US or China - Who has the Stronger Negotiating Position in Trade Talks?

Author: Chris Wood

The base case here remains that the US has no leverage over China on the tariff issue, as previously discussed here (see In Tariff Negotiations, Trump Has No Ace Up His Sleeve, 29 May 2025).

This is why Beijing made it crystal clear that it will not cut tariffs unless the US made the first move since it is the Trump administration which initiated this trade war.

This has now happened with the commencement of talks between the two sides.

Meanwhile, it has been obvious that the plan of the Trump administration has been to seek to isolate China by agreeing trade deals with more friendly countries, such as Japan and India.

If this pressure means Japan and India may be able to negotiate better deals with the US than might otherwise have been the case, they are unlikely to agree terms that threaten their trading relationship with China.

On that point, China specifically warned in late April that it will retaliate against any country that negotiates trade deals with America “at the expense of China’s interests”.

In this respect, it is a reality that for many countries China is now a more important trade partner than the US.

To be precise, a total of 143 or 71% of countries traded more with China than with the US in 2024, while 107 or 53% of countries traded more than twice the amount with China that they trade with the US, based on IMF’s data on international trade in goods by partner countries (formerly Direction of Trade Statistics).

This compares with 22% and 11% respectively back in 2001 when China joined WTO.

All of the above is why Donald Trump still badly needs an off-ramp before his tariff agenda inflicts too much unnecessary damage on the American economy, evidence of which is likely to show up in data in the next few weeks.

The base case remains that the 47th American president should revert to a universal 10% tariff for everybody.

Does China Need Stimulus to Fend of Trump's Tariff Threats?

Meanwhile the message from Beijing is that no aggressive stimulus is coming for now.

This is in part because President Xi Jinping does not believe in such a policy and in part that the central government does not want to be seen to be panicking in the face of the US tariff threat.

Still the politburo meeting, held at the end of April, clearly acknowledged in the official statement the threat to external growth from tariffs while emphasising the need to strengthen the role of consumption in driving economic growth. State media Xinhua reported that the meeting said “efforts will be made to increase the earnings of low- and middle-income groups and boost service sector consumption to strengthen the role of consumption in driving economic growth”.

The meeting also called for a swift removal of restrictive measures in the consumption sector and proposed the setting up of a PBOC “re-lending facility” to finance service sector consumption and care for the elderly (see Xinhua article: “Xi chairs CPC leadership meeting on economic situation and work”, 25 April 2025).

On this point, the reduced role of consumption in the post-Covid era can be seen in the rise of net exports as a driver of Chinese GDP growth.

Thus, net exports contributed 2.1 percentage points to real GDP growth of 5.4% YoY in 1Q25 and 1.5ppts to 5.0% growth in 2024, accounting for 39.5% of the 1Q25 growth and 30.3% in 2024.

Still for now the market has not seen the degree of cuts in RRR and interest rates it was probably expecting at the start of this year.

The PBOC has only cut its policy 7-day reverse repo rate by 10bp year-to-date to 1.4%, while the reserve requirement ratio (RRR) was lowered by 50bp in May to 9.0% for the major banks.

As for the timing of more aggressive easing to boost domestic demand, some investors believe a similar timeline as last year may apply this year, with stimulus following the July Politburo meeting after a clear economic slowdown in 2Q25.

Still it could clearly happen earlier depending on the tariff newsflow.

Meanwhile, the reduced expectations of near-term stimulus have been reflected in a renewed decline in the Chinese 10-year government bond yield.

The 10-year government bond yield has declined by 26bp from a recent high of 1.95% on 11 March to 1.69%, after rising from a record low of 1.59% on 3 January.

