What Data Will Trigger the Interest Rate Pivot Markets Have Been Waiting For?

Author: Chris Wood

It is still a close call. But the latest US CPI and employment data make it slightly less likely that the Fed will tighten by another 25bp at the next FOMC meeting on 20 September.

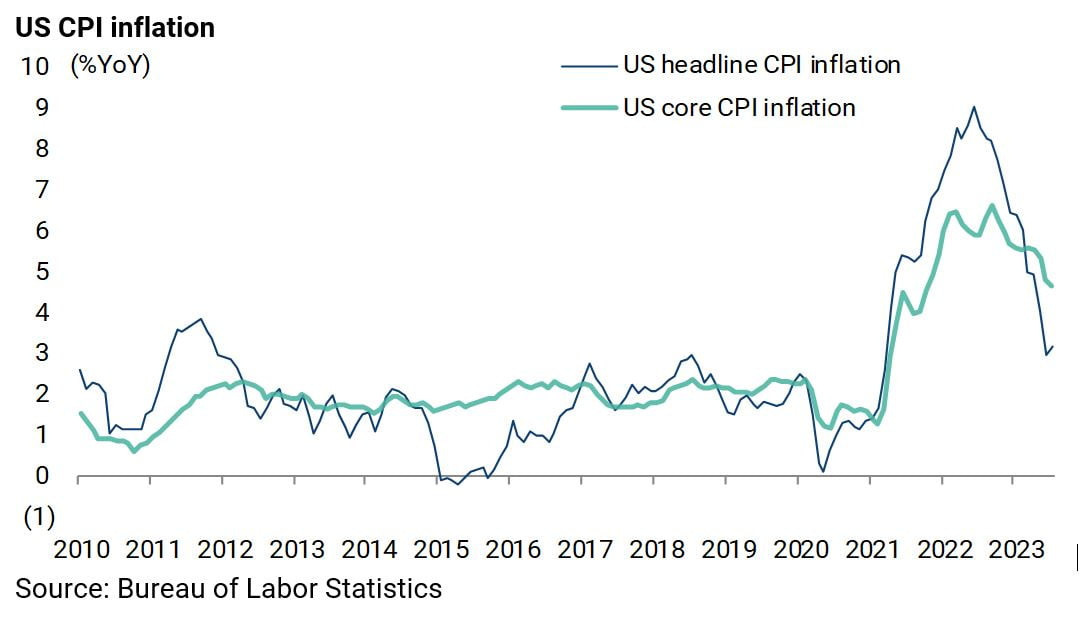

The US CPI data released in mid-August shows that CPI inflation rose from 3.0% YoY in June to 3.2% YoY in July, compared with consensus expectations of 3.3% YoY.

While core CPI inflation declined from 4.8% YoY in June to 4.7% YoY in July, which was in line with consensus expectations.

As for last Friday’s employment data, which in this writer’s view has become almost more important than the inflation data of late, it was almost goldilocks in the sense that the labour market is cooling but not alarmingly so.

