Is China Weaponizing US Dollar Bonds?

Author: Chris Wood

Wall Street has bought to remain focused on the bullish side of Donald Trump’s agenda, namely tax cuts and deregulation, while downplaying the tariff threat where the base case remains that this is primarily a negotiating tactic on the part of the 47th American president.

Meanwhile, Donald Trump has said he wants to end wars.

His impending return to the White House seems to have been the main pressure point on Israel’s leadership to conclude the Israel-Hamas ceasefire on the day before the inauguration, though what the exact policy on the Ukraine conflict will be remain; unclear.

As regards the Middle East, this writer was in Dubai recently.

The visit was a reminder that the UAE, and Dubai in particular, is on the point of achieving escape velocity in terms of moving from a regional hub to a global hub for the digitally enabled mobile wealthy.

The two key catalysts for the transition were first the pandemic, where Dubai turned out to be much more open and less restrictive than the likes of Hong Kong and Singapore, and then the Ukraine war and the resulting surge in Russian residents as they fled sanctions imposed elsewhere.

In this respect, Dubai’s population has grown from 2.3m to 3.8m since 2014, while the number of millionaires in Dubai has risen by 78% to 72,500 in the ten years to 2023, according to the World’s Wealthiest Cities Report by Henley & Partners.

Dubai Stocks On the Rise

Meanwhile Dubai’s stocks have surged in recent months.

The Dubai Financial Market General Index has risen by 29% in US dollar terms since 5 August.

If the property market has been booming, the valuation of Emaar Properties, the main quoted property play, is nothing like as elevated as at the peak of Dubai’s last boom-bust cycles in 2014 and 2006-08.

Emaar now trades on 8.8x 12-month forward earnings, compared with a peak of 25x in 2014 and 16.5x in 2006.

China Tightens Relationships with the 'Global South"

Staying on the international theme, there was an interesting juxtaposition of late.

China in December started to give all the least developed countries (LDCs) with which it has diplomatic relations (including 53 African countries) zero-tariff treatment for all products within the tariff quota from 1 December.

At almost the same time then President Joe Biden visited Angola from 2 December in his last overseas visit as president.

The amazing point about that trip is that it was the first visit to the Sub-Saharan African continent by a US president since 2015 and was the first visit ever by a US president to Angola.

The above is a reminder of the much greater attention paid to Africa and other developing countries by China compared with the US.

This is not just reflected in President Xi Jinping’s many visits to developing countries, for example to Peru in November where he opened a giant port built by Chinese state-owned Cosco Shipping, but also in the growing share of China’s exports to the Global South.

China’s annualised exports to the Global South have more than doubled from US$662bn or 29% of total exports in 2017 to a record US$1.34trn or 37% of total exports in 2024.

The Weaponization of US Dollar Bonds?

If this is all part of China’s effort to improve economic linkages, as reflected in President Xi’s Belt and Road Initiative (BRI) originally launched back in 2013, there was another notable development on this theme of late.

This was the issuance in November of US$2bn US dollar-denominated China sovereign bonds in Saudi Arabia with 3-year and 5-year maturity.

While the bonds were almost twenty times oversubscribed, the most interesting point is the pricing of the issue.

China sold the bonds at only 1-3 basis points above the comparative maturity US Treasury yield.

Yet historical experience suggests that if a country with a triple-A credit rating sells a dollar bond, which is not a normal occurrence, it is usually 10-20 basis points above Treasuries.

This means that China is borrowing dollars at the same rate as America which means that, in theory at least, it is a competitor for the foreign flows America needs to fund its deficit.

But the more interesting point is that China could use dollars raised in such a manner to provide dollar liquidity to help Belt and Road countries to pay off their dollar debt and therefore remove them from the orbit of the likes of the IMF.

This would also reduce dollar dependency and doubtless further improve economic linkages with China. There are now 155 countries in the BRI programme.

Clearly, for such a strategy to be effective on a global scale, Beijing would have to issue tens of billions of dollars annually.

And, equally clearly, America could respond by threatening sanctions against buyers of such dollars or even restricting or, in a more extreme move, curtailing China’s ability to clear dollars as happened to Russia.

But such actions would, likely, ultimately be self-defeating since they would trigger further concerns about weaponisation of the US dollar and further moves to promote an alternative system, as reflected in the growing amount of trade done outside the dollar.

