Oil Stocks Hang Tough vs. Crude

Examining Strategies to Play the Differential + Stock of the Week: Tellurian

Commodity investors are seasoned in the art of the rug pull, it is the inherent nature of highly cyclical industries - escalator up and elevator down.

The biggest performance determinant for commodity stocks is the performance of the underlying commodities they produce - straightforward logical stuff.

When commodity prices rip higher, there are a host of reasons why commodity stocks can lag (management, resource quality, operations etc.); however when commodity prices fall - it’s very rare to see commodity equities hang tough and not fall in tandem.

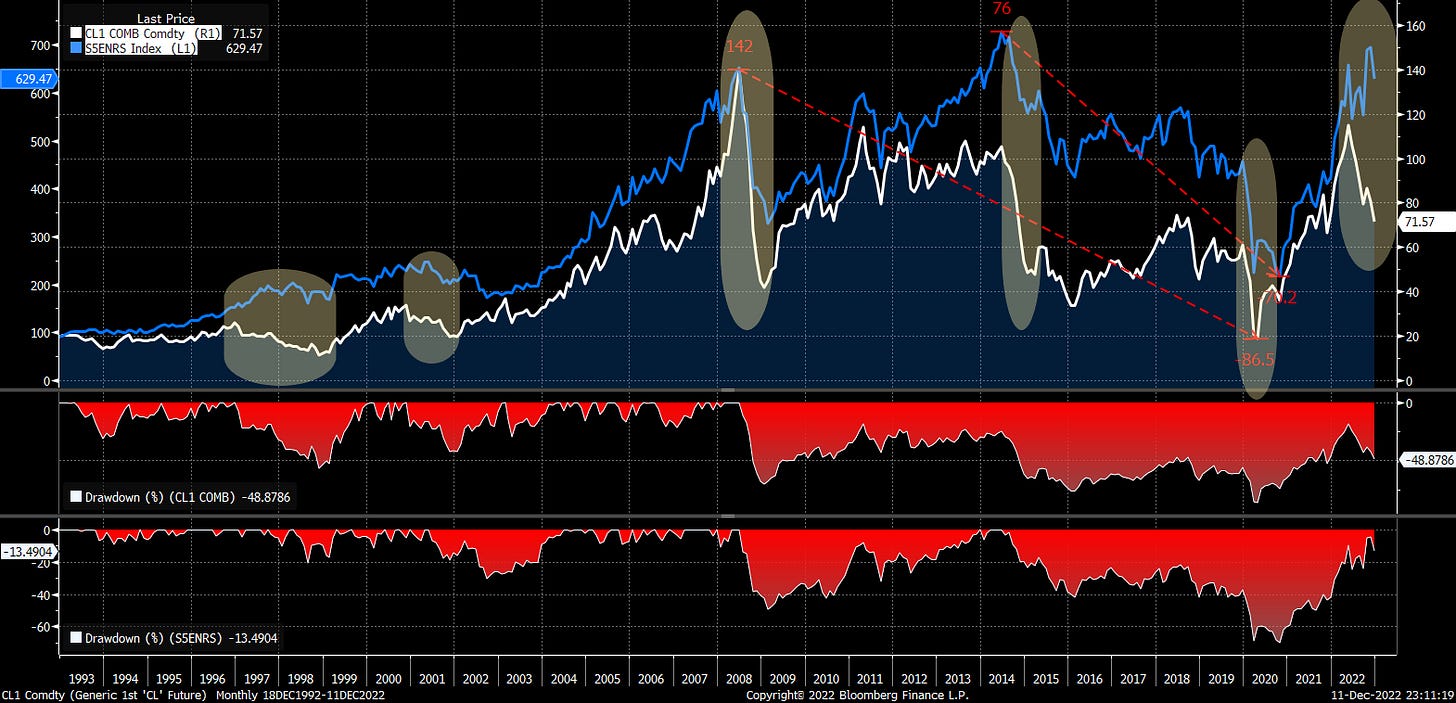

With respect to crude, since 1993, major sells off in oil (highlighted in yellow) have been accompanied with sizeable selloffs in oil stocks - 2022 is the clear anomaly.

The counter argument is that the oil equities never fully baked in the rally to $120/bbl; over the last 5 years WTI crude is up 25% and energy stocks are up 23%.

