The Research & Quant 2025 Market Outlook

Bonds, Stocks or Both?

Author: Chris Wood

It may just turn out to be the case that the most important Federal Reserve meeting this year happened just before the end of the year.

The relatively hawkish message sent by Jerome Powell at last week’s Federal Reserve meeting suggests that further interest rate cuts are no longer guaranteed given the recent data, be it employment-related or inflation-related.

It is also the case that parts of President-elect Donald Trump’s stated agenda, be it tariffs or cracking down on immigration, look fundamentally inflationary, a point the Fed will clearly be aware of.

Powell said in the post-meeting press conference that last week’s 25bp rate cut was a “closer call” while expressing caution about further cuts.

Still this writer’s guess for now remains that more Fed rate cuts are coming, if only because of the unacknowledged need to reduce debt servicing costs from a fiscal standpoint.

Still, it remains of note that the ten-year Treasury bond yield has risen by 88bp since the Fed commenced easing in September.

This is not what the central bankers would have expected.

And it clearly suggests investors want a term premium for investing in longer term Treasuries.

How Long Can Stocks Ignore Rising Interest Rates and Inflation?

The case for remaining bearish on Treasury bonds is straightforward.

As for the stock market, if the short-term impact of Trump’s election has been positive in terms of the expectation of tax cuts extended and a deregulatory wave as animal spirits are unleashed, the risk for equities is clearly that at some point the stock market will not be able to ignore rising bond yields; though it also has to be admitted that it has done a very good job of doing just that so far.

The other negative for equities is that the liquidity situation has begun to deteriorate at a time when valuations are at historic highs.

Meanwhile, if the base case is that Trump’s policies are long-term bearish for the dollar, it is worth highlighting that Elon Musk, who has probably done as much as any other individual save Trump himself to get the Donald elected, has committed to cutting US$2tn of federal government spending in a Trump administration via the setting up of a new government agency called the Department of Government Efficiency (DOGE).

On this point, it should be noted that US$2tn amounts to about 29% of federal government spending and is more than the amount Congress spends annually on government agency operations, including defense.

It seems clear that the incoming president is likely to confront at some point increasingly negative bond market sentiment in the face of America’s deteriorating fiscal fundamentals unless there is a dramatic change of course along the lines discussed by Musk.

That would amount to shock therapy for the economy and would hit the stock market negatively.

Near Term Risk to Stocks from Tightening Liquidity

Meanwhile, as already noted, there is growing evidence of liquidity tightening which raises a near-term risk to equities.

This is at a time when the market trades at near historic peak to sales.

The S&P500 price to sales ratio rose to a high of 3.26x on 6 December and is now 3.18x, compared with a historic peak of 3.27x in November 2021.

At the macro level the growing liquidity pressure is shown in the continuing decline in the US M2 to GDP ratio based on the latest GDP data.

The US M2 to nominal GDP ratio declined to 0.719 in 3Q24 or 4.8% below the pre-Covid trend, down from 0.722 or 4.1% below trend in 2Q24 and a peak of 0.887 or 25.7% above trend in 2Q20.

