In Tariff Negotiations, Trump Has No Ace Up His Sleeve

Author: Chris Wood

“What’s Trump’s ace up his sleeve? What’s the weapon that he can legitimately use to inflict real pressure on China and push them to the negotiating table with meaningful concessions?”

This writer was asked this question a month ago amidst the escalating tariff war. It is a very good question and made this writer realise, on reflection, that the US president has no “ace up his sleeve.”

A major problem for Donald Trump, as it would be for any US president, is simply that China has the savings whereas America does not.

China’s household savings rate was 31.8% of disposable income in the four quarters to 1Q25, while US household savings rate was only 4.2% of disposable income in the 12 months to March.

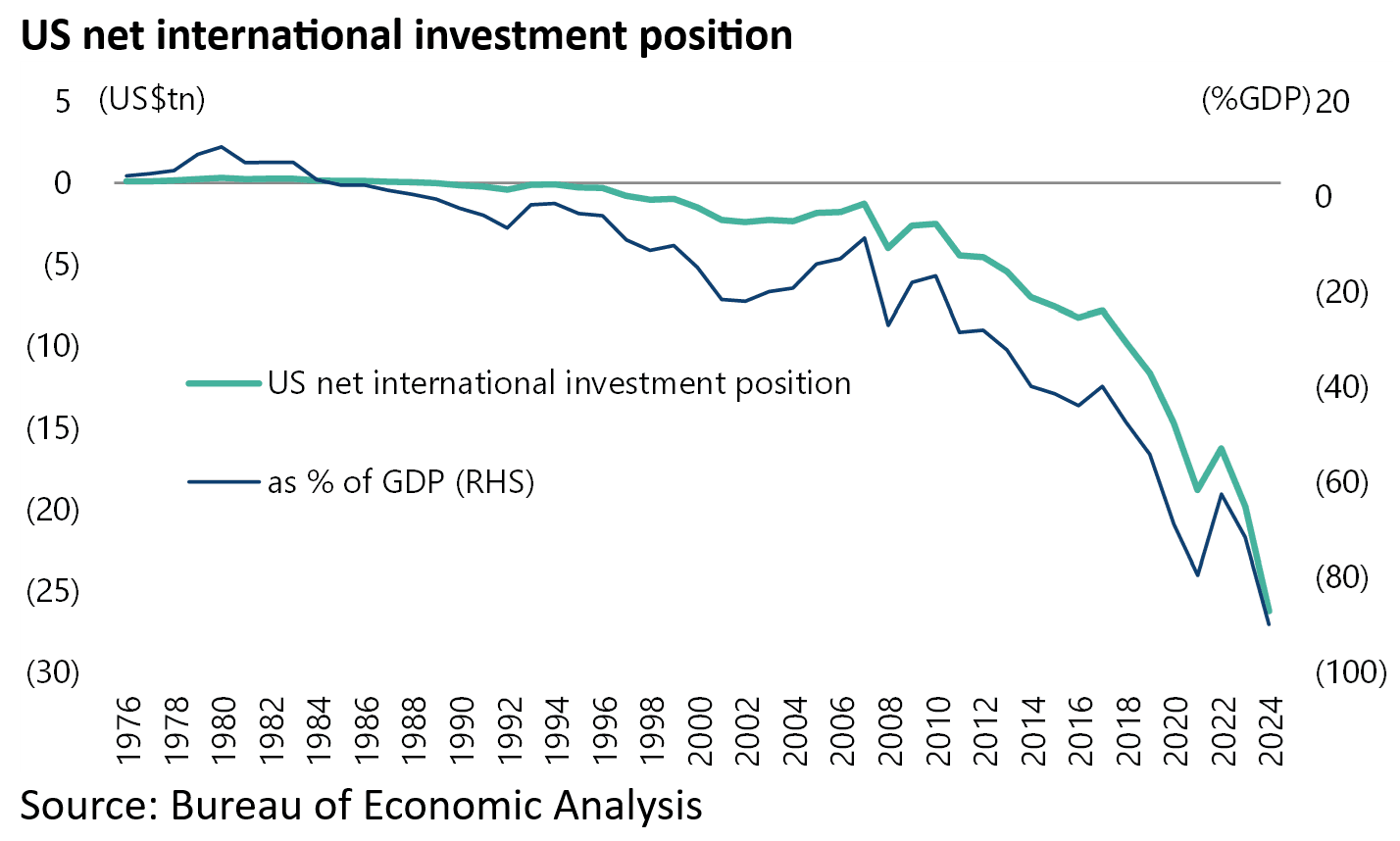

This is also why America’s extreme net international investment position (IIP) is the key chart to focus on.

This measures the difference between US residents’ foreign financial assets and foreigners’ holdings of US assets.

America’s net IIP deficit has risen from US$7.8trn or 39.9% of GDP at the end of 2017 to a record US$26.2trn or 89.9% of GDP at the end of 2024.

