The Bitcoin ETF Blitz: Which Stocks to Own

Bitcoin Goes Mainstream

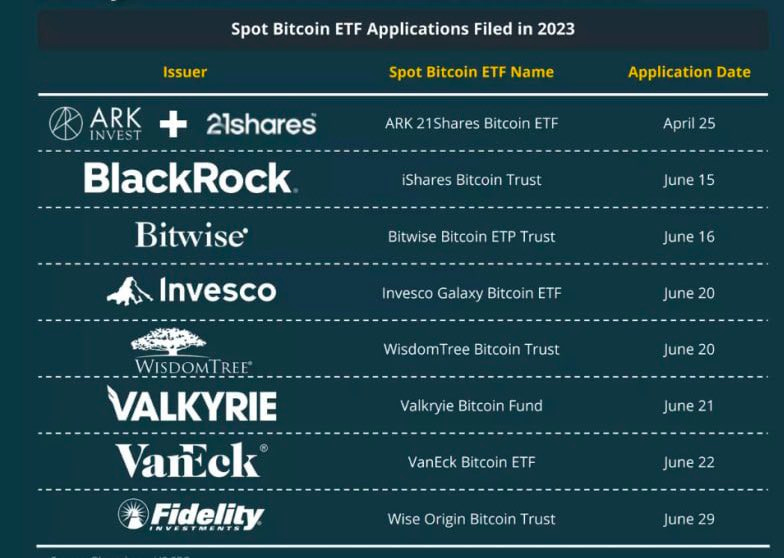

We are weeks away from a watershed moment for Bitcoin - the pending SEC approval of Spot Bitcoin ETFs sometime between January 8th - 10th, 2024. If approved, trading could begin as early as January 15th and the mainstreaming of a new asset class begins.

At our Hard Money Conference, Bloomberg Analyst James Seyffart shared his team’s view that the odds of SEC approval in early January was over 90%.

The sheer amount of time the SEC has devoted to this file along with some of the largest ETF industry players strongly suggests that the SEC has bought into the Spot Bitcoin ETF concept at a fundamental level.

We’re now at the mechanical, operational wrangling stage of pre-approval.

The Power of Institutional Capital & Bitcoin Whales that HODL

One of the defining virtues of Bitcoin holders is their discipline to hodl (not sell) BTC irrespective of the price. If future Bitcoin ETFs were to attract significant capital there would be a challenge finding the required liquidity. Some of the largest Bitcoin whales are not selling: MicroStrategy, Winklevoss Twins, Tim Draper & Michael Saylor.

Historically, the combination of large capital inflows and investors who hodl result in strong price squeezes.

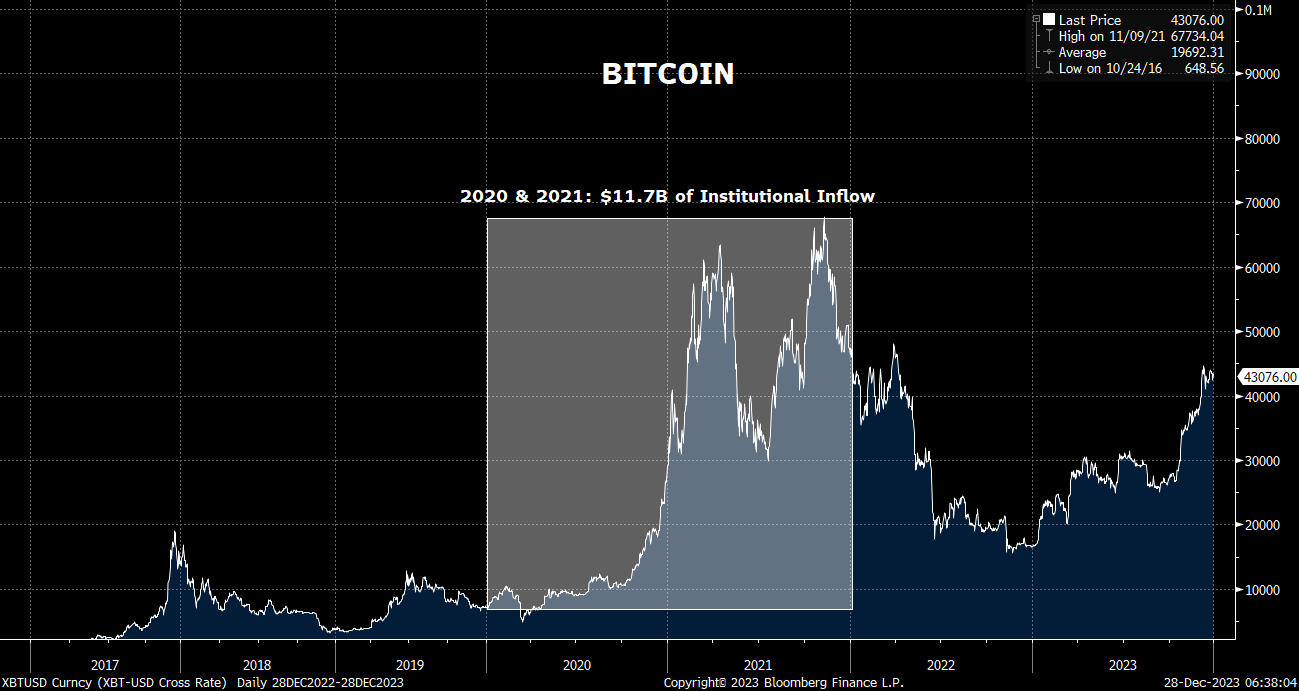

Let’s examine the squeeze in 2020/2021 for clues on what could happen in early January. CoinShares estimated that Bitcoin investment products saw an inflow of $11.7 billion over the 2 years.

