The Market is Thirsty for the Fed Pause

With the Fed hike out of the way the market is getting real thirsty for the pause; in this week’s market wrap we highlight some stellar Grizzle content to help you navigate the path forward. If you’re enjoying our work please share this email with friends - it’s greatly appreciated!

In this edition:

Fed Softens Language but Remains Coy on Outlook

Chris Wood: Private Credit is Extending the Typical Interest Rate Hike Adjustment Cycle

Warren Pies of 3Fourteen Research: Bear Market Rally vs. New Bull Market

Canada’s Role as a Lithium Producer with Robin Dunbar, CEO of Grid Metals

Hunting for Elite Dividend Yields - Zoom Call - May 10th at 4PM ET with Phil Hodge, CEO of Pine Cliff Energy

Tracy Shuchart & Grizzle Interview Presidential Candidate Vivek Ramaswamy

AI Dominating as a Hot Topic on Earnings Calls

Fed Softens Language but Remains Coy on Outlook

As expected by the market, Jerome Powell hiked by 25bps, taking the Fed Funds rate over 5% in just over a year. We’re back to where rates peaked in 2006 and the market desperate for any indication of a pause.

The Fed statement removed the phrase “some additional policy firming may be appropriate”; however in the press conference Powell noted that while the language change was important, it would not be appropriate to cut rates as inflation remains elevated.

The market thinks otherwise, it is currently pricing in three Fed rate cutes by mid-December.

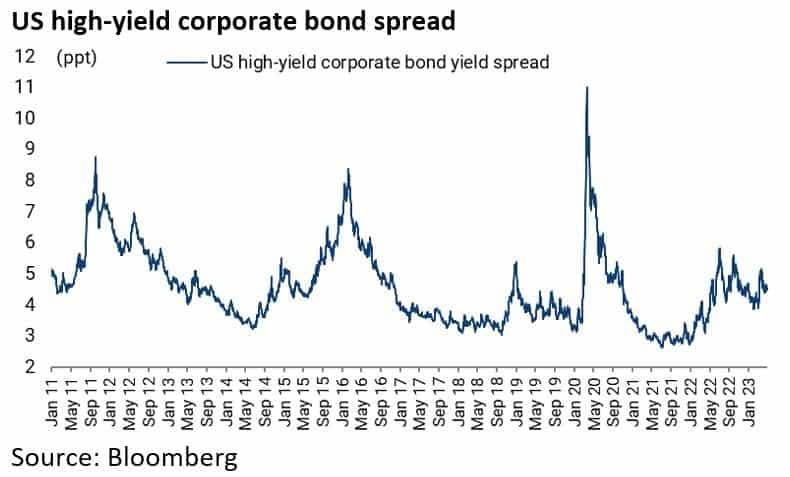

The Fed’s Blind Spot: Private Credit

Grizzle’s Strategist Chris Wood highlighted last week that the Fed is being lured into thinking financial conditions are benign because of relatively tame credit spreads. The real credit boom has been in the private lending market, the the dynamics of which are much less understood by central bankers, macro-economists and investors at large.

Bear Market Rally Vs New Bull Market With 3Fourteen Research's Warren Pies

Warren Pies the Co-founder and Strategist at 3-Fourteen Research joined Grizzle in a recent podcast (iTunes, Spotify) to help investors make sense of both the equity and commodity markets and why he believes we are in the midst of a bear market rally. Below is a curated list of the top themes the macro quant strategist is watching.

Are we in a bear market rally or in a new bull market? Market bulls have long been touting the October lows to signify the bottom for equities but Warren Pies highlights four key reasons on why he’s skeptical.

Earnings Still Falling

Yield Curve Still Inverted

Fed Still Hiking (equites have never bottomed during major hike face in fed cycle)

Lack of Market Breadth (high concentration in large cap tech)

When will we get a recession, and how will it impact oil? One of the biggest debates in the market right now is whether or now the economy will enter a recession. Warren Pies predicts a recession to take hold in Q4, but what’s even more interesting is he’s still long oil.

Inventories Draws Are Improving

OPEC Cuts Take Effect in May

China Demand Picking Up

US Recession Won’t Be Drastic

“If you think about 2008 cycle we entered a recession at the very end of 2007, oil made new all-time highs that we never even got back to I don’t believe. In July of 2008, technically seven months into the recession oil is shooting higher” Pies adds “It can often be months into the recession before oil falls apart, especially if OPEC and Russia follow through with all their cuts.”

Will The Fed Pause? Last week the FOMC hiked rates by 25 bps but will this be the last hike? The market is pricing in a pause at the next June meeting, followed by a series of cuts in the back half of the year but Warren Pies warns the market could be “front running” the pause which could lead to more hikes in the future.

Historically Fed Doesn’t Pause When Markets Rally

Usually See 5-10% Correction That Comes at End of Hike Cycle

What Happens in June Will Be Dictated By Market Performance

If CPI Remains Sticky A Pause From The Fed Will Be Harder

Canada's Role As A Lithium Producer With Robin Dunbar CEO Of Grid Metals

In last week’s podcast (iTunes, Spotify), Grizzle spoke with Robin Dunbar, the CEO of Grid Metals, to discuss Canada's role as a lithium producer as the global energy transition unfolds. Dunbar also highlights why North America is becoming an attractive hub for the sector, as more countries like Chile and Mexico work towards nationalizing their industry. He also outlines key advantages that will accelerate Grid Metal's production timelines such as their processing deal with one of the only operating lithium mines in Canada, the Tanco Mine.

