Evaluating World Geopolitics and a Trump Victory

Author: Chris Wood

On the US presidential election, the ElectionBettingOdds.com website now shows 61.4% odds of a Trump presidency compared with 38.1% for Kamala Harris, based on the results of five betting markets.

Similarly, the RealClearPolitics Betting Average, which includes the results of eight betting markets, shows 61.3% odds of a Trump presidency compared with 37.7% for Harris.

By contrast, at the end of September the betting markets were still projecting an average 51.1% probability of a Harris presidency compared with 47.6% for the Donald.

What does this mean for markets?

Stock market action of late makes it clear that a Trump victory is viewed as bullish.

There is also the potential of a US dollar rally on a Trump victory based on his pro-growth agenda.

Largest Near-Term Risk to Markets is Geopolitics Not the US Election

Meanwhile, the view here remains that the biggest near-term risk to markets remains geopolitics aside from the other political risk, namely that there is a disputed outcome in the presidential election.

Certainly, nothing has changed to alter that view, with the conditions on the ground in Ukraine and the Middle East remaining as highly charged as ever, most particularly the latter.

Indeed it is no exaggeration to say that the newsflow is as scary as anytime this writer can remember.

In this context, it was somewhat astonishing to read last quarter that the heads of the CIA and MI6 made a public appearance together at the Financial Times’ “Weekend festival” in London in September (see Financial Times article: “Kursk has raised doubt in Russian elite over Putin’s war, top spies say”, 9 September 2024).

While this may seem an appropriate venue to advertise the “special relationship” between America and Britain, the London-based newspaper reported that it was the first time that the heads of the two intelligence agencies had made a public appearance together in their 77-year partnership of “intelligence sharing”.

This would seem for good reason to this writer, given intelligence agencies are meant to operate in the shadows.

Still, while the joint appearance might have provided a boost to Britain’s post-colonial ego, the truth is that Britain is a mere shadow of its former prominence on the global stage, a situation only made worse by Brexit.

Still, the comments made by CIA director Bill Burns, a former career diplomat, at the event are worth noting given the passage of events since then.

This writer read his memoirs published a few years ago (see Grizzle: “Tracking Three Risks That Could Sink Markets: Oil, Geopolitics and Private Debt”, 13 May 2024, and book “The Back Channel: A Memoir of American Diplomacy and the Case for Its Renewal” by William J. Burns, Random House, March 2019).

As a former ambassador in both Russia and Jordan, it is clear that he has a nuanced understanding of both regions.

While Burns’ comments on Ukraine at the FT event were understandably guarded, it is clear from reading his memoir that he did not believe at that time in encouraging Ukraine to believe that it could join NATO, as this was a Russian “red line”.

As for the Middle East, Burns stated, according to the FT’s report, that a “two-state solution” was central to securing a lasting peace.

Yet it is also crystal clear from reading Burns’ own memoir that Israeli Prime Minister Benjamin Netanyahu has always been resolutely opposed to such a policy and remains opposed to this day.

Ukraine War Update

Meanwhile, returning to the issue of Ukraine, there is also the question of the recent Ukraine incursion in August into Kursk, an oblast district in western Russia. Burns described this Kursk offensive at the FT event as a “significant tactical achievement”.

However, there is another narrative that the dispatching of an estimated more than 10,000 troops into Kursk only served to weaken Ukraine’s defences in its own territory and allowed Russia to make further advances to the West.

Meanwhile, Ukraine President Volodymyr Zelenskyy’s increasingly desperate lobbying of both Washington and Brussels to allow his forces to use Western-supplied long-range weapons to strike targets deep inside Russia have so far been in vain.

Still the pressure from Ukraine’s leader is entirely logical because the incentive for Kyiv is to try to trigger full-scale NATO intervention as soon as possible by provoking Russian retaliation, given the growing risk that Trump wins in November and cuts off funding to Ukraine, which has essentially been his stated policy.

