Stablecoins, Bonds & Hyperscalers Oh My!

Author: Chris Wood

The US stock market has continued to rally even as the tariff threat lingers.

Investors continue to bet on the TACO trade but the risk is that, with both the S&P500 and Nasdaq making all-time highs in recent days, Trump starts to think that markets are not worried about his tariff agenda.

Meanwhile, the reality is that the stock market has been rallying of late primarily on growing confidence about the continuing momentum in the AI capex arms race which means that Big Tech is fast moving from an asset light to an asset heavy business model.

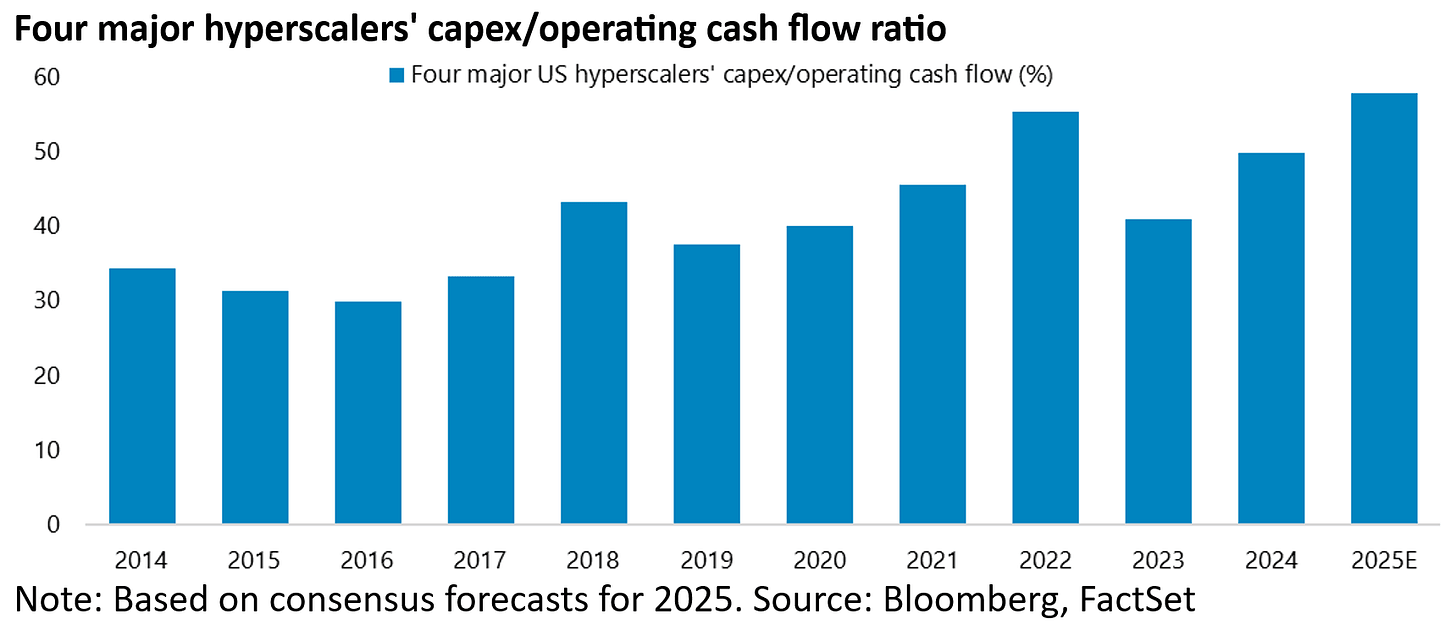

The four major US hyperscalers’ capex to revenue ratio this year is projected at 21%, or 58% of their combined operating cash flow based on consensus forecasts.

Still the recently enacted so-called One Big Beautiful Bill Act (OBBBA) contains items, as regards treatment of depreciation and the like, which will serve to delay the impact on free cash flow of the hyperscalers’ aggressive capex spending.

This has been clearly bullish for the relevant tech stocks.

Meanwhile, the focus has also shifted back to the bullish part of the Trump agenda for equity investors, namely tax cuts and deregulation, with Congress passing the OBBBA on 3 July.

This will lead to an estimated US$3.4tn increase in the federal government’s outstanding debt of US$36tn over the next ten years resulting from this legislation.

That at least is the estimate of the Congressional Budget Office (CBO) (see CBO report: “Information Concerning the Budgetary Effects of H.R. 1, as Passed by the Senate on July 1, 2025”, 1 July 2025).

