Is This Gold's Inflection Point + The Canadian Housing Crisis?

Its been a busy week at Grizzle. We hosted a thought provoking interview on the future of gold and discussed the potential Canadian housing crisis with housing strategist Ben Rabidoux.

This week’s newsletter highlights the most important investment reserch we read and watched from the prior week, covering gold, housing, China and the end of the mutual fund as we know it…

The Bull Case for Gold

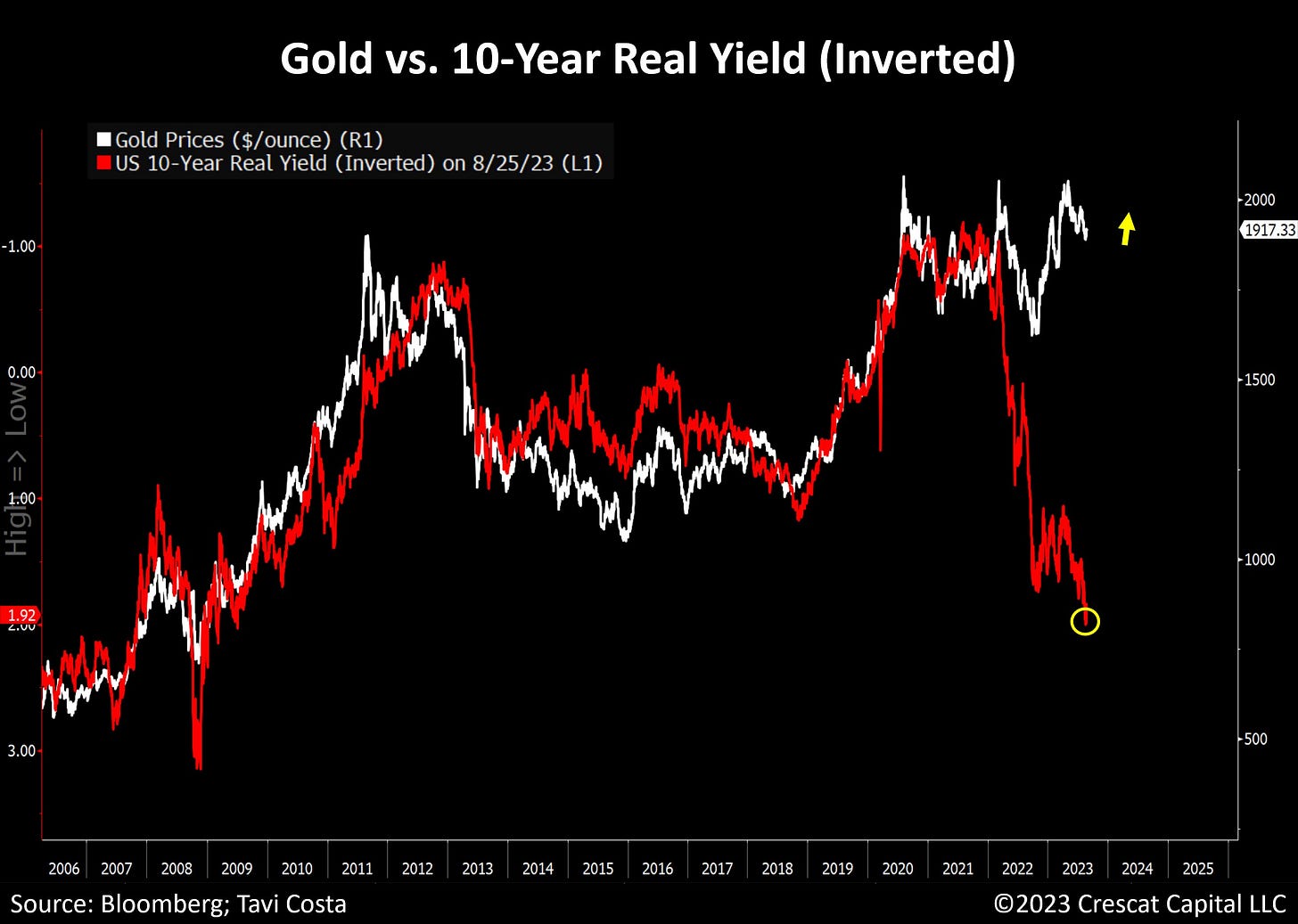

Market veteran Fred Hickey highlighted an important graph last week showing that gold bullion has decoupled from its historical correlation with US real yields.

Gold Holding Up Despite Rising Real Yields

How can this be explained? Massive gold buying from emerging markets.

With central bank buying propping up gold during a time when we would usually see weakness, Fred Hickey asks the important question, what happens when the western financial buyer returns to the market?

Gold stocks are also trading historically cheap vs gold bullion, indicating a near-term bottom could be in.

A good research piece from the website Capital10x.com lays out all the bullish catalysts for gold if you’d like to learn more.

Another macro catalyst may be rates, with the Fed likely to pause rate hikes over the next 6 months.

Historically gold has performed extremely well after a peak in the Federal Funds Rate

The visual above comes from a recent far ranging interview with Amandip Singh of Gold Miner West Red Lake. Amandip examined the importance of gold throughout history and its outperformance against other assets in 2022 as rates skyrocketed.

The full interview can be found HERE

Thomas George to Present at the Moneyshow Toronto September 8-9

If you’re in Toronto in early September, consider stopping by the Moneyshow to hear Grizzle’s own Thomas George present a keynote speech on how to profit from thematic growth & commodities, two industries that typical are worlds apart in the eyes of investors.

There are dozens of other industry experts covering interesting topics, making this a conference worth bookmarking.

Is China Facing a Real Financial Crisis?

This week our global strategist Chris Wood weighs in on if China is truly facing systematic risks from the recent meltdown in the property sector. Chris is more knowledgable on China issues than any other investor we talk to, making this note a must read, especially given the 87% fall in one of China’s largest property developers, China Evergrande, this morning.

The Canadian Housing Crisis With Ben Rabidoux

We sat down last week with quite possibly the most plugged in real estate strategist in Canada to find out the hard truths about Canadian real estate. Ben answers the key questions: Why hasn’t anything blown up already with interest rates up 5% in 15 months and when will trouble emerge?

Life After Mutual Funds

With active ETFs making up over 60% of fund launches the last three years, its clear the death of active mutual funds is at hand.

But its still early for active ETFs with the category making up only 6% of total investment assets. However active ETFs are capturing 16% of all new money flows meaning they are firmly in asset gathering mode.

The rise of active ETFs just makes sense. You still get access to the same investment options as a mutual fund and sometimes even the same top performing portfolio managers, however the fees are lower and the liquidity is just better.

At Grizzle we are in the early innings of launching ETFs that either #1 offer access to unique high growth themes or #2 improve the risk adjusted returns of current strategies. The Grizzle Growth ETF (Ticker: DARP), our first fund, has been succeeding at both by limiting the downside and volatility of innovation while also generating attractive risk adjusted returns since inception.