Evaluating Euro Zone Cohesiveness

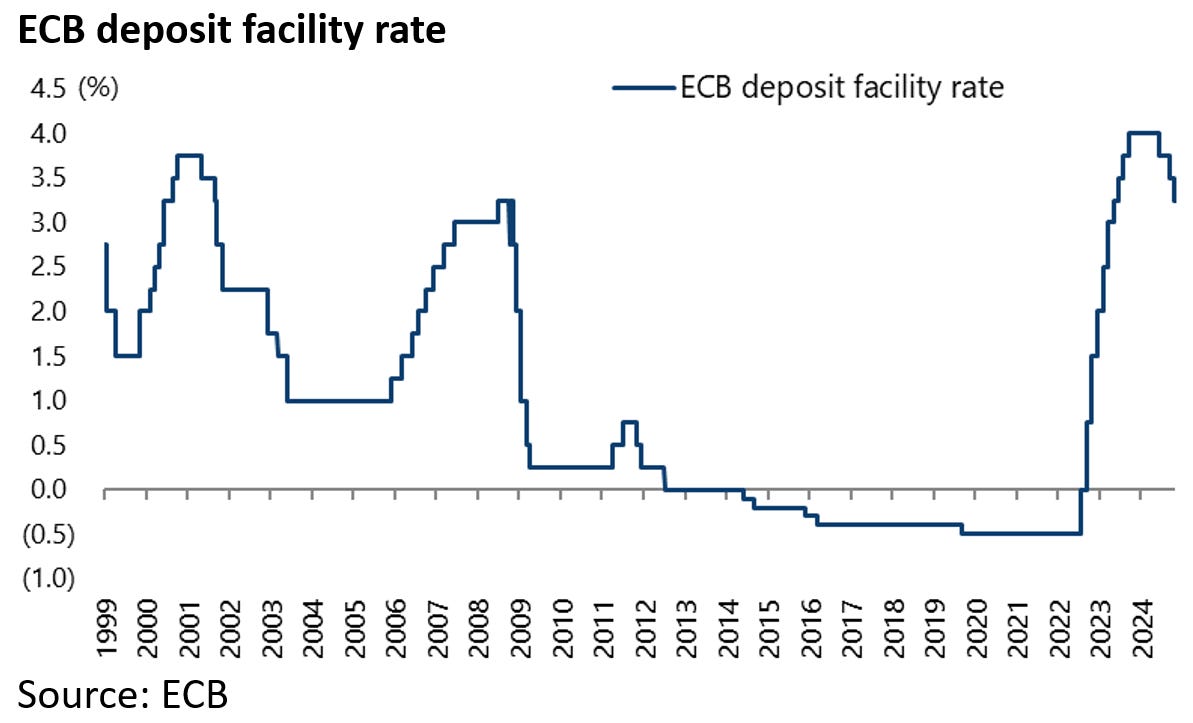

Staying in Europe, the ECB has now cut rates by 75bp to 3.25% on the deposit facility rate following recent inflation data which has proved less sticky than in America.