Grizzle’s strategist Chris Wood highlighted in his article last week the fact that energy was the best performing sector in the S&P 500 last year and remains the best performing year to date.

Oil and gas executives are finally focused on running their companies for cash flow and dividends; attractive characteristics for investors in the current market environment.

Grizzle has a long standing bullish view on oil and energy stocks (A Third Major Oil Crisis is on the Horizon - July 2021) - which we continue to maintain on the view that this cycle is different as a result of the lack of investment in recent years by the oil and gas industry.

Global E&P capital expenditures are significantly below the recent high in 2013.

So What if Oil Bulls are Wrong?

We remain positive on energy stocks over the medium term due to not enough drilling amid geopolitically driven energy shortages.

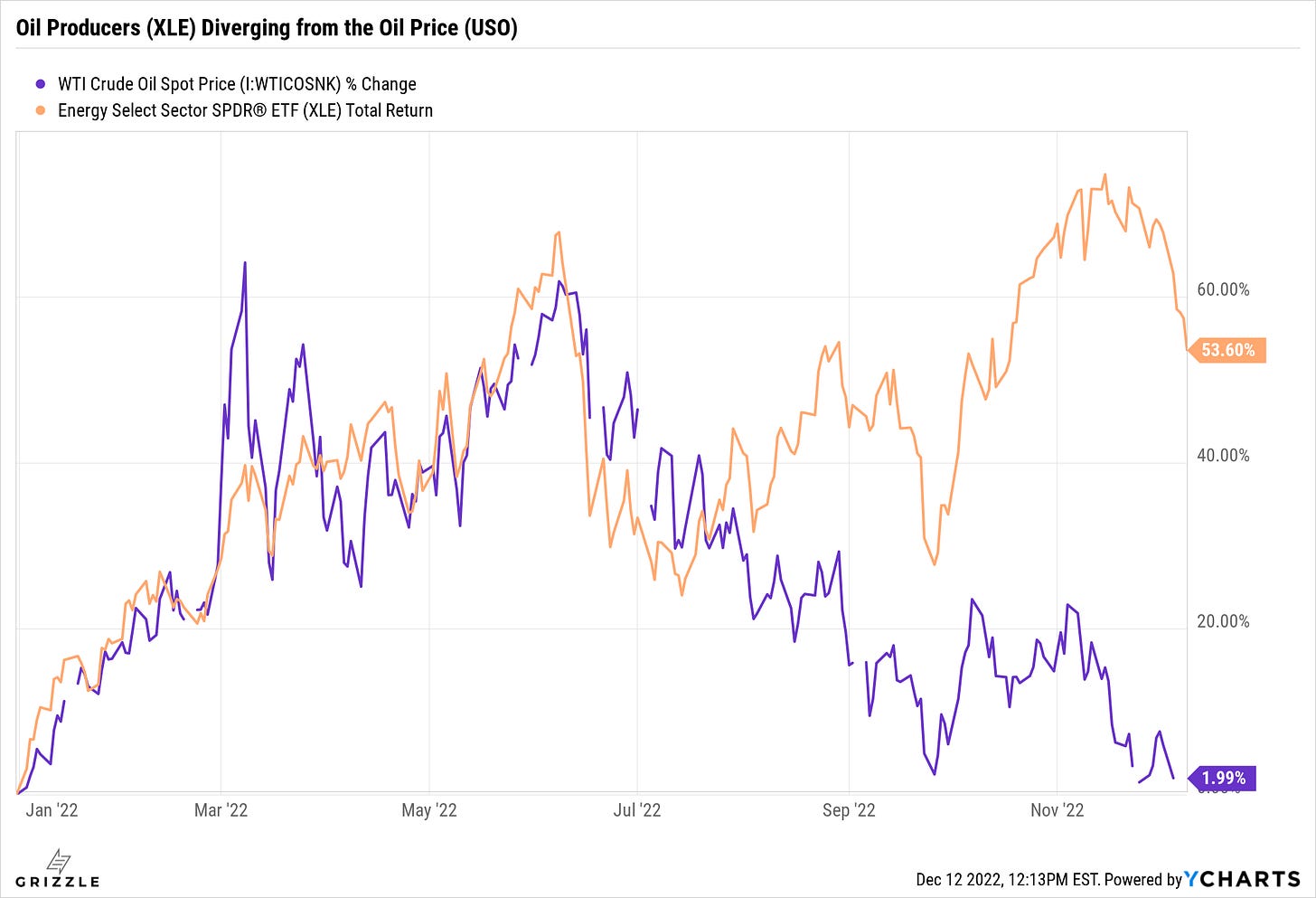

But what if we’re wrong in the short term? What if this historic gap between the oil price and oil stocks is about to close?

