Global Equities Are Breaking Out, Is This Time Different?

Author: Chris Wood

This writer is not a chart watcher by trade.

But it is not necessary to be a technical analyst to highlight the importance of the following development.

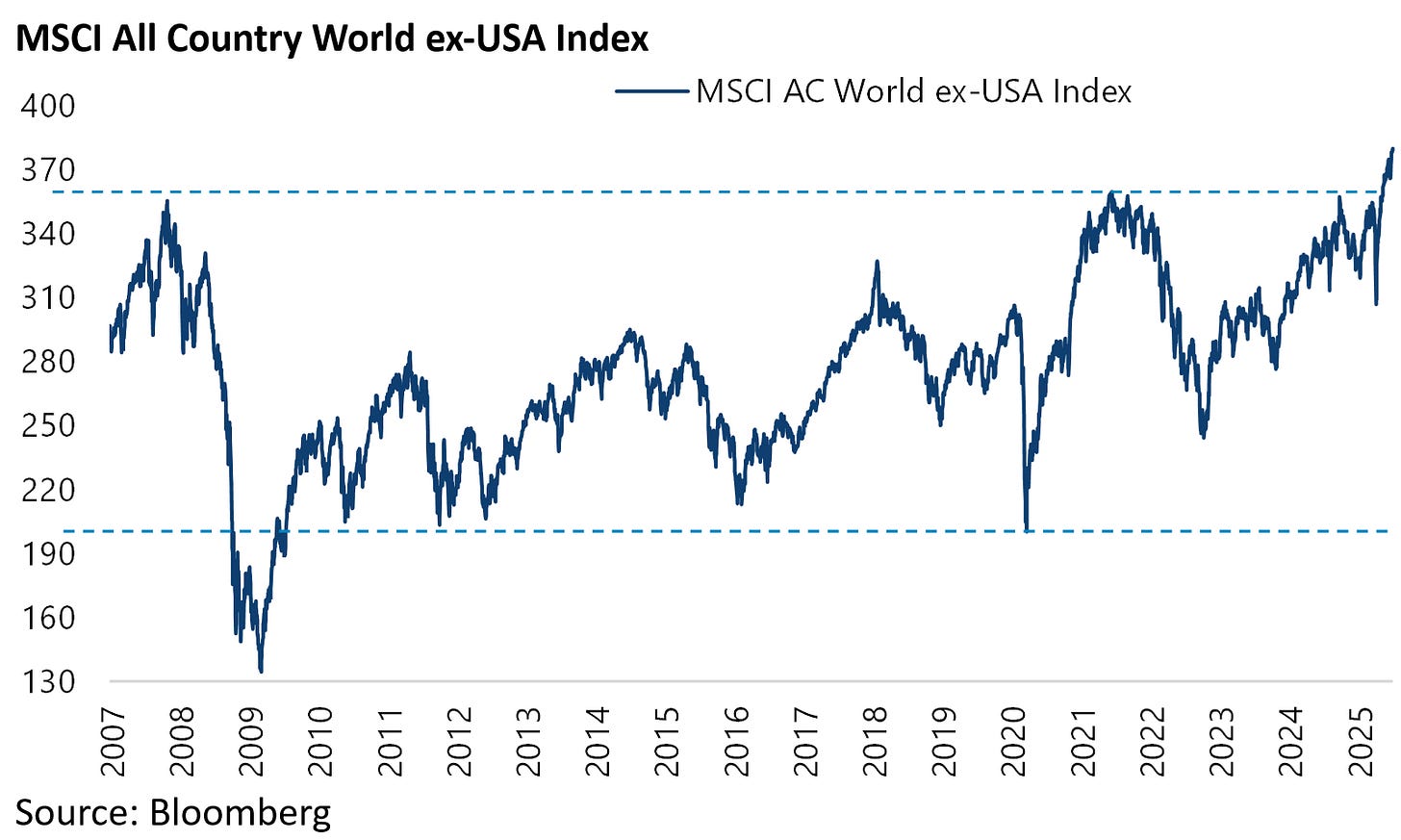

That is that global equities have recently broken out decisively on the chart with the MSCI All Country World ex-US breaking a trading range that has held since 2009.

This is technical confirmation for now of the base case here.

That is, that America reached an all-time peak of 67.2% of the MSCI All Country World Index on 24 December last year amidst euphoric chatter about “American exceptionalism”.

The above does not mean that the American stock market has to collapse, and clearly the S&P500 closed last quarter at a record high.

The point is that a share of 67% is huge, given America accounts for only 26.4% of the world economy in terms of nominal GDP in US dollar terms and only 14.9% on a PPP basis, even allowing for the global franchises of US Big Tech.

But it does suggest that the US dollar has entered a long-term downtrend, which remains the base case here.

There are several reasons to anticipate long-term dollar weakness.

One not unimportant one is that President Donald Trump himself wants a weaker dollar.

Another is that the highly personalized nature of Trump’s style of governing, with the resulting unpredictability reflected in the recent twists and turns on tariffs, should create a natural discount.

Still, by far the most important reason to assume a long-term weakening of the US dollar is that America’s extreme fiscal deterioration post-Covid, courtesy of Fed largesse, means that the most likely end game remains a growing resort to financial repression resulting in some form of yield curve control and even possibly exchange controls.

Such a trend would clearly be US dollar-bearish, most particularly yield curve control.

