History Rhymes: It’s Uranium Small Cap Season

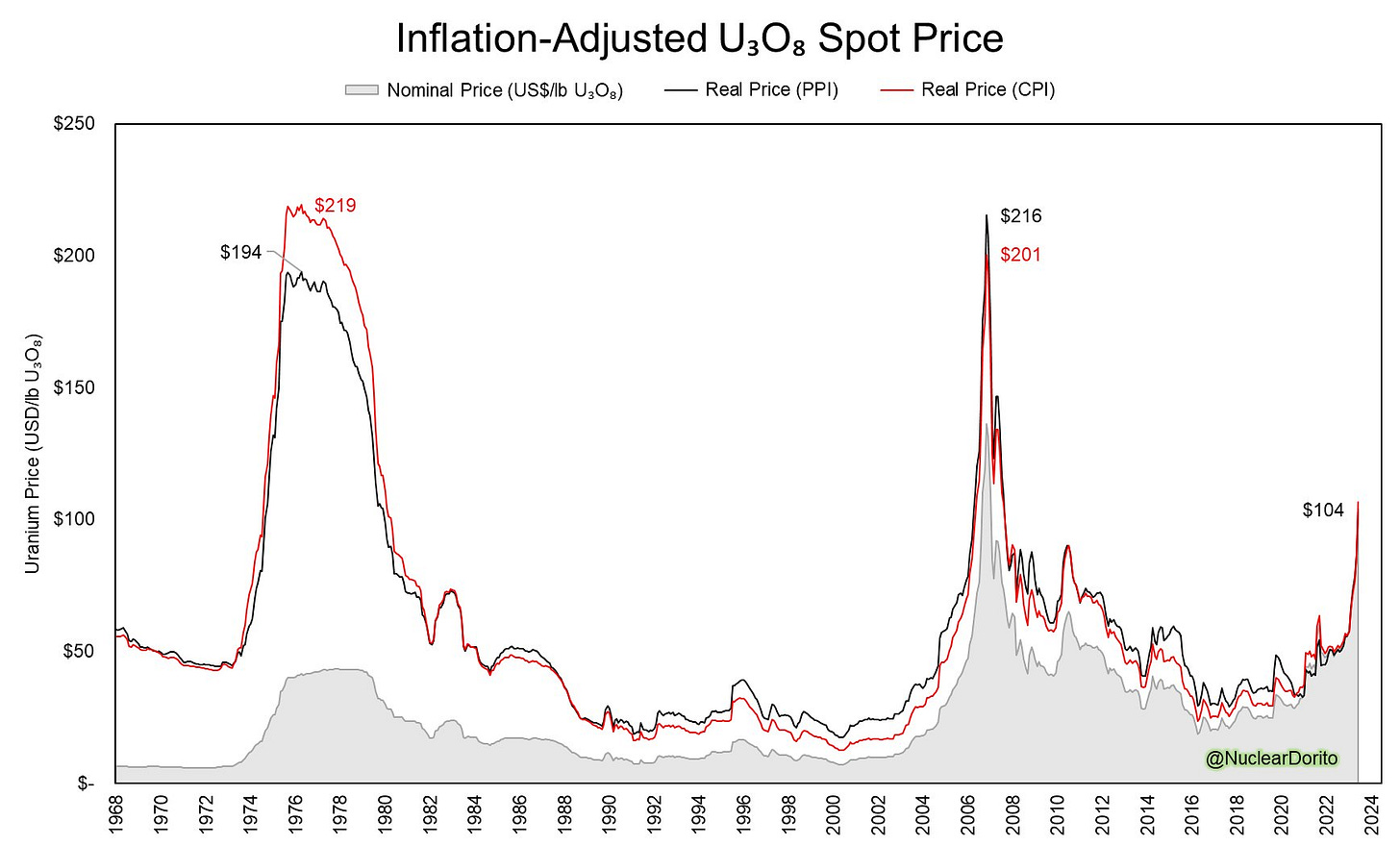

The bedrock of a uranium equity bull market is underpinned by the commodity itself; in that respect we’re full tilt bullish - whether you look at spot price, long-term contract price or inflation adjusted spot price.

The Inflection

Our historical quant analysis of the last bull market (2003-2007) highlighted the dynamic where small caps initially lagged Cameco but then went parabolic and ultimately outperformed the bellwether by a wide margin (500%).

What was the trigger? The commodity price.

In the last bull run the inflection in prices for small caps happened when spot uranium hit $55/lb (Sept ‘16); on an inflation adjust basis $55/lb equates to the current spot price of $90/lb… a price level that’s high enough to trigger small cap season.

And it has! Large cap uranium stocks (Cameco and Kazatomprom) outperformed every other market cap bucket in 2023; however when we take a look at 2024 the market internals have shifted dramatically within uranium equities - YTD large caps are down -2%, while mid-cap, small-cap and micro-cap are all firmly in the green.

We quantitatively dug deeper to analyze what worked within each prospective market-cap range (mid-cap, small-cap and micro-cap); highlighting a total of 18 stocks we believe are optimally positioned for the next phase of the uranium equity bull market which has the potential to be explosive.

Also to thank our valued subscribers for their support we are shipping out special edition Grizzle Mining & Uranium lids to anyone who signs up for a yearly subscription in the next 30 days. Don’t miss this limited run uranium swag. Thank you for riding with Team Grizzle!