GameStop Trading: From Meme Stock to Value Opp

No Short Squeeze Required. Target: $54/Share

GameStop: The Fundamental Business Thesis

GameStop requires a tangible business model to take it from meme stock to value opportunity. This elusive business model is missing in the conversation, a short squeeze can’t be the central thesis - icing yes, but not the cake.

We believe that if GME management were to transform the company into a trading platform there would be significant value accretion and a strong case for the stock to reach a value of $54/share on the back of business fundamentals (revenue, cashflow).

We believe this is very real and tangible opportunity and will blow out the competition. For that reason, we've taken a position in GME in our DARP ETF. The opportunity for GameStop to become much more than a video game store is finally here.

GameStop the Movement - For the People, By the People

GME isn’t any stock, it’s a flat-out movement. An army of shareholders who want to rug the Wall Street establishment; and they are willing to put capital behind it. The vision of creating a zero grift enterprise, with leadership fully aligned with shareholders.

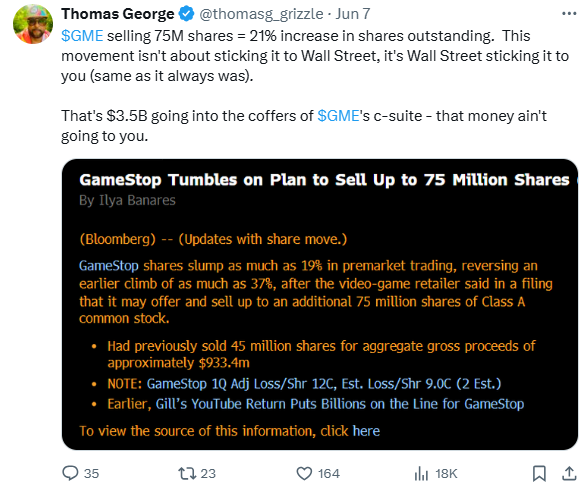

We initially viewed the GME 75 million ATM share sale as a classic Wall Street play to fill the coffers of the c-suite at cost of shareholders (20% dilution in this case). Analyzing the company further, we stand corrected - Ryan Cohen is a legit CEO of the shareholders.

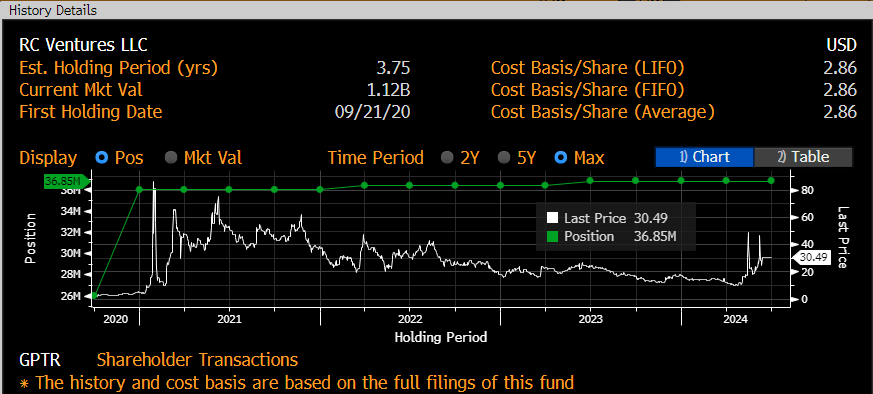

Ryan Cohen has real skin in the game. His VC firm RC Ventures LLC owns 36.85M shares outstanding (10.5% of the GME); he’s taken zero salary since he took on the role of Chairman (06/21) and there’s been no freebie options given to him.

This is a leader shareholders can put their support behind, trusting that he’s acting in their best interests. However, a leader aligned with shareholders isn’t enough on its own to drive a share price higher - the business has to deliver.

