Have Tariffs Taken Rate Cuts Off the Table for 2025?

Author: Chris Wood

The relatively hawkish message sent by Jerome Powell at the last two Federal Reserve meetings suggests that further interest rate cuts are no longer guaranteed given the recent data, be it employment-related or inflation-related.

It is also the case that parts of President Donald Trump’s stated agenda, be it tariffs or cracking down on immigration, look fundamentally inflationary, a point the Fed will clearly be aware of.

Powell said in the post-meeting press conference in December that the 25bp rate cut then was a “closer call” while expressing caution about further cuts, which meant that last week’s FOMC decision to stay on hold was no surprise to the market.

Still our guess for now remains that more Fed rate cuts are coming later this year, in part because of the unacknowledged need to reduce debt servicing costs from a fiscal standpoint.

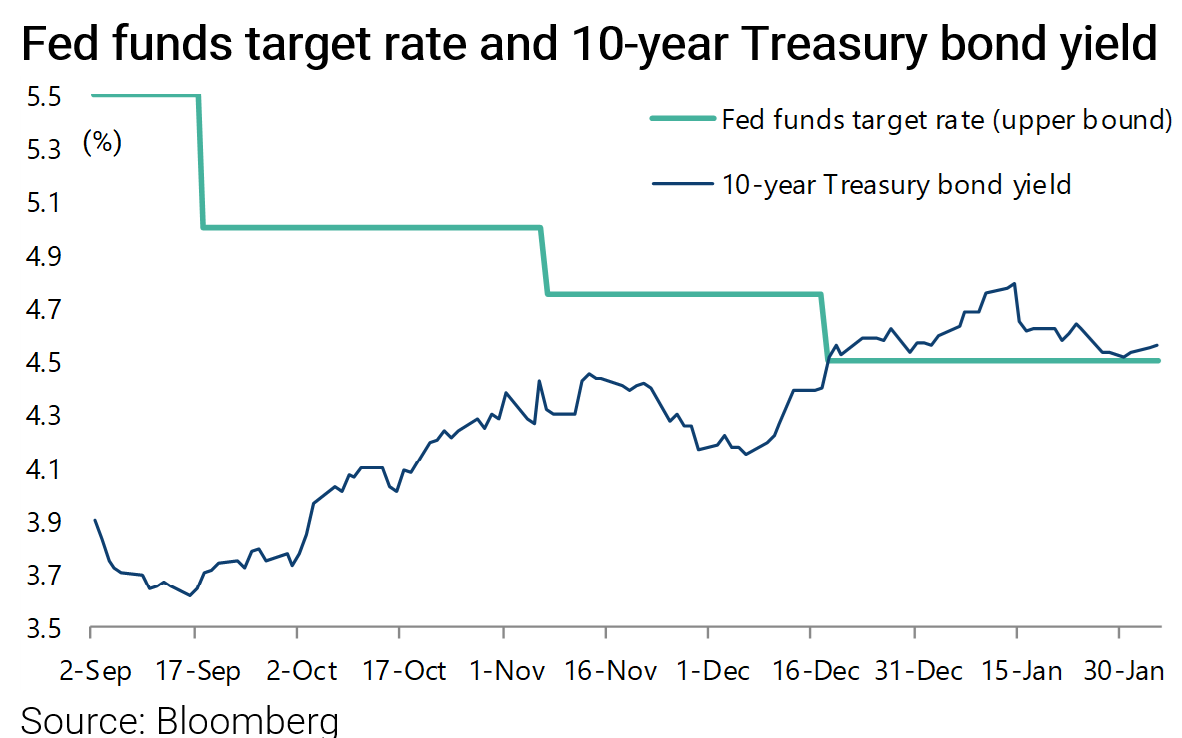

In this respect, it remains of note that the ten-year Treasury bond yield has risen by 92bp since the Fed commenced easing in September.

Fed funds target rate and 10-year Treasury bond yield

Source: Bloomberg

This is not what the central bankers would have expected. And it clearly suggests investors want a term premium for investing in longer term Treasuries.

A Change in Treasury Funding Tactics?

On this point, there is likely to be growing focus on whether there will be a change in Treasury funding tactics now that Scott Bessent has become Treasury Secretary.

It has been discussed here in the past how short-term Treasury bill issuance was massively accelerated under Janet Yellen over the past year and more (see “The Growing Risk of The Treasury’s Addiction to Short Term Debt”, 11 September 2024).

This has meant a collapse in the duration of the debt amidst a growing reliance on short-term funding.

