Fed Easing and Falling Earnings... At the Same Time!?

Is it Possible?

The continuing problem as regards the American banking system is that the Silicon Valley Bank episode has now exposed the vulnerability of regional banks’ “held to maturity securities” portfolios to deposit outflows.

And there is a rational reason for depositors to keep moving their money out of these banks, even if they do not think they are about to go bust, given the far higher yield still paid on money market funds.

The average depositor is still only earning 0.39% on his/her bank savings deposits and 1.54% on one-year deposits as of 17 April, according to the Federal Deposit Insurance Corporation (FDIC).

By contrast, the US government MMFs yielded 4.63% as at the end of March, according to the Securities and Exchange Commission.

Meanwhile, it seems almost inevitable that the federal government will have to end up guaranteeing all retail depositors in the banking system both to try and prevent such an outcome, and given the practical political consequences of the unfortunate precedent created by bailing out mostly rich depositors in Silicon Valley Bank.

All this means that the US$163bn rise in the Fed balance sheet since 1 March,

with the opening of a new Fed funding facility for the banking system, the Bank Term Funding Program (BTFP),

looks like the beginning of a new trend in central bank balance sheet expansion despite the Fed’s continuing formal commitment to quantitative tightening.

In this respect, this writer is confused by current trendy talk of central banks’ dual mandates, with one area of central bank policy targeting inflation and another targeting financial stability.

This writer is a simple soul, and a central bank balance sheet is, surely, either contracting or expanding.

A Fed U-Turn Coming Sooner Rather than Later

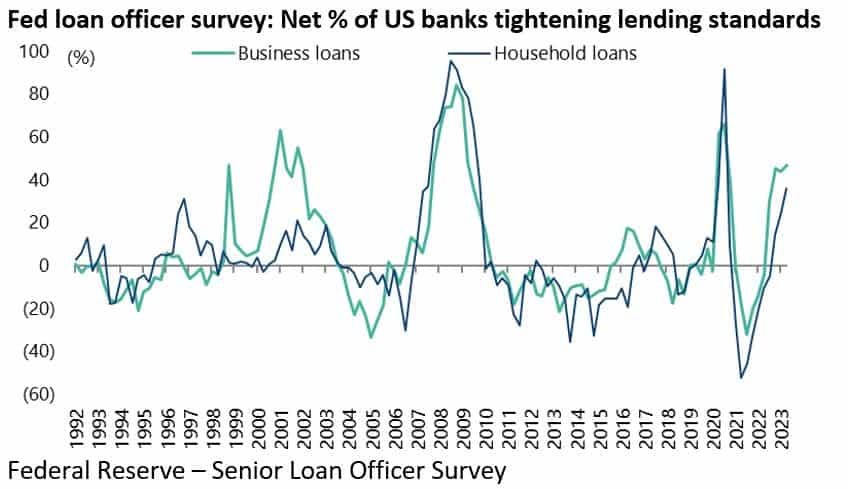

The above also surely means, as already noted, that a Fed U-turn is coming sooner rather than later with bank lending standards likely to tighten significantly from here on.

The Federal Reserve’s April Senior Loan Officer Opinion Survey shows that a net 46.9% and 36% of US banks tightened lending standards for business loans and household loans respectively over the past three months, up from 44% and 24.9% in January and the highest levels since Jul 2020.

As for loan demand, a net 45.3% of US banks reported weaker demand for business loans, up from 37.8% in January and the weakest level since October 2009.

This is the most significant data point from this writer’s point of view.

While a net 15.8% of banks reported weaker demand for household loans, though down from 64.5% in January which was the lowest level since October 2008.