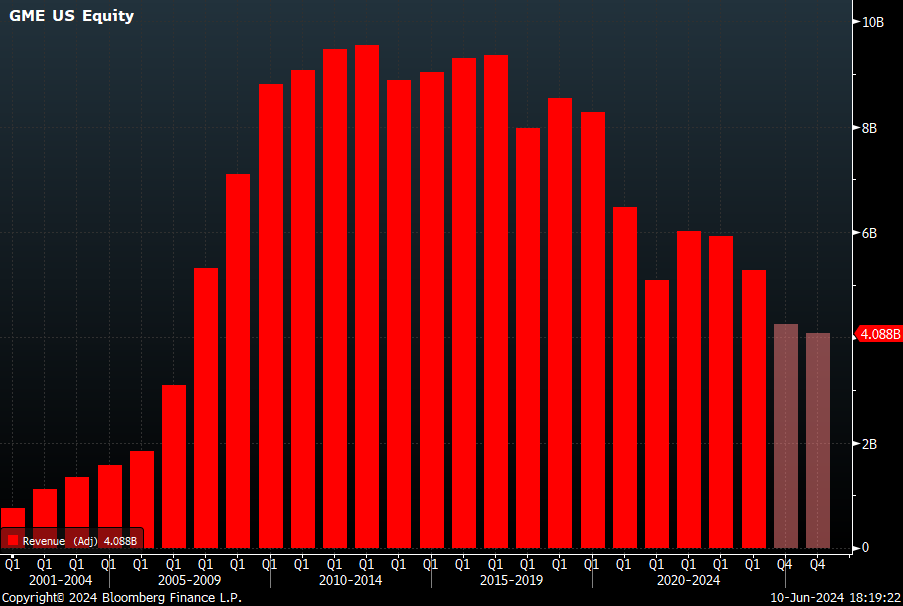

That’s where GameStop has been challenged, since 2012 revenue is falling at an average clip of -5% per year.

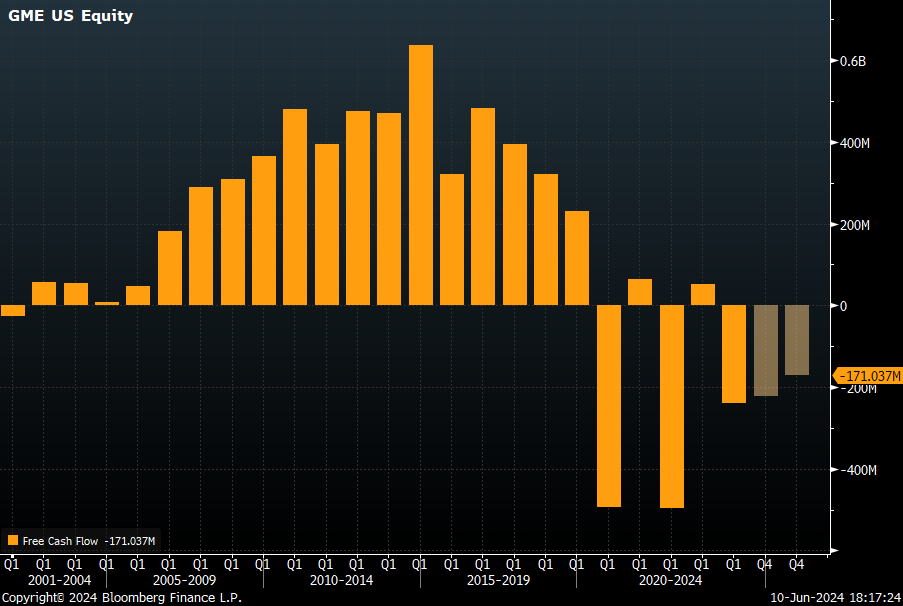

And the company hasn’t been able to shed costs fast enough, free cash flow has been in primarily negative territory for the last 4 years.

The inherent advantage of GameStop is cost of capital; the ability to raise a cash war chest overnight is unparalleled. After the latest raise the company is sitting on $4B cash pile (vs. market cap of the company at $11B.

Roaring Kitty (Keith Gill) is the Product

Roaring Kitty aka Deep F’ing Value aka Keith Gill is the product - the sooner GME management leverages that the more valuable GME becomes.

Roaring Kitty will forever be lionized at the guy who took on the Wall Street machine and won, no just a little - but BIG. He’s the leader of the movement; a trader who can rally retail traders nationwide to join the force of good, a trading platform for the people, by the people - GameStop Trading.