In this respect, the one real example of American exceptionalism in terms of financial matters remains the ability to print the world’s reserve currency.

Yet this is precisely what has been threatened by recent risk-off action, in which both the US dollar and the US Treasury bond market sold off in response to negative US stock market action, which flashed growing recession concerns.

This writer cannot remember a similar case in the past 30 years where risk-off action was accompanied by a weakening dollar.

The Asian Crisis and the resulting Long-Term Capital Management (LTCM) blowup in 1998, the 2008 US subprime mortgage crisis and the 2020 COVID-induced financial panic all triggered a strong-dollar risk-off move before the Fed intervened with the inevitable bailout, resulting in ever greater socialisation of credit risk.

It is, of course, this worrying combination of US dollar weakness and US Treasury bond weakness that triggered Trump’s initial U-turn on tariffs on 9 April.

That U-turn has continued for the most part ever since, such as the exemption of tariffs on various electronic devices even if the delay is potentially only temporary, subject to Commerce Department investigations.

Thus, the Trump administration announced on 11 April that smartphones, computers, hard drives, flat-panel displays, memory chips and some other electronic devices will be exempted from the reciprocal tariffs.

But then Trump said in a post on his Truth Social platform on 13 April that he would launch a new national security trade investigation into semiconductors and the “whole electronics supply chain,” which could lead to other new tariffs.

These on-again/off-again announcements serve only to perpetuate uncertainty, with the sole positive being increased volatility for traders to exploit.

The Questioning of the Dollar's Reserve Currency Status Has Officially Begun

Meanwhile, the reason recent market action is potentially so disconcerting is precisely because it suggests that a questioning of the reserve currency status has begun.

This status has been a massive privilege for the US, even though the likes of Stephen Miran, Chairman of the Council of Economic Advisers, seem to view it as a burden.

Miran said at a Hudson Institute event on 7 April that “the reserve function of the dollar has caused persistent currency distortions and contributed, along with other countries’ unfair barriers to trade, to unsustainable trade deficits.”

This bizarre logic reminds this writer of former Federal Reserve chairman Ben Bernanke’s attempt to blame the US subprime crisis, an event he totally failed to anticipate, on a “global savings glut.”

Trump Badly Needs a Tariff Off-Ramp

Returning to the matter of tariffs, the 47th American president has been reluctant to admit he has done a U-turn for ego reasons, as have the people around him.

Thus, he tweeted on 13 April that “nobody is getting ‘off the hook’ for unfair trade balances.”

Still, the reality is that he badly needs an off-ramp to regain the initiative, and indeed rescue his presidency.

