Is China Investable Yet?

Author: Chris Wood

The Chinese economy remains the world’s second largest, with a GDP of US$18tn, so it is hard to ignore even if many global investors now view it as uninvestable.

In Beijing recently it became clear to this writer that there is no bazooka stimulus in the works. Rather the pattern will remain one of incremental easing.

This looks even more the case given that the growth in the first quarter in real GDP terms came in above the central government’s target of around 5% this year which was also the target last year.

China’s real GDP rose by 5.3% YoY in 1Q24, up from 5.2% YoY in both 4Q23 and 2023.

In this respect, the political leadership is still targeting real GDP growth.

But the problem, reflected in the mainland’s financial markets, is that nominal GDP growth remains below real GDP growth as has now been the case for the past four quarters.

Thus, nominal GDP growth rose by 4.2% YoY in 1Q24 and is up an average 4.4% YoY over the past four quarters, compared with an average real GDP growth of 5.4% YoY.

Meanwhile, the last time nominal growth was below real GDP growth for four successive quarters was 1999.

This means the deflationary backdrop continues.

This is what the government bond market has also been signaling.

The 10-year government bond yield remains near an all-time low and is now, at 2.25%, 30bp below where it was at the start of the year.

Meanwhile, even more money has been made in the 30-year government bond where transaction volume was recently running at record levels.

The 30-year bond yield is now at 2.44%, down by 57bp since late October , while the spread between the 10-year and the 30-year fell to a record low of 12bp in late February and is now 19bp.

Meanwhile the past quarter saw clear evidence of government support for the stock market, with the buying done by the so-called “national team” primarily via the purchase of ETFs.

The aim seems to establish a floor for the market at a level of around 3,000 on the Shanghai Composite Index.

It was 3,065 on 19 April.

This suggests that the major impact of the price keeping operation (PKO) is now reflected in the stock market.

Companies have also been encouraged by regulators to buy back their shares, as reflected in an increase in share buybacks.

Thus, 932 companies bought back their shares worth Rmb16.1bn in March following Rmb26.5bn of buybacks in February, up from share buybacks of Rmb6.1bn in August 2023.