A Stampede into MM Funds Could Drive Further Deflation

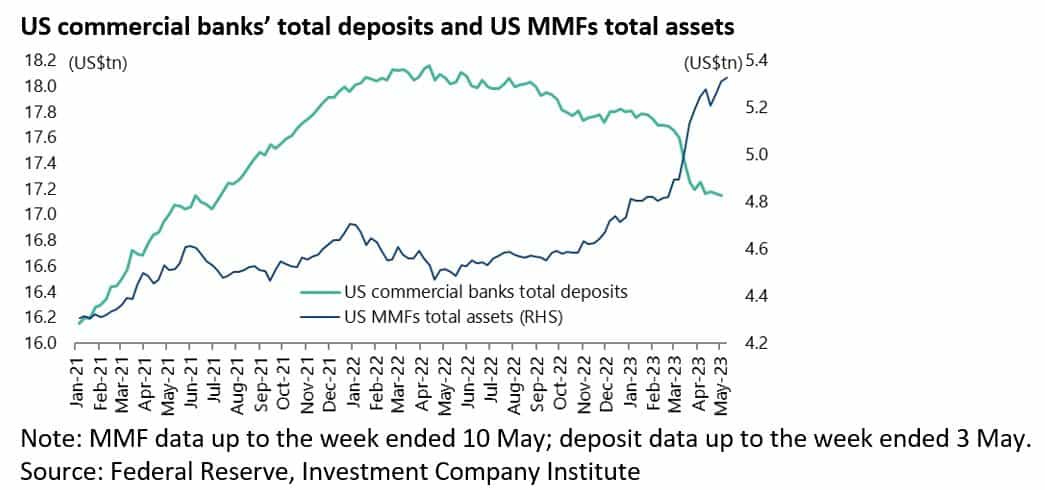

Still the real threat to the credit multiplier in America, and the ultimate harbinger of a deflationary collapse in velocity, would be a mass stampede out of bank deposits into money market funds.

US bank deposits have already declined by US$1.01tn or 5.6% as of 3 May since peaking in mid-April 2022.

By contrast, assets in MMFs have risen by US$859bn or 19.2% since late April 2022 as of 10 May, according to the Investment Company Institute.

Meanwhile, the positive point about the new Fed facility is that it stops banks having to force sell debt securities at a loss.

But that does not overcome the money market fund issue, and remember that 78% of money market funds are also now federal government guaranteed.

The US stock market’s initial response to any coming Fed U-turn, and renewed easing cycle, may well be positive, just as it will likely be negative for Treasury bonds, most particularly if it involves an implicit abandonment of the Fed’s 2% inflation target.

Still, at some point, the stock market has to react to the earnings downgrade risk triggered by a recession, even if that is in the context of a declining federal funds rate.

Labour Market Ramains Strong for Now

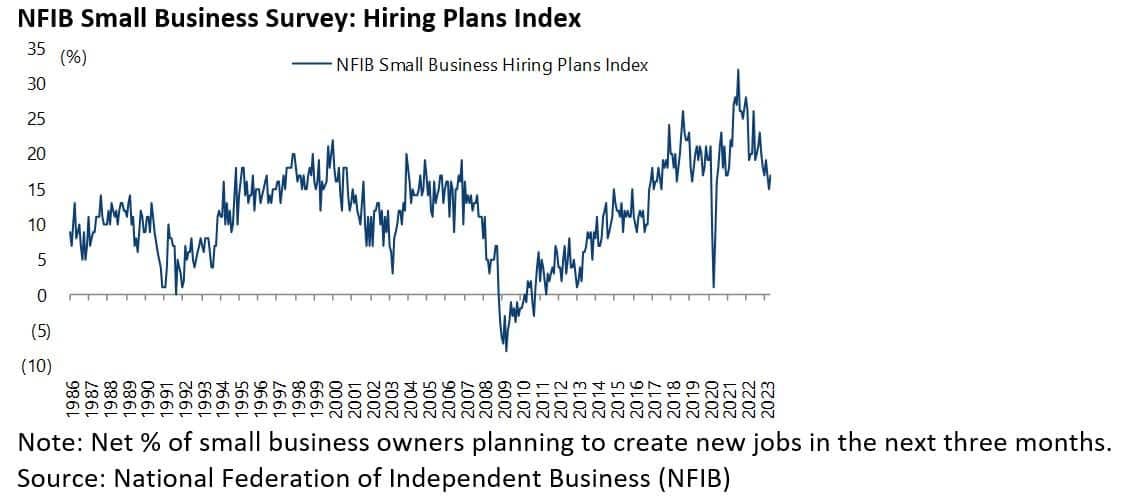

Still, for now, the labour market remains strong.