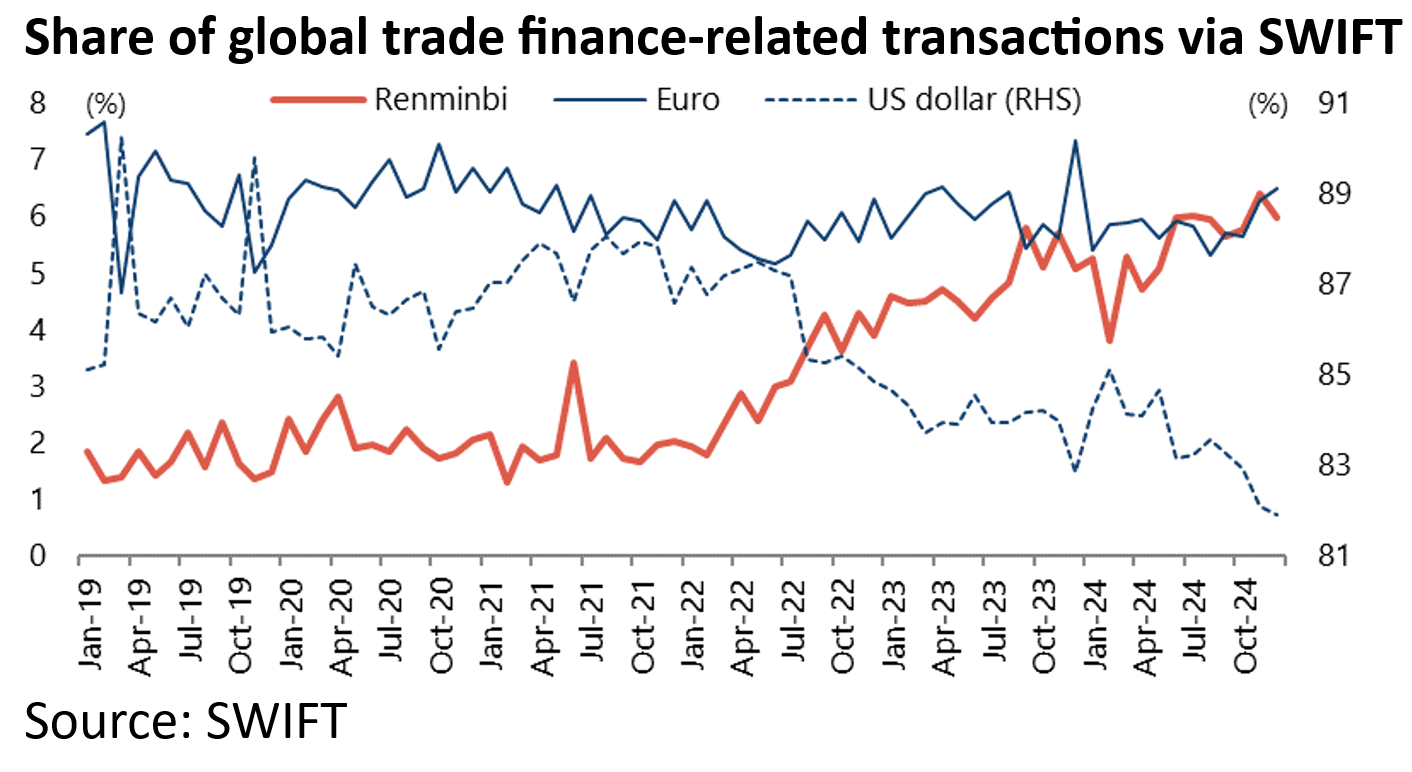

On this point, the SWIFT data shows that the renminbi’s share of global trade finance-related transactions rose to 6.41% in November, surpassing the euro (6.3%) as the second most used currency after the US dollar, though it fell to 5.98% in December.

By contrast, the US dollar’s share has declined from 88.1% in August 2021 to 81.89% in December.

Still, this data is based only on financial messages exchanged on SWIFT.

The transactions between Russia and China, for example, will be excluded since the major Russian banks have been banned from SWIFT since March 2022.