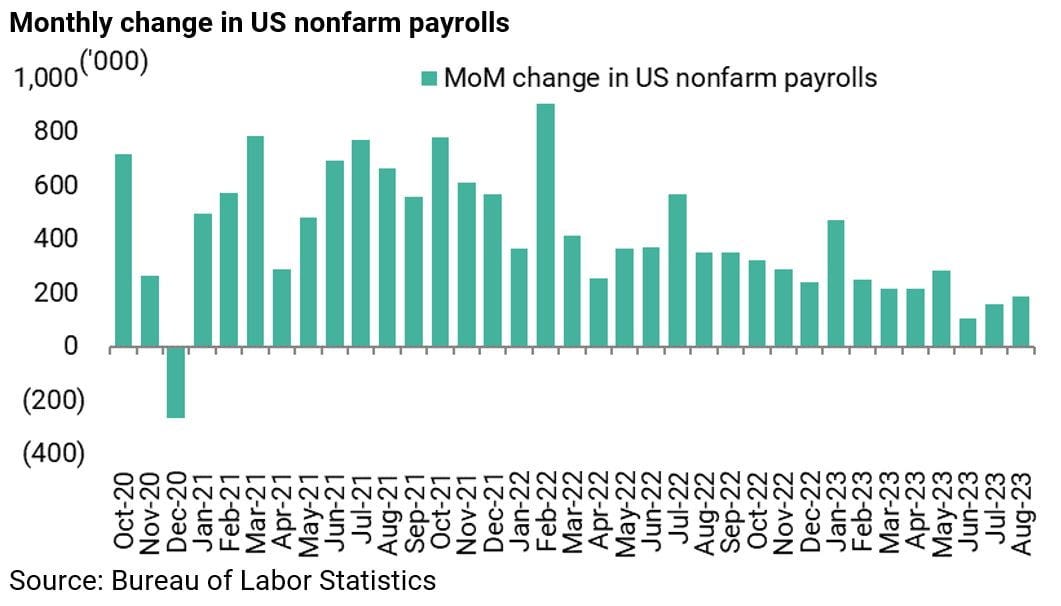

US nonfarm payrolls increased by 187,000 in August, compared with consensus expectations of 170,000, while the job growth for the previous two months has been revised down by a combined 110,000.

As a result of the revision, nonfarm payrolls increased by only 105,000 in June, the lowest level since December 2020.

Meanwhile, the unemployment rate rose from 3.5% in July to 3.8% in August.

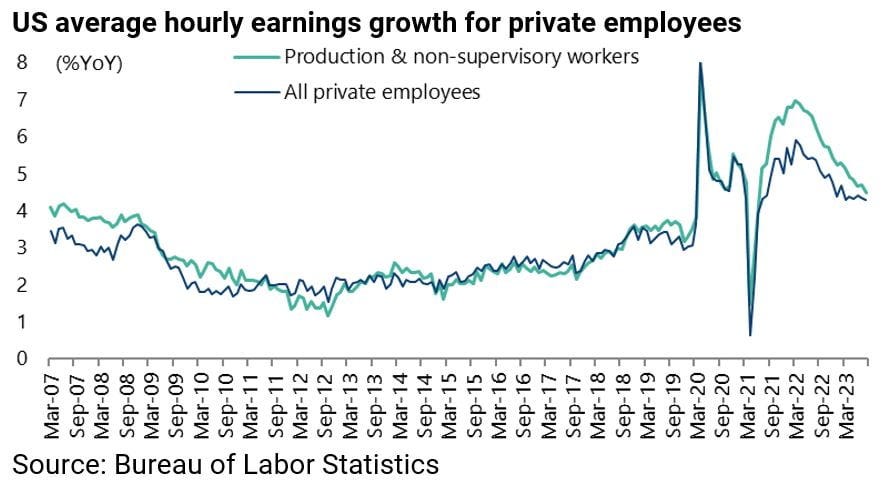

As for wage growth, the average hourly earnings growth for all private employees slowed from 4.4% YoY in July to 4.3% YoY in August.

The reason the employment data has become more important is that any sign of a real weakening will trigger the moment markets, and this writer, have been waiting for all year.

That is which of the Fed’s two mandates it will prioritise in such a stress test, namely employment or inflation.

This writer’s base case remains that Jerome Powell will prioritise employment, most particularly with the US presidential election season having now effectively commenced.

But for now, in his continuing wannabe Volcker act, the current Fed chairman is placing huge importance on the labour market despite its longstanding reputation as a lagging indicator in terms of forecasting economic cycles, in contrast to more classic forward looking macro signals such as the shape of the yield curve and money and credit growth.