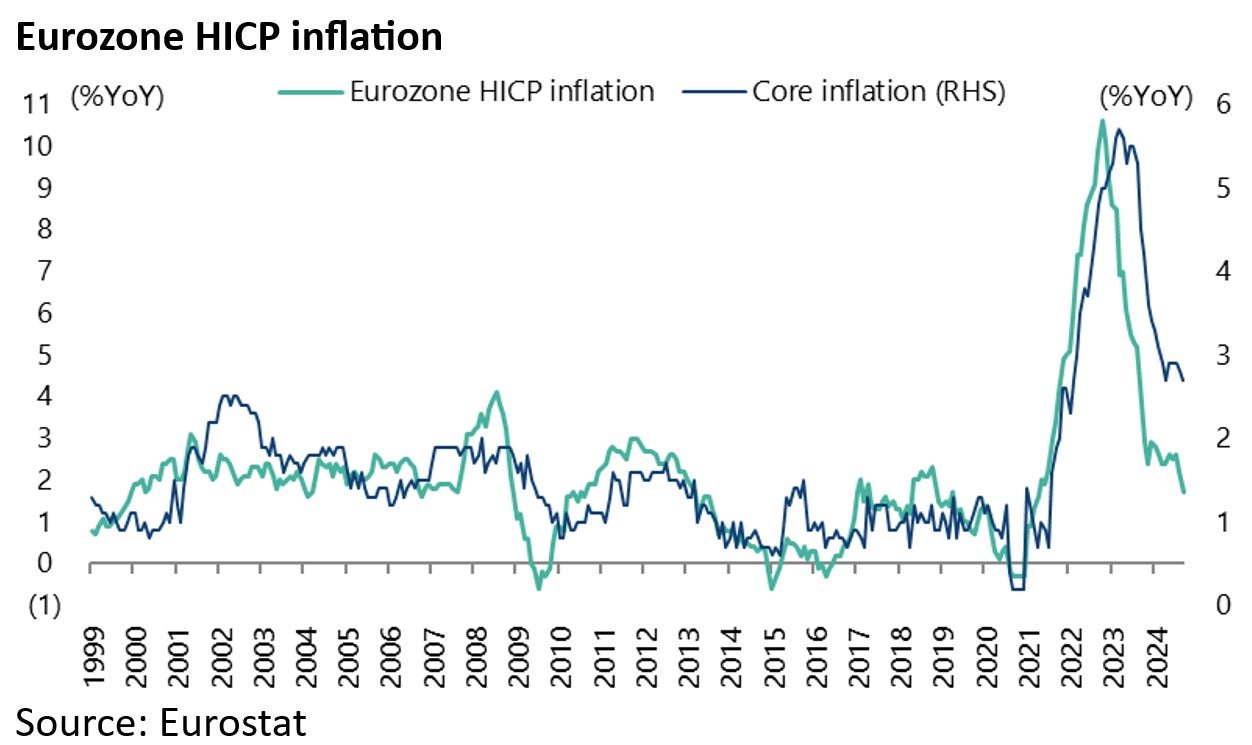

A point doubtless in part explained by the fact that the expansion of broad money supply during the pandemic was less explosive than in the US. Eurozone M3 growth rose from 5.4% YoY in February 2020 to a peak of 12.6% YoY in January 2021, compared with peak US M2 growth of 26.6% YoY in February 2021.

Eurozone headline inflation was 1.7% YoY in September, the lowest level since April 2021, while core inflation was 2.7% YoY.

Still, if rate cuts provide some relief, with money markets anticipating another 134bp of ECB rate cuts by the end of next September, recent political developments in Germany and France are a reminder of the tensions festering in the Eurozone in its two most important countries.

Two state elections in Eastern Germany last quarter have provided the latest evidence of the unpopularity of the policies of the current German government.

The “far right” AfD won the state of Thuringia outright on 1 September and came a close second to the CDU in Saxony, securing 32.8% and 30.6% of the vote, respectively.

While the three parties comprising the current German government, namely the SPD, the Greens, and the FDP, received only a combined 10.3% and 13.3% of the vote, respectively, in the state elections.

It should be noted that both AfD and the radical left-wing populist BSW party, which won 15 seats each in the same state elections, do not support the policy of funding Ukraine.

The BSW received 15.8% and 11.8% of the vote, respectively, in Thuringia and Saxony.

Meanwhile, in France, President Emmanuel Macron, after two months of prevarication, finally picked in early September a prime minister in the form of former Brexit negotiator Michel Barnier.

But the parliamentary arithmetic is such as a result of the July legislative election that the government can be voted out of office at any time by the “far right” party Rassemblement National (RN) led by Marine Le Pen.

With a government debt-to-GDP ratio of 112% and government spending running at an enormous 57% of GDP, France does not have much room for manoeuvre if its politics turn dysfunctional.

Still, this writer continues to believe that the real fault line in the Eurozone is in German politics, most particularly in the context of the traumatic deindustrialization which the country is now suffering.

See again the chart below of negative net FDI flows.

This deindustrialization is, of course, in part self-inflicted as a result of both the ban on nuclear energy in 2011, with the last three nuclear power reactors shut down in April 2023, and the decision in mid-2022 to stop importing Russian energy.

This is at the same time as Germany’s most important sector, autos, faces an existential crisis.

While the base case remains that the CDU will win the German federal election in September 2025 and that the AfD will be kept out of power at the national level, the tensions are clearly building against current Berlin and Brussels orthodoxies — just as they are in France.

In this respect, it should be noted that there is no Eurozone without Germany...