Two Years is Too Long...The AI Conundrum

Author: Chris Wood

It can legitimately be described as the stampede from wokeism.

Since Donald Trump’s decisive electoral victory in November, this writer has noticed a change in behaviour in continuing meetings with investors.

Fund managers are increasingly willing to say what they really think, even in the presence of colleagues, on such politically charged issues as ESG (Environmental, Social, and Governance) or DEI (Diversity, Equity, and Inclusion).

At the corporate level, the accelerating change in behaviour saw its ultimate manifestation at the start of the year with Meta’s decision to abandon what the Wall Street Journal aptly called in an editorial the company’s “censorship regime” (see Wall Street Journal article: “Mark Zuckerberg’s Speech Mea Culpa”, 8 January 2025), in terms of the effort to police content via employing an army of fact checkers.

The move to follow the precedent set by Elon Musk after his purchase of the former Twitter, now renamed X.com, has made complete sense from a Meta standpoint.

First, it puts CEO Mark Zuckerberg on the right side of the political tide, given the potential vulnerability from the controversial decision to ban Trump from the Facebook platform after the events of 6 January 2021.

Second, the former Facebook always saw itself as a platform, not a publishing business, and indeed had no expertise in editing content.

Third, Meta will now presumably no longer need to employ the so-called content moderators who, from a shareholder perspective, were a complete waste of money.

For such reasons, if this writer was to own one hyperscaler, it would be Meta.

Still there remains the issue of whether investors will start to question the amount of money being spent on the AI arms race.

Microsoft Copilot is Just the First Step, But Will the Market Wait for Step 2?

As discussed here recently (see The Two Big Risks for Stocks in 2025, 17 February 2025), the four major hyperscalers are now on course to invest about US$320bn in capex this year, up from US$228bn in 2024.

Meanwhile this writer must admit to being somewhat irritated by the efforts to hoist Microsoft’s Copilot on a user when engaged in ordinary word processing on the computer.

On that point, it should be made crystal clear that this writer has always been a fan of Microsoft Word, while long remaining unconvinced of the need for the seeming never ending upgrades.

In an article published at the end of last year (“Microsoft Wraps AI Into Package”, 27 December 2024), the Wall Street Journal reported that Microsoft has begun to add Copilot to its software package in certain parts of the world when customers have not asked for it.

The article noted also that various customers have found it irritating.

It is also reportedly the case that inclusion of Copilot raises the price of the software for everyone who uses the service called Microsoft 365 in these specific countries.

Such a strategy suggests Microsoft is not getting great traction in the sense of selling Copilot separately at a price of US$20 a month in the US.

None of this is to say that AI is not the future, and to be fair the same WSJ article reports that Copilot is only viewed as a “stepping stone” within Microsoft with the real hopes for AI centred on the “next wave”, which will be automated tools, known as “agents”, handling specific tasks.

This may well end up being the case.

But there is also the question of time.

In this respect, the Internet bubble of 1999-2002 is the obvious precedent.

Much of the optimism generated then by the arrival of the Internet, in terms of the transformation to a whole new digital economy, turned out to be completely true.

But the process took much longer than originally anticipated, while, in the near term, there was suddenly recognition in 2002 of massive overcapacity in fiber-optic cables.

