Inflation Could be the Casualty of OPEC's Return to Oil Market Dominance

Author: Chris Wood

The oil price has corrected in recent days.

The Brent crude oil price has declined by 13% since peaking in late September.

Still its rally last quarter to a peak of US$97.7/bbl on 28 September is a potentially awkward development in the context of the prevailing narrative that both the Federal Reserve and the ECB are all but done in this tightening cycle seven if the official mantra in both cases remains “data dependent”.

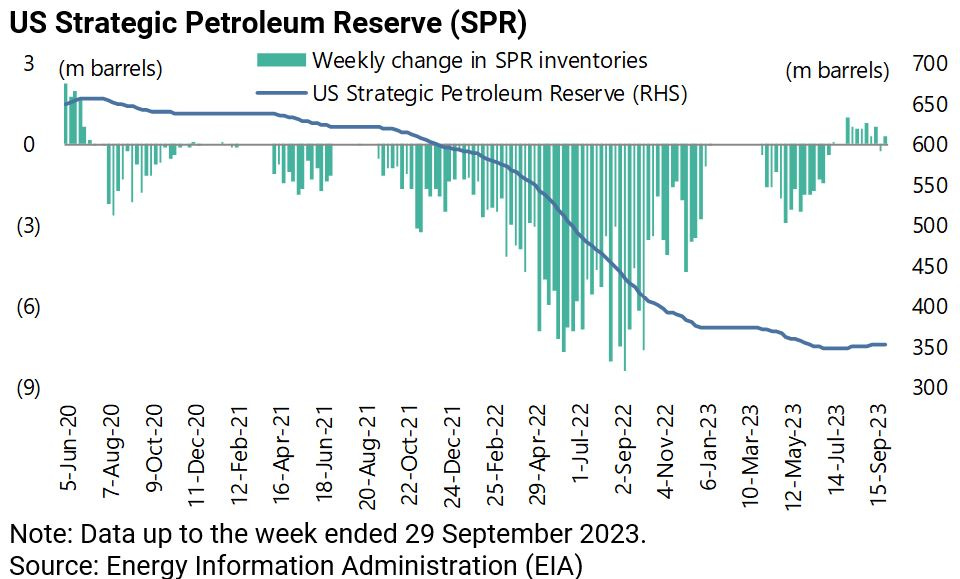

The best explanation for oil’s decline in the first half of 2023 remains that the Biden administration continued to drain oil from the Strategic Petroleum Reserve (SPR) despite an official statement last October that it would do the exact opposite.

President Joe Biden announced in October 2022 a plan to replenish the SPR using fixed-price purchase contracts of crude oil for future delivery when prices were at or below US$67-72/bbl.

Then the Department of Energy announced in mid-December that would start repurchasing crude oil for the SPR.

In reality, the Biden administration continued to drain oil from the SPR by a further 25.2m barrels in the first half of this year.

The current status is that the SPR has now declined by 41% since the start of 2022 to 351.28m barrels on 29 September, after rising by 4.52m barrels or 1.3% from the low of 346.76m barrels reached on 7 July, the lowest level since August 1983.

So, the Biden administration stopped draining oil out of the SPR for the past 12 weeks which coincided with the rally in oil.

This does not seem to be a coincidence.

Oil Market is Refocused on Supply Constaints

Meanwhile, the oil market has of late refocused on the fundamental supply constraints long discussed here, in the context of the lack of investment in oil in recent years as a result of the green lobby’s political attack on fossil fuels combined with the geological reality that US shale production looks like it has peaked in most regions except the Permian.

True, total crude oil production in the seven shale regions in America has risen by 1.18m barrels per day over the past two years to 9.46m b/d in August.

Still it remains only 1.8% above the previous peak of 9.295m b/d reached back in December 2019.

And the production in the Permian region has accounted for 75% or 883,767 b/d of the increase over the past two years.

Excluding the Permian region, crude oil production in the other six shale regions remains 20% below the peak reached in October 2019.

The result is that OPEC is the swing producer again and OPEC-plus, in terms of the agreement with Russia, seems for now to be cooperating on supply constraints.

On this point, OPEC+ decided at its meeting in Vienna on 4 June to cut oil production by another 1.4m b/d to 40.46m b/d in 2024 while maintaining its planned production cuts for this year.

The alliance agreed in October last year to a 2m b/d production cut in 2023, while some OPEC+ members also announced in April voluntary cuts of 1.66m b/d, including a 500,000 b/d cut by Russia.

