Low Inflation or Jobs, Which Will Jerome Powell Choose?

Author: Chris Wood

The recent regional bank jitters are a reminder that deposit flows out of US banks and into money market funds remain a key variable to monitor.

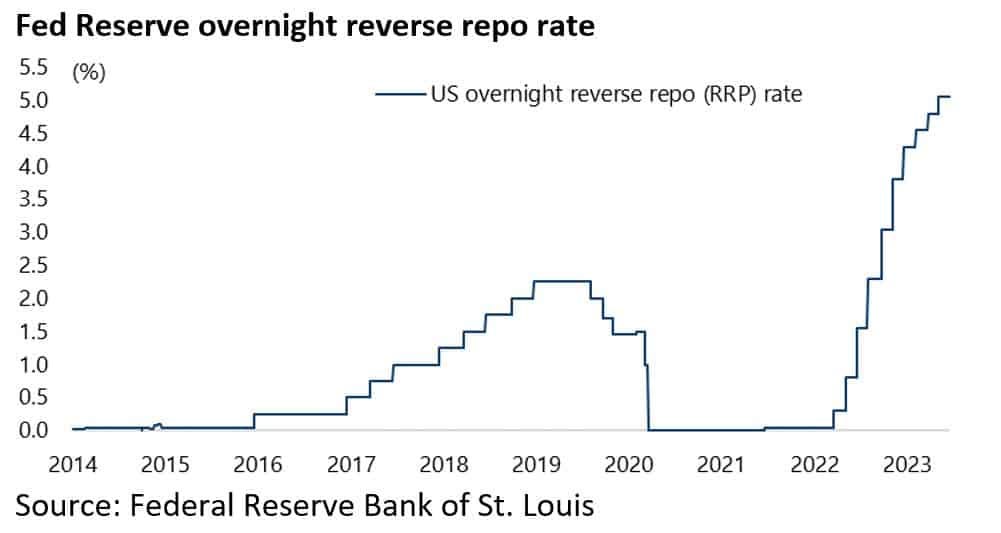

Following the last 25bp rate hike on 3 May, the Fed’s reverse repo facility now pays 5.05%.

