The Shareholder Yield Advantage

Focus on Small & Micro-Caps: MYLD ETF

Grizzle had the opportunity to sit down with Meb Faber and team Cambria at their HQ in Manhattan Beach, California, an epic location to work and vibe.

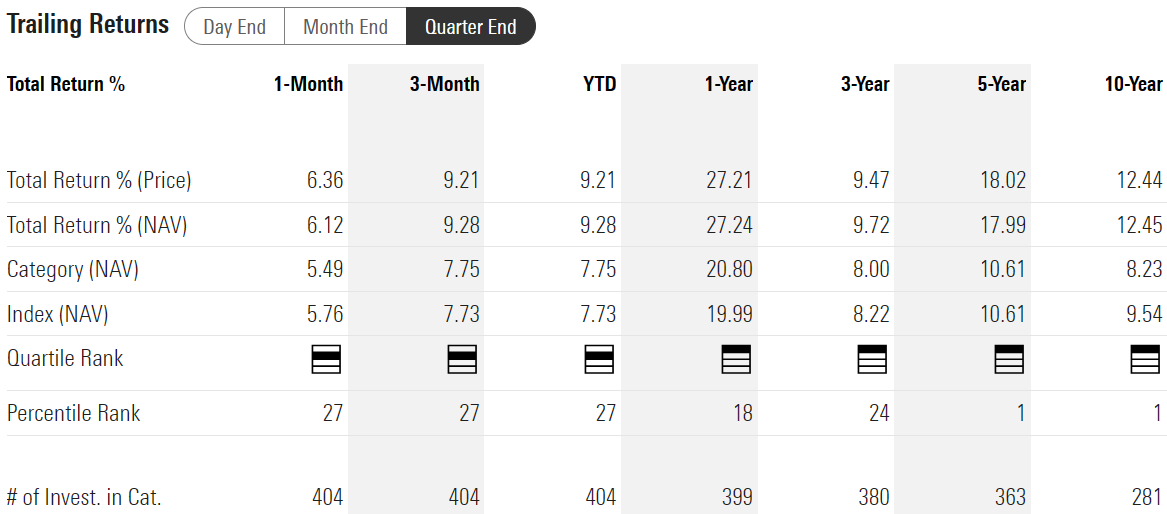

Their flagship Cambria Shareholder Yield ETF (SYLD) with over $1.2 billion in assets has achieved what only a handful of actively managed funds have done, ranking 1st percentile in their peer group (Morningstar Mid-Cap Value) over a 10-year period.

In an era where value and active management have been challenged, the SYLD ETF has trounced the passive iShares Russell Mid-Cap Value ETF (IWS, $12.6B assets) over the last decade - outperforming by 100%.

Analyzing the performance attribution of SYLD vs. IWS over the last 10 years, what’s impressive is that the outperformance is balanced across sectors and the majority of the outperformance (81% of the total) came from stock selection - indicating the framework for shareholder yield derives a majority of it’s value from security selection and not sector tilts.

Defining Shareholder Yield

Meb was early in identifying buybacks & debt repayments as core components of returning value to shareholders, areas that were under appreciated relative to the traditional form of shareholder returns - dividends. He wrote a book about it in 2013: Shareholder Yield - A Better Approach to Dividend Investing, which can be download for free on his shareholder yield website.

On a total shareholder yield basis the SYLD ETF yields 6.98% vs. the S&P 500 at 0.36% - indicating share and debt issuance have diluted away the dividend yield of the S&P 500.

In addition to having a higher shareholder yield than the market, SYLD is cheaper than peers and the market across every major valuation metric.

Shareholder Yield for Micro & Small Caps: MYLD

Small and micro cap stocks have significantly lagged the market over the last decade; the iShares Small-Cap ETF (IJR) is underperforming the S&P 500 by 92% and the iShares Micro-Cap ETF (IWC) is underperforming by 143%.

According to Intuitional Investor, small caps have been underperforming large caps for the second longest stretch since the 1930s. From a historical quantitative perspective, it is advantageous to own small caps after long periods of underperformance:

“Jefferies analyzed seven similar periods of significant underperformance of small vs. large stocks. On average, after these difficult periods, small caps outperformed large caps by 22.2 percent, 10.5 percent, and 9.8 percent annually over the subsequent 1, 3, and 5-year periods, respectively.”

In early January of this year Cambria launched the Cambria Micro & SmallCap Shareholder Yield ETF (MYLD); Meb highlighted the current market environment as an opportune time to take the successful shareholder yield framework and apply it to small cap companies.

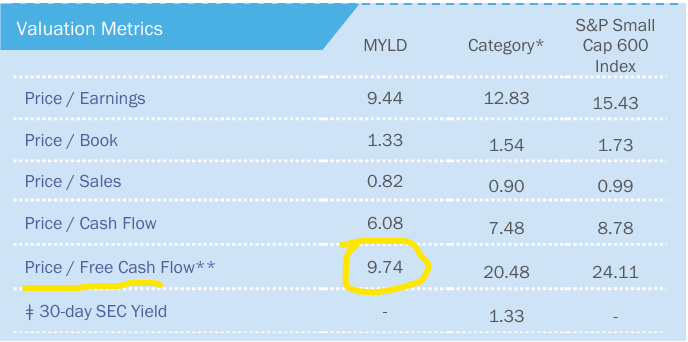

There’s a stark valuation difference between quality small cap companies with a high shareholder yield vs. the small cap universe and peers across all metrics. MYLD trades on 9.7x Price/Free Cash Flow - a 60% discount vs. the S&P Small 600 Index.

Small caps have faced a headwind of being orphaned from a equity research perspective, there simply isn’t the quality or quantity of research for this market cap range that there was 10-20 years ago. We believe that is fundamentally changing, as research gets disaggregated from traditional Wall Street brokerages to independent analysts on platforms like Substack.

Price-to-Free-Cash flow will be one of the key metrics that the market will gravitate towards when identifying deeply undervalued small & micro-caps. We looked at the underlying holdings of MYLD for the type of deep value opportunities having a cash flow focus provides; of the 8 companies in the ETF with Forecast Price/Cash Flow’s less than 4X - half of them were energy companies. This dovetails with our research in the energy space, there’s a ton of undervalue opportunity particularly among the small caps.

The energy sector represents 14% of the overall ETF; financials, industrials and consumer discretionary are the top three.

The Cambria shareholder yield investment strategy has been a great source of mid-cap alpha in the market as demonstrated by the SYLD ETF; conceptually taking the same strategy down market cap with MYLD make a lot of sense - particularly when small caps are coming off a historic period of under performance.