Saudi Arabia also announced on 4 June a voluntary cut in its production by an additional 1m b/d to 9m b/d in July and has subsequently extended the cut to December.

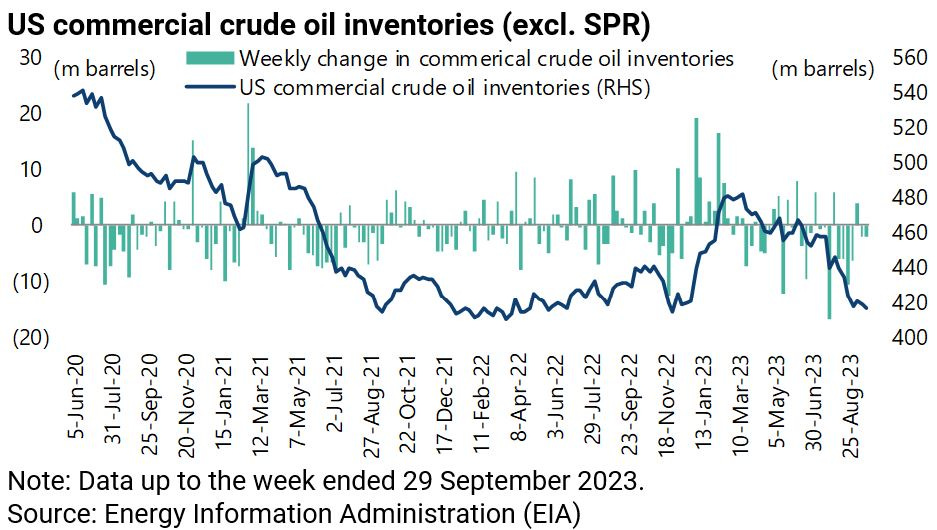

Meanwhile the oil market received another reminder of the lack of supply in late July with the largest weekly decline in US commercial crude stockpiles since the weekly data began to be published 41 years ago in August 1982.

US commercial crude oil inventories, excluding the SPR, declined by 17.05m barrels in the week ended 28 July to 439.77m barrels.

They ended last quarter only 4.11m barrels or 1.0% above the recent low of 409.95m barrels reached in March 2022.

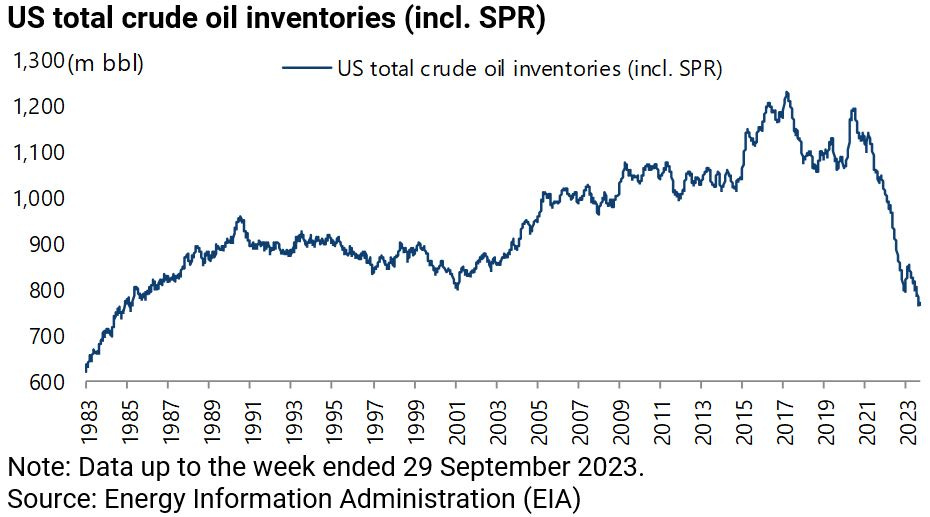

As a result, US total crude oil inventories, including SPR, have declined by 24% since the start of 2022 to 765.343m barrels on 29 September, the lowest level since April 1985.

The result is that the Biden administration faces an awkward dilemma since a higher oil price threatens the political imperative in the run up to next year’s presidential election to be seen to be prevailing over inflation.

Yet a further draining of the SPR invites accusations from political opponents of threatening America’s strategic access to oil for the sake of short-term political expediency.

The SPR was established in December 1975, and began to be filled in 1977, for the express purpose of not allowing America again to be subject to political leverage from oil producers as was the case with the OPEC cartel in the 1970s.