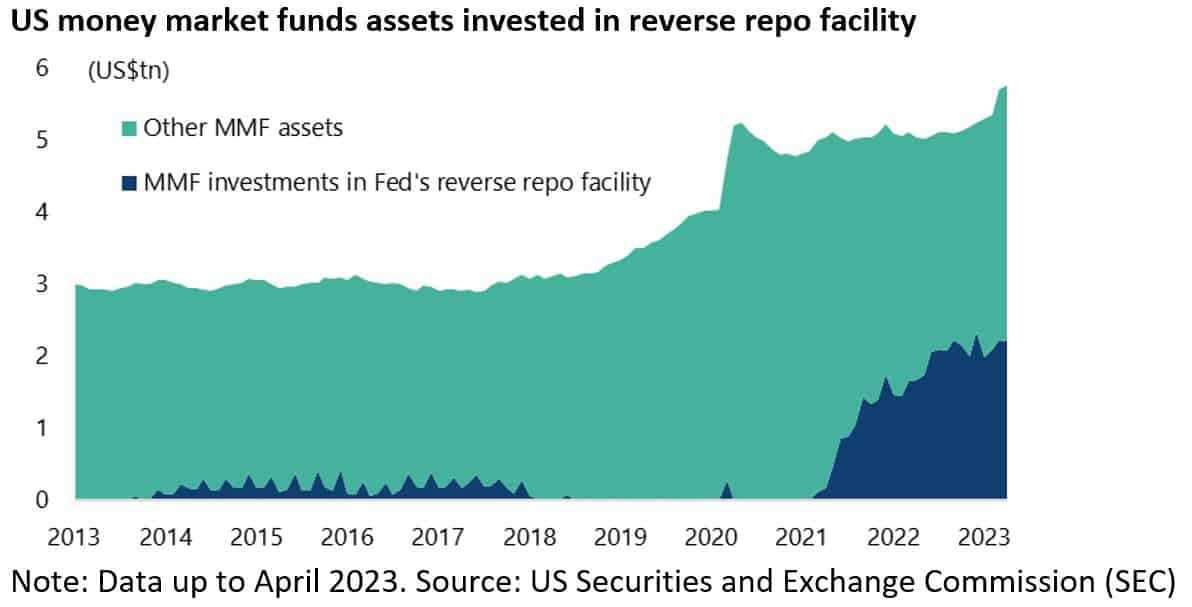

Remember that 38% of money market funds are invested in this facility.

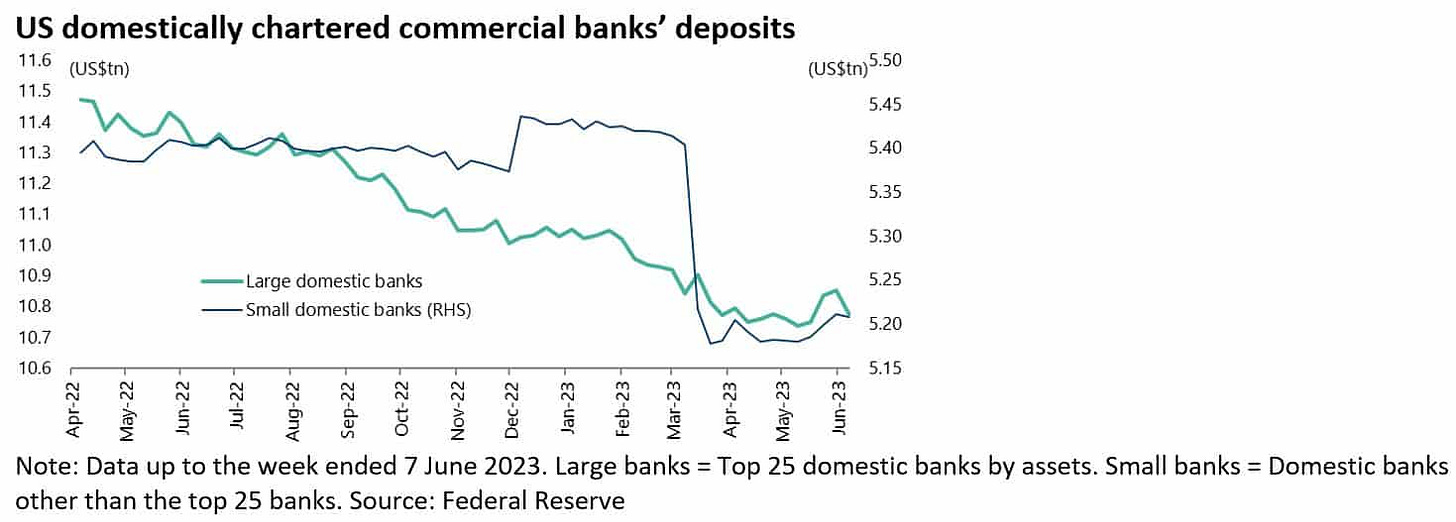

For the record, US commercial banks’ deposits have declined by US$955bn or 5.3% since peaking in April 2022, while small regional banks’ deposits have declined by US$228bn or 4.2% since peaking in early December.

Still, deposit growth turned up in the last three weeks of May even as flows into money market funds’ assets continued.

US commercial banks’ deposits rose by US$160bn in the last three weeks of May, with small regional banks’ deposits up US$31bn, while MMF assets increased by US$92bn over the same period.

But total bank deposits declined again by US$79bn in the first week of June with regional banks’ deposits down US$3bn.