To protect ourselves from just such a reversion, we sifted through most of the available ways to express a view on oil stocks and the oil price. We came back with three top ideas.

Three options, each with a slightly different risk profile and expected payoff.

Option 1

A simple bet on a reversion to the mean, either through rising oil prices or falling energy stock prices.

We express this by buying $50 of the Direxion Daily S&P Oil and Gas 2x Bear ETF (NYSE: DRIP) for every $100 of the United States Oil ETF (NYSE: USO). There are no simple inverse producer ETF’s, DRIP is a 2x inverse product, so the simplest way to put on this trade is to use a 1 to 2 ratio of DRIP and XOP.

Inverse ETF’s rebalane daily so they aren’t suitable for long holding periods but because we think reversion risk will be highest over the next 3-4 months, a fund like DRIP should be sufficient.

DRIP holds a wide ranging basket of producers beyond just Exxon and Chevron, while USO invests in the front month WTI oil contract, the main benchmark used by companies in DRIP to price their products so there is largely no mismatch in economic exposure.

Option 2

Bullish oil stocks, but not sure they will go up in the short term with all the slowing economic growth headlines. You want to cushion some of the potential downside if we do enter a recession while also getting paid to wait if stocks go sideways.

Selling calls on your positions is the play here. We screened the entire energy option universe to find the calls with the most yield trading 20% out of the money. At 20% out of the money we like the balance of upside opportunity (20% in 3 months) while still generating an attractive yield which serves as a return enhancer and downside protection.

WARNING: Selling call options on stocks you already own is what we are doing here, not selling call options by themselves. Selling “naked” calls is one of the most dangerous things you can do in investing, your downside is unlimited (the stock can go up to infinity). The strategy above sells 1 call option for every 100 shares of the stock you own.

The four call options below should have something for everyone. Tellurian is the highest yielding, paying ~14% through March. TEN Ltd has the best liquidity with more than 2,000 options out while still yielding a heathly ~8%.

For Canadian investors Birchcliff is the highest yielding, but currently has no options outstanding potentially making it difficult to put on. The most liquid canadian option was Cenovus, yielding 4.6% with over 500 options outstanding.

Best Covered Call Options

Option 3

Bullish oil stocks but believe downside risk is elevated over the next three months.

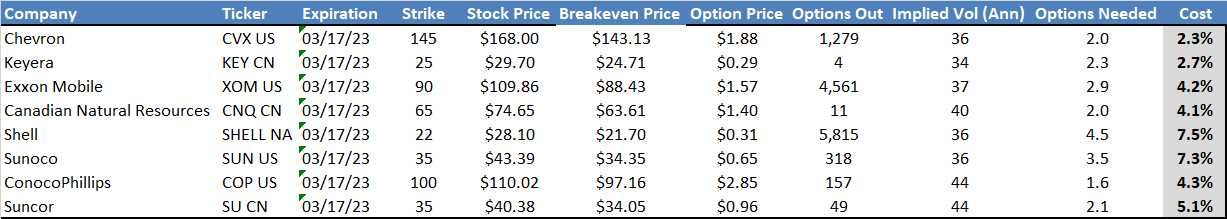

We screened for the cheapest puts that would fully offset a 30% loss on your stock position.

In bear markets, energy stocks often fall 50% or more so a 30% selloff can easily happen due to a short term demand or growth scare, even in the middle of a bull market.

No suprises here, the larger and less volatile the stock, the cheaper the put. We picked names with cheap puts that still declined more than 50% in 2020’s selloff. Cheap protection but the protection will “pay off”.

Note: The options needed column tells you how many options you must buy to fully offset a 30% decline of 100 shares of that stock.

Best Put Options

Sector Ideas

This section of Grizzle strategy and quant screens for interesting ideas across stocks and options. We’ll usually have an in-depth writeup on a stock specific idea as well as other potential trades based on what our screens are highlighting.

Importantly, all sector specific portfolios (coming in January) will live here. Each portfolio is a concentrated list of 10 stocks we think are poised to outperform given our proprietary factor screening methodology. Factor portfolios will be updated monthly.