Key Topics Discussed:

History of Grid Metals

Outlook On Chile Nationalizing Their Lithium Sector

Why Canada Is Becoming A Top Jurisdiction For Mining

Geographic Location To Produce Lithium In Canada

Why Grid Metal's Deal With Tanco Could Accelerate Their Production Timeline

Outlook On Global EV Demand And Lithium Prices

Hunting for Elite Dividend Yields (Zoom Call) May 10th with Phil Hodge, CEO of Pine Cliff

This Wednesday May 10th at 4PM ET we’ll be reviewing our “Hunting for Elite Dividend Yields in Oil & Gas” report with paid subscribers on a Zoom call (details to follow). We’ve opened up a 7-day free trial for non-paid readers who’d like to participate.

We’re thrilled to have Phil Hodge, CEO of Pine Cliff Energy joining us for the 2nd half of the call to discuss his company and his approach to dividend sustainability.

The report quantitatively identified the highest quality dividend yield payers across four key pillars: Free cash flow dividend coverage, dividend yield, balance sheet strength and insider ownership.

The top decile of stocks (the dividend elite) have a 9.5% dividend yield - 2-times higher than energy yielding peers and this group of stocks have pristine balance sheets. Pine Cliff Energy was the top ranking stock in the study.

Tracy Shuchart & Grizzle Interview Presidential Candidate Vivek Ramaswamy

Team Grizzle had the pleasure of joining Tracy Shuchart on The MicDropMarkets Podcast to interview Republican Presidential candidate Vivek Ramaswamy. A thought provoking discussion about the Federal Reserve, national energy policy and trade with China.

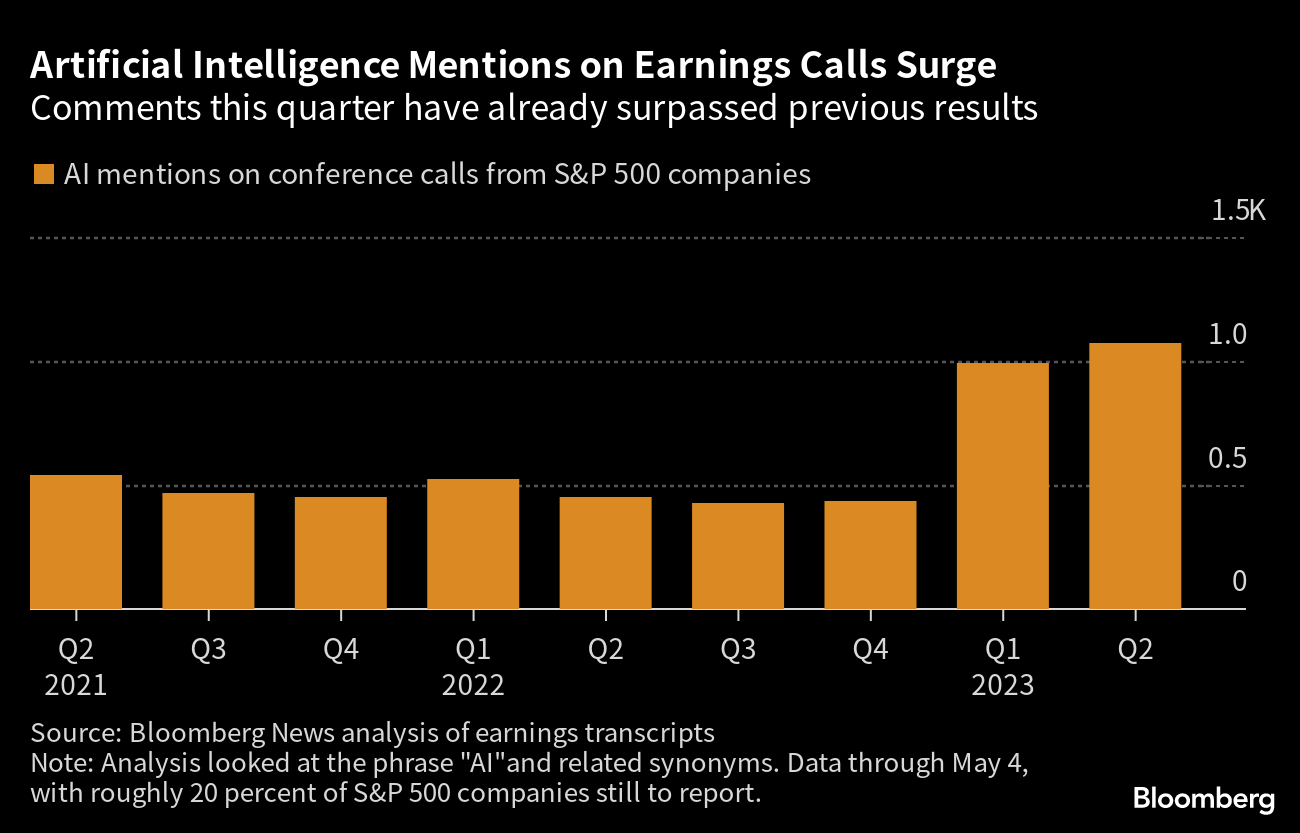

AI Growing As Hot Topic On Earnings Call

Ever since Open AI’s Chat GPT launched last November artificial intelligence is becoming a key topic in corporate America. According to Bloomberg, references to AI during earnings calls with investors have more than doubled from a year ago. Recently, the CEO of online travel agency Expedia Group, said their performance was enhanced by the use of AI and machine learning. Coinbase has also been examining how the use of AI can enhance its userbase and customer experience. While none of the advances seem to have had an impact on employment in the works place so far, IBM recently highlighted they plan to pause hiring on the back of AI developments. Their CEO Arvind Krishna said he expects AI to replace 30% of the firm's back-office roles in the next five years.