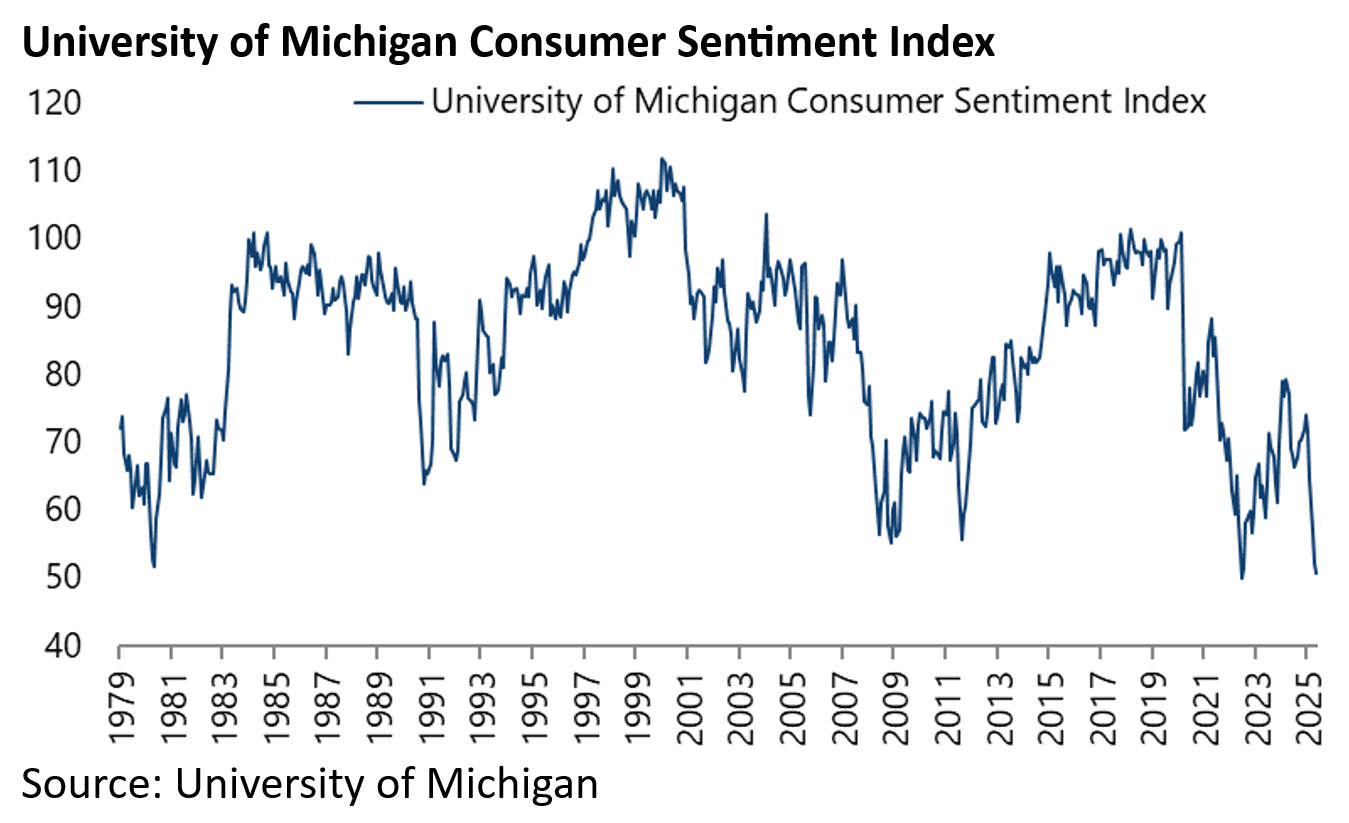

Anecdotal evidence points to US corporates shelving decisions and cutting orders amid the prevailing uncertainty, while the latest US Michigan consumer confidence survey data has been predictably weak.

The University of Michigan Consumer Sentiment Index declined by 1.4 points or 2.7% from 52.2 in April to 50.8 in early May, according to the preliminary reading published on 16 May.

This is the second-lowest level on record. True, this is only “soft” data. Still the index has now declined by 23.2 points or 31% from the recent high of 74 in December.

If recession risks have risen, the question for Trump is: what is the best way of getting out of a bad situation and regaining the initiative?

In this writer’s view, the best way out is to pivot to a universal, nondiscriminatory 10% import tax, abandon the longstanding tariff and trade war obsessions, and revert to the bullish part of the Trump agenda, namely tax reform and deregulatory agenda.

Tax cuts and deregulation are bullish from a stock market standpoint, just as tariffs are plain bearish.

Tariffs also create incentives for new relationships to be formed as confidence is lost in the US, both as a country to trade with and as a guarantor of security.

In this context, top EU officials are reportedly planning a trip to Beijing in late July to meet with President Xi Jinping. China and the EU have also commenced talks on ending the bloc’s duties on electric vehicles.

The idea seems to be that Europe, in a reversal of traditional practice, will provide access to its internal market if China supplies the continent’s car makers with valued EV-related technology.

It has certainly long been Beijing’s desire to separate the Eurozone from Washington’s more extreme anti-China national security lobby, though the Ukraine conflict has made this more difficult in recent years.

Trump’s tariff agenda, however, may have just made this easier.

Trump's Lack of Leverage Over China

Meanwhile, returning to where this article started, namely what aces does Trump or the US hold as leverage against China, this writer would have said a few years ago that the US had the advantage of having the weapons to maintain Pax Americana. But this no longer looks to be the case.

First, the Trump agenda is fundamentally isolationist.

Second, and as important, the Ukraine conflict has revealed that the US military is dependent on components from China to fight its wars and suffers from a shortage of many things, including ammunition.

This manufacturing deficiency cannot be corrected overnight.

China, for example, now accounts for 32% of global manufacturing output in volume terms, more than the US, Japan, Germany and South Korea combined.

Another point is that the impact of low-cost drones has raised a question mark over the continued importance of sea power in military matters, reflected in America’s fleet of 11 aircraft carriers.

It also needs to be highlighted that, as part of China’s retaliation against Trump’s tariff agenda, Beijing imposed on 4 April export restrictions on seven types of rare earths used in the defense, energy and automotive sectors. Companies are now required to secure special export licenses to export such elements.

China is the world’s biggest producer and exporter of rare earths.

Mark Smith, CEO of NioCorp and a 40-year veteran of the mineral mining industry, was quoted as saying recently on the subject of rare earths that “there is not one of our jet airplanes in the United States Air Force that does not have rare earths in multiple forms, particularly in magnets” (see Fox Business article: “Here’s how China could retaliate against US tariffs”, 10 April 2025).

That does not mean that Trump cannot generate new positive momentum by the approach already suggested, namely dramatically scaling back tariffs and refocusing on tax cuts and deregulation, but it does mean that the base case remains US underperforming other stock markets in the context of a weakening US dollar and a bearish Treasury bond market.

On the latter point, Elon Musk’s looming exit from the Department of Government Efficiency (DOGE) and the scaling back of the proposed targeted cuts in federal government spending to US$150bn, down from the original US$2trn target, has removed the best argument for owning long-term Treasury bonds.