Have the Stars Finally Aligned for Japanese Stocks?

Author: Chris Wood

Bank of Japan Governor Haruhiko Kuroda has finally departed from office after ten years of pursuing extreme monetary easing.

Former BoJ policy board member and academic economist Kazuo Ueda is the new governor.

He faces the considerable challenge of gradually normalising monetary policy without triggering major ripple effects in the markets.

In that respect, Kuroda failed at his last policy meeting on 10 March to end negative rates and left the deposit facility rate at minus 0.1% where it has been since February 2016.

The Bank of Japan has continued to engage in extreme monetization with the Bank of Japan owning 52% of JGBs outstanding as at the end of 2022 to maintain its yield curve control policy; though the ten-year JGB yield ended last quarter at 0.35%, 15bp below the pegged rate of 50bp which the BoJ has been defending in recent months by massive buying of JGBs.

The BoJ’s balance sheet is now Y735tn, equivalent to 132% of Japan’s GDP.

Bank of Japan balance sheet as % of annualised GDP

Note: Data up to 31 March 2023. Source: Bank of Japan, Cabinet Office

The above actions are despite the growing evidence of rising nominal wage pressures which should have provided Kuroda with the perfect excuse to declare victory and raise rates.

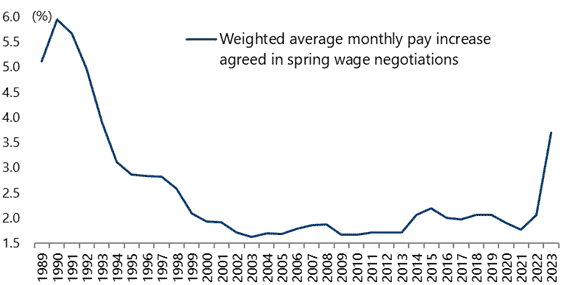

The Japanese Trade Union Confederation (Rengo) reported in its third preliminary survey of 2,484 affiliated unions on 5 April that major companies have concluded their annual wage talks with average wage hikes of 3.70%, the largest increase in three decades, including a 2.16% increase in base pay.

Japan weighted average monthly pay increase agreed in spring wage negotiations

Note: Based on third preliminary survey reported on 5 April 2023.

Source: Japanese Trade Union Confederation (Rengo)

While average monthly scheduled cash earnings for full-time employees rose by 1.5% YoY in the three months to February.

Japan average monthly scheduled cash earnings growth for full-time employees

Source: Ministry of Health, Labour and Welfare

It is also the case that core CPI has been running above BoJ’s 2% target for the past 11 months

Japan core CPI inflation (excl. fresh food)

Source: Statistics Bureau

One issue now is the potential for yen repatriation of Japanese institutional capital from abroad, if Japanese interest rates start to normalize.

The estimate is that that 1% on the 10-year JGB yield and 2% on the 30-year JGB are the levels that would likely trigger such a repatriation of capital given the yen return that the likes of Japanese life insurers need to meet, from an asset-liability standpoint, is currently in the range of 1.8-1.9%.

A Shift from Domestic Bonds to Stocks?

Another issue is whether Japanese financial institutions will not only return money home but also decide to re-allocate domestically out of yen fixed income into Japanese equities.

This is logically what they should do if they believe inflation has returned, which is what corporate Japan seems to believe given the apparent willingness of large companies to announce the highest wage increases this year for 30 years.

In this respect, domestic institutions have been reducing the allocation to Japanese equities relative to yen fixed income since the Bubble began to burst in 1990.

Still the estimated current weightings of pension funds and life insurers in Japanese equities, excluding investment trusts, of only 8% and 6% no longer make any sense if deflation has ended.

Indeed such an asset allocation has not made any sense since the launch of Abenomics back in late 2012 since when the Topix has outperformed the 10-year JGB on a total-return basis by 202%.

Topix relative to 10-year JGB (total-return basis)

Source: Datastream

Still former Prime Minister Shinzo Abe was only successful in getting the Government Pension Investment Fund (GPIF) back in 2014 to raise its Japanese equity asset allocation target from 12% to 25%, and reduce its domestic bond exposure from 60% to 35%.

But the rest of institutional Japan did not really follow.

Still any such re-allocation into Japanese stocks would cause a true tsunami in the context of the Japanese market since if one institution does it they will probably all do it.

Meanwhile the positive of a domestic reallocation into local equities would massively outweigh any negative caused by a higher yen courtesy of repatriation of overseas capital.

Indeed the idea that a weak yen is needed for a Japanese stock market rally is outdated in this writer’s view, with the 12.2% decline in the yen against the US dollar last year failing conspicuously to help the Japanese stock market.

Quantifying the Size of Overseas Capital Waiting to Come Home

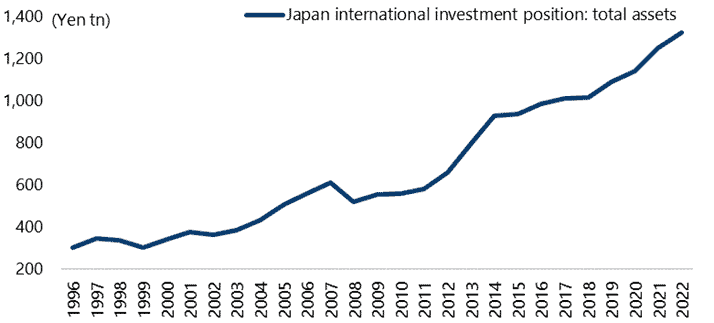

Meanwhile, in terms of the potential capital repatriation pressures, the stock of Japanese overseas investments totaled Y1,325tn (US$10tn) as at the end of 4Q22, according to the Ministry of Finance’s international investment position data.

Japan international investment position: total assets

Note: Data up to 4Q22. Source: Ministry of Finance

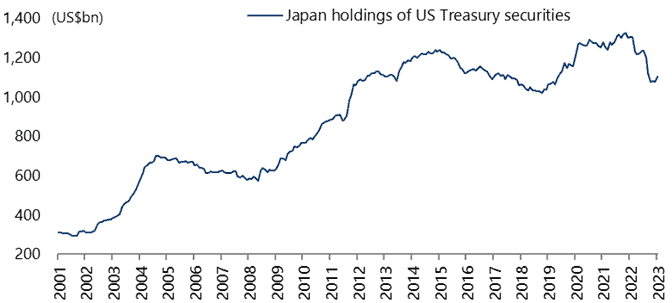

Within this total Japan still owned US$1.1tn worth of US Treasury securities as of January, the latest data available, though down from a peak of US$1.33tn in November 2021.

Japan holdings of US Treasury securities

Note: Data up to January 2023. Source: US Treasury

While the regional portfolio investment position data from the Ministry of Finance showed that Japan held Y104tn (€795bn) of European debt securities as at the end of 2021, the latest data available

.