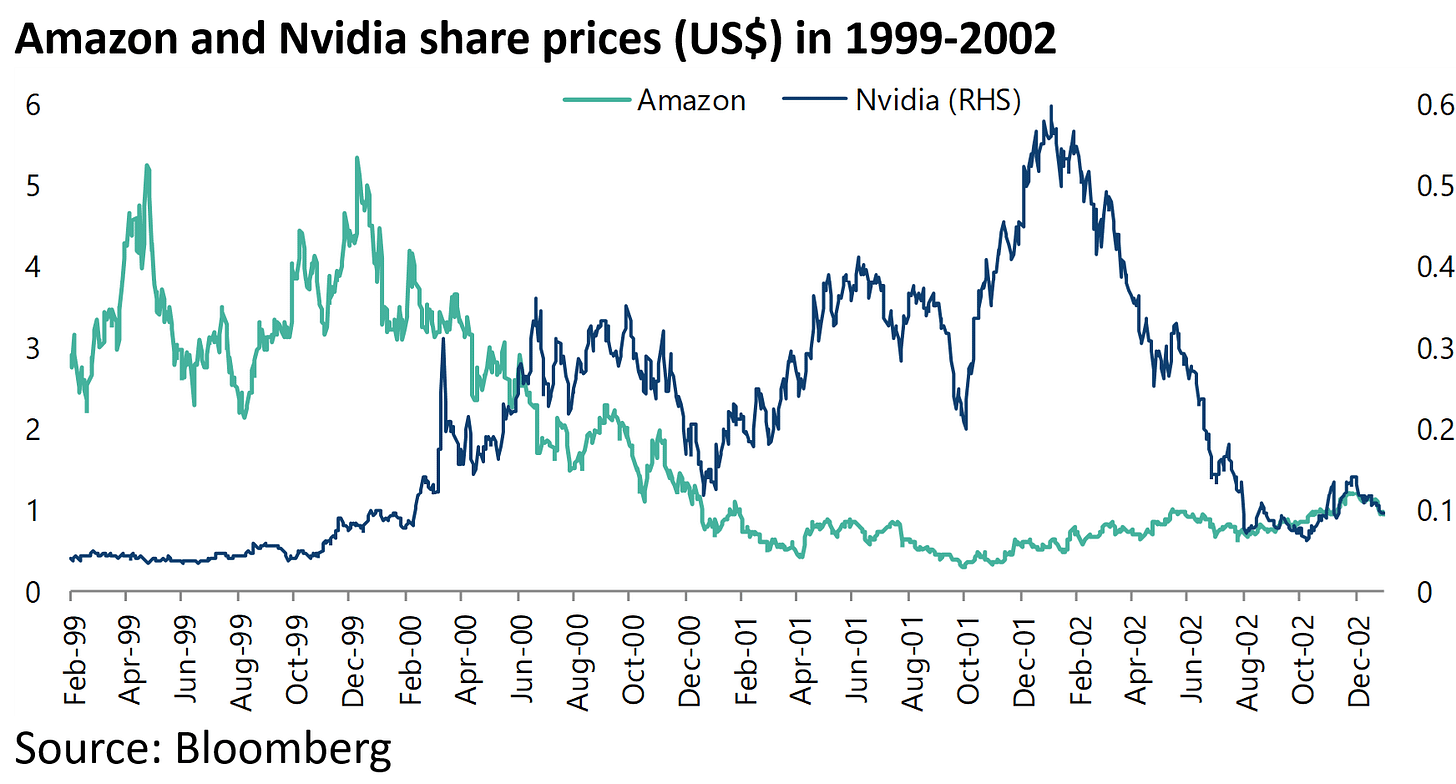

Amazon and Nvidia, to take just two examples, declined in the Nasdaq bust by 95% between December 1999 and October 2001 and by 90% between January and October 2002 respectively, while Cisco collapsed by 90% between March 2000 and October 2002.

History rhymes but does not repeat exactly.

Still, there has got to be a real possibility, if not probability, that it will take a lot longer to deliver the promised land of so-called AGI than currently assumed - just as was the case with the Internet bubble.

And if this is indeed the case, the potential for the market to question the capex spending at some point becomes almost a certainty.

On that point, the table below shows the rising percentage of sales accounted for by the hyperscalers’ current capex spend.