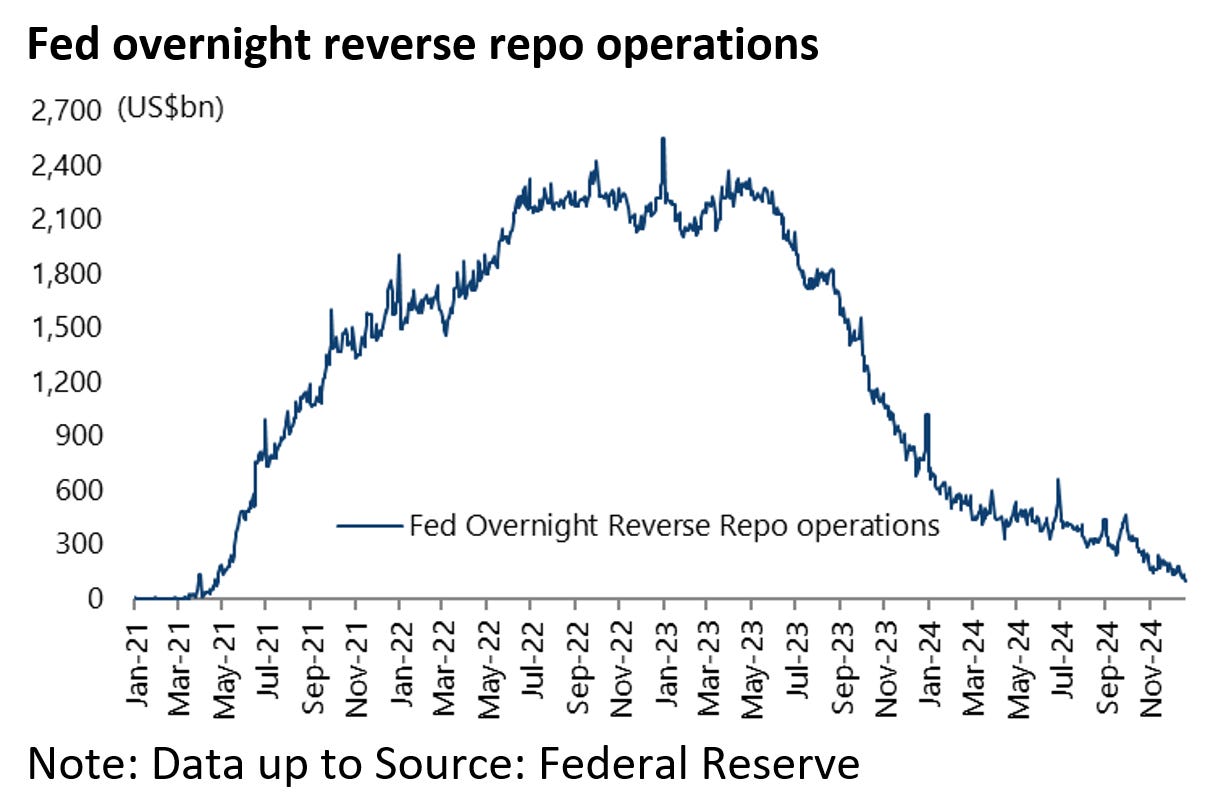

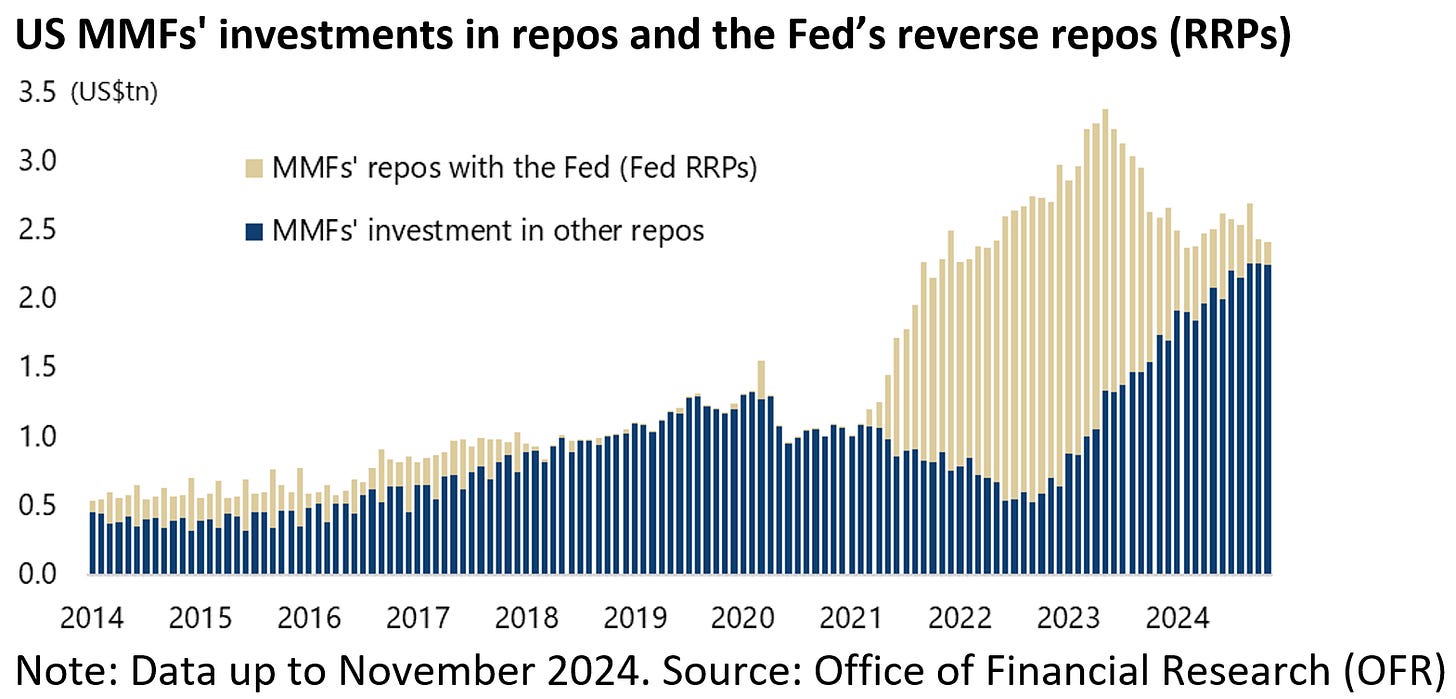

At the micro level the liquidity tightening is reflected in the fact that the overnight reverse repo market has collapsed in the past 21 months from US$2.375tn at the end of March 2023 to only US$98bn on 20 December as money market funds (MMFs) have used the proceeds from the Fed’s overnight reverse repo facility to invest in the repo market.