True, this estimate does not include any potential revenue increase from higher tariffs.

A 10% increase in tariffs is likely to raise around US$350bn per year, based on US imports of goods of US$3.47tn in the past 12 months to May.

Meanwhile, it should be pointed out that the CBO assumes “only” annual real GDP growth of 1.8-1.9% during this period.

Remember the original plan of the Trump administration, namely that Elon Musk and Department of Government Efficiency (DOGE) would establish the fiscal credibility to give more room for the tax cuts, is clearly now not happening.

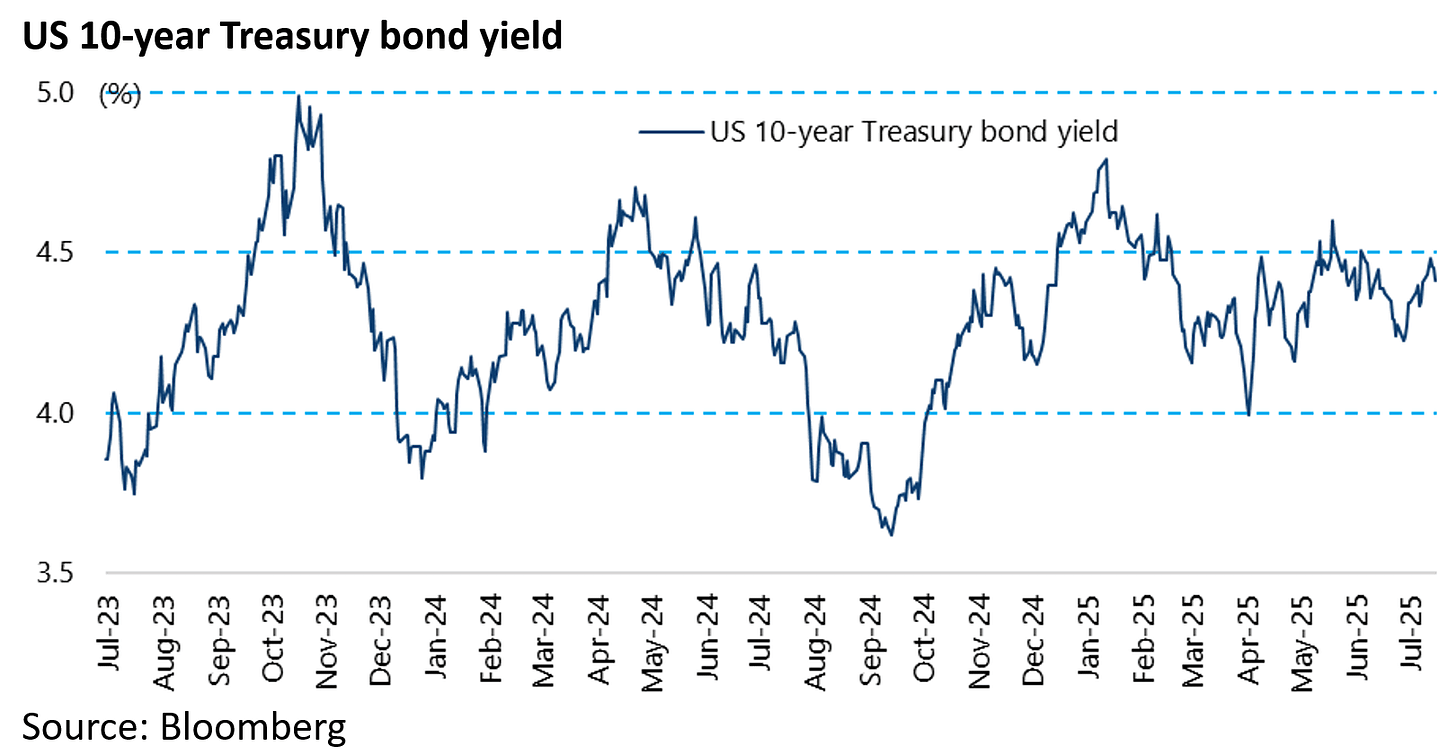

This is why the long end of the Treasury bond market has now become more important than the Fed for the markets in terms of the potential for a bond vigilante revolt.

Still, for this to really start making headlines, and upset the stock market, the 10-year yield probably needs to break 5% on the upside whereas it is now 4.42%.