Meanwhile, the most likely currency bloc to enjoy long-term appreciation against the US dollar remains Asian currencies in what amounts to a reversal of the dynamic triggered by the Asian Crisis nearly 30 years ago, as previously discussed here (Why The Time Has Come to Overweight International Stocks, 19 June 2025).

This is not only because the Trump administration is targeting mercantilism, where Taiwan is by far the supreme practitioner.

It is also because Asia, as a region, has the savings.

Gross national savings in emerging Asia, which includes China but excludes Taiwan and Korea among others, were 39% of GDP in 2024, compared with 20.1% in G7 countries and 17.3% in America, according to the IMF.

True, Moody’s sovereign downgrade of America in May was not a big deal in terms of moving markets, as the rating agency’s downgrade has only arrived where S&P and Fitch already were.

Thus, Moody’s downgraded US sovereign credit rating by one notch from Aaa to Aa1.

S&P and Fitch already lowered their credit ratings for US debt back in August 2011 and August 2023, respectively, from AAA to AA+.

Still, the Moody downgrade will mark a chapter in the history books.

Staying on the US, the near-term recession risk has clearly been significantly reduced by the Trump administration’s seeming retreat on a tariff agenda, which threatened to impose a significant regressive tax hike on ordinary Americans in a country with extreme emerging market–style levels of income distribution.

Data from the Internal Revenue Service (IRS) shows that the top 1% of Americans accounted for 22.4% of total gross individual income and 40.4% of income taxes paid in 2022, the latest data available, while the top 10% of Americans accounted for 49.4% of total income and 72% of the income taxes paid.

By contrast, the bottom 50% of Americans accounted for only 11.5% of total individual income and 3% of the taxes paid.

It is also the case that individual income tax accounted for 53.5% of total US tax collections in 2023.

The American Consumer Remains Strong, but Lower Income Brackets are Starting to Show Cracks

Meanwhile, a positive is evidence of a growing number of Americans increasing their credit card payments.

Thus, the share of credit card accounts making a full balance payment increased from 31.8% in 2Q20 to a record 36.7% in 2Q21 and was still 35.25% in 4Q24, according to data reported on 9 April by the Federal Reserve Bank of Philadelphia.

This seems a consequence of the most positive trend for ordinary Americans in the recent past.

That is a rise in real incomes.

Average real hourly earnings growth for private employees rose to 1.4% YoY in May, the 25th straight month of positive real wage growth.

That can only help in an economy where the top 20% of consumers accounted for 39% of consumption in 2023, the latest data available.

Still, it is also the case that the share of credit card accounts making only minimum payments is also rising.

The same Philadelphia Fed survey showed that the share of credit card accounts making only the minimum payment rose from 8.01% in 1Q21 to 11.12% in 4Q24, the highest level since the data series began in 3Q12.

If Big Tech is Misallocating Capital, US Equities are at Risk.

Still, the real issue for American equities’ relative performance in a global equity context, given the dominance of Big Tech in the S&P500, remains less US macro than the issue put front and center by the DeepSeek moment in late January, as previously discussed here (Own the AI Picks and Shovels, Not the Models, 9 April 2025).

That is, whether Big Tech is misallocating capital on an epic scale in the continuing AI capex arms race. For now, the last earnings season has made clear that the market is still viewing increases in capex as bullish confirmation of the AI growth story.

The other related point is that Big Tech is in no hurry to account for the investment spending in terms of depreciation schedules and the like.

Can Tether Decentralize AI?

Meanwhile, Big Tech’s dominance of the internet economy, outside China, remains the antithesis of the supposed decentralized nature of so-called Web3 and related blockchain technology.

On this critical point, it was interesting to read that Tether, issuer of the dominant stablecoin USDT in the crypto space, announced recently that it plans to release later this year an open-source software development kit for its upcoming AI platform, QVAC (QuantumVerse Automatic Computer), which it claims will let developers run and evolve AI agents directly on personal devices, with no data centers required (see Decrypt.co article: “Meet 'QVAC': Tether’s Decentralized AI God in Your Pocket”, 15 May 2025).

Tether CEO Paolo Ardoino highlighted in a tweet in May the threat such a development poses to Big Tech’s highly profitable business model of surveillance capitalism based on impertinent algorithms and naïve consumers giving away their data for free.

He stated that “while Big Tech wants to be the gatekeeper of AI, to squeeze society of any last drop of personal data and information, at Tether we realized that . . . AI needs to be part of the fabric of the universe itself.”

Tether also said in its statement in May that the goal of its QVAC architecture is to support potentially trillions of AI agents and applications running across user devices rather than centralized servers.

Such a decentralized approach, Tether noted, also aims to remove single points of failure or attack while allowing AI agents to operate autonomously and transact in Bitcoin and USDT.

If the above represents a source of potential disruption, the simple point for investors is that the four hyperscalers, with a still combined market capitalisation of US$10.1tn, or 7.4% of global stock market cap, are not priced for any disruption at all.

Still, they are down from a peak of 7.9% of global market cap reached in early February when the combined market capitalisation was US$9.9tn.

The major Dollar cycle lasts around 15 years, give or take a couple. The previous cycle spanned 1992–2008, roughly 16 years. The current long-term cycle began in 2008 and is now in its 17th year. As you can see, this cycle is very mature. It seems likely that it peaked in September 2022. Given the extended length, the bottom may be reached soon, followed by a prolonged consolidation phase, similar to the early 1990s and early 2010s.