US MMFs’ investments in repos, excluding the Fed’s reverse repos (RRPs), have risen by US$1.72tn from a low of US$523bn in September 2022 to US$2.24tn in November 2024.

With only US$98bn left in the Fed’s overnight reserve repo facility, there is a limit to how much more funding can come from this source.

The Treasury is Still Addicted to Short Term Debt Issuance

Meanwhile the Treasury’s quarterly refunding announcement in late October confirmed the continuing resort to short-term issuance.

It is worth noting again that a recent paper by economist Nouriel Roubini and former Treasury official Stephen Miran (see Hudson Bay Capital report: “ATI: Activist Treasury Issuance and the Tug-of-War Over Monetary Policy”, 22 July 2024) argued that the increasing “activist” Treasury bill issuance has had the practical effect of offsetting the negative impact of the Fed’s recent quanto tightening (see Grizzle article: The Growing Risk of The Treasury’s Addiction to Short Term Debt, 11 September 2024).

For now the Treasury, based on the latest announcement on 30 October, intends to maintain the same auction size of notes and bonds for “at least the next several quarters”.

This means bills’ share of total issuance will remain for now in the 60-70% range.

Hedge Funds Are Increasingly Funding the Government

Shortening duration is clearly not the ideal way to finance a government since it increases rollover risk.

This in turn raises the issue of the decline in the quality of the buyers of Treasuries.

Interestingly, this issue was discussed in the latest report by the Treasury Borrowing Advisory Committee (TBAC) released in late October (see TBAC report: “Inter-Agency Working Group’s efforts on Treasury Market Resilience”, 29 October 2024).

The question at hand is the ongoing decline in official foreign holdings of Treasuries and the rise in the ownership of leveraged hedge funds engaged in the so-called “basis trade”.

These arbitrage trading strategies are meant to be non-directional in the sense that they are designed to exploit small gaps between the cash bond and the related futures contract using borrowed money.

There are also some interesting data and charts on hedge funds contained in the latest TBAC report.

First, hedge funds’ repo borrowing has risen from US$1.23tn at the end of 2022 to US$2.22tn at the end of 2Q24.

Second, hedge funds’ long and short US Treasury exposures have increased from US$1.0tn and US$694bn respectively at the end of 2022 to US$1.73tn and US$1.38tn at the end of 2Q24.

If hedge funds arbitraging the price differences between futures and the cash market is a legitimate function, it is again not the ideal way for a government to be funded as foreign central bank holdings, as a percentage of total Treasuries outstanding, have continued to decline, down from 38% in July 2010 to 13.8% in October 2024.

