Waiting for the Natural Gas Payday with a Life Jacket On

Our last quant analysis was all about getting paid to wait for higher commodity prices. This month’s screen is about investing in a deep value commodity with a life jacket. We can’t enjoy the spoils of higher long-term natural gas prices if the stocks we own don’t make it through the valley of death ($2/mmbtu).

The key to making life changing money in commodities is to stay alive during the bad times so you can harvest the cyclical gains during the good times.

But Why Gas?

We are focusing on gas stocks this week for two reasons.

Gas prices crashed 78% over the past year and are sitting close to many companies cost of production. Knowing which companies can still make money and pay their debts if prices stay depressed is the most important analysis you can do right now given the opportunity from reason #2.

We strongly believe the upside for North American gas stocks is far higher than for oil stocks over the next 4 years. Buying the survivors when prices are down 77% is far better than chasing the winners once pricing turns around.

The Elevator Pitch for Gas Stocks

The invention of liquified natural gas (LNG) in 1820 and the ramp up of commercialization after the Arab oil embargo in 1979 have revolutionized energy markets.

Natural gas can now be transported anywhere in the world as a liquid, just like oil, yet trades for 40%-80% less per unit of heat than oil.

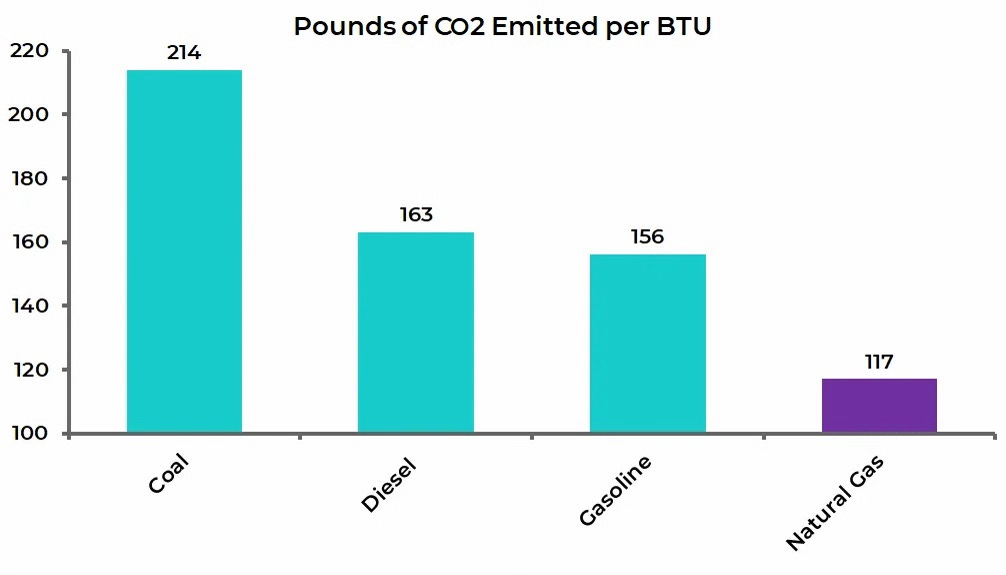

Coupled with its far smaller emissions footprint, gas is emerging as the transition hydrocarbon of choice as the world moves from oil to renewable energy.

Global LNG demand is estimated to increase 33% by 2026 and 65% by 2030 or 10% and 7% a year respectively.

North American gas is the cheapest in the world outside of Qatar and the US is emerging as the the largest LNG exporter globally with 54% market share of new LNG capacity built from now until 2030.

What this means for local demand is nothing less than explosive. US natural gas demand has been growing at 1.4BCF/d on average for the past 10 years. With the help of LNG, we think gas demand will grow 3.1BCF/d from now until 2026, or more than double the historical rate.

On top of historic demand growth, North American gas prices are trading cheap vs oil on an energy equivalent basis. Owning gas stocks over oil stocks when the price of gas is cheap vs oil has historically generated market beating returns and we think it will do so again.

Gas Stock Performance in 2012 (Recent Peak for Gas to Oil Price Spread)

Top Decile Results

Our screen identified 13 stocks with best in class metrics.

They are well prepared to survive $2/mcf gas with the lowest production costs in the industry, significant cashflow leverage to rising gas prices in the future and pristine balance sheets.

This month’s analysis includes:

Table of the top 13 companies based on 7 proprietary metrics. The top decile from our last quant study is outperforming the energy sector by 8% since the publish date.

Our top three picks based on the data and a deep dive analysis of each.

Detailed screening methodology. Which factors are important and why.

And now for the top 13