Author: Chris Wood

The oil price has started to rise again this past week after an extended period in the doldrums.

The Brent crude oil price has risen by 6.7% since 20 July and is now up 18% since late June.

This rally should be seen in the context of OPEC’s decision at its meeting in Vienna on 4 June to cut OPEC+ production by another 1.4m b/d to 40.46m b/d in 2024 while maintaining its planned production cuts for this year.

For the record, the alliance agreed last October to a 2m b/d production cut this year, while some OPEC+ members also announced voluntary cuts of 1.66m b/d in April.

Saudi Arabia also announced on 4 June a voluntary cut in its production by an additional 1m b/d to 9m b/d in July.

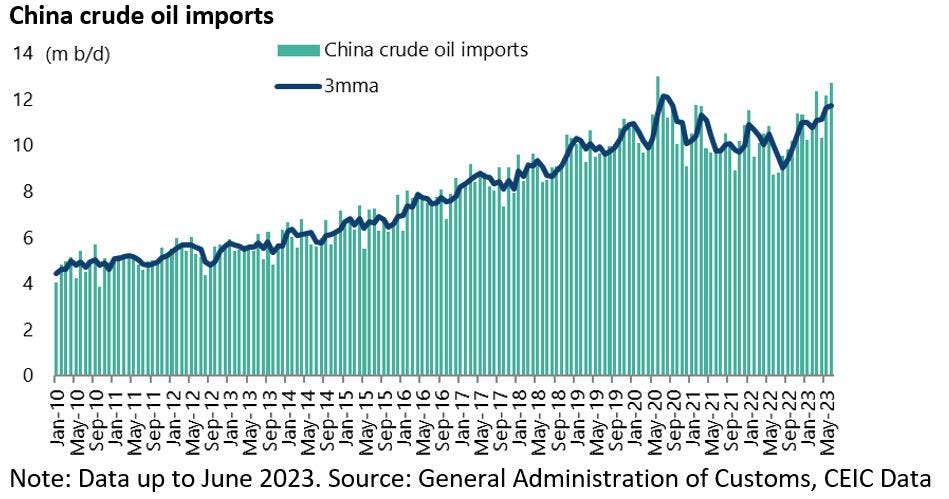

Meanwhile, the explanations for oil’s weakness this year have varied from Russia ‘cheating’, in terms of the tensions between its commitments as a member of OPEC-plus and its need to fund a military conflict, to slowing demand in the West and the lack of a more vigorous recovery in China, though the data shows that Chinese oil imports have actually been rising.

China’s crude oil imports have increased from 9.0m b/d in the three months to August 2022 to 11.8m b/d in the three months to June, close to the peak of 12.1m b/d reached in the three months to July 2020.

Still another factor has received much less attention so far as this writer can tell.

That is that the Biden administration last quarter resumed drawing down from the Strategic Petroleum Reserve again even though its official stated policy was to do the exact opposite.

The US Strategic Petroleum Reserve (SPR) declined by 24.02m barrels in 2Q23, or 1.85m barrels per week, and a further 401,000 barrels in the first week of July to 346.76m barrels on 7 July, the lowest level since August 1983.

It rose by 1,000 barrels in the second week of July and was flat in the week ended 21 July.

This followed a pause in the first quarter.

The SPR has now declined by 309.39m barrels or 47% since July 2020.

This is despite a statement made by the Biden administration in December that it would start repurchasing crude oil for the SPR.

Meanwhile, the fundamental point as regards oil remains that OPEC has become the key swing factor given the continuing weakness in US shale production.

True, total crude oil production in the 7 shale regions in America has risen by 1.34m b/d over the past two years to 9.41m b/d in June.

Still it remains 1.3% above the previous peak of 9.29m b/d reached back in December 2019.

And the production in the Permian region accounted for 79% or 1.05m b/d of the increase over the past two years.

Excluding the Permian region, crude oil production in the other six shale regions remains 20% below the peak reached in October 2019.

The above means that the supply constraint should be maintained which, in turn, means that the key swing variable in the oil market remains demand in terms of the potential for a US recession and the continuing questioning of the strength of the Chinese recovery.