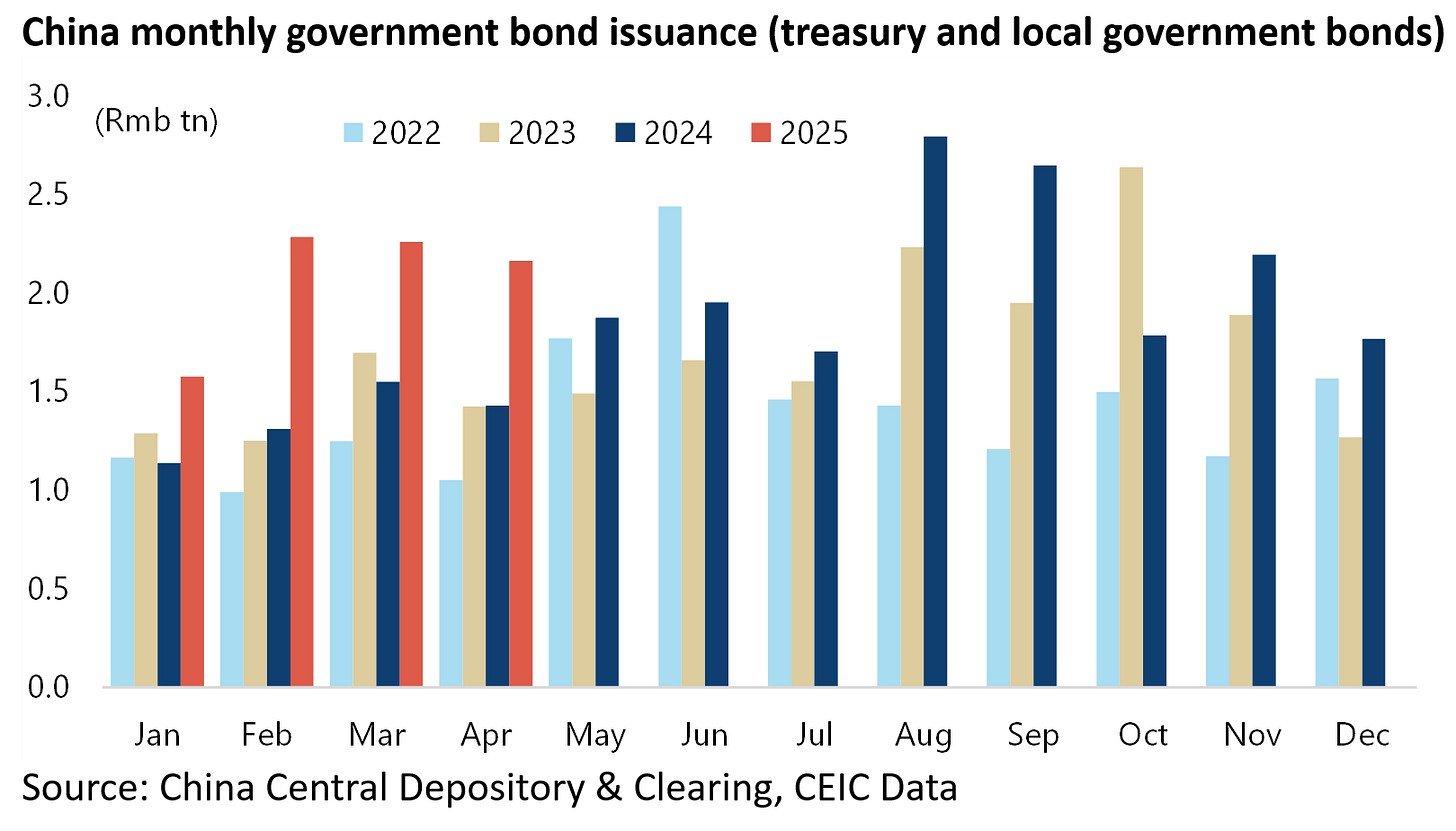

Meanwhile, there is definitely room for more fiscal easing since the amount of both treasury bond issuance and local government special bond (LGSB) issuance is more than in previous years, which enables quicker fiscal spending to support the economy.

China government bond issuance, including treasury bonds and local government bonds, totaled Rmb8.3tn in first four months of 2025, compared with Rmb5.4tn in the first four months of 2024.