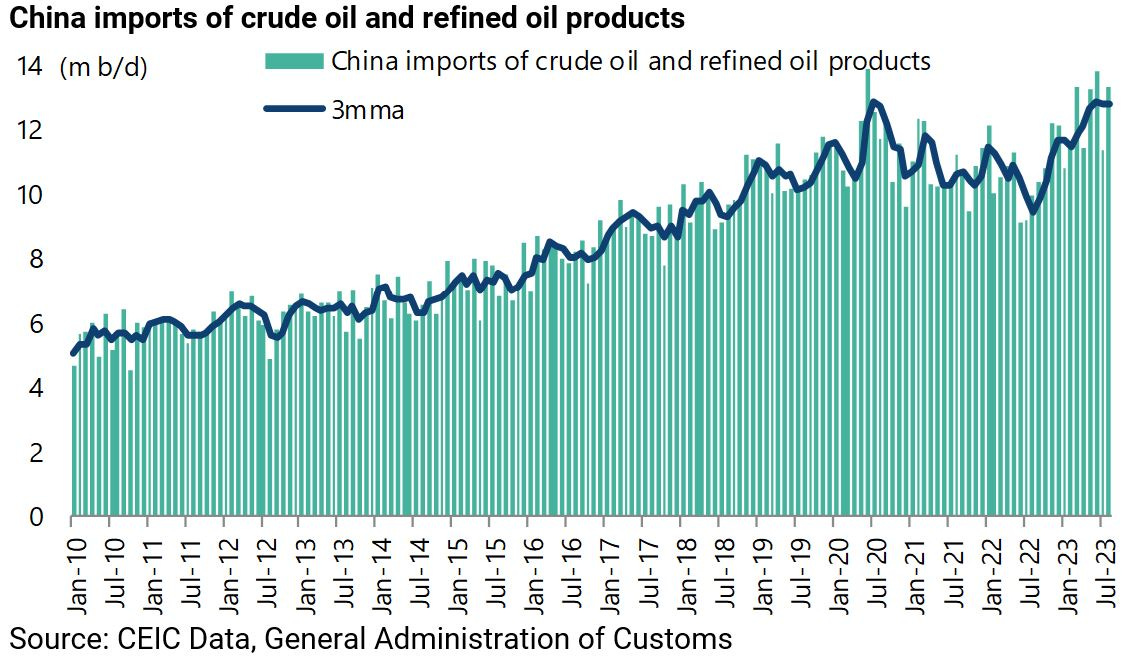

Meanwhile it is worth highlighting again that the common media explanation for oil’s weakness in the first half of this year, namely a weak Chinese economy, is not borne out by the data.

China’s imports of crude oil and refined oil products have increased from a recent low of 9.5m b/d in the three months to August 2022 to 12.8m b/d in the three months to August, close to the previous peak of 12.9m b/d reached in the three months to July 2020.

It may seem odd to be going on about oil when EVs are ramping up globally, most particularly in China where EVs now account for 34% of passenger car sales.

Still oil will be a factor in financial markets for many years to come even though it is also clear that energy producers, from Saudi Arabia down, need to think about diversification as Saudi is clearly doing.

A reminder of the continuing relevance of fossil fuels comes from the latest edition of the BP’s annual energy book, the Statistical Review of World Energy, which is now published by the Energy Institute.

The latest data, published in late June, shows that fossil fuels still accounted for 81.8% of world primary energy consumption in 2022, though down from 82.3% in 2021 and a recent high of 86.7% in 2007.

Energy Inflation Making the Fed's Job Harder

Meanwhile the oil price is clearly relevant for the Fed given the main driver of the statistical decline in inflation so far this year has been the decline in energy prices.

Thus, US headline CPI inflation declined by 3.3 percentage points from 6.5% YoY in December to 3.2% YoY in July, though up from 3.0% YoY in June.

While energy CPI inflation fell from 7.3% YoY in December to a negative 12.5% YoY in July, contributing 1.6 percentage points to the decline in headline inflation.

Similarly, the pickup in inflation in August was the result of the renewed rise in energy prices.

The headline CPI inflation increased by 0.5 percentage point from 3.2% YoY in July to 3.7% YoY in August, while energy inflation rose by 8.9 percentage points from a negative 12.5% YoY to -3.6% YoY, contributing 0.8 percentage point to the increase in headline inflation.

Excluding energy, US headline inflation declined from 4.7% YoY in July to 4.3% YoY in August.

Great work.