Is China Experiencing a Lehman Brothers Moment?

Author: Chris Wood

The working assumption that the Chinese have turned temporarily Japanese is borne out by the latest credit data which has increased concerns that the authorities may be pushing on a string.

Renminbi bank loan growth slowed from 11.3% YoY in June to 11.1% YoY in July, while private sector credit growth declined from 9.1% YoY to 9.0% YoY.

A big feature of the weak credit growth data, in spite of monetary easing, is that households are prepaying mortgages.

Individual residential mortgage outstanding declined by Rmb340bn in 2Q23 to Rmb38.6tn at the end of June, the second quarter of decline since the quarterly data series began in 2012, after a Rmb110bn decline in 4Q22.

As a result, residential mortgages declined by 0.7% YoY in 2Q23 for the first time since 2012.

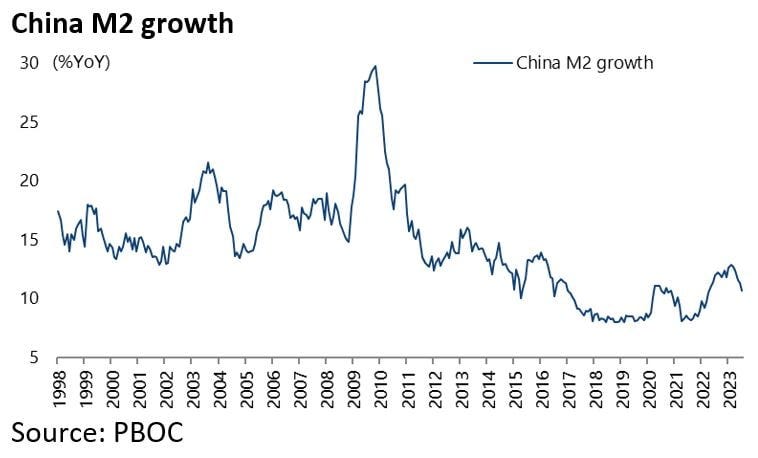

Meanwhile, China M2 growth has slowed from 11.3% YoY in June to a 15-month low of 10.7% YoY in July.

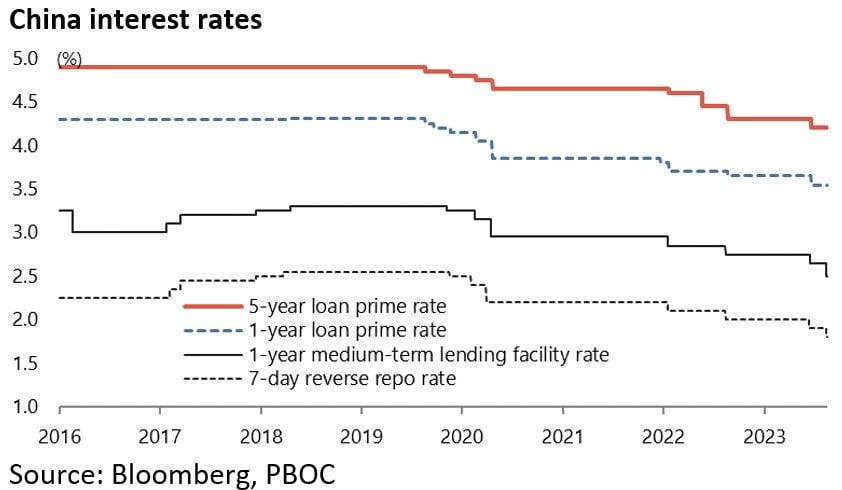

The data, and the above concerns, explain why the PBOC cut its 7-day reverse repo rate and one-year medium-term lending facility (MLF) rate by 10bp and 15bp respectively to 1.8% and 2.5% on 15 August.

This follows the 10bp cut on both rates in mid-June, the first such rate cuts for both since August 2022.

Private Developers in Trouble

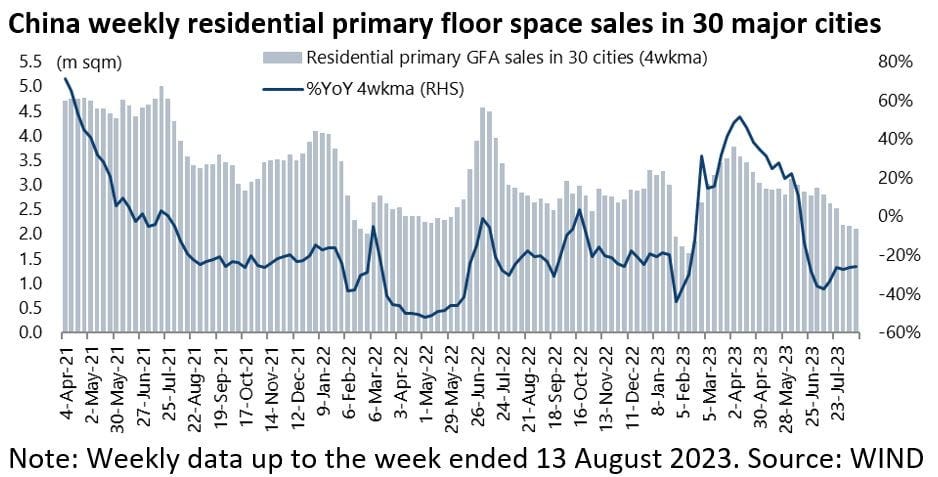

It is ever clearer that the technocrats are becoming more concerned about the lack of economic momentum following the ongoing deceleration in residential property sales.

