Move Over Core Inflation, Headline is All that Matters Now

Author: Chris Wood

Amidst the never ending focus on Federal Reserve policy there remains the remarkably undiscussed issue of exactly which measure of inflation the Powell Fed is actually targeting in terms of its 2% target.

In the disinflation era which ran from the early 1980s to early 2020, the Fed became increasingly comfortable focusing only on core PCE inflation.

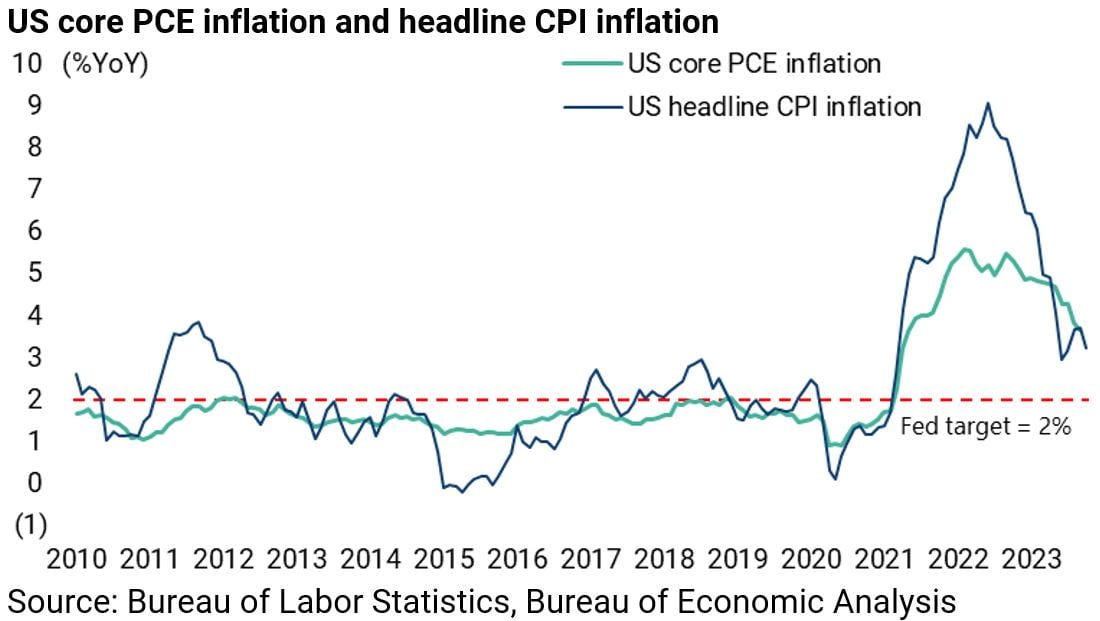

However, with the loss of the Fed’s institutional credibility resulting from the surge in headline CPI inflation from 1.7% YoY in February 2021 to 9.1% YoY in June 2022, it was no longer credible for Jerome Powell and his colleagues to talk about inflation only in terms of core PCE.

Hence the increased rhetorical focus on headline CPI inflation, though in recent months that has moderated.

Still the renewed rally in the oil price last quarter means the headline measure may have to be focused on again, though the oil price has corrected again of late.

The practical issue for the Fed for now is that inflation remains above its 2% target on the traditionally dovish measure of core PCE inflation.

US core PCE inflation was 3.7% YoY in September while headline CPI inflation was 3.2% YoY in October.

The base case has been for some time that the Fed has done its last rate hike in this tightening cycle.

Still the relative stickiness of core inflation is why further rate hikes cannot be completely ruled out so long as the US employment market is deemed to be healthy.

It is also why a sharp rebound in the oil price has the clear potential to trigger risk-off action in both stocks and bonds if that is accompanied by a surge in inflation expectations.

Meanwhile the Fed is being deliberately vague on exactly which inflation measure it is targeting.

In this respect, it is a little absurd that none of the assembled reporters at Jerome Powell’s regular post-FOMC press conferences ever seem to ask him this obvious question.

If that is the state of play on the Fed, this writer continues to believe that Powell and his colleagues will pivot to focusing on the central bank’s employment mandate on any real evidence of US labour market weakness, thereby sending a message to markets that they are fudging the 2% target.

But clearly that stress test has not yet occurred.

Government Spending in Focus

Moving away from matters of monetary policy, there is no doubt that America’s increasingly aggressive fiscal policy has been attracting growing attention of late.