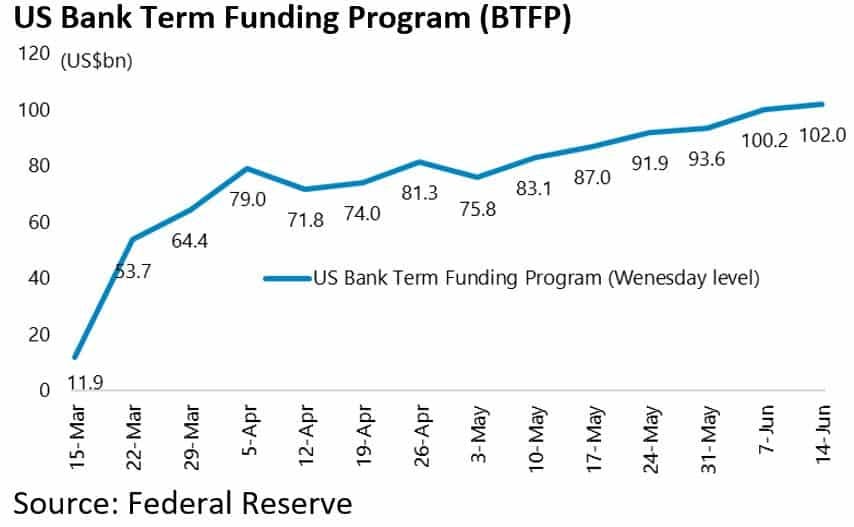

Meanwhile, it is worth noting, in a sign of lingering stresses, that the amount being borrowed from the Fed’s Bank Term Funding Program (BTFP), set up in mid-March in the wake of the SVB failure, is now at its highest level since inception, totalling US$102bn.

The BTFP offers loans of up to one year to eligible depository institutions to help assure banks have the ability to meet all deposit outflows.

Crucially, eligible collateral pledged to the Fed is valued at par, not at market value. This is a departure from traditional central banking principles.

The pressures at regional banks, who will now have to pay up for deposits, means that there is likely to be pressure on their willingness to supply credit.

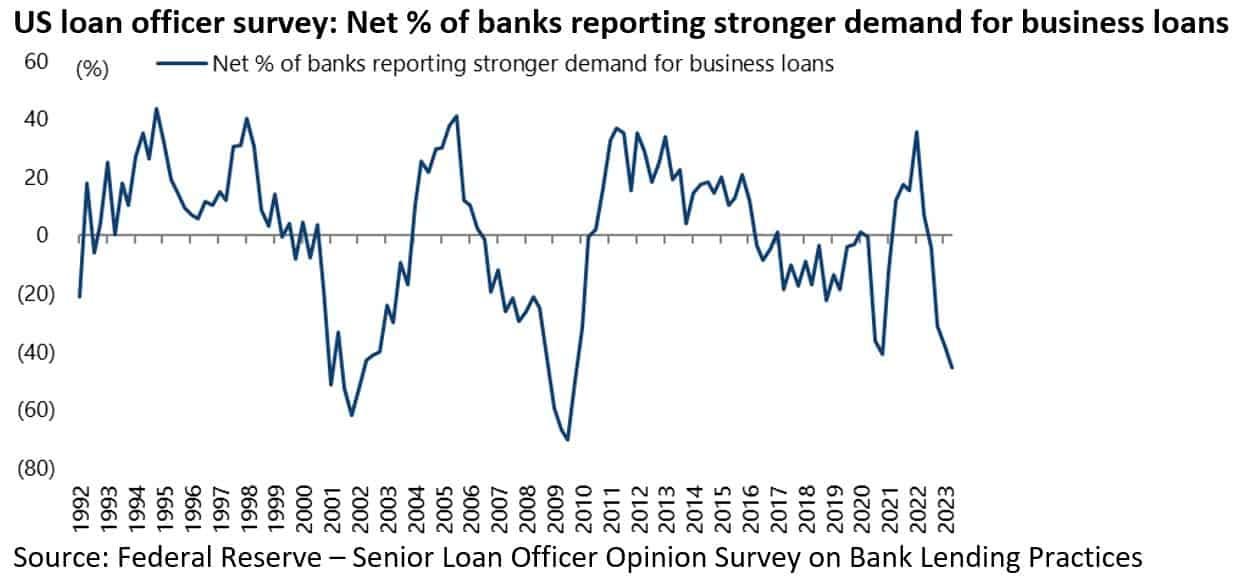

As for the demand for credit, the latest April Fed loan officer survey, published on 8 May, showed that a net 45.3% of US banks reported weaker demand for business loans, up from 37.8% in January and the weakest level since October 2009.