Stock of the Week: Tellurian (NYSE: TELL)

Tellurian is a multi-year play on energy shortage and energy transition. Based in the US, Tellurian is in the process of building ~28mtpa of LNG (Liquidified Natural Gas) capacity which would make it one of the largest suppliers in the world. The first 11mtpa is expected to start up in 2026

There is an acute gas shortage globally, driven by Russia’s decision to cut off gas supplies to Europe. LNG demand is now expected to be undersupplied at least through 2026, giving Tellurian a long window to sign long term contracts at attractive prices.

Why we like it: Tellurian is trading for an implied LNG price of $9.60 mmbtu vs current prices in Europe and Asia close to $40 and futures prices in 2027 at $15

If the company simply signed their 2026 planned capacity on long term contracts at the 2027 futures price the stock would be worth $15/sh, 7x higher than the $2.14/sh it currently trades for.

LNG Futures Prices as of Sept 2022

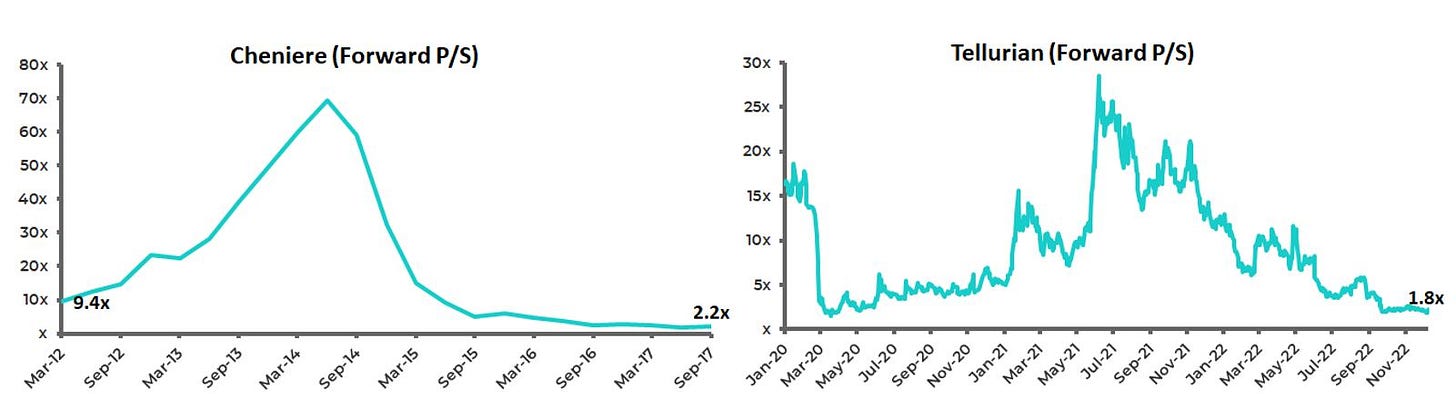

Looking at public comps, Cheniere, the largest LNG producer in the US traded for 10x revenue 4 years before first production (2016), while Tellurian trades for only 1.8x sales 4 years out.

Looking at the upside in Tellurian a third way, even if margins were 50% lower than what management expects in 2026 the stock will still be worth $7/sh, 3.5x higher than today.

Keep in mind this analysis assumes US gas costs Tellurian $5.50/mmbtu when over the last 10 years its averaged $3.33/mmbtu. Lower costs could potentially balance out lower selling prices and help Tellurian maintain higher margins.

The Details

Tellurian is building 2 plants totalling 11mtpa of LNG. These plants are estimated to cost $13.6 billion through 2026. We assume Tellurian funds the entire cost themselves though they’ve already publicly announced a desire to find partners to shoulder some of the costs.

Construction has already been permitted and began in 2022 with Bechtel as the contractor.

