The Fed Fudge is Quickly Approaching

Author: Chris Wood

Inflation is falling but not as quickly as the Federal Reserve would wish.

US headline CPI inflation slowed from 6.0% YoY in February to 5.0% YoY in March, compared with consensus expectations of 5.1% YoY, while core CPI inflation rose from 5.5% YoY in February to 5.6% YoY in March, in line with consensus expectations.

It is also worth noting that the decline in headline CPI inflation is primarily driven by a 6.4% YoY decline in energy prices as a consequence of the base effect.

Excluding energy, headline CPI inflation slowed only from 6.1% YoY in February to 6.0% YoY in March.

Core services CPI also slowed from a peak of 7.3% YoY in February to 7.1% YoY in March, the first slowdown since August 2021, while shelter CPI rose only marginally from 8.1% YoY to 8.2% YoY.

If the rental component is taken out, core services inflation slowed from an estimated 6.1% YoY in February to 5.7% YoY in March.

Still the base case remains that the economy is slowing with America’s small business sector likely to be facing growing margin compression by the middle of the year in the context of declining nominal GDP growth, resulting in job shedding in the second half of 2023.

Remember that the small business sector, in terms of companies with less than 50 employees, accounts for 44% of US private sector employment.

In this respect, the latest National Federation of Independent Business (NFIB) small business survey shows a clear weakening trend.

A net 15% of small business owners are planning to create new jobs in the next three months in March, the lowest level since May 2020, down from 17% in February and a recent high of 32% in August 2021;

while a net 22% of businesses are planning to raise wages in the next three months, down from 23% in February and a recent high of 32% in October.

As for the NFIB small business optimism index, it fell from 90.9 in February to a three-month low of 90.1 in March, though it remains above the recent low of 89.5 reached in June 2022.

In such an outcome a Fed pause is the minimum that can be expected, even if inflation remains sticky.

In this respect, the base case remains that, sooner or later, it will become clear to investors that the Fed will be willing to fudge its 2% inflation target in the interest of supporting the economy and preserving negative real interest rates; though whether there is ever a concrete announcement to that effect by the Fed is another matter altogether.

That would set up the potential for inflation to remain structurally higher, at say 3-4%, in America.

How Will Bond's React to a New Higher Fed Inflation Target?

The question will then become how the US government bond market will react to such an assumed fudge.

It is unlikely to be a bullish reaction.

And the more Treasury bond yields rise on such a fudge, the more focus will grow on the sustainability of funding America’s large government debt resulting in a temptation to resort to Japanese-like yield curve controls, in terms of a move from implicit to explicit financial repression.

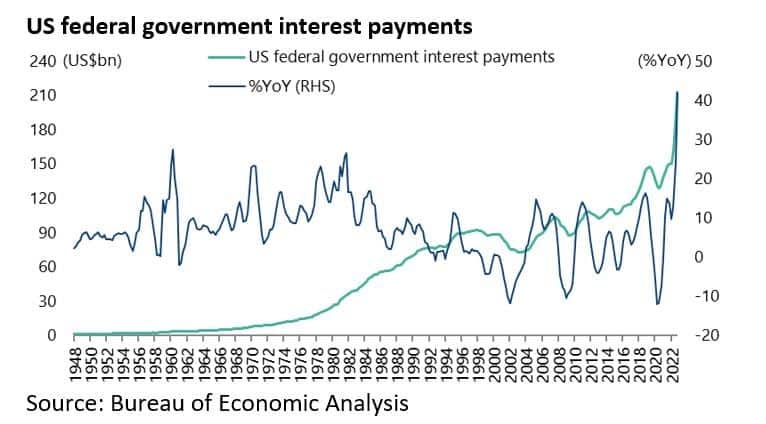

Meanwhile, the debt servicing costs of the federal government are rising sharply.

Federal government interest payments surged by 42% YoY to US$213.6bn in 4Q22.