Japanese Government Bond Sell-off in Focus

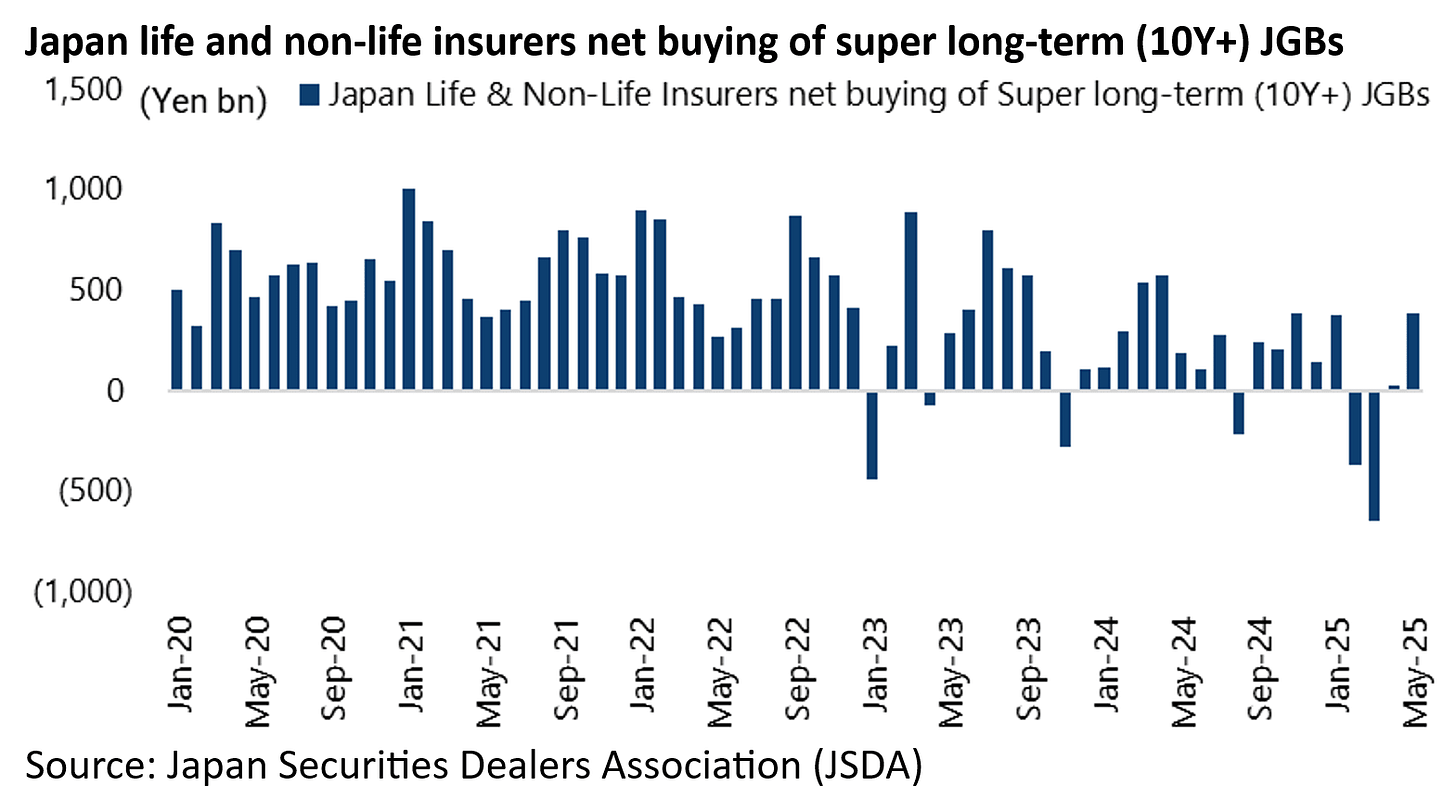

Moving to Asia, the sell-off in the Japanese government bond market has continued of late, amidst the growing evidence of weakening demand for the super-long bonds.

Life and non-life insurers sold a record net Y646bn worth of super-long JGBs with a maturity over ten years in March.

One reason for this is that life insurers have now closed their asset liability duration mismatch.

When they were short duration, they were avid buyers of JGBs and especially the ultra-long JGBs.

This is no longer apparently the case.

The other potential concern is that the likes of domestic insurers and pension funds are now focusing on mark-to-market losses on portfolios, which they have tended to value on hold-to-maturity accounting.