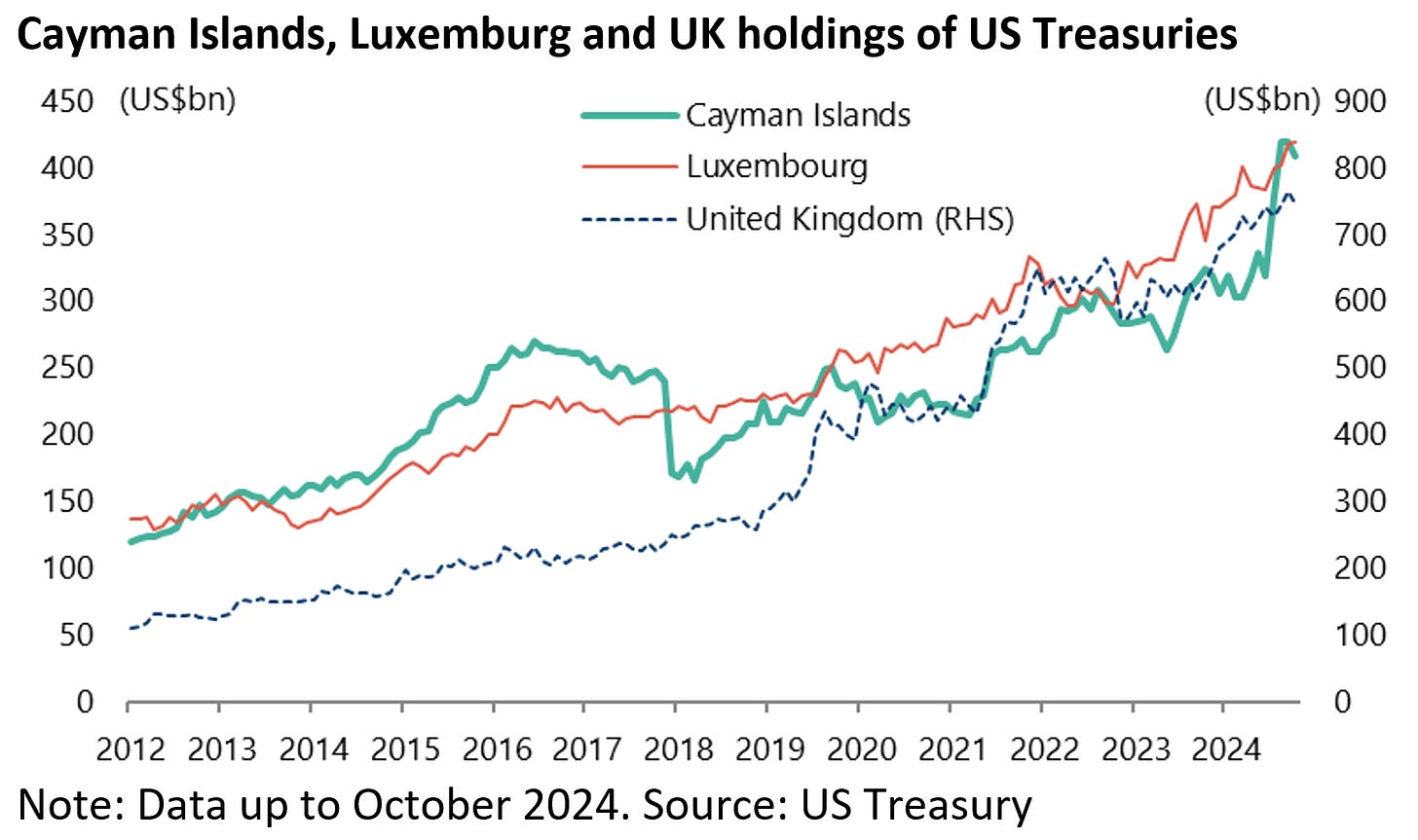

Note: Data up to October 2024. Source: US Treasury

Meanwhile the growth in the amount of Treasuries owned by entities based in the likes of Cayman Islands, Luxemburg and London again suggests the increased role of hedge funds engaged in leveraged arbitrage in terms of funding the deficit.

Cayman Islands, Luxemburg and the UK’s holdings of US Treasuries rose by 26%, 22% and 18% YoY respectively to US$409bn, US$420bn and US$746bn at the end of October.

Regulators Want US Banks to Step into the Void Left by Foreign Central Banks

Meanwhile, banks’ traditional role as market makers in Treasuries was reduced significantly by post-2008 regulation.

This is why there is likely to be growing focus by the authorities on incentivising or cajoling commercial banks to increase their holdings of Treasuries.

In this respect, the latest TBAC report proposes an exemption of Treasuries and central bank reserves from the calculation of banks’ Supplementary Leverage Ratio (SLR).

It also should not be forgotten that US commercial banks do not have to mark their Treasury bonds to market if they have stated they will held them to maturity.

This was an issue which came to prominence, albeit briefly, with the failure of Silicon Valley Bank in March 2023.

Still it is worth noting again that US commercial banks, based on the latest data, owned US$1.76tn of Treasury securities as of 11 December,

and are sitting on mark-to-market losses on their total securities holdings of US$364bn as at the end of 3Q24.

Risks to Stocks are Short Term, Risks to Bonds are Long Term

It is also worth highlighting that US Treasuries are currently on course to record their third year in four of declining prices providing more evidence that they have entered a structural bear market.

But if the investment case against Treasuries looks for now at least relatively straightforward, what about US equities?

So far, as already noted, US stocks have proved remarkably resilient in the face of rising bond yields.

Thus, when the 10-year bond yield briefly hit 5% more than a year ago, the stock market barely blinked at the index level helped by the then growing focus on the AI thematic.

Still at some point the stock market will have to react negatively to rising bond yields, which may be another reason aside from peak equity valuations why the legendary investor from Omaha, Warren Buffett, has been selling of late.

Such a correction could happen at any time, most particularly if markets give up on more Fed easing.

Still what has always seemed to this writer the most likely ultimate Washington policy response to America’s fiscal issue, namely yield curve control, would end up being long term equity bullish though also US dollar bearish.

This is because it means renewed Fed balance sheet expansion and related currency depreciation, as the authorities focus on keeping the cost of borrowing below nominal growth to reduce the real burden of debt.

In this respect, US equities should continue to be favoured over US fixed income from a long-term basis in a world where inflation should settle structurally higher post pandemic.