In this respect, as in so many other matters in recent decades, be it the introduction of quantitative easing or negative rates, Japan is leading the way in its current tentative efforts to normalize its own monetary policy, and adjust yield curve control, without blowing up its own government bond market.

But the above is to look out in time.

In the short term, given the backdrop of continuing monetary tightening for now with money markets still expecting another 25bp hike at the next FOMC meeting on 3 May, and with Treasury bond bullish-quantitative tightening continuing, the expectation remains for the ongoing bond market rally to continue until that fudge.

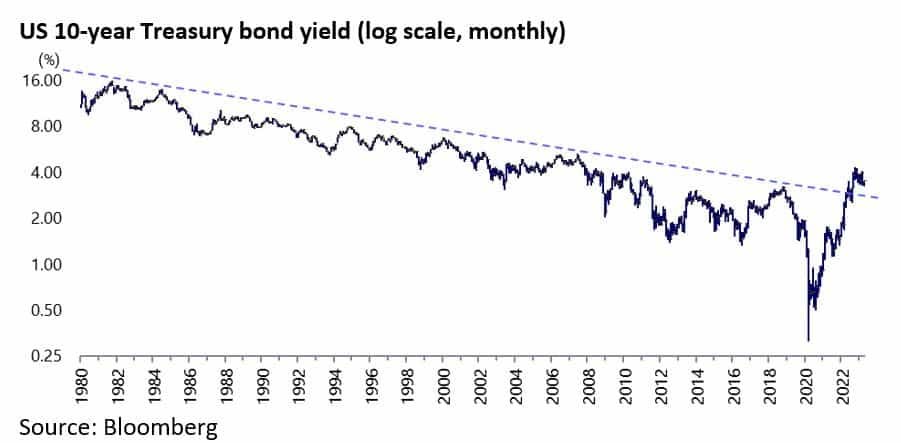

The 10-year Treasury bond yield has already fallen from 4.34% to 3.51% since late October.

The yield has the potential to decline to the long-term trendline on the log-scale chart of the 10-year yield prior to the bond market selling off again on the anticipated Fed fudge, thereby confirming that Treasury bonds have entered a bear market.

The 10-year yield on the trendline is now around 2.7%.

The Bond Rally Depends on No Further Geopolitical Shocks

But all of the above is to assume no geopolitical shocks.

And here, it has to be said, the risks of geopolitical shocks triggering, say, a renewed surge in the oil price, are rising.

This writer is not just referring to the ongoing escalating tensions between US and China, but also the risk that financial markets start to react to newsflow on Ukraine again, having essentially ignored the conflict for the past several months.

It is also the case that America’s formal raising in February the subject of the potential supply of arms to Russia by China has again linked the issue of Ukraine and US-China relations, as was also the case at the start of the conflict in February last year.

It should be remembered that when the attack on Kyiv was launched on 24 February, the immediate assumption of many (though not this writer’s) was that China’s President Xi Jinping had approved of the invasion in advance, resulting in investors fearing that China would be ‘cancelled’ from the investment benchmarks like Russia was.

If such fears have since receded, that does not mean that they cannot resurface. Meanwhile, the economic links between Russia and China are growing.

An analysis published by the Free Russia Foundation in January estimated that China became Russia’s most important trade partner in the first nine months of 2022, accounting for about 20% of Russia’s total exports and 35% of Russia’s total imports.

Meanwhile, the mainstream narrative in the Western media has been that Russian military efforts are failing and that the country is suffering massive casualties.

Still if the Russian situation is quite so hopeless, it has to be wondered why Ukrainian President Volodymyr Zelenskyy has remained so desperate for more military support from the US and Europe given the huge amount already spent on providing weapons.

