How to Play the Cannabis Bear Market

Betting on multi-baggers is all consuming, it’s easy to get intoxicated in the echo chamber of FOMO - we’ve all been there. We love taking bets on big ideas, however portfolio sizing is ultimately what determines if you live to fight another day.

It’s all about limiting your downside on the ideas that don’t pan out and getting max weighting for the ideas that do - it’s an art, investing in growth is tough gig at the best of times. A value investor has a much easier job, buy companies with cheap multiples in low growth industries and just stick it out.

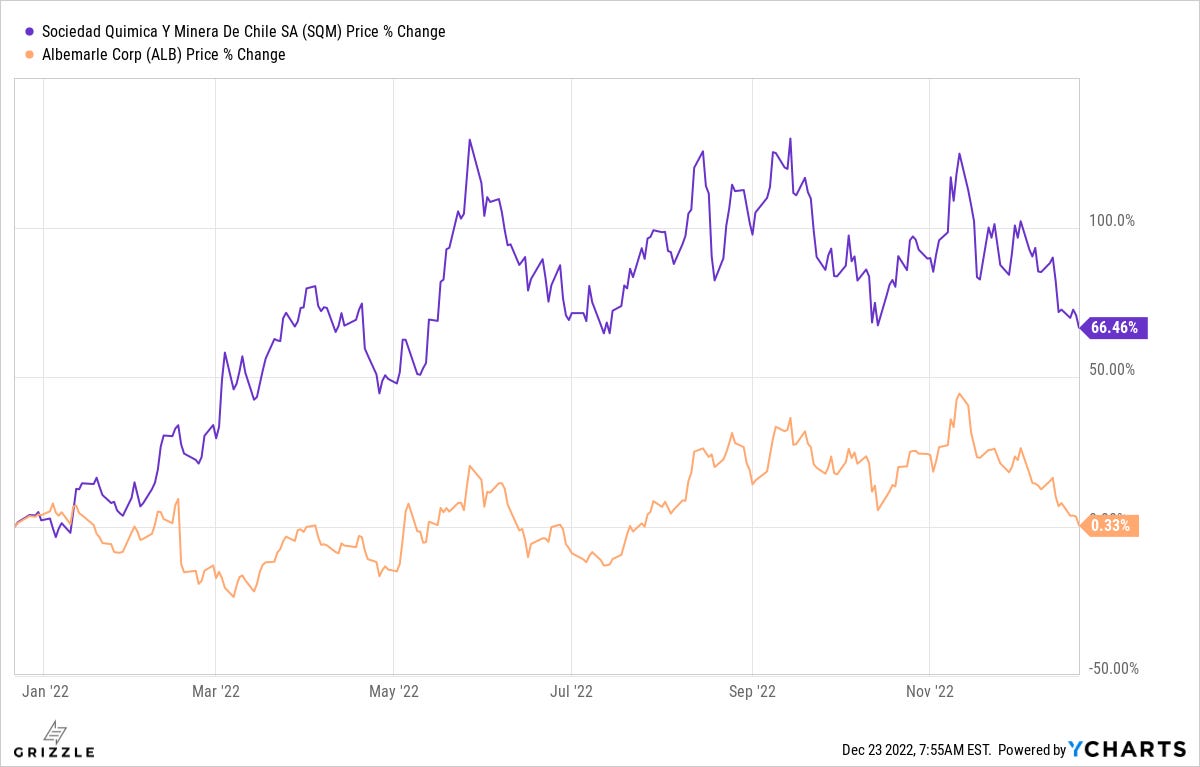

One of our big bets this year was on lithium through SQM, this was a conviction call for us, we took the weighting to 10% of our fund. Fund managers typically don’t take those kinds of bets, they diversify alpha away - job security dictates their bets, an unfortunate reality of the asset management industry.

What gave us high conviction on our bet size was two things: strong valuation support and industry tailwinds. SQM was trading on 1/3rd the multiple of the more well known large cap lithium name Albemarle.

Bet sizing is everything in portfolio management. Going all in on a bet, having more than 50% of your portfolio in a theme is gambling - that isn’t investing. Twitter isn’t a platform to champion prudence, the algorithm feeds everyone the stuff that people are most passionate about.

So here’s the simple way to think about sizing bets, truly - if you have a 5% position in cannabis and it does a 10 bagger you have a 50% gain, that is an incredible return that would put your portfolio among some of the best in the world. The challenge is that people get incredibly focused on the idea (stuck in the silo) and believe that 50% is now the prudent weighting because well it’s an opportunity of a lifetime. That is gambling, pure and simple - growth investing is about prudent bets. We have bets that haven’t worked out, many of them in fact, but our weights were less than 0.5% of the portfolio and that is something we can stomach. Even our 10% bet in SQM is something we could stomach, if it fell 70% we’d be down in the portfolio 7% - while it hurts it doesn’t break us. If you were 100% in cannabis and your down 70%, that’s a really tough spot to be in - and how that impacts your psychology of bets you take going forward is significant.