But it should be noted that the labour market, in stark contrast to the trend in credit, is usually a lagging indicator.

Meanwhile, there are signs of growing weakness if an investor wants to look for them.

The recent Challenger job cuts data is worth noting.

Layoffs by US companies increased fourfold YoY in the first four months of this year to 337,411.

This is the highest figure for the first four months of the year since 2020.

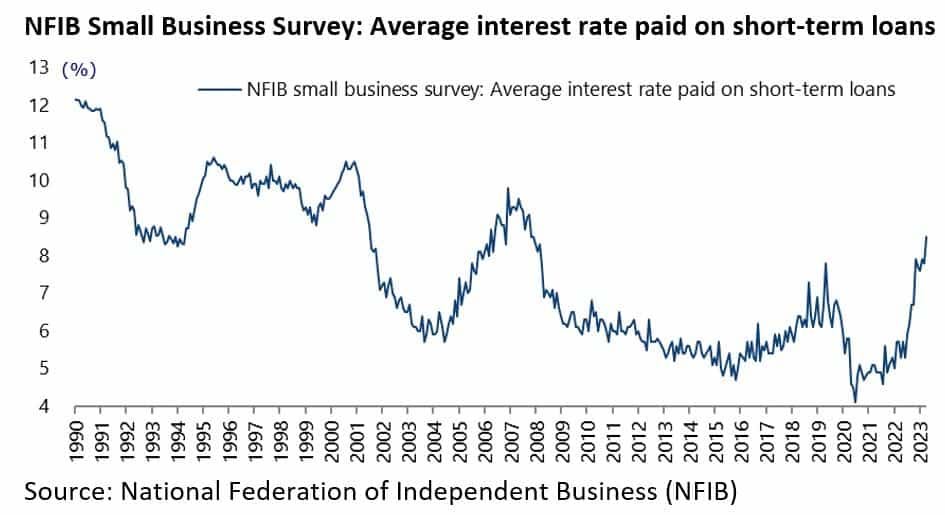

The NFIB Small Business Survey’s hiring plans index also continues to decline, down from a peak of 32% in August 2021 to 17% in April 2023,

while the average interest rate paid by small businesses in April was a not insignificant 8.5%, the highest level since October 2007.

While the number of Americans quitting their jobs, a sign that they are confident to find a better job elsewhere, has declined from a peak of 4.5m in November 2021 to 3.85m in March, the lowest level since May 2021.

The Fed clearly knows the labour market is a lagging indicator.

But Fed chairman Jerome Powell is on a mission to try and restore the institution’s credibility as an inflation fighter since it let inflation get out of hand as a result of the massive money printing trigged by the pandemic.

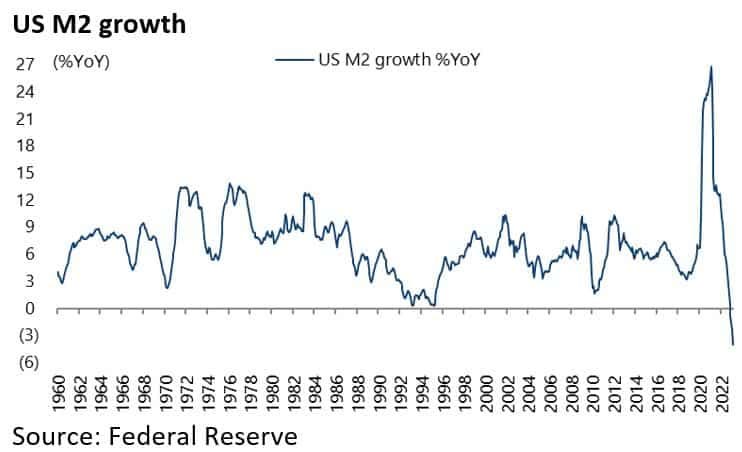

But for now M2 continues to collapse, declining by 4.1% YoY in March, after having soared by 26.9% YoY in February 2021.