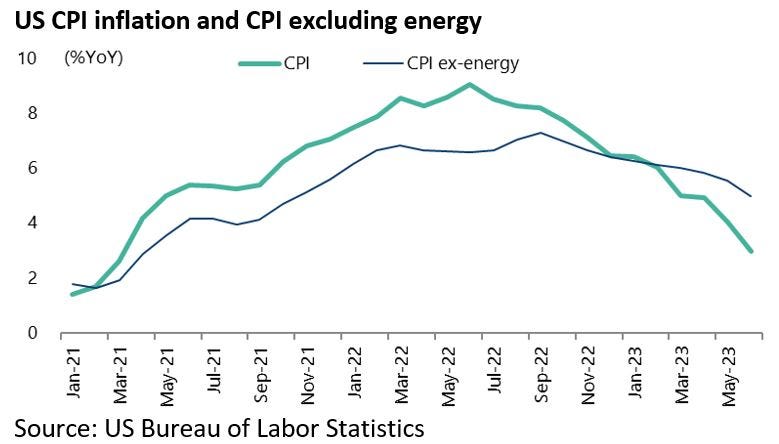

Energy Prices have Become a Key Driver of Falling Headline Inflation

Meanwhile, it remains the case that a significant part of the decline in inflation seen so far this year has been driven by a decline in energy prices.

US headline CPI inflation has fallen from 6.5% YoY in December to 3.0% YoY in June while energy prices declined by 16.7% YoY in June, down from a 7.3% YoY rise in December.

As a result, CPI inflation excluding energy has slowed only from 6.4% YoY in December to 5.0% YoY in June.

An Update on US Monetary Policy

On the subject of monetary policy, there has been no great change in money market expectations following last Wednesday’s 25bp Fed rate hike to 5.25-5.5%.

The Fed funds futures are now discounting another 9bp of rate hikes to 5.42% on the Fed funds effective rate by November, compared with an expected terminal rate of 5.435% last Tuesday before the rate hike.

Falling Hours Worked Confuses More than Reveals

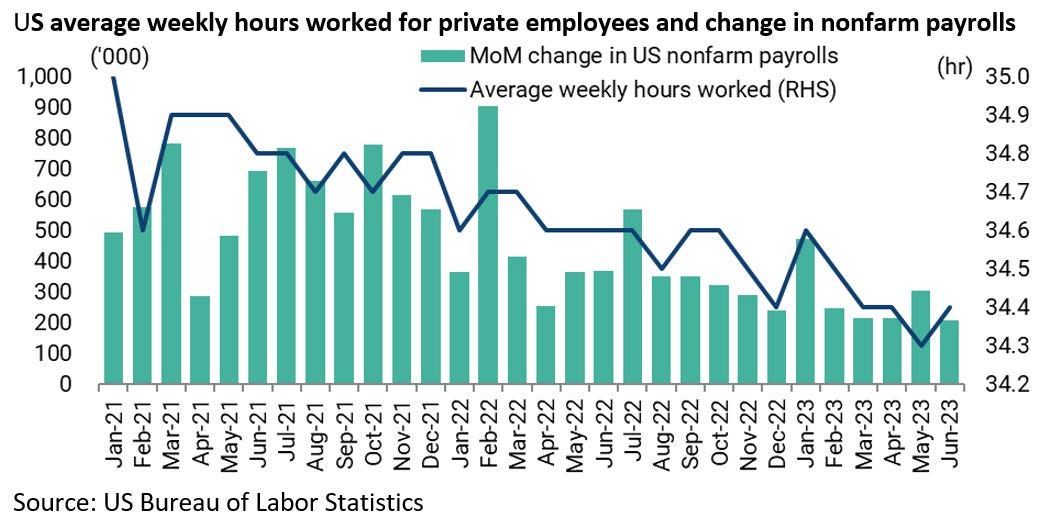

Meanwhile, it is also the case that recent employment data continues to confuse as much as it reveals.