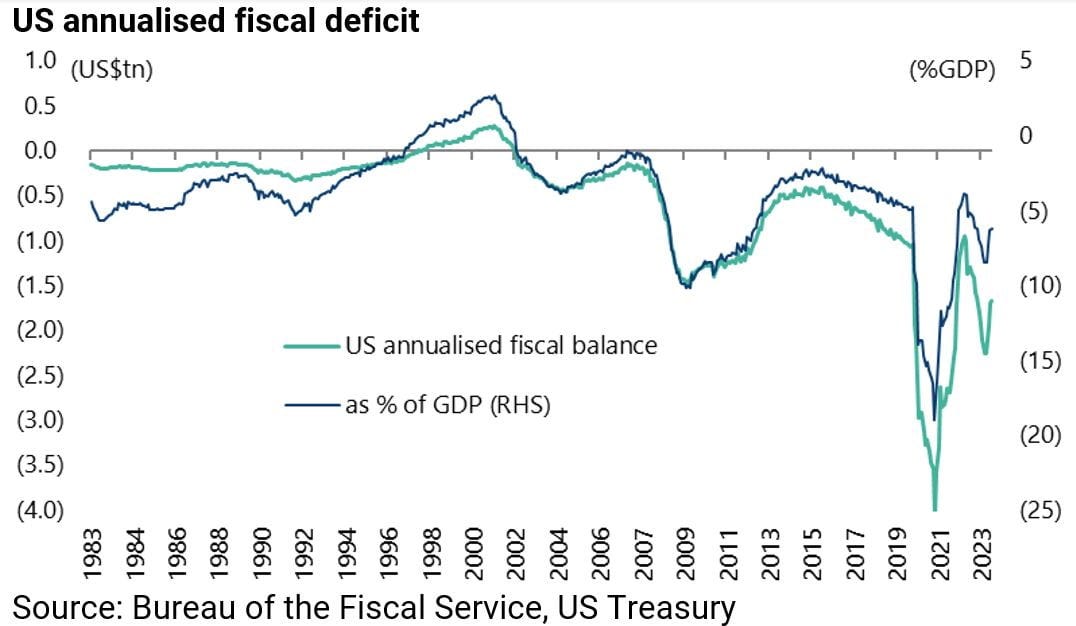

As previously discussed here (see A pronounced slowdown in inflation is coming, 14 September 2023), the fiscal deficit reached 8.5% of GDP in July on an annualised basis which is not so far off the levels reached in the aftermath of the global financial crisis in 2009-10 and, clearly, the US is not for now in such a crisis.

The annualised fiscal deficit peaked at 10.2% of GDP in February 2010.

Indeed, in US dollar terms, the US annualised fiscal deficit rose to US$2.26tn in July, far above the peak of US$1.48tn in February 2010.

Why Does the US Even Have a Debt Ceiling?

Meanwhile, the annualised fiscal deficit declined to US$1.67tn or 6.2% of GDP in October.

In this context, it is worth posing the question why exactly does the US have a debt ceiling?

The origins go back, apparently, to World War 1 when it became clear that the executive arm of government needed more flexibility to spend money to execute the conduct of the war whereas prior to the debt ceiling it was necessary to keep getting appropriations from Congress for specific expenditures.

The other interesting point is that there is apparently only one other country with such a debt ceiling that is set at an absolute fixed amount, namely Denmark.

If that is the history, with the debt ceiling now suspended until January 2025, this writer has to wonder whether it might become a matter of convenience for Washington for it to be permanently suspended, just as the convertibility of the dollar to gold was temporarily suspended in 1971 but then became permanently suspended in 1973.

The obvious answer against this happening is that the debt ceiling is a useful construct for one political party to use to criticise the other.

