Hunting for Elite Dividend Yields in Oil & Gas

Getting Paid While You Wait…

For our inaugural fundamental quant screen we wanted to focus on yield. In a market where risk free treasury bonds are yielding close to 5%, owning high yielding stocks can serve as both a return generator and downside protector.

Investors are currently less willing to take on stock risk in return for uncertain price appreciation, however a high yielding stock pays you to take on price risk and have become popular hiding places for investors.

We’ve gone one step further and narrowed our search down to the North American energy sector, where we’ve found mispricings abound.

Meet the Grizzle Dividend Elite: Have Your Cake & Eat it Too

Typically when a company yields in the double digits it signals a dividend cut and financial distress are imminent.

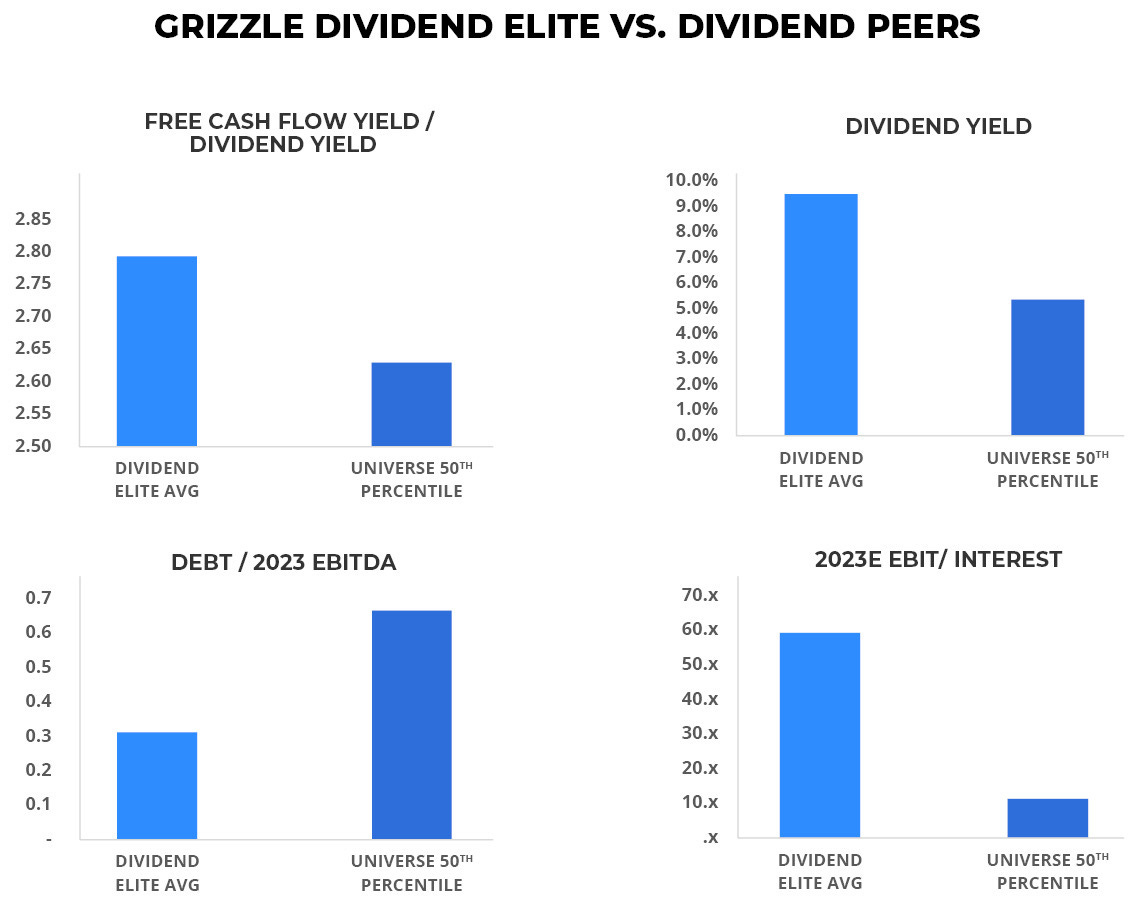

However our quant screens have surfaced a group of companies with absolutely pristine balance sheets and management teams committed to dividends and buybacks over growth at all costs. For the first time in our two decades watching this sector, there are companies with high dividend yields AND low or no debt.

Buying the 8 dividend elite stocks would create a portfolio diversified across North American basins, generating a dividend yield 2x the energy average with less than half the balance sheet risk.

In the rest of this report you will find:

An explanation of our screening methodology and the factors that matter in oil & gas

A list the top 8 stocks with deep dives into the top 3.

Full factor rankings of the 80 stocks in the study.