Cannabis is the One Industry Where Diversification Fails

The finance industry will tell you from day one to always diversify. Putting all your eggs in one basket is the easiest way to blow up your portfolio they say.

Its solid advice, most of the time…

When investing in Cannabis however, diversification actually increases your risk and leads to worse performance over time.

The reason is because legal cannabis is an emerging industry oversaturated with growers and flooded with supply.

Fierce competition and fragmented market share has made it difficult for companies to make consistent profits. Now with a recession on the horizon and access to new capital largely gone, a potential shakeout is coming where only the strongest companies survive.

In this situation owning an ETF like MSOS, with 27 holdings, means you are getting some of the weakest players along with the best, not a great situation.

Owning struggling companies instead of a basket of only the best leads to more downside in falling markets as we saw in 2022 so far.

The MSOS ETF is down 10% more than the largest individual cannabis stocks even with a far more diversified group of companies.

And downside isn’t the only problem MSOS holders, its upside as well.

Four times in 2022, cannabis stocks rapidly increased as seemingly positive momentum leaked out of Washington.

100% of the time, investors who owned large, highly liquid stocks like Tilray instead of the diversified MSOS did far better.

In cannabis investing, unlike almost any other sector, diversification hurts you on both the upside and the downside.

The next time you see legalization chatter come out of Washington, the optimal choice will be to buy Tilray or a basket of the 3-4 largest US operators, not the MSOS cannabis ETF.

TLRY vs Cannabis ETF (MSOS) Upside Performance in 2022

A Long / Short Hedged Trade

The reality in the cannabis bear market is that many of the small undercapitalized companies will not make it across the line (see section below: What Survives the Cannabis Bear Market?)

We believe a cannabis market neutral strategy captures the alpha of the undercapitalized and smaller companies failing. Our preferred pair trade is to go short the MSOS ETF and long a small basket of Tier 1 operators with the most cash vs. their debt and spending + Tilray.

Based on our quantitative analysis and fundamentals research, this is our preferred long basket: Trulieve, Curaleaf, Cresco Labs, Verano and Tilray.

What Survives in Cannabis?

We screened the entire cannabis universe to find out which stocks are best positioned to weather the coming storm.

With yet another failure of the SAFE banking act to pass the Senate, cannabis investors may be looking at a yearslong period of inaction in Washington.

A lack of regulatory catalysts, the most difficult money raising environment the industry has ever seen and cannabis sales down ~20% year over year across North America tells us one thing, pot stocks are fighting to survive, not grow.

We think investors need to prepare for the coming economic storm if they want to continue owning pot stocks.

Survival trumps multi-baggers for at least the next 12 months.

We have a strong view that cannabis companies need two or more of the following characteristics to survive the next few years:

Profits. This means positive cashflow from operations after deducting CAPEX to build facilities and buy equipment. It can also mean positive EBITDA which is used to pay interest on debt.

More cash than debt

No debt coming due before the middle of 2024.