Labor Market Nuances In Focus

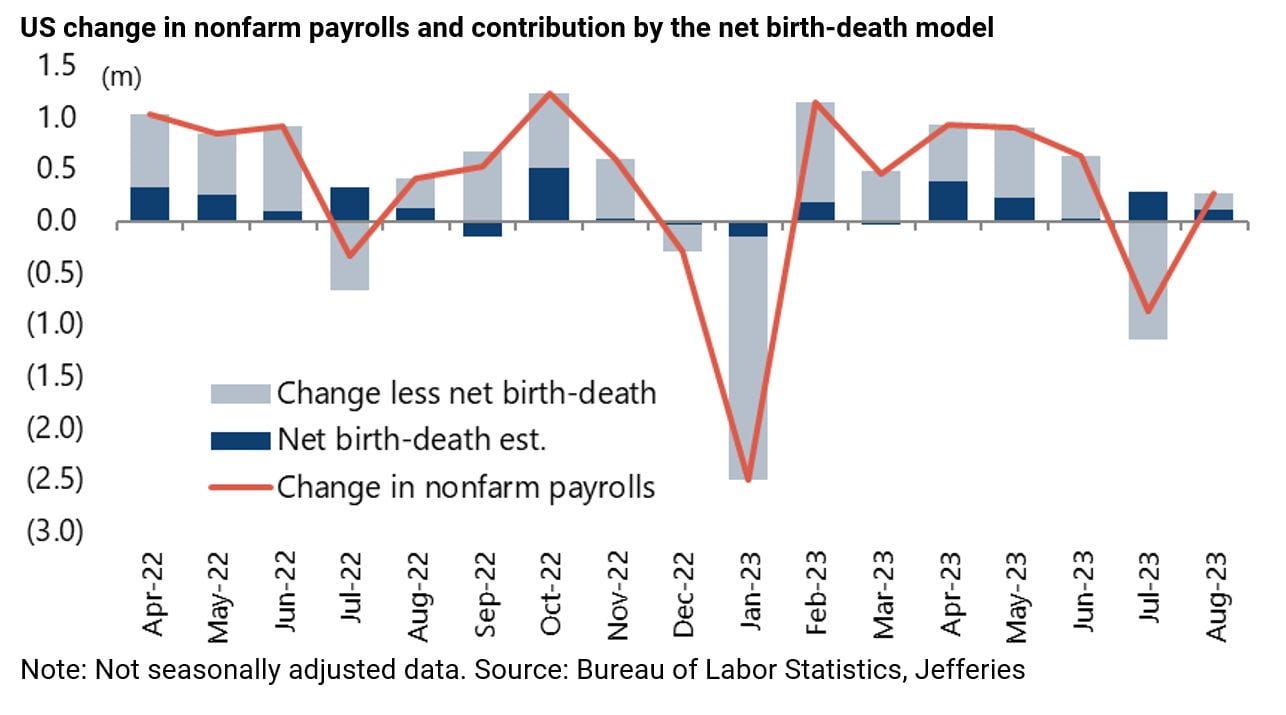

Given the current importance attached to the employment data by the Fed, it is worth recalling some of the weird methodology that goes into compiling it, most specifically the Bureau of Labor Statistics’ so-called “net birth-death” adjustment.

This is used to estimate the net effect of job gains from business openings (births) and job losses due to business closings (deaths).

It should be noted that the net job gains/losses from the net birth-death model is measured only on a non-seasonally adjusted basis and therefore it should be compared with the non-adjusted nonfarm payrolls data.

For example, the birth-death model added 280,000 jobs to the job growth in July and 103,000 in August, when the non-seasonally adjusted changes in nonfarm payrolls were -871,000 and 268,000, respectively.

As a result, the net birth-death model has added 1.363m of jobs to the nonfarm payrolls in the past 12 months to August, accounting for 45% of the total increase in nonfarm payrolls of 3.017m.

