile the BoJ’s continuing efforts to suppress JGB yields, despite its two modifications of yield curve control in late July and October, means the central bank’s balance sheet has continued to rise thereby providing a support to global liquidity.

The BoJ balance sheet rose by Y46tn or 6.5% last year to Y750tn at the end of 2023.

Meanwhile, with the pressures for a change in corporate behaviour growing, not to mention the continuing potential for a re-allocation out of yen fixed income into Japanese equities on the part of domestic institutions,

Japanese equities remain interesting with the one obvious risk being that of an external downturn in the US.

Odds of a US Recession are Remote as Long as Small Businesses Muddle Along

On the subject of a US recession, it remains the case that the labour market in America will remain healthy so long as SMEs are not laying people off since they employ about 75% of private sector employees, based on businesses with fewer than 250 employees.

On that point, it is worth highlighting that the latest NFIB small business monthly survey published last week shows that the average interest rate paid on small businesses’ loans rose from 9.3% in November to 9.8% in December, matching the level in September which was the highest level since December 2006.

Source: National Federation of Independent Business (NFIB)

While the NFIB small business hiring plans index declined from 18% in November to 16% in December, down from a peak of 32% in August 2021.

SMEs remain the key area to monitor as regards the labour market.