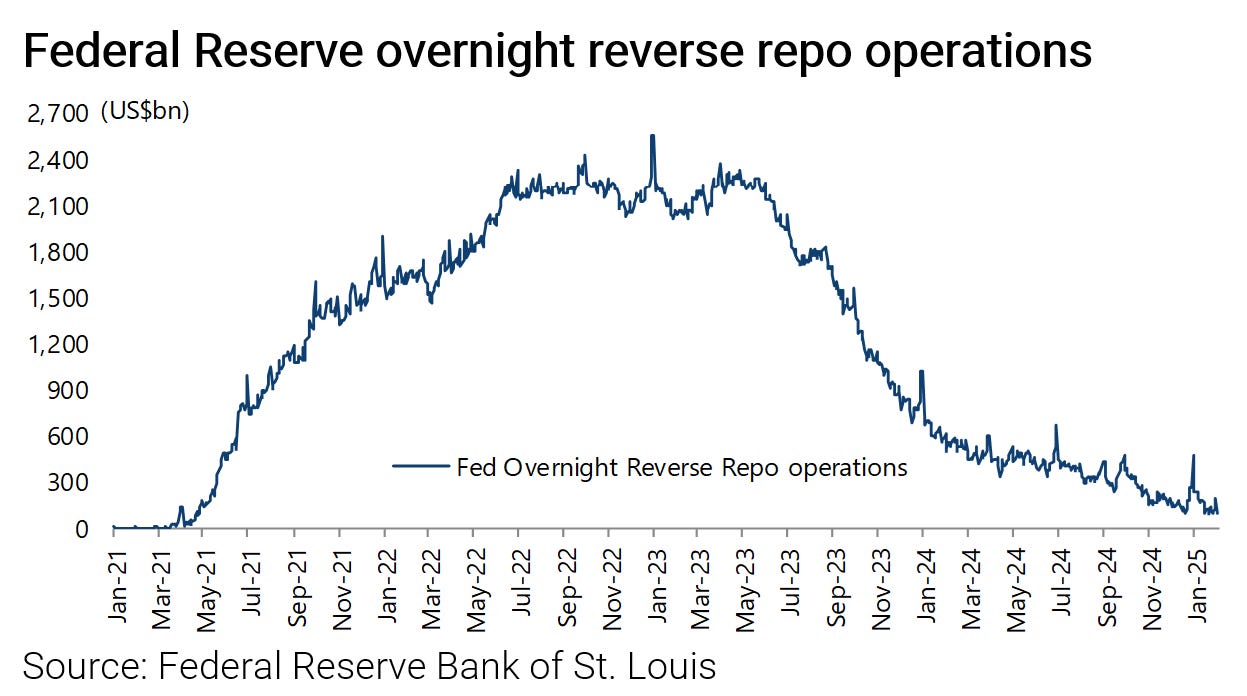

But it has also been beneficial for liquidity as reflected in the collapse in funds locked up in the Federal Reserve’s reverse repo facility.

The Fed’s reverse repo facility has declined by US$2.277tn or 96% from US$2.375tn at the end of March 2023 to only US$98bn on 3 February.

An interesting paper, also previously referenced here (see “The Growing Risk of The Treasury’s Addiction to Short Term Debt”, 11 September 2024), published in July argued that this “activist Treasury issuance” has had the practical impact of offsetting in liquidity terms the negative liquidity impact of Fed quantitative tightening.

It has, as a result, certainly been a positive for equities (see Hudson Bay Capital report: “ATI: Activist Treasury Issuance and the Tug-of-War Over Monetary Policy” by Nouriel Roubini and Stephen Miran, 22 July 2024).

The above is why it is interesting that Bessent is on record as having described high bill issuance as a “risky strategy” in a report issued by his fund Key Square Capital Management in January 2024, and one “with significant costs”.

He continued: “In addition to a higher interest expense, concentrating issuance in short tenors exposes the Treasury to greater volatility via refinancing risks and creates the potential for a financial accident” (see Bloomberg article: “MacroScope: The Bessent Bonfire of Bills Is Bad News for Stocks” by Simon White, 17 December 2024).

This writer could not agree more.

Inflationary Tariffs vs Deflationary D.O.G.E

Still such a change in policy clearly implies more longer dated issuance and, therefore, the potential for higher treasury bond yields.

There is also the negative impact on the fiscal deficit of the anticipated extension of the tax cuts.

During his electoral campaign, Trump pledged to extend many provisions in his 2017 Tax Cuts & Jobs Act (TCJA) that overhauled the tax code.

Clearly, if Elon Musk really starts cutting US$2tn from the federal budget that will reduce funding pressures considerably.

But that in itself will represent a deflationary shock for the economy.

Remember that 60% of the growth in nonfarm payrolls in the 12 months to December has come from government-related sectors.

As for the growing fiscal stresses, they remain best captured by the following statistic.

Net interest payments and entitlements accounted for 94% of total government receipts in the 12 months to December.

All of the above suggests a difficult balancing act for Bessent and others dealing with the economy under Trump given that the stated policy agenda is inflationary.

Still the base case remains that the Trump tariff threat in the case of China, is primarily a negotiating tactic and that the best way for Beijing to counter it is to offer to set up production in America, thereby presenting the Donald with a “win”.

A reminder that Trump is not anti-China or anti-Chinese people has come with his decision to turn TikTok back on.

Thus, Trump signed an executive order on his first day in office on 20 January granting TikTok a 75-day extension to comply with a law banning the app if it is not sold.

As for the immigration issue, mass deportations seem unlikely in the extreme.

But the inflow will likely be dramatically reduced, the impact of which will be stagflationary.

The same applies to tariffs.

What are Market Inflation Expectations Telling Us?

Returning to the Fed, money markets now expect only 41bp of Fed rate cuts in 2025, down from 68bp as recently as 6 December.

As for the ever hyped “dot plot” the median prediction of Fed officials is now for two 25bp rate cuts this year, down from four in September.

The positive for the Fed is that five-year five-year forward inflation expectations remain well behaved at 2.29%.

Still, it was pointed out to this writer of late that there has of late been a record wide spread between the mean/average and median responses for long-term inflation expectations for the next 5-10 years in the University of Michigan consumer sentiment survey.

Thus, the mean inflation expectations for the next 5-10 years rose to 6.6% in October and was 6.4% in January, while the median response was only 3.0% in October and 3.2% in January.

It is not clear what to make of it.

But the 3.6 percentage point spread between the mean and median inflation expectations in October was the highest level since the data series began in 1979.

It was still 3.2 percentage points in January.

Excellent stuff