Chinese Stocks Lack a Near Term Catalyst

From a stock market standpoint, the lack of evidence of accelerating stimulus deprives the China equity story of a near-term catalyst.

Still this writer is comfortable with China equities both from a valuation standpoint, in a context where consumer sentiment appears to be stabilising at worst, and from a diversification standpoint since China is significantly uncorrelated to Wall Street-correlated global equities.

The index correlation between MSCI China and MSCI AC World has been only 0.25 since the start of 2023.

Meanwhile, the Chinese consumer confidence index has risen from a low of 85.7 in September 2024 to 87.8 in April.

If the biggest potential positive catalyst for China equities, and indeed US equities, is a total Trump U-turn on tariffs, the biggest risk is a threatened Washington delisting of US$1tn worth of US-listed Chinese ADRs. This writer views this as extremely unlikely but clearly nothing is impossible.

There have been reports that American institutional investors own an estimated US$250bn of these ADRs, and they will certainly be under pressure to sell on such an outcome.

China’s ADR listings have a market value of around US$400bn, excluding OTC instruments. Of these, only about US$175bn are companies which also have a listing in Hong Kong, implying that about US$225bn will have no access to a secondary market.

Any such delisting action would be a massive buying opportunity for the rest of the world including European investors who will probably not follow the US in the context of the current Trump administration.

Still such a delisting move would seem very unlikely if only because it would severely damage the credibility of US stock exchanges.

Catching up with the Chinese Property Market

Returning to the state of China, the residential property market still seems to be stabilising in the biggest cities.

Weekly secondary market residential property sales in 13 major cities have risen by 26% YoY in the first 20 weeks of 2025 to an average of 1.62m sqm.

But there has so far been a lack of follow through on previously announced central government schemes to incentivise local government purchases of unsold homes from private sector developers.

Meanwhile the latest state of play on the so-called “white list” is as follows.

Chinese commercial banks approved Rmb5.03tn worth of loans to “whitelisted” property projects in 2024, exceeding the target of Rmb4tn.

And the figure has increased further to Rmb6.7tn as of early May, according to the National Financial Regulatory Administration (NFRA).

The “white list” is the process whereby banks are essentially required by the relevant local government to finance the completion of an unfinished housing project once it has made it on to the designated list.

For us Canadians, the bullying dynamic extends considerably beyond dealing with Trump’s America. There has been a particular irritation noticeably expressed by the governments of China and increasingly India when our (Canada's) government — unlike with, notably, mighty American assertiveness — dares to anger and/or embarrass them, even when it’s on reasonable and just grounds.

China's leadership was particularly angered by the relatively-weak Canada having been the one to detain (on Dec.1, 2018) and hold on (albeit luxurious) house arrest Meng Wanzhou, the Huawei executive and daughter of the tech corporation’s founder. Considering that a U.S. arrest warrant obligated Canada to detain her, why didn’t Beijing publicly express similar bluster towards Washington D.C. and, most notably, the then first administration of Donald Trump? Because size thus capability definitely matters?

Instead, Beijing took the more cowardly path by arbitrarily detaining two Canadian men, commonly referred to by the news-media as “the 2 Michaels”, under bogus espionage charges effectively as human political hostages. Quite unlike Meng Wanzhou's “house arrest” in a luxurious Vancouver mansion, the 2 Michaels did comparably very hard time in mainland China for a total of 1,020 days. They just happened to be released at the same time as the Trump U.S. dropped its charges against Meng Wanzhou, who was then released, for something political and/or economic in return from China.

With India’s government, Canada dealt (at least somewhat) firmly after Hardeep Singh Nijjar, a prominent Canadian Sikh separatist, was assassinated in Surrey, B.C., on June 18, 2023. Undoubtedly already aware of the diplomatic furor likely to come, even at Canada’s expense, an investigation nonetheless resulted in Canada charging three Indian nationals for the murder.

… It might be that more national governments around the globe are feeling and expressing a growing sense of foreign relations and power-politics entitlement toward militarily and/or economically weaker nations, including Canada — one that we are expected to simply get used to.