If not profitable, at least 1 year of cash runway

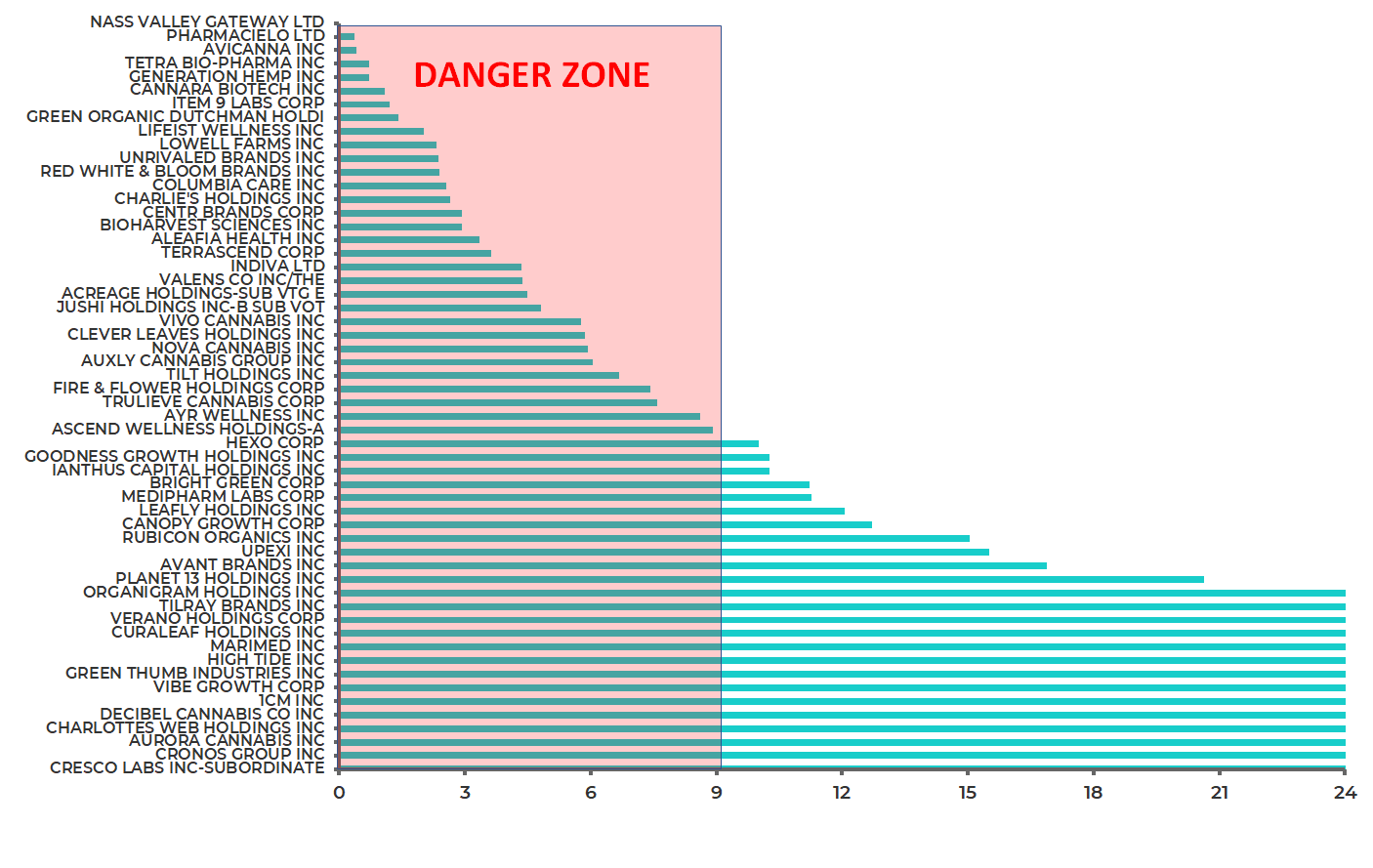

To start, we found a simple way to screen for which companies the market thinks are in trouble. How much of a company’s enterprise value* is the debt it owes someone else?

If debt divided by enterprise value is above 100% it means the company is trading for less than the value of the cash on its balance sheet, a sign investors think the stock is a zero.

Of the entire cannabis universe, the market thinks 25% of the stocks are likely already bankrupt or will have to reorganize in the near future.

Debt as a % of Enterprise Value*

Source: ycharts.com, SEDAR, SEC.GOV

Another way to look at survival for an unprofitable pot stock is to see how many months of cash the company has left.

We calculate months of cash by taking the cash balance and dividing it by monthly spending on operations and CAPEX, which is a fancy name for equipment and greenhouse construction.

We then have a months of cash left number.

Before you look at the results there are two shortcoming to this method.

Months of cash left doesn’t take into account when debt is due. A company may have enough cash to pay the INTEREST on the debt for years, but if the debt needs to be paid back soon and exceeds cash in the bank, bankruptcy is inevitable.

We are using historical CAPEX spending. Management has the discretion to cut CAPEX if times are tight so in general the real cash runway is likely a bit longer for most companies than what is shown in the chart below.

Months of cash shows the poor state the entire cannabis industry is in.

Investors already think 25% of stocks are worthless today, but with 70% of the stocks in this chart having less than 1 year of cash runway, the ultimate failure rate could be far higher.

Months of Cash Left (Higher is Better)

Source: ycharts.com, SEDAR, SEC.GOV

An interesting variation on the chart above is to compare months of cash left to debt as a % of EV.

A company with many months of cash runway but a high % on the right hand column tells you big debt maturities may be coming which are making investors nervous.

Decibel Cannabis and Vibe Growth are two examples.