A hint of what may be to come was provided by the sharp decline in the availability of credit in the National Federation of Independent Business (NFIB) small business survey in March.

Thus, a net 9% of small businesses reported in the March survey that their last loan was harder to get than previous attempts, up four points from February.

This was the biggest monthly deterioration in loan availability since December 2002, even surpassing anything that happened during the subprime mortgage crisis.

Still, since then the monthly NFIB survey has shown a somewhat less alarming trend.

A net 6% of small businesses reported in both April and May that their last loan was harder to get than previous attempts.

Dovish Pivot or Hawkish Pause?

As for Fed policy, the decisions to pause last week should not surprise, but it does not guarantee an end to Fed tightening.

The dovish side of the debate at the US central bank lacks an articulate exponent since the departure of former Fed Vice Chair Lael Brainard from the FOMC in February.

Meanwhile, Fed Chairman Jerome Powell is still engaged in his wannabe Volcker act.

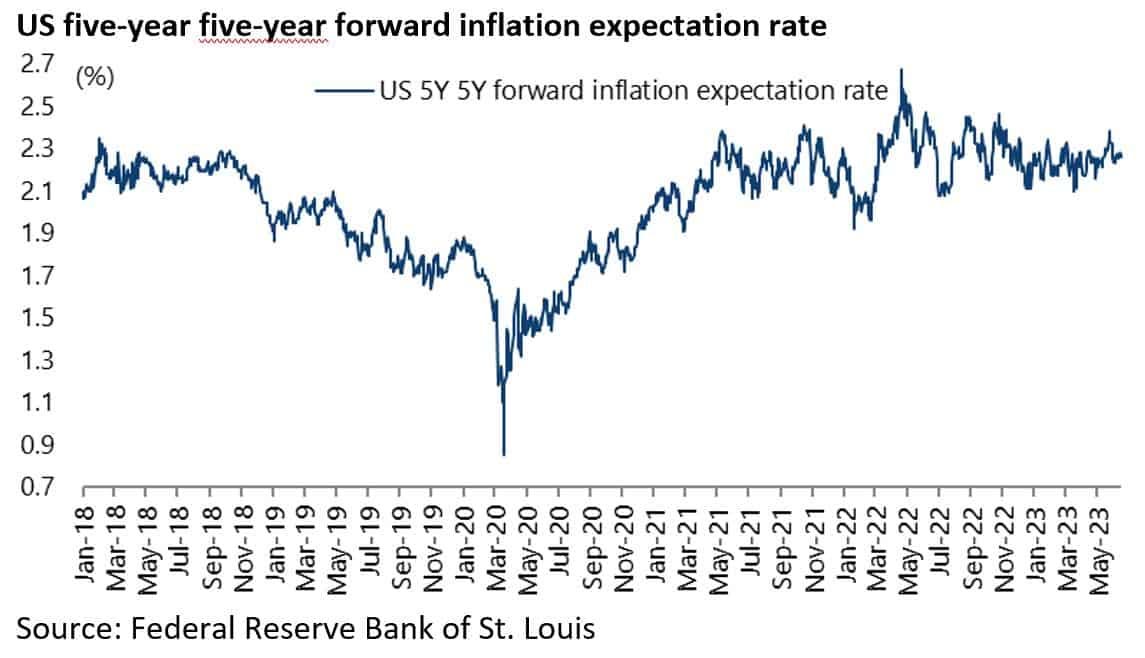

It remains the case, from a dovish standpoint, that inflation expectations remain “well-anchored”.