Small Business Under Pressure

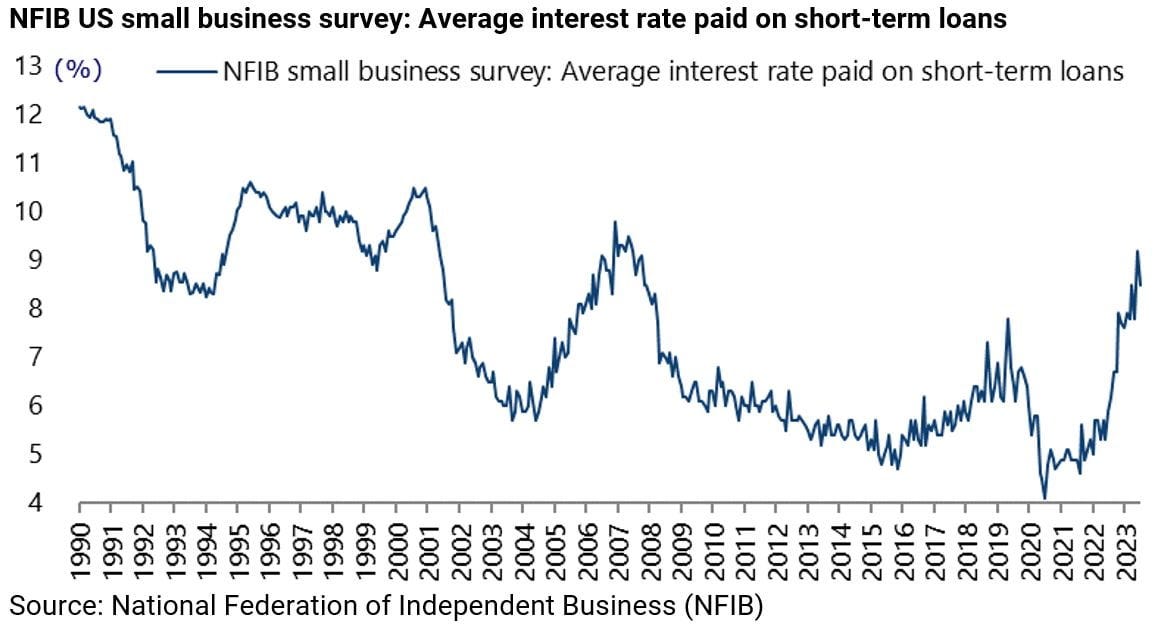

Meanwhile, the average interest rate paid by small businesses rose to 9.2% in June, the highest figure since July 2007, based on the monthly NFIB survey, though it declined to 8.5% in July.

In this respect, small businesses with less than 250 employees account for 74% of US private sector employment.

On a related point, the Job Openings and Labor Turnover Survey (JOLTS) shows that job openings at small businesses fell outright.

Total private sector job openings have declined by 3.143m or 29% since peaking in March 2022 to 7.865m in July, while job openings at small businesses (with <250 employees) are down 2.102m or 26% over the same period to 6.105m.

As a result, small businesses’ share of total private sector job openings peaked at 78.6% in December and has since declined to 76.6% in May and was 77.6% in July.

Despite the reality of the rising cost of money for small businesses who do not have access to the bond market, the reality is that the consensus is increasingly giving up on US recession forecasts.

Still this writer continues to emphasise the lags in monetary policy as previously discussed here (When will the recession start? The answer may surprise you, 3 May 2023).

Recession Fears in the Eurozone are Rising

Meanwhile recession concerns are rising again in the Eurozone after 425bp of rate hikes in this ECB tightening cycle.