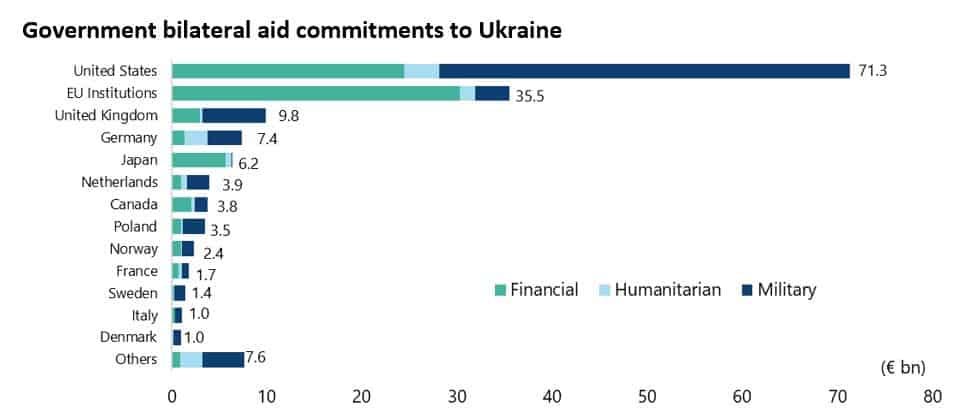

Government bilateral aid commitments to Ukraine totaled €156.6bn as of 24 February, including €71.3bn from America and €61.9bn from EU members and institutions, of which €43.2bn and €19.2bn are military commitments, according to the Kiel Institute.

Note: Include aid commitments between 24 January 2022 and 24 February 2023. Source: Kiel Institute (IfW Kiel) - Ukraine Support Tracker

There is also the unanswered question of what are the Ukrainian casualties relative to the latest US estimate of nearly 200,000 casualties on the Russian side.

Certainly, the latest disclosure of the biggest leak of US intelligence data since Edward Snowden in 2013 has also suggested that the conflict in Ukraine may not be proving quite as disastrous for the Russian side as portrayed in the Western media.

Clearly, there has been much talk of late of Ukraine launching a so-called spring offensive.

But if the outcome proves to be less decisive in military terms than advertised, investors should watch out for any sign of a growing questioning in Washington and indeed Europe of the amount of money being spent supplying weapons to Ukraine.

For now, the Republican Party is split on this issue with those opposed to giving more military support to Ukraine in a minority.

Still, the two leading candidates in the Republican primary race, based on current polling, namely Donald Trump and Florida Governor Ron DeSantis, are both on the isolationist side of the Republican Party on this issue.

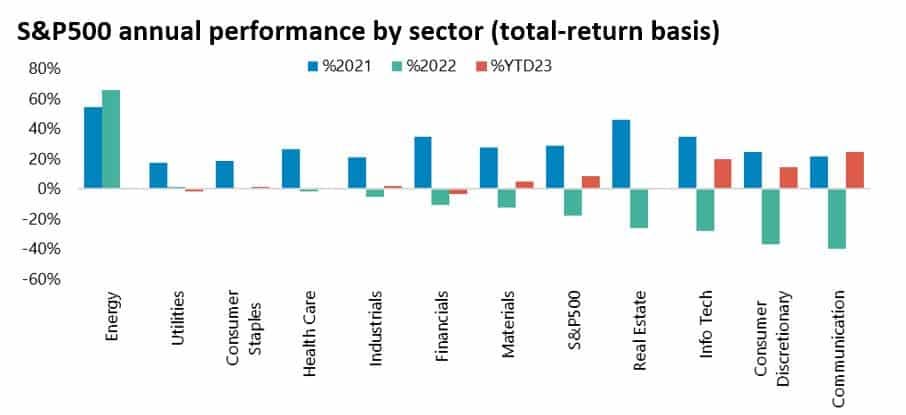

The point of the above is simply to convey the message that it is risky for investors to forget completely about Ukraine, while it also makes sense, as discussed here in the past, to maintain energy stocks in portfolios as the best hedge against a Ukraine triggered energy spike, even though the energy sector was already the best performing sector in the S&P500 in 2021 and 2022 and is underperforming the US benchmark year to date.

The S&P500 Energy Index rose by 55% and 66% on a total-return basis in 2021 and 2022 respectively and is up 0.7% so far in 2023, while the S&P500 is up 8.3% year-to-date.