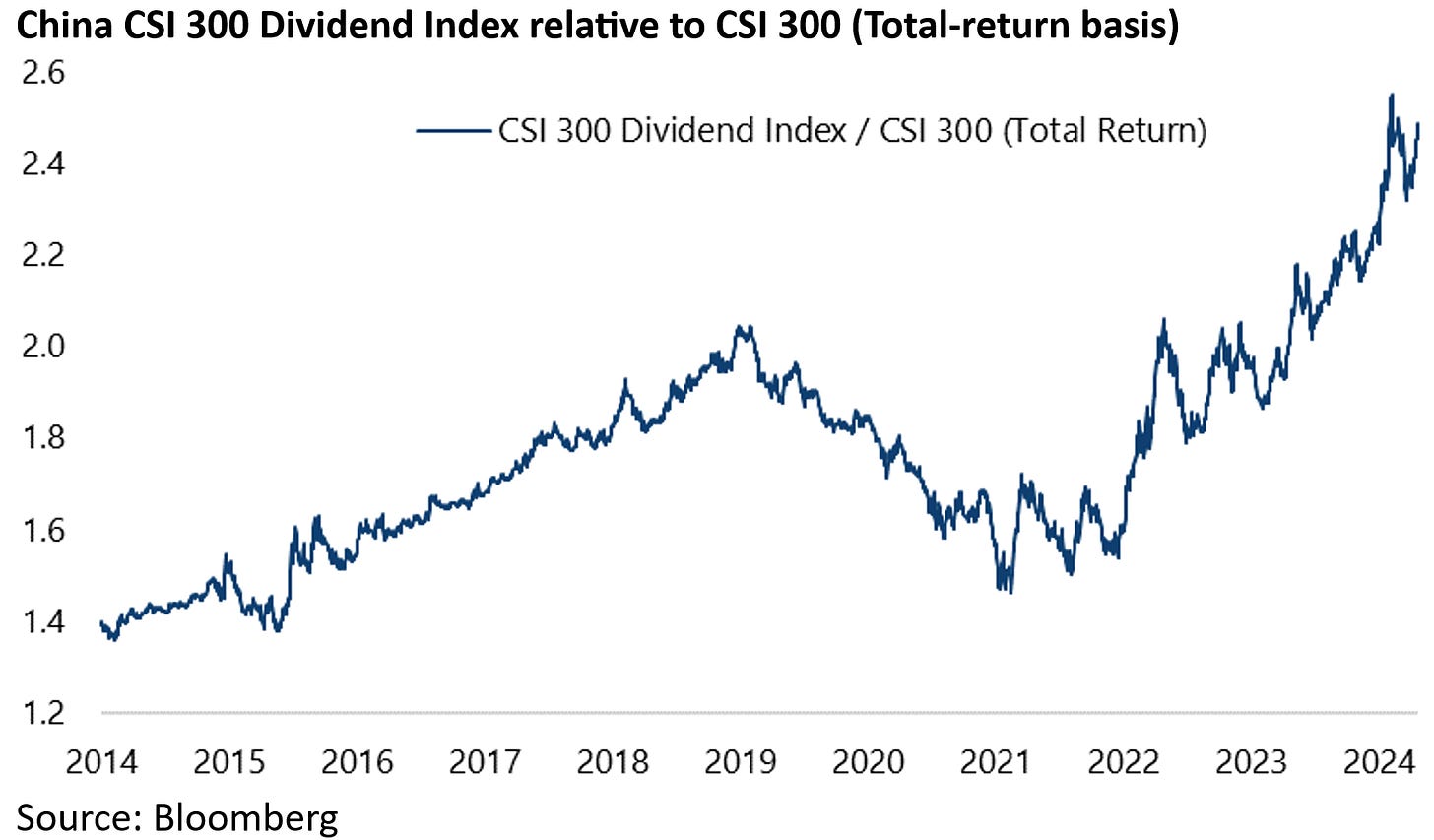

The deflationary backdrop is also reflected in the outperformance of dividend stocks since the start of 2023.

The CSI 300 Dividend Index has outperformed the CSI 300 by 27% on a total-return basis since the start of 2023.

The latest GDP data also reflects the ongoing collapse in sales of new residential properties.

New residential floor space sold declined by 23.4% YoY in 1Q24.

Does China Have a Plan to Fix the Real Estate Market?

In this respect, there remains a lack of a strong central government-directed initiative on the issue of uncompleted residential property projects.

Rather the message is that the residential property market is not a strategic priority of the central government since the understandable aim is to wean the economy from its previous over-dependence on the property sector for driving growth.

Still there remains the practical problem that people have paid up-front for properties in projects which have not been completed, which is extremely damaging to confidence.

The aim is to address this issue at the local government level via the so-called “white list”.

The key point about the “white list” is that it is based on individual projects not developers, and it is done at the local government level.

To get on the list a project has to be approved by the relevant local housing regulator.

If the project makes it on to the list the banks will be expected to lend on it.

But the key point is that the money can only be used to complete the project and not to fund a distressed developer.

The above is to address the moral hazard issue of not bailing out developers, an issue which Beijing takes far more seriously than its Western counterparts.

How effective can this “white list” policy be?

It is not the central government-directed initiative investors would certainly like to see from the standpoint of reviving confidence.

But it is certainly better than a total vacuum.

The other point is that the programme has only recently got under way.

The Ministry of Housing started the programme in late January and, as at the end of March, nearly 2,000 projects had obtained lines of credit from banks amounting to Rmb469bn of which 1,247 had received loans worth more than Rmb155bn, according to the Ministry of Housing and Urban-Rural Development.

One issue is that a lot of uncompleted projects are in tier-3 and tier-4 cities where the credit risk, as regards residential property, is probably the greatest because of the lack of underlying demand.

Not Giving up Completely on Housing as an Asset Class

Meanwhile in China’s largest cities the property market is fast transitioning from a primary driven market to a secondary one.

The estimates are that the secondary market accounts for about 25% of the overall residential property market.

But that ratio is a much higher 75% in China’s four major tier-one cities and in the 40-50% range in China’s 35 tier-two cities.

The relative vibrancy of the secondary market, in terms of activity, is proof that Chinese people have not given up completely on residential property as an asset class.

However, they are understandably wary of paying for pre-sales upfront, most particularly where the developer is private sector.

In this respect, there is an estimated 700-800m square metres a year of fundamental demand for residential property in China which is mainly driven by upgrading demand.

That compares with the 1.5bn sqm purchased at the peak of the property boom.

Housing Price Action in Shenzhen signals more deflation for Hong Kong

Meanwhile, as regards price action in the secondary market high beta Shenzhen, next to Hong Kong, is down as much as 30-40% in certain areas from peak levels while Shanghai is down around 25% from the peak and Beijing 20%.

It should be noted in passing that the decline in Shenzhen is of relevance to Hong Kong where the pressure for integration triggered by President Xi Jinping’s Greater Bay Area project implies more of a deflationary adjustment for the city state.

For such reasons, the Hong Kong government in its budget in February abolished its stamp duty on foreign purchases of property altogether.

It was levied at 30% as recently as last October.

Meanwhile Chinese stocks are cheap trading at 9.4x forecast 2024 earnings though the risk is clearly that they remain value traps.