However, this writer understands that the securities have to be marked down when their value drops more than 50% from the original purchase price even under the held-to-maturity category.

The response of the Japanese authorities to the back up in long-term yields has been to reduce the issuance of long-term bonds.

The Ministry of Finance announced on 23 June that it will reduce the volume of 20-, 30- and 40-year bonds sold in regular auctions by a combined Y3.2tn or 17% for the rest of this fiscal year ending March 2026.

These cuts will be mostly offset by increases in the issuance of shorter-term JGBs and Treasury bills.

But long-term yields are still under upward pressure.

The 30-year and 40-year JGB yields have risen by 81bp and 76bp respectively year-to-date to 3.11% and 3.40%.

That said, Japan has room to reduce supply at the long end because the duration of its government debt is much longer than the US.

The average maturity of Japanese government debt is now 9.5 years, compared with only 6 years for US marketable Treasury securities.

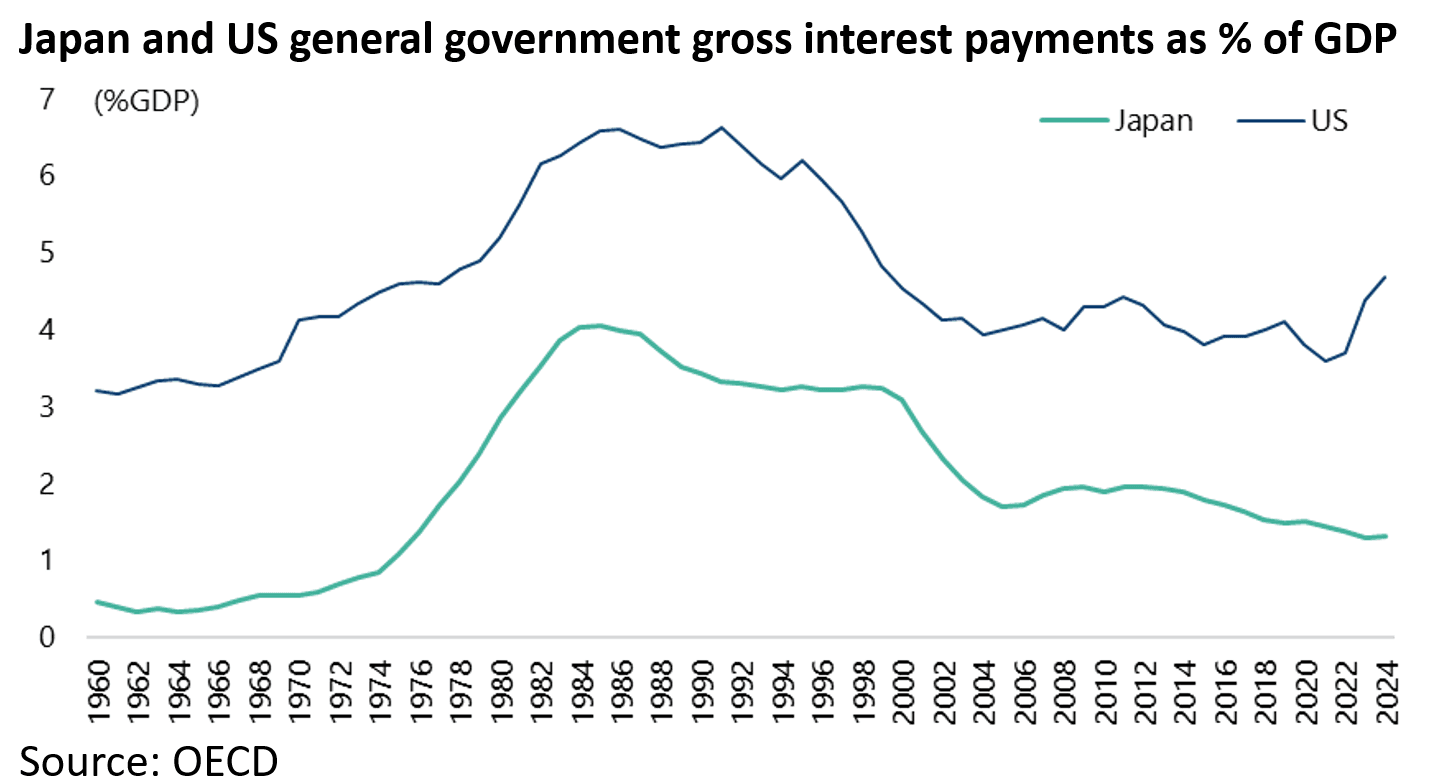

Meanwhile, another positive of Japan’s fiscal situation, compared with America, is that its debt servicing costs remain much lower as a percentage of GDP.