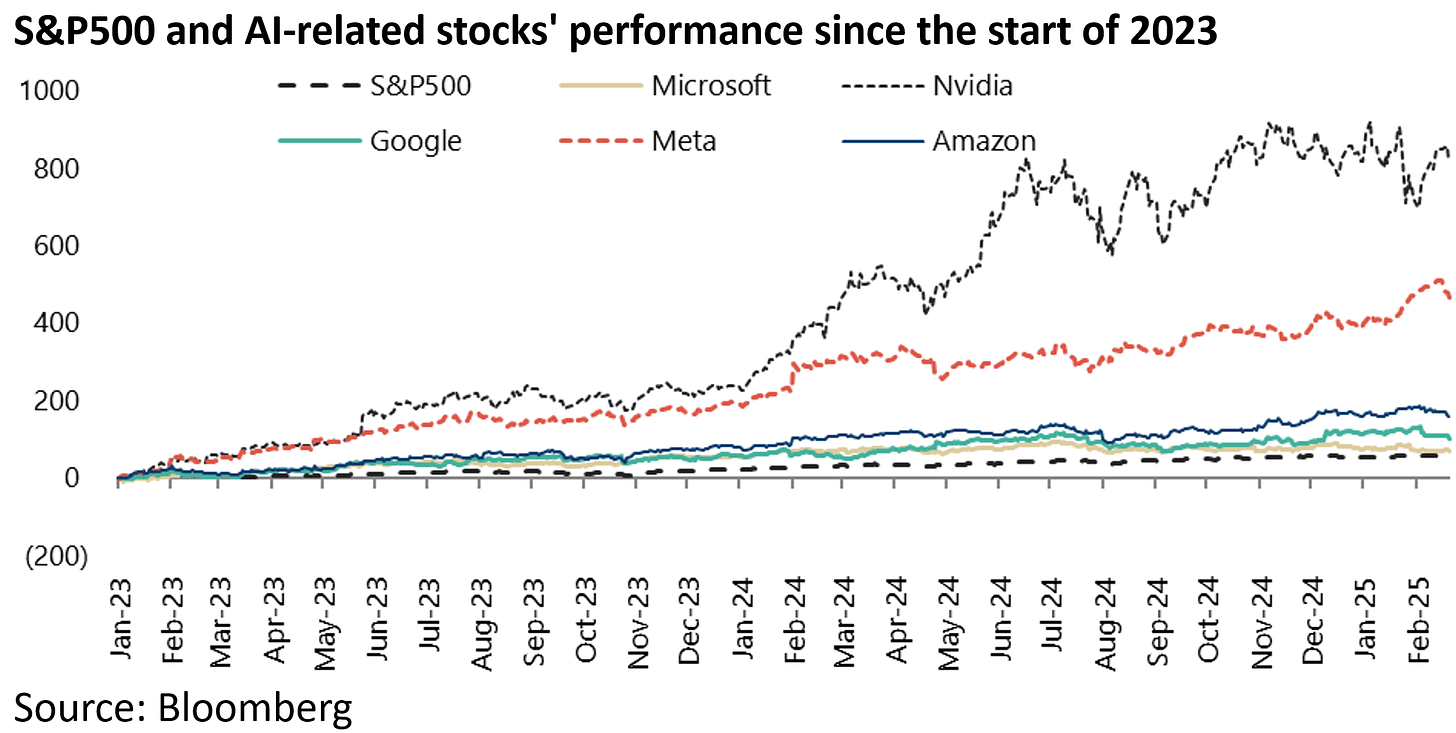

While the US stock market will remain focused in coming weeks on the policies of the Trump administration, and also on bond yields if they resume rising, it remains the case that the big driver of the US stock market in the past two years has been the AI thematic, as reflected in the fact that the major AI-related stocks have driven the benchmark index’s return.

Thus, the S&P500 has risen by 57% since the beginning of 2023, while Nvidia, Microsoft, Alphabet (Google), Meta Platforms, and Amazon have risen by 820%, 70%, 104%, 468%, and 158%, respectively, over the same period.

Still so far this year the Magnificent-7 have been underperforming.

The Magnificent-7 Index has declined by 1.9% year-to-date, compared with a 2.2% gain in the S&P500.

How Patient Will the Market be for AI Profits to Materialize?

Returning to the issue of how long so-called Generative AI will take to deliver on the potential driving the current AI capex arms race, this writer was struck by a comment made by Arvind Narayanan, director of Princeton University’s Center for Information Technology Policy, in another WSJ article, published in late November (see Wall Street Journal article: “Generative AI: Separating Hype From Reality”, 25 November 2024).

He said, “We’ve been hearing for a couple of years that this transformation is about to happen. It hasn’t happened yet. My position is that it probably will happen but more on the time scale of something like a decade. It isn’t going to be one or two years”.

Two years is too long for the current valuations of the hyperscalers given the money they are spending.