That level of investment product inflow contributed to BTC rallying to a peak of $68K (+820% from Jan 1, 2020).

Large capital flows into Bitcoin correlate to higher exchange traded volume. Whenever there’s been a volume spike in Bitcoin the price has always squeezed higher. Conversely, Bitcoin price declines are accompanied by lower levels of volume.

Bitcoin price action simplified: high volume hodl squeezes on the way up and low volume gaps on the way down.

It pays handsomely to get in ahead of institutional capital inflows and volume.

Bitcoin Price vs Volume on Exchanges

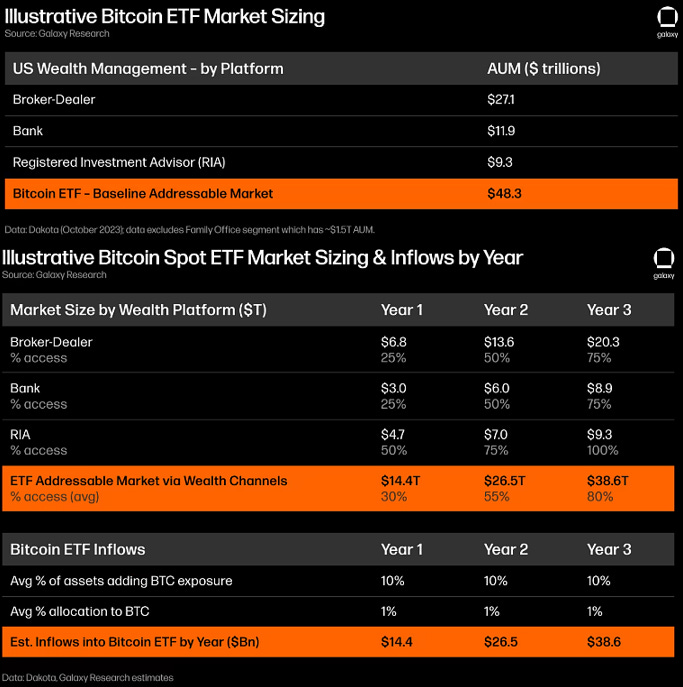

The critical question is how much capital can the Bitcoin ETFs attract in 2024?

The Bloomberg ETF team views $10 billion as a reasonable baseline of asset inflow for the first year; while Galaxy Digital’s bottom-up analysis suggests $14 billion of inflow.

Year-to-date there’s been net $1.7 billion of institutional flow into Bitcoin, we can conservatively view that as demand pulled forward from 2024, which would lower the anticipated capital inflow next year to $8-12 billion (Bloomberg and Galaxy estimates less $1.7 billion).

We however believe the inflows levels could be significantly higher than these estimates.

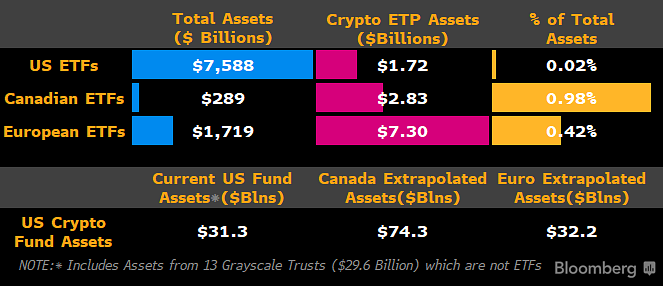

Using Canada as an example, crypto ETFs there have attracted $3 billion. If the U.S. were to attract an equivalent percentage of total market assets that would amount to an inflow of ~$74 billion for US ETFs.

Potential Bitcoin ETF Inflows

We believe a significant amount of that $74 billion would come in year 1 based on what happened in Canada.

The largest Bitcoin ETF in Canada - the Purpose Bitcoin ETF holds some clues on what may happen. Of the total ETF units outstanding in the fund, 65% of these units were created in the first year. Units are the equivalent of money coming into an ETF.

Using this level of Bitcoin asset penetration for the US market would result in $50 billion of inflows into Bitcoin ETFs in year 1.

If the Bitcoin ETFs are approved we believe a price squeeze is the highest probability scenario for the following reasons:

The estimated $12 billion of 2024 inflows is enough to drive a spike based on history (2020/2021 analog). If we adjust for 2023 inflows as demand pulled forward it still results in $10 billion of inflow.

We believe the market will see closer to $50 billion of inflows in 2024, inline with asset penetration rates in Canada. An inflow this high has the potential to eclipse the price appreciation of prior spikes.

These anticipated levels of asset inflows should enable Bitcoin to handily take out the previous $68K high. We are thus very bullish Bitcoin.

Bullish Bitcoin = Very Bullish Bitcoin Equities

The highest leverage way to express a bullish view on Bitcoin is through equities with operational exposure to Bitcoin - they have the beta.

To find the best positioned Bitcoin stocks for the coming price squeeze, we quantitatively analyzed all equities with Bitcoin exposure. We narrowed the universe down to 5 uniquely positioned names with key advantages including:

1.2x average beta to Bitcoin

Low share count issuance

Significant Bitcoin held on balance sheet (17% of market cap on average)

A high Bitcoin mining rate compared to the market cap

Trading at half the P/S multiple of Coinbase & Marathon Digital.

Let’s dig in…