Japan’s general government gross interest payment as a percentage of GDP was only 1.3% in 2024, compared with 4.7% in America.

Source: OECD

Trump Needs Short Term Treasury Buyers, Enter Stablecoin Legislation

On that point, with DOGE no longer effective, the strategy of the Trump administration has become to encourage the adoption of stablecoin as the new way of creating demand for short-term Treasury bills.

Congress has passed legislation to create a regulatory framework for US dollar-pegged cryptocurrency tokens known as stablecoins.

As a result, Donald Trump signed the so-called GENIUS Act into law on 18 July.

The legislation has the benefit from a federal government perspective, given the Treasury’s reliance on short-term funding, of increasing the demand for short-term Treasury bills since the bill requires stablecoins to be backed by liquid assets such as Treasury bills.

Indeed Treasury Secretary Scott Bessent has openly referenced the demand for Treasuries that should be derived from this source.

Thus, he wrote in a social media post in mid-June that “a thriving stablecoin ecosystem will drive demand from the private sector for US Treasuries, which back stablecoins.”

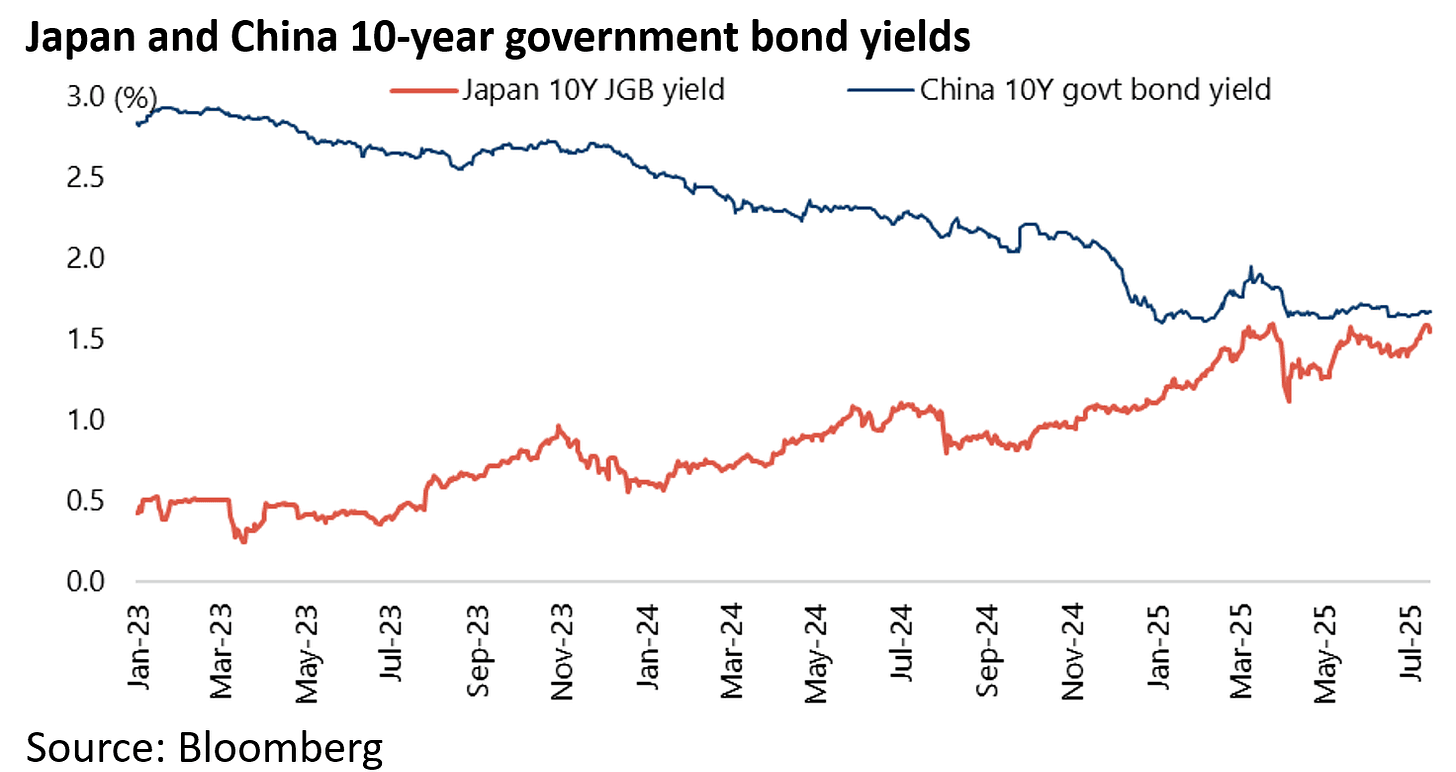

Yields in Japan and China are Converging

Another interesting consequence of the JGB sell-off is that yields are about to cross with China where long-term government bond yields remain near an all-time low.

Thus, the 10-year JGB yield has risen from 0.45% in late July 2023, when the BoJ removed the 0.5% cap on the 10-year JGB, to a recent high of 1.6% on 16 July.

While the China 10-year government bond yield has declined from 2.66% in late July 2023 to a record low of 1.59% in January and is now 1.68%.

If the easy money has long since been made in China bonds, the Japanese example shows that bond yields can go lower in an extended deflation.

G7 Bonds Remain in a Bear Market - Steer Clear

Staying on the subject of bond markets, this writer remains firmly of the view that “risk free” G7 government bonds remain in structural bear markets.