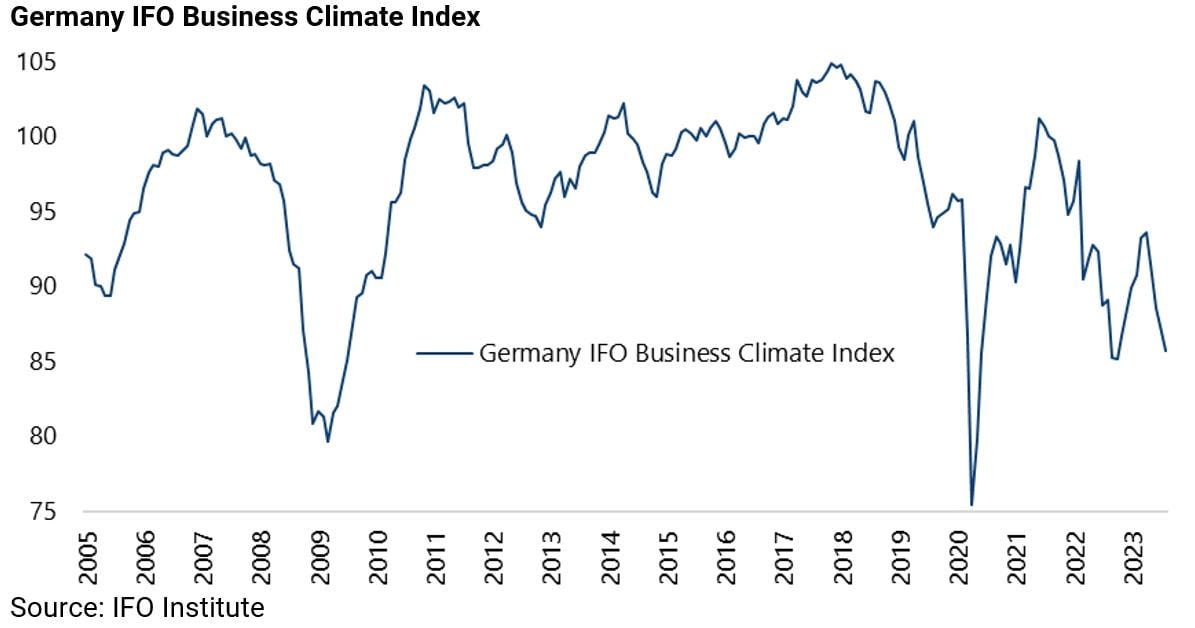

The biggest concern remains about the German economy where the latest survey of business confidence showed a further weakening.

The IFO Business Climate Index for Germany declined from 87.4 in July to 85.7 in August, the lowest level since October and well below consensus expectations of 86.8.

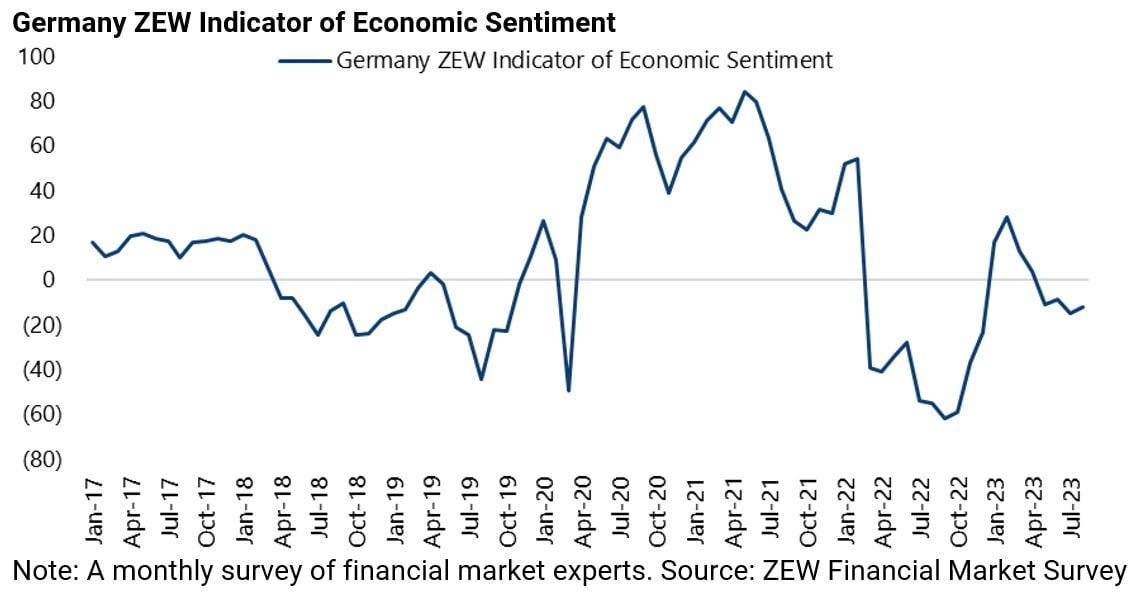

While the ZEW Indicator of Economic Sentiment in Germany also fell from -8.5 in June to -14.7 in July, the lowest level since December, and was -12.3 in August.