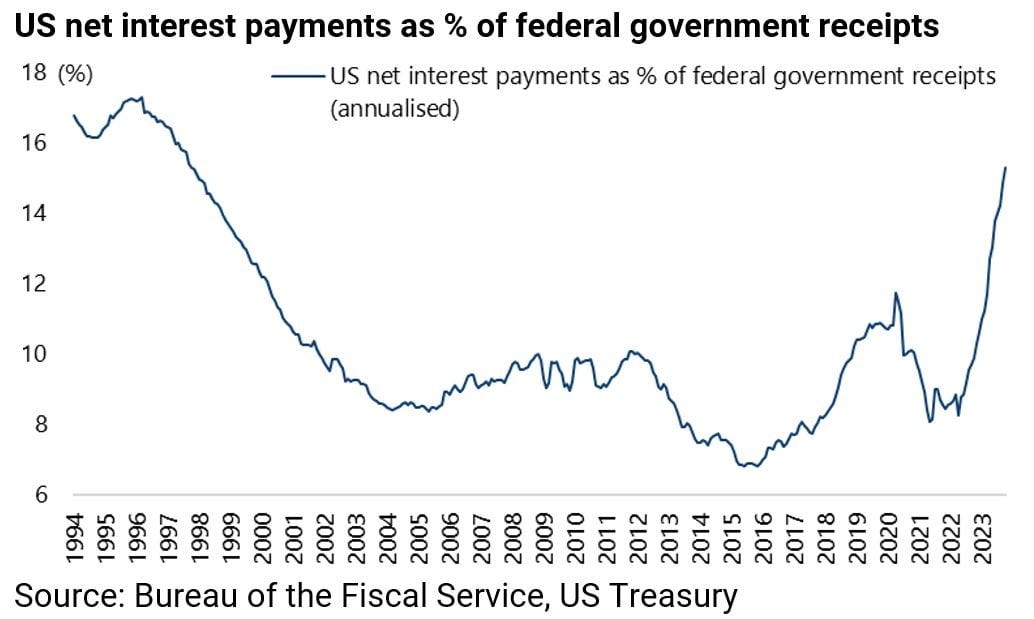

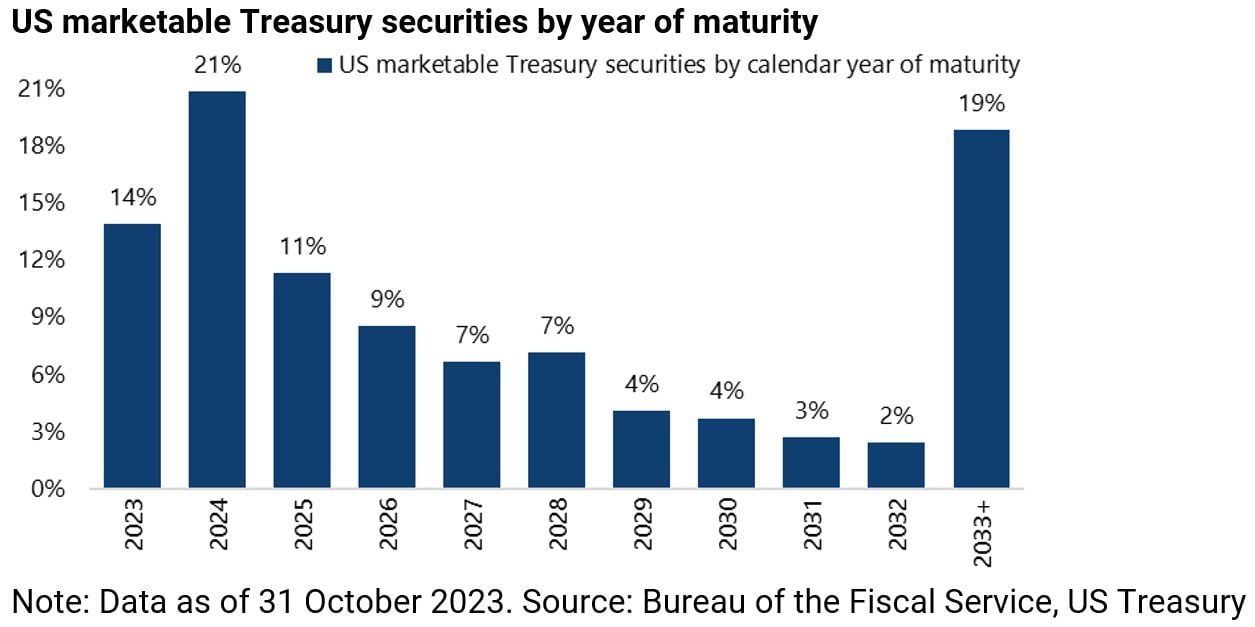

Still, as the recently agreed fudge shows, there is a certain convenience for both sides of the political aisle in Washington to forget about it altogether given the painful arithmetic consequences of the recent double whammy of rising Treasury bond yields and the relative short maturity of Treasury debt.

On this point, it is worth highlighting again that American corporates have done a much better job terming out their debt than the US Treasury.

US annualised net interest payments as a percentage of federal government revenues have risen from 8.3% in April 2022 to 15.3% in October 2023, the highest level since September 1997.

While 46% of US marketable Treasury securities will mature before the end of 2025 with 53% maturing within the next three years.

The above is why it remains tempting to see the recent weakness in Treasury bonds, in terms of relatively elevated yields, as evidence of supply concerns entering the market.

But the acid test of this will only come if Treasury bond prices fail to rally on bearish economic data, such as clear evidence of a real weakening in the US labour market. And, as already noted, such a stress test has not yet arrived.

What is Fiscal Dominance?

Meanwhile, this writer has been reading of late more and more references to an economic theory known as “fiscal dominance”.

What does this mean exactly?

An article in the Oxford Financial Group website contains the following definition: “Fiscal dominance is an economic condition that occurs when a country’s debt and deficit levels are sufficiently high that monetary policy ceases to be an effective tool for controlling inflation”.

So, the above theory appears to argue that fiscal policy can by itself create inflation and not monetary policy.

Or that “fiscal dominance” can make monetary policy redundant.

This writer remains of the view that monetary policy is powerful and if the Federal Reserve really wants to get inflation back below 2% it definitely has the means to do so.

But where this writer has massive doubts is whether it has the political will, or indeed backbone, to do it.