The US five-year five-year forward inflation expectation rate has declined from a high of 2.67% in April 2022 to 2.27%.

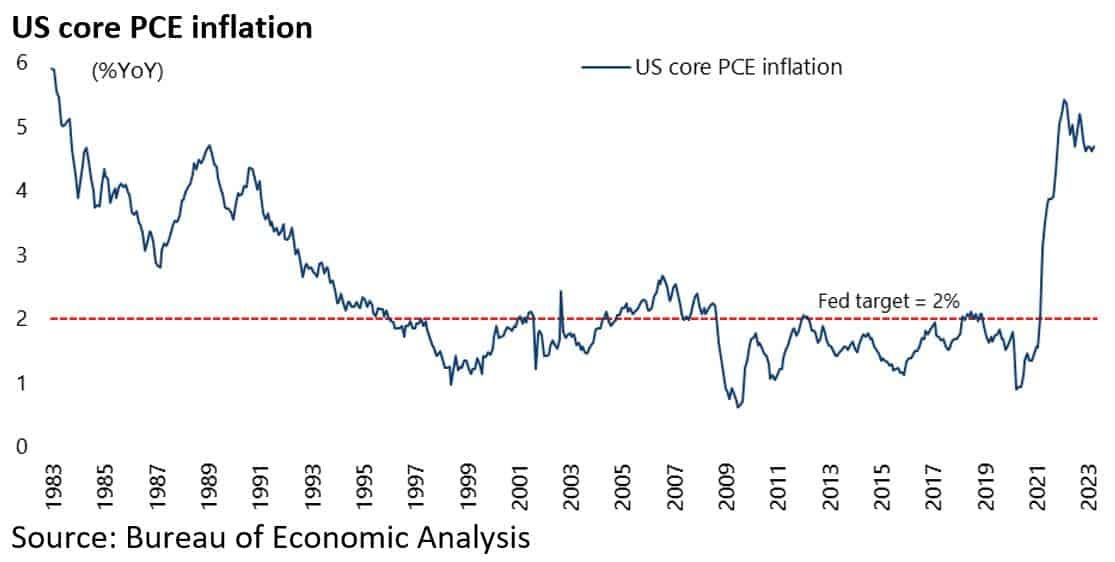

But the inconvenient truth for the Fed is that its favourite inflation indicator, core PCE inflation, remained 2.7 percentage points above the 2% inflation target on the most recent April data.

This is why it will be hard for Powell to avoid a fudge of the target if the labour market starts to weaken in the second half of this year. For at that point, the Fed will have to choose between its two mandates, employment and inflation.

A Recession is Still the Key Risk to Financial Markets

Certainly, whether a recession is coming in the US, or not, remains the key call for financial markets.

There are a lot of classic negative signals.

The yield curve remains extremely inverted.

The spread between the 10-year Treasury bond yield and the 3-month T-bill rate declined to -174bp in May, the lowest level since May 1981, and is now -157bp.

While M2 declined by 4.6% YoY in April, the biggest YoY decline since the data series began in 1959.