Overall you want high bars and low blue squares

Months of Cash Left (LHS) vs Debt % of EV (RHS)

Source: ycharts.com, SEDAR, SEC.GOV

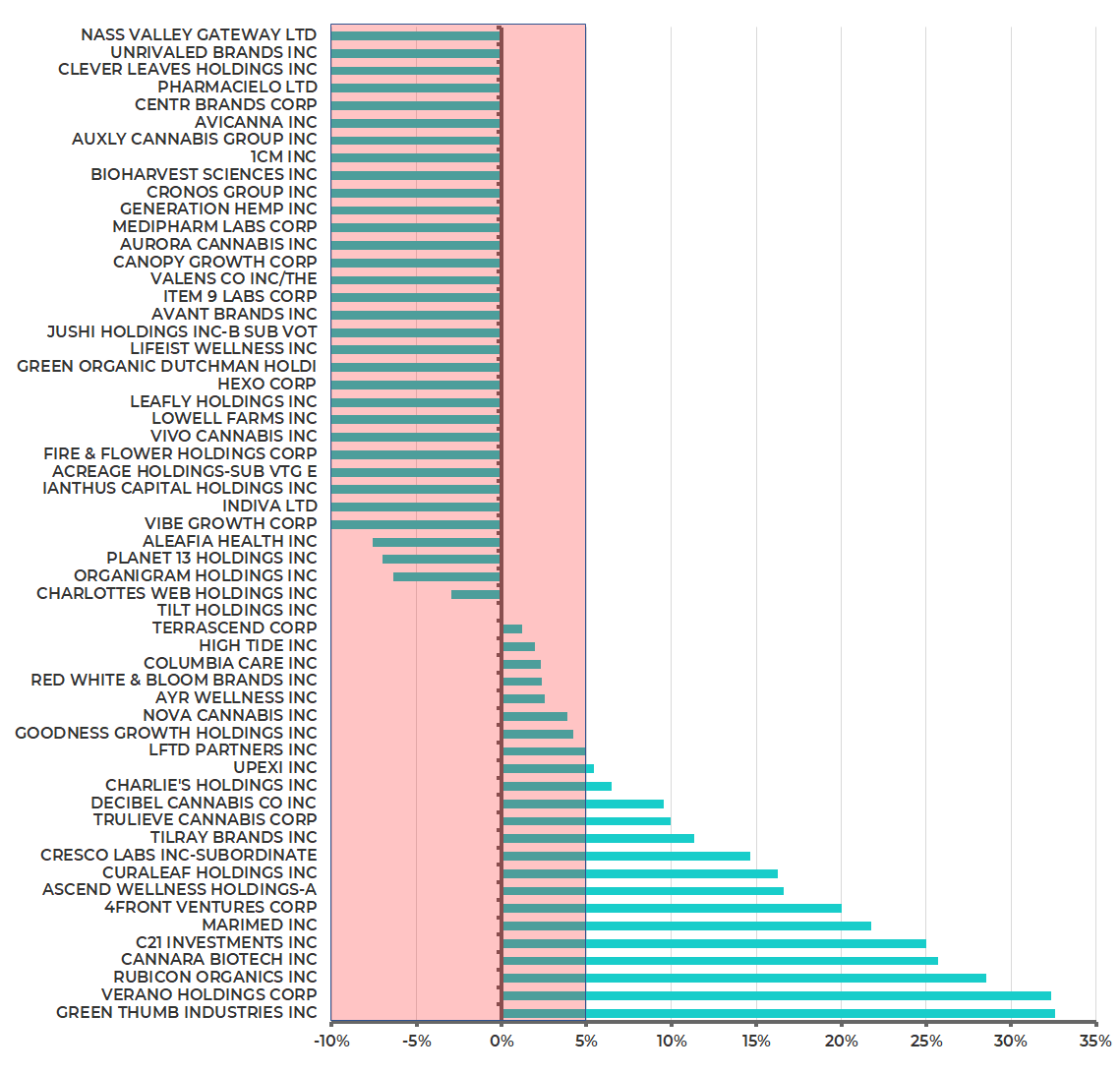

Our final screen looks at which pot stocks are the most profitable. The more profitable, the more wiggle room to make debt payments on time and to renegotiate debt if the company can’t avoid a technical bankruptcy (See Aurora Cannabis).

Profits may also indicate pricing power which will show up as the industry matures.

Again its ugly out there.

Only 11 out of 75 stocks in the cannabis universe have EBITDA margins above 10%.

We put any company with a margin below 5% in the danger zone. With debt costs running around 10% or higher industrywide, a 5% cashflow margin doesn’t leave much money to pay off debt maturities and reinvest in growth.

Latest EBITDA Margin

*Enterprise Value = Market cap + Debt - Cash

Disclosure: The opinions provided in this article are those of the author and do not constitute investment advice. Content is not to be construed as offers to purchase securities in the companies which may be the subject of such content pursuant to federal or state law or the laws of any foreign jurisdiction. As of the date of publish, the author owns shares in Trulieve and Cresco Labs. Readers should assume Grizzle employees or related entities own stocks mentioned in this newsletter.