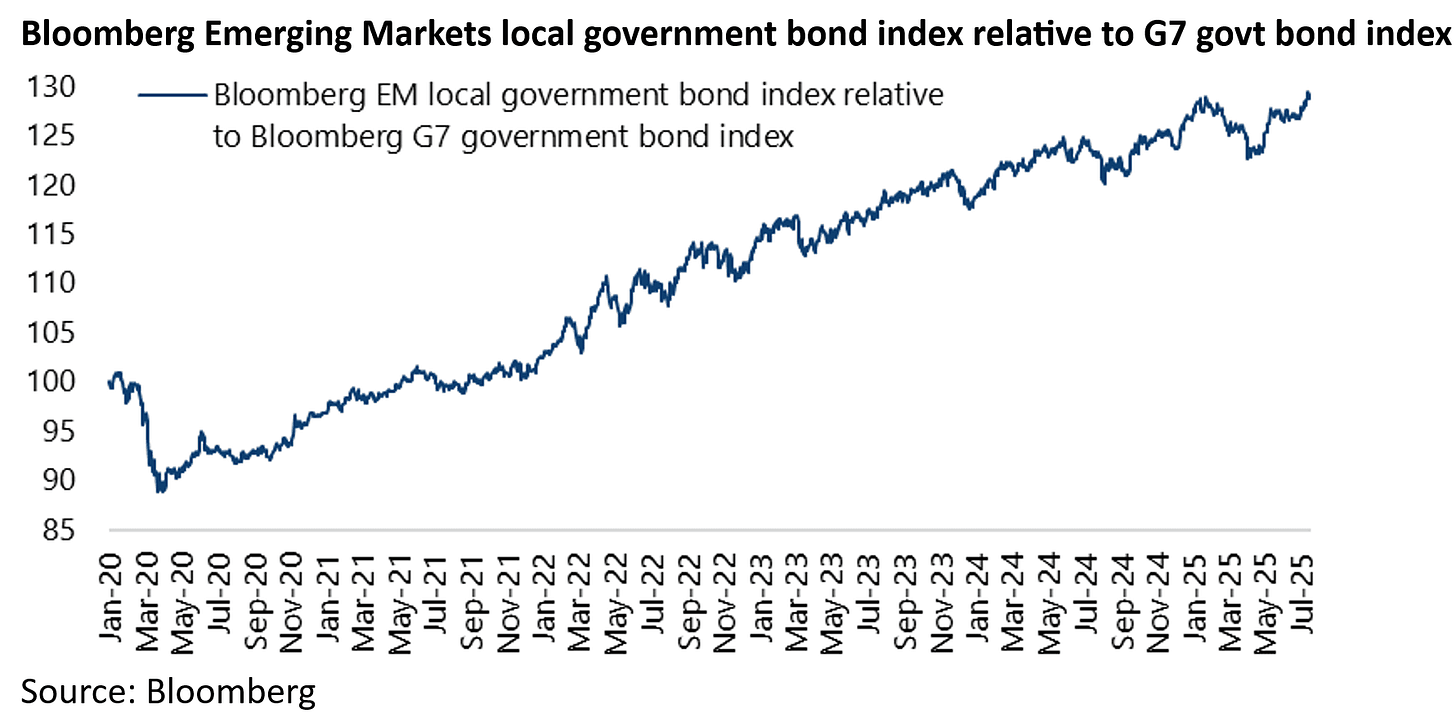

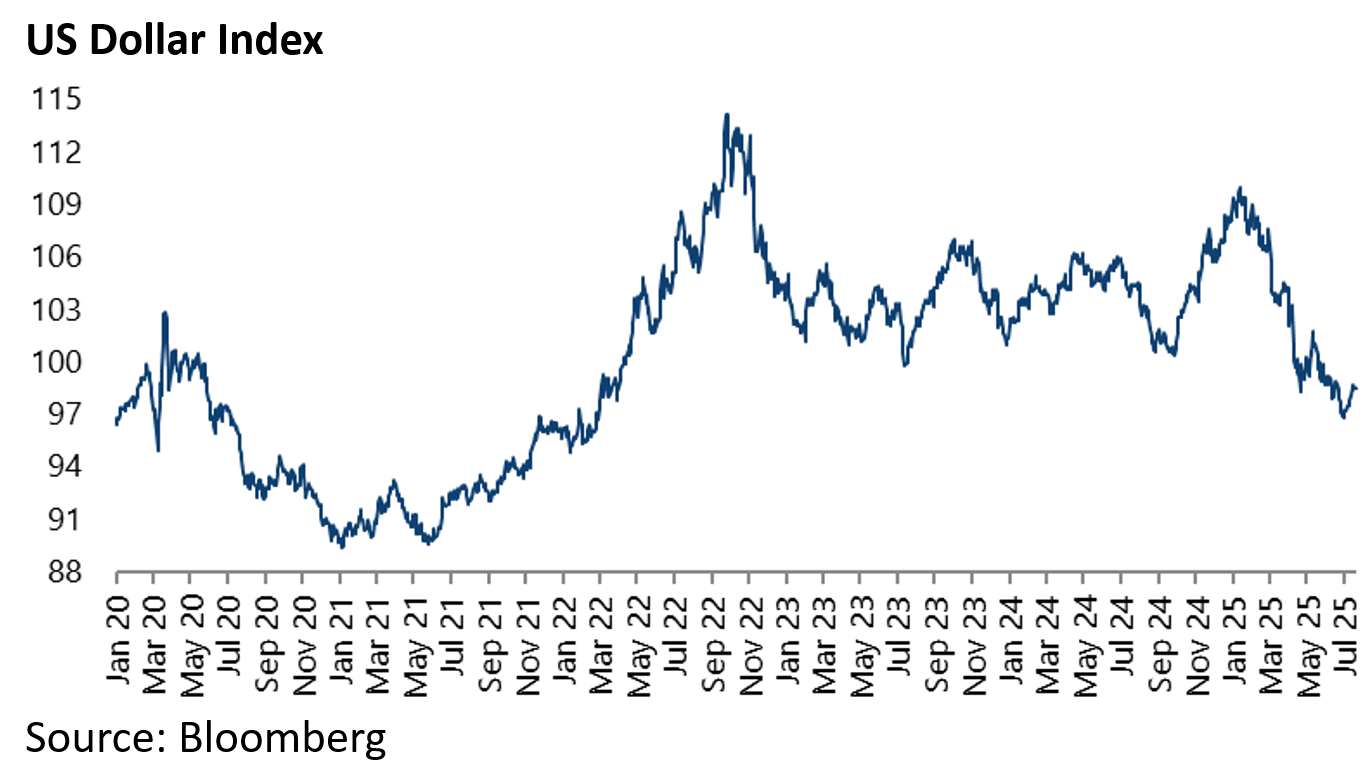

For related reasons, local-currency emerging market government bonds continue to be favoured for those who need fixed income exposure.

On this point, these bonds continue to outperform G7 government bonds, which is one of several signs of regime change from the Bretton Woods era.

The Bloomberg Emerging Market local-currency bond index has now outperformed the G7 government bond index by 45% in US dollar terms since 23 March 2020 when the Fed embarked on its massive monetary expansion triggered by Covid.

For most of this period, the outperformance of local-currency emerging market government bonds has been achieved despite a strong US dollar, which is remarkable.

But that trend has now clearly changed with the US dollar index down 9.2% year to date.