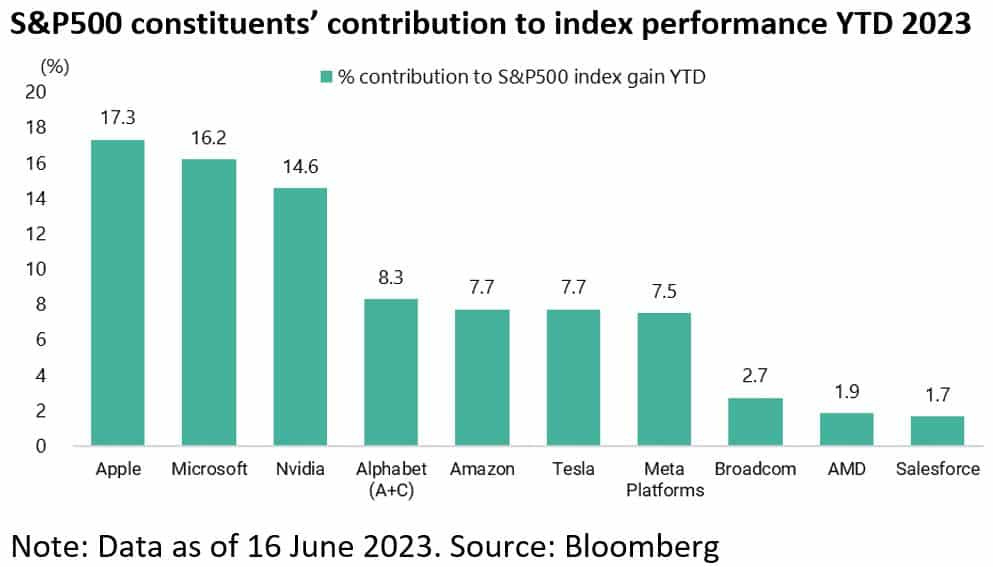

Meanwhile, the 2023 stock market rally has been very narrow, driven primarily by the AI theme, as discussed here recently (The age of American financial dominance is over, Here’s what comes next, 23 May 2023), though it has broadened somewhat of late.

Thus, the top five stocks have contributed 64% of the S&P500’s index gain year-to-date, down from 80% in mid-May.

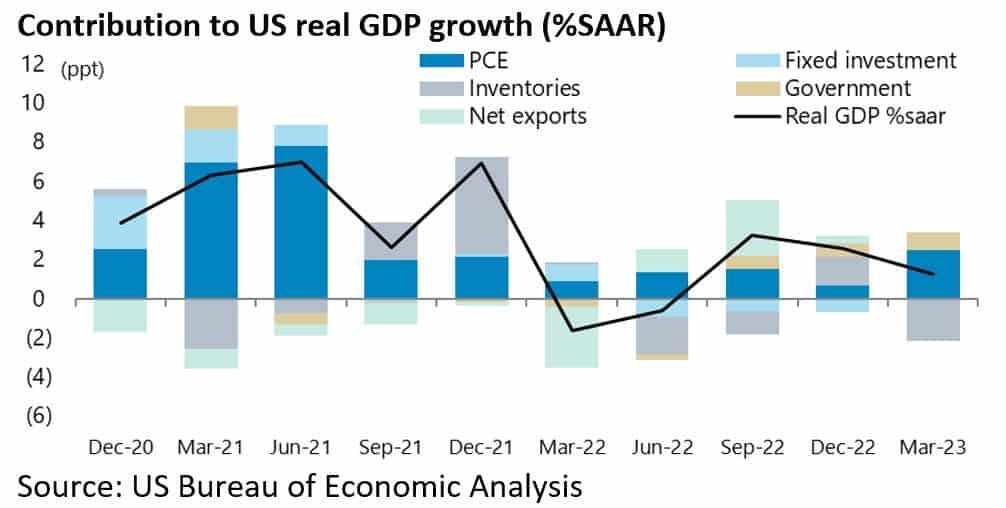

That said, it should be acknowledged that the most recent US quarterly GDP data showed resilient consumption.

Real personal consumption expenditure growth rose from an annualised 1.0% in 4Q22 to 3.8% in 1Q23.

This is the highest quarterly consumption growth since 2Q21, and it contributed 2.52 percentage points to real GDP growth.

Still, it is also the case that total real private investment, including business capex, residential investment and the change in private inventories, declined by an annualised 11.5% QoQ in 1Q23 and is down 7.9% YoY, the biggest YoY decline since 2Q20.

This decline in private investment has matched the contractions seen before any of the recessions since 1960.

And investment is much more of a lead indicator than consumption.