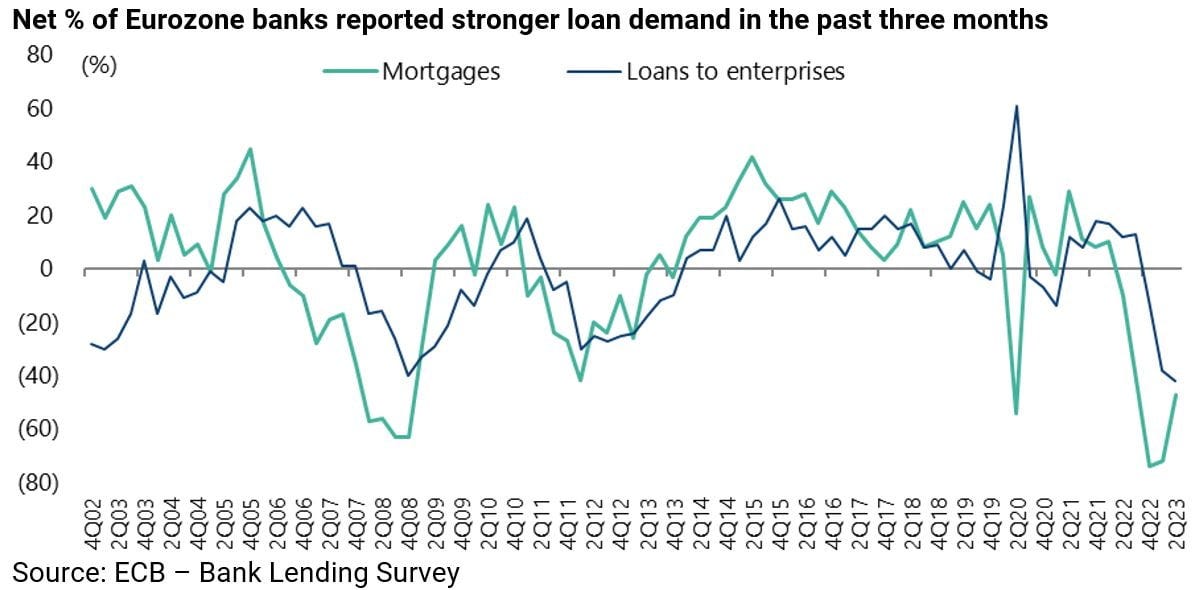

It is also worth noting that the ECB’s quarterly Bank Lending Survey released in late July showed a continuing weakening in loan demand.

A net 47% of Eurozone banks reported weaker loan demand for mortgages in 2Q23, though down from 72% in 1Q23 and 74% in 4Q22.

While a net 42% of banks reported weaker loan demand for enterprises in 2Q23, the highest level since the survey data began in 4Q02.