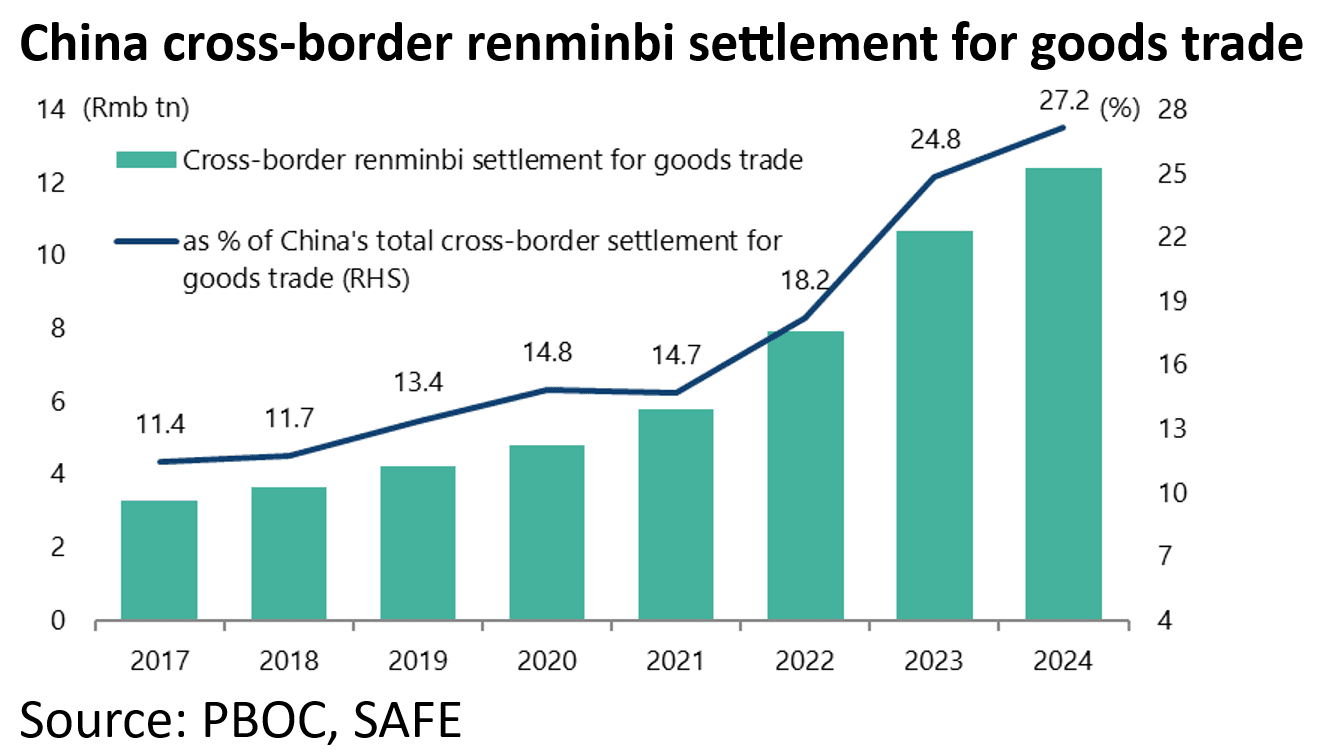

Data from the PBOC and the State Administration of Foreign Exchange (SAFE) also shows that China’s cross-border goods trade settlement in renminbi totaled Rmb12.4tn in 2024, accounting for 27.2% of the total cross-border settlement for goods trade, up from 14.7% in 2021.

China's Dollar Bond Issue Not a Threat...For Now

If this is the potential, the base case for now is that China is just sending a message via this pioneering dollar bond issue.

Still it is an interesting move, to say the least, and certainly suggests that the situation is much more nuanced than implied by Donald Trump’s attack in late November on the BRICS block for trying to replace the dollar.

Trump issued a message on his social media platform Truth Social saying that BRICS countries should commit not to create a new currency or support another currency that would replace the US dollar or otherwise face the risk of 100% tariffs (see Reuters article: “Trump warns BRICS nations against replacing US dollar”, 1 December 2024).

The reality is that the BRICS group, at its meeting in Kazan, Russia in October, avoided the temptation of a direct attack on the US dollar in its formal announcement, just as it did not make a formal commitment to establish an alternative currency.

Rather the focus is all about an ongoing process of progressively reducing dependence on the dollar, which makes sense for every country outside the G7 world.