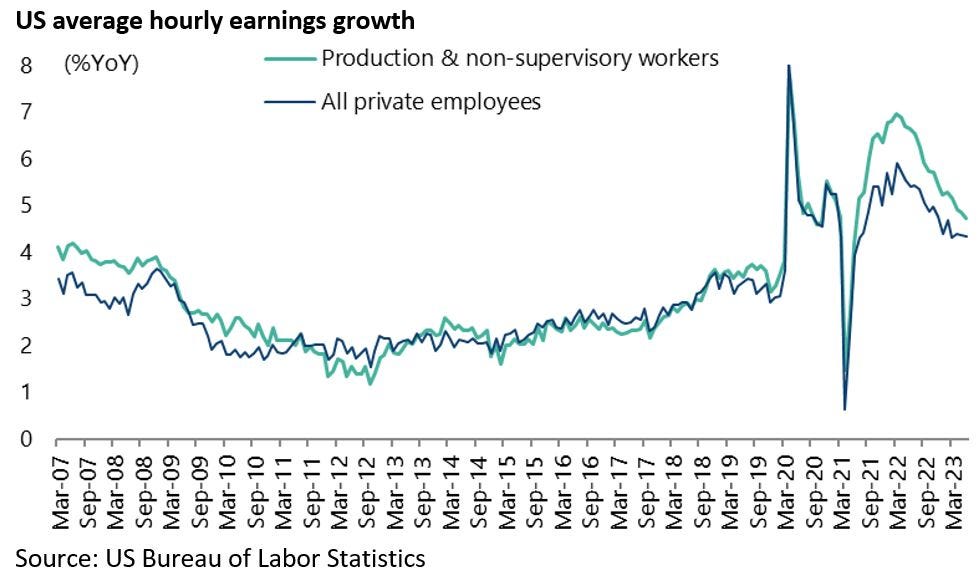

It is worth highlighting, in particular, that weekly hours worked have been on a declining trend for several months while wage growth is also slowing.

Thus, average weekly hours worked per private employee have declined from 34.6 hours in January to 34.3 hours in May and 34.4 hours in June or down 0.6% YoY.

While average hourly earnings growth for private employees has also slowed from 4.7% YoY in February to 4.4% YoY in June, and is down from 5.9% YoY in March 2022.

The unemployment rate has also risen from 3.4% in April to 3.7% in May, the highest level since October 2022, and was 3.6% in June.

The next employment data is due on Friday.

The base case remains a further weakening of the US job market in the months to come, though the political pressure on the Fed to pivot will only likely kick in in the context of headlines reporting a decline in job generation.

US nonfarm payrolls increased by 209,000 jobs in June, though down from 306,000 in May (see previous chart).

Meanwhile, the continuing failure of the labour participation rate to rise to pre-pandemic levels also raises the question of whether European-style welfare programmes in Democrat-governed states have changed incentives in the labour market.

It is certainly a possibility to consider though it cannot be proved in a spreadsheet.

The US labour force participation rate remained unchanged at 62.6% in June, compared with the pre-pandemic level of 63.3% in February 2020.

As for the fudge reached on the debt ceiling in early June, that suggests that both major political parties do not want to be blamed for a fiscal crisis, with the next deadline for the ceiling rescheduled to 1 January 2025.

This fits conveniently with the next inauguration due to be held on 20 January 2025 following the presidential election on 5 November 2024.

Still it should be noted that the debt ceiling was simply suspended until January 2025.

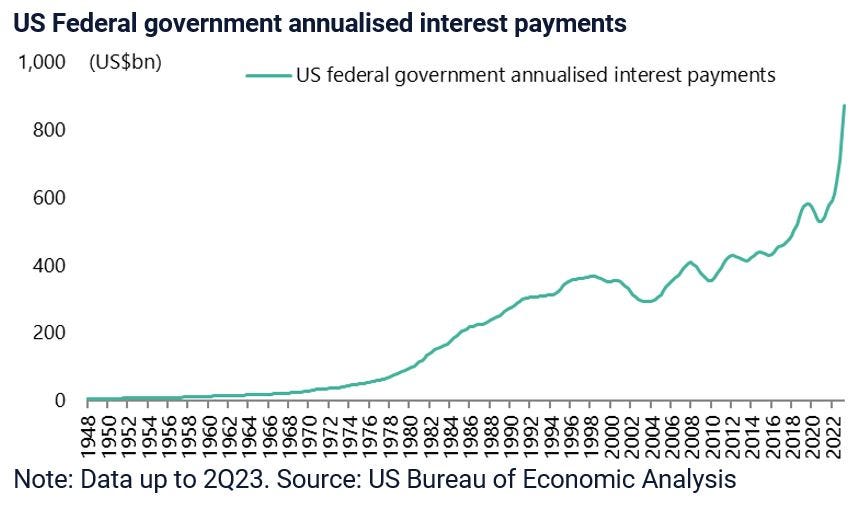

Looking forward, the federal government debt level is likely to be around the US$35tn level when the deal expires, compared with the current debt ceiling of US$31.4tn, while the annual cost of funding that debt will likely be around the US$1tn level.

Federal government interest payments totaled US$872bn in the 12 months to June reflecting higher Treasury bond yields.

Dear ladies and gentlemen,

I am a subscriber and do not know how to access to the subscription content.Can yu help me?