Weekender: Exxon Goes Big Shale Hunting

Energy equity investors are enjoying back-to-back weekends of good news bumps; first it was OPEC’s surprise cut and now the WSJ reports that Exxon is in preliminary acquisition talks with Pioneer.

In this edition of the Weekender:

Is Exxon doubling down on shale oil? We examine Exxon’s rationale to acquire Pioneer

All In Commodities: Harris “Kuppy” Kupperman weighs in on OPEC and the future of the periodic table

Mining 101: BC’s Golden Triangle & The Leverage of Silver Stocks with Shawn Khunkhun, CEO of Dolly Varden

Analyzing OPEC’s Surprise Cut with Rory Johnston of Commodity Context

Teck Resources rejects Glencore’s Merger Proposal

Is Exxon Doubling Down on Shale Oil?

Rumors are swirling that ExxonMobil is once again looking to buy a whole lot of hydrocarbons in the form of Permian Basin operator Pioneer Natural Resources. What’s more interesting than who Exxon wants to buy is where and what they want to buy.

Pioneer has probably been the most successful shale oil producer in America over the last decade plus, and if this deal does become a reality, it demonstrates Exxon’s belief in the continued attractiveness of North America for one and shale resources in Texas for another. Exxon Mobil would not spend over $50 billion if they thought the Permian rocks were past their peak production as some energy analysts like to call for. North America also has no windfall profit’s tax and is a reliable and stable political jurisdiction, two point not lost on Exxon management as they hunt for new resources.

Exxon has been very wrong before however, buying gas giant XTO in 2009, right as exploding shale oil and associated gas production crashed gas prices for a decade. An official deal would send a strong message that US shale oil is here to stay.

As far as the financial reasoning behind a deal, the answer can be broken into three parts:

Pioneer is growing 6% while Exxon is struggling to grow production even 1%. Buying Pioneer would boost growth from 0.6% this year to 1.6%, a meaningful increase.

Exxon has lots of cash, $36 billion to be exact. Exxon could pay for 56% of Pioneer with cash alone, meaning it definitely has the ability to get a deal done if it wants the Pioneer assets.

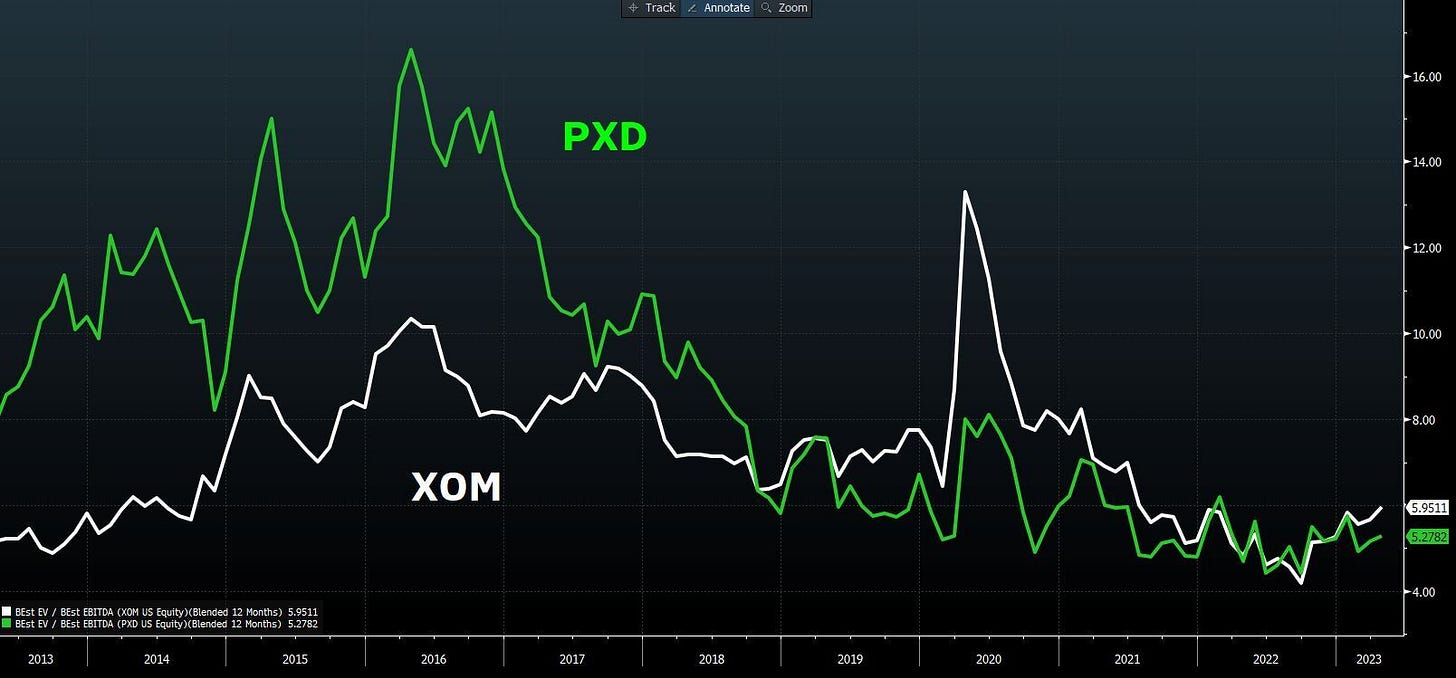

Pioneer is cheap compared to history. Pioneer’s EBITDA multiple (a measure of cashflow) was as much as 2x the price of Exxon as recently as 2014. Today Pioneer is 12% cheaper than Exxon. Exxon could buy Pioneer with all shares and it would still benefit Exxon shareholders.

PXD vs. XOM: Forward EV/EBITDA

All In Commodities with Harris “Kuppy” Kupperman

We were joined by the one and only Harris “Kuppy” Kupperman, Founder & CIO of Praetorian Capital to discuss his outlook on OPEC’s surprise output cut, how it will impact the markets & the Fed, and the bull thesis for oil and commodities going forward.

An episode not to be missed!

iTunes: https://apple.co/430Trls

Spotify: https://spoti.fi/3MnUINA

YouTube:

Mining 101: BC’s Golden Triangle & The Leverage of Owning Silver Stocks with Shawn Khunkhun

Grizzle had the pleasure of launching its Mining 101 Twitter Spaces series with Shawn Khunkhun, CEO of Dolly Varden. With gold breaking through the 2K barrier it was a timely and dynamic discussion that covered the historical fundamentals of gold and silver, his bullish outlook for silver, BC's prolific Golden Triangle and why miners provide significant leverage over owning physical precious metals.

iTunes: https://apple.co/3Goz6gs

Spotify: https://spoti.fi/3zI9C9X

Analyzing the OPEC Cut with Rory Johnston

Rory Johnston, Founder of Commodity Context, joins Grizzle to discuss his outlook on what led to OPEC’s surprise production cut, his views on growing tensions between Washington and the cartel, and where he sees oil demand heading in the second half of the year.

YouTube:

Teck Resources Rejects Glencore’s Takeover Bid

Teck Resources issued a statement on April 3rd that it had received and unanimously rejected an unsolicited and opportunistic acquisition proposal from Glencore. Glencore offered 7.78 Glencore shares for each Teck Class B and 12.73 Glencore shares for each Teck Class A common share; a 20% premium for both classes and total value of $23 billion.

Glencore had proposed to create two standalone companies from the combined entities: MetalsCo (base metals) and CoalCo (coal and carbon steel materials).

The bid continues to highlight the significant value of electric metals for mining companies (particularly copper) and signifies that the M&A phase of the base metals structural bull market has begun.