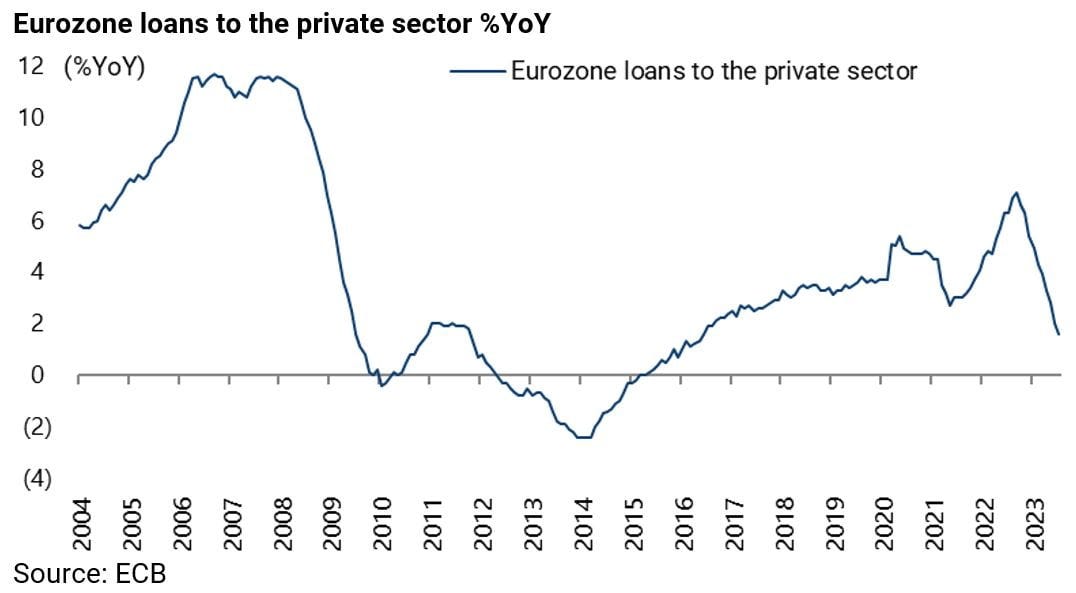

As for overall bank loan growth, Eurozone loan growth to the private sector has slowed from 7.1% YoY in September 2022 to 1.6% YoY in July.

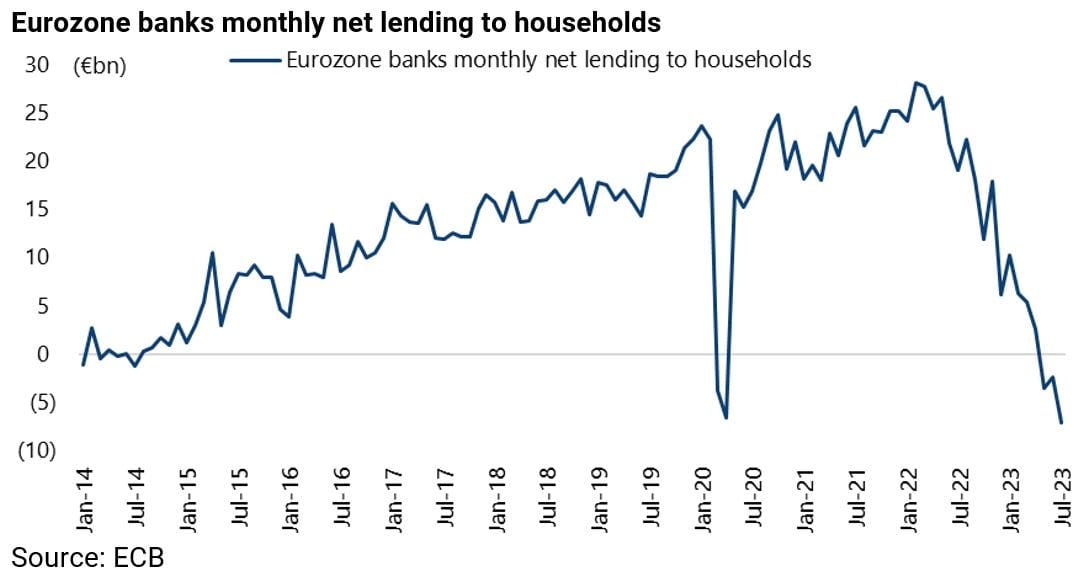

While net new lending to households has collapsed from €28bn in February 2022 to a record negative €7.2bn in July.

Similarly bank lending continues to decline in America. US commercial banks’ total loan growth has slowed from 12.5% YoY in early December to 4.8% YoY in the week ended 23 August.

While commercial and industrial (C&I) loans rose by only 0.7% YoY in the week ended 23 August, down from 15.3% YoY in November.