On this issue, the most important data point in the Chinese economy at present is residential property sales in the 30 largest cities.

Average weekly residential primary floor space sales in 30 major cities declined by 26% YoY in the four weeks to 13 August and are down 20% compared with the previous four weeks.

So long as sales continue to decline, the financial problems of private sector developers will continue to grow as reflected in their surging bond yields.

For example, the yield of private-sector developer Longfor’s dollar bond due 2027 has risen from 6.5% in early February to 21.4%.

This in turn reduces any hope of a resumption in land sales which continue to decline sharply.

Land sales in 100 major cities have declined by 23% YoY in value terms in the first seven months of this year.

That then renews focus on the growing problems in local government finances given their historic dependence on land sales for revenues.

Collateral Damage in the Shadow Banking Sector Grows

Meanwhile last week saw growing evidence of collateral damage in the shadow banking sector.

The newsflow on Zhongzhi Enterprise (see Bloomberg article: “China Finance Giant’s Missed Payments Alarm Regulators, Markets”, 14 August 2023) not making interest payments on wealth management products is likely to be followed by others if property sales continue to decline.

In this respect, the risk of a real Lehman moment in China is rising.

By contrast, Evergrande was not such a Lehman moment in late 2021, contrary to what the media said at the time, primarily because Evergrande’s problems were induced by the authorities in terms of the so-called “three red lines” policy which stated that developers had to comply with specific leverage ratios by a certain date or be cut off from bank funding.

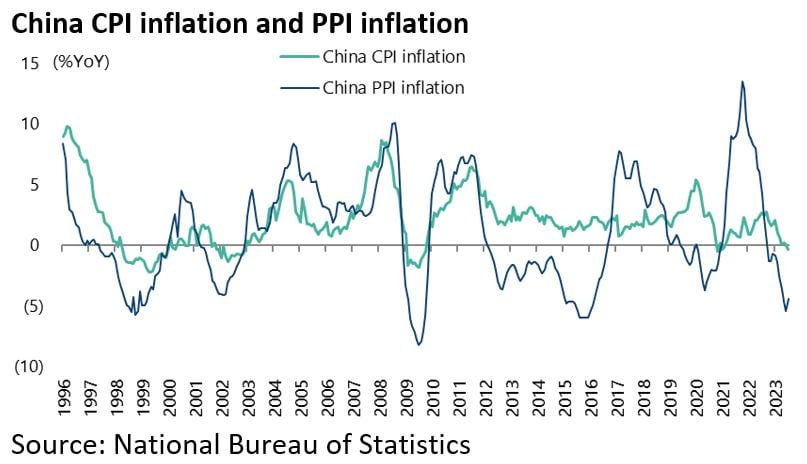

There is certainly room for the authorities to ease more giving the near complete absence of inflationary pressures.

China CPI declined by 0.3% YoY in July while PPI declined by 4.4% YoY.

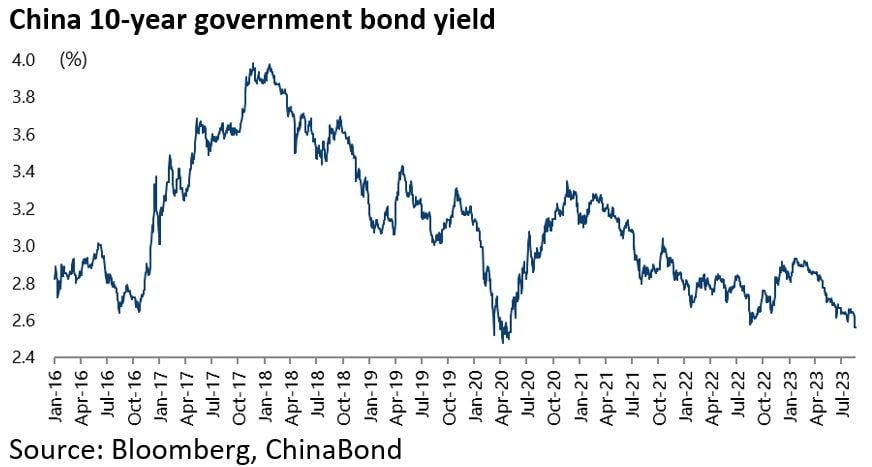

Meanwhile the Chinese government bond market has continued to rally amidst growing talk that China faces the risk of a Japanese-style balance sheet recession.

The 10-year government bond yield has declined from a recent high of 2.93% reached in late January to 2.56%, the lowest level since May 2020.