His livestream broke the financial internet, over 600K viewers live and 2.4 million total views. He’s redefining the concept of financial & trading media, the CNBC coverage of the whole thing was the chef’s kiss!

He can lead this movement to the promised land, a trading platform doesn’t throw retail traders under the Wall Street bus.

GameStop Trading should be the Crown Jewel of GameStop Inc.

With a mere $1 billion, GameStop could become a retail trading juggernaut overnight. The company should acquire Public - a trading venue that’s already operating offering stocks, options and most importantly a platform that doesn’t take payment for order flow (PFOF).

With the backing of Keith Gill, GameStop trading could be a formidable trading platform that could certainly reach the size of Robinhood - if not larger. This is a classic Good vs. Wall Street Evil narrative; the will of the GME movement can make this happen in short order.

Public.com closed its last funding round at a $1.2 billion valuation in February 2021, given that Robinhood is off 40% from its 2021 IPO - we believe that an offer of $1 billion (shares or cash) for Public would more than suffice; there’s no question that Public rebranded as GameStop offers far greater upside for investors in Public vs. going it alone.

GME: Sum of the Parts Valuation

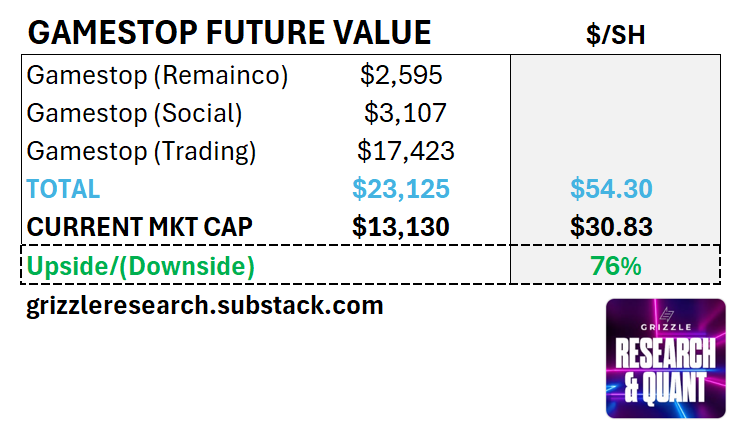

So what is a successful GameStop pivot worth? We think at least $54 per share.

Value comes from three places:

The legacy video game business

GameStop Trading - Public.com buyout

GameStop Media - Monetizing retail investor attention

Legacy Business

We think the legacy business is conservatively worth $2.6 billion assuming Ryan Cohen can stabilize revenue at a $3 billion per year run rate which is the current Wall Street consensus. The business isn’t exciting so we assume it trades for a multiple in line with where GameStop traded prior to meme stock mania in 2019 (0.86x price/sales).

GameStop Exchange

Turning Public.com into the new face of retail investor trading is the real opportunity for GameStop. Robinhood already emerged as the villain in 2021, and with Roaring Kitty as the public face, GameStop has a real chance to become a major player in retail trading.

Public.com was rumored to have 3 million accounts back in late 2021, so could be closer to 6 million or higher today. We think GameStop trading could easily match Robinhood’s 23.9 million customer count over time, generating revenue of $2 billion annually. Slap only a 9x P/S multiple onto this business, in line with Robinhood’s current multiple and you have $17 billion of value created for shareholders.

GameStop Social

The social side of the equation is straightforward but could be worth even more.

Roaring Kitty and GameStop have captured the public’s attention. They can monetize it many different ways.

Most simply we assume ads are used throughout GameStop digital properties to generate advertising revenue. Assuming GameStop can generate ads dollars at a similar level to Snap, Twitter or Pinterest and the business trades at a similar multiple (pre-covid), advertising could bring in ~$300 million or so, worth $3.1 billion.

Putting it Together

Adding it all up, a GameStop pivot could effectively double revenue while generating sustainable profits that avoids any more meaningful dilution. The upside is significant and CEO Ryan Cohen should seriously consider this opportunity to enhance shareholder value.