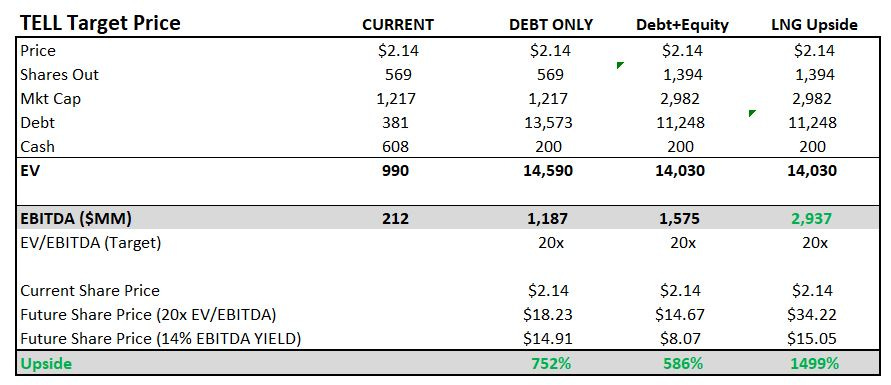

Below are three scenarios for what this stock is worth based on if the entire $13.6Bn is funded with debt, or a mix of debt and equity.

We looked at valuation two ways.

Forward EBITDA multiple of Cheniere at first gas (20x)

EBITDA yield based on Chenier’s first full year of production (14%)

Regardless of how you look at it Tellurian has significant upside under everything but the most pessimistic global gas demand scenario.

Our upside scenario simply assumes management achieves the margin target of $7/mmbtu. The rest of the analysis assumes only a $3.50/mmbtu margin.

Risks: The elephant in the room is funding a project of this size. Raising $13.6 billion is no joke and the upside for Tellurian hinges on the companies ability to either raise the entire $13.6 billion or find a partner to offload a big chunk of the upfront costs.

The fact that the company hasn’t signed any new long term contracts lately tells us either buyers are trying to avoid locking in costs they think will be temporary or Tellurian management think they are better off with spot (short term) exposure to prices instead of locking in lower prices for a long time.

Either way we don’t think the gas crisis in Europe will end this spring so come next fall, LNG prices will spike yet again and buyers may finally give in to paying $15/mmbtu for gas in 2027.

The downside should they not be able to raise the construction funds is protected somewhat by the $212 million EBITDA run rate for Tellurian’s current gas wells.

At a typical gas producer multiple of 5x EBITDA, the gas production is worth $1 billion, only 25% below the current enterprise value of $1.3 billion.

Energy

Why aren’t producers drilling?

This is the question thats been nagging us all year and is key to making sense of how much longer the bull run in oil & gas can go.

Yes government pressure through windfall tax threats is definitely part of the reason, but we never had a good explanation for how investors were pushing management to favor payouts over drilling.

A company only cares what investors think if the company needs money or investors start a proxy battle. With oil & gas companies minting cash in 2022 they could care less about making lenders happy, so this explanation never held up for us.

Last week we finally found an explanation that makes a lot of sense, courtesy of our friends over at Goehring & Rozencwajg.

They argue that with the sector trading at only 0.8x NAV its actually better for shareholders to buy back stock than drill a new well. Let us explain.

Say a CEO has $100M to either buy back stock or drill new wells. Here is how the return math looks for both options.

Drill: At $80 oil and $5 gas G&R estimate a $100M investment would generate $130M of NAV. Yet because the stock is trading at a 20% discount to NAV the public value of that investment is ~$100M. No public value has been created for management or shareholders.

Stock Buyback: $100M spent on buying back stock would result in the share count of this company decreasing by ~20% and the implied stock price rising by 5%. This 5% return is better than what management would get from drilling.

Finally! We have a dollars and sense answer for how capital return instead of growth is a rational return maximizing decision that benefits shareholders and management teams. Even though individual well returns are as high as 80%, the market has created a situation where management teams generate more value through buybacks than through the drillbit. Fascinating!

G&R went a step further and looked at the entire exploration & production universe and found those trading above their NAV are growing production by 8% on average while companies trading at a discount to NAV are shrinking production by 4%!

We don’t think every team out there is this sophisticated, so government threats are likely doing the rest of the heavy lifting to keeps firms from drilling, but this still is the first compelling explanation we’ve found for how investors are directly influencing a lack of drilling in the middle of a worldwide energy crisis.

As energy investors we are happy to sit back and collect dividends and big buybacks because the longer companies fight the impulse to drill new wells the longer the energy bull market will last.

Disclosure: The opinions provided in this article are those of the author and do not constitute investment advice. Content is not to be construed as offers to purchase securities in the companies which may be the subject of such content pursuant to federal or state law or the laws of any foreign jurisdiction. As of the date of publish, the author does not own shares in Tellurian. Readers should assume Grizzle employees or related entities own stocks mentioned in this newsletter.

Great article