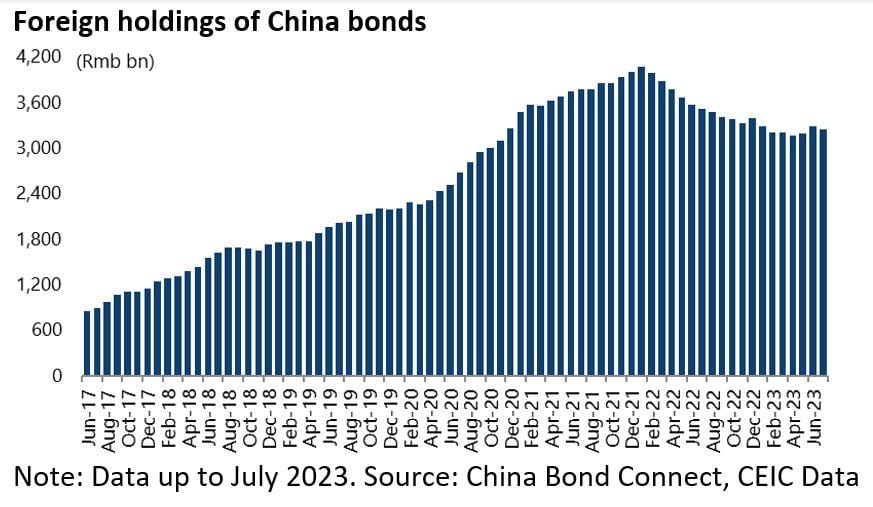

Despite the rally in government bonds, foreigners have continued to sell with their holdings of China bonds down 20.4% from the peak of Rmb4.07tn recorded at the end of January 2022 to Rmb3.24tn at the end of July 2023, though up marginally from the recent low of Rmb3.17tn at the end of April.

Supply, not Just Demand for Credit the Issue

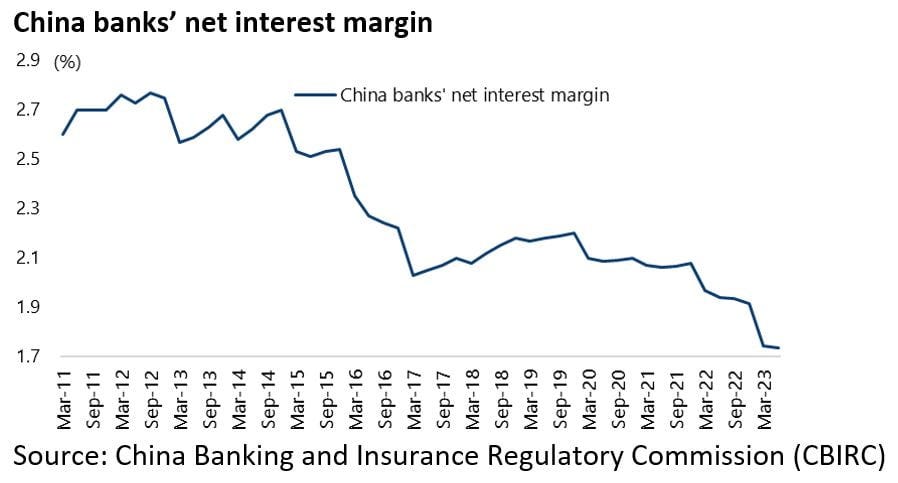

Meanwhile the issue in China is not just the demand for credit but also the supply of it.

In this respect, the banks are operating on a record low net interest margin of 1.736% as of 2Q23, according to the China Banking and Insurance Regulatory Commission.

This also explains the decision in early June to allow the banks to cut deposit rates by 5-10bp given the subsequent rate cuts.

Meanwhile the banks are likely to end up being the entities tasked with extending LGFV debt, as opposed to a formal central government bailout, given the above-mentioned mounting pressures on local government finances.

Consumers are Finally Starting to Spend Again, But is it Enough?

Meanwhile, if the technocrats are becoming more concerned, that does not necessarily mean that President Xi Jinping is so concerned.

While he has toned down his slogan “housing is for living in, not for speculation”, with the phrase removed from the outlook section of the annual government work report in March, he has not completely abandoned it.

For the moment there are still restrictive measures in place in the four biggest cities for example as regards property purchases.

For example, the minimum downpayment is still 30-40% for first-home buyers in these four Tier-1 cities while required downpayments for second homes are an onerous 50-80%.

Meanwhile a small ray of hope, amidst the evidence of Chinese consumers’ increased risk aversion, is that household deposit growth actually slowed in the past five months, albeit from a very high level.

Thus, China household bank deposit growth has decelerated from a recent high of 18.3% YoY in February to 16.8% YoY in July, with household deposits outstanding declining from a peak of Rmb132.2tn in June to Rmb131.4tn in July.

China Is Not the Reason for Global Oil Weakness This Year

Finally, amidst the bearish newsflow on China’s economy, it is also worth noting again that China’s oil import demand picked up further in May.

This is now running at nearly the peak level reached in mid-2020.

China imports of crude oil and refined oil imports rose by 29% YoY to a monthly average of 53.6m tons in the three months to July, or about 12.8m barrels/day, only 0.7% below the peak of 53.9m tons/month reached in the three months to July 2020.

So China has not been the reason for the weakness in the oil price in the first half of this year.