Economic Boom? What Does the Data Say?

Author: Chris Wood

The consensus of markets prior to the US presidential election was that a Federal Reserve easing cycle has begun and that, in the much-anticipated soft landing, the Federal funds rate should be at 3.5% by the middle of next year.

Still, in financial markets it is always necessary to consider alternative narratives, most particularly in this post-pandemic US cycle which has been more bizarre than any this writer can remember; which is also why it does not make sense to be too dogmatic about the macro outcomes.

In this respect, one alternative narrative is the delayed impact of monetary tightening leading to a real economic downturn rather than the widely anticipated soft landing.

The risk of such an outcome remains best reflected in the M2 to nominal GDP chart.

The US M2 to nominal GDP ratio has declined to 0.720 in 3Q24 or 4.7% below the pre-Covid trend, down from 0.722 or 4.1% below trend in 2Q24 and a peak of 0.887 or 25.7% above trend in 2Q20.

What if an Economic Boom is Ahead?

Still there is another alternative narrative for which most investors were not positioned for.

That is that the US economy runs hotter than anticipated, most particularly with the pro-cyclical policies espoused by president-elect Donald Trump.

This is why it makes sense to continue to keep a close eye on US bank credit growth which, for now at least, appears to have stabilised at a lower level.

US commercial banks’ total loan growth slowed from 12.4% YoY in early December 2022 to 1.6% YoY in March 2024 and was 2.5% YoY in the week ended 6 November.

Still if the aim was to hype up the case for a surprise pickup in economic activity this writer would highlight that US monetary aggregate growth has of late risen on an annualised basis.

US M2 rose by 2.6% YoY in September and was up 3.8% on a 3-month annualised basis.

As for the narrower monetary aggregate, US M1 also rose by an annualised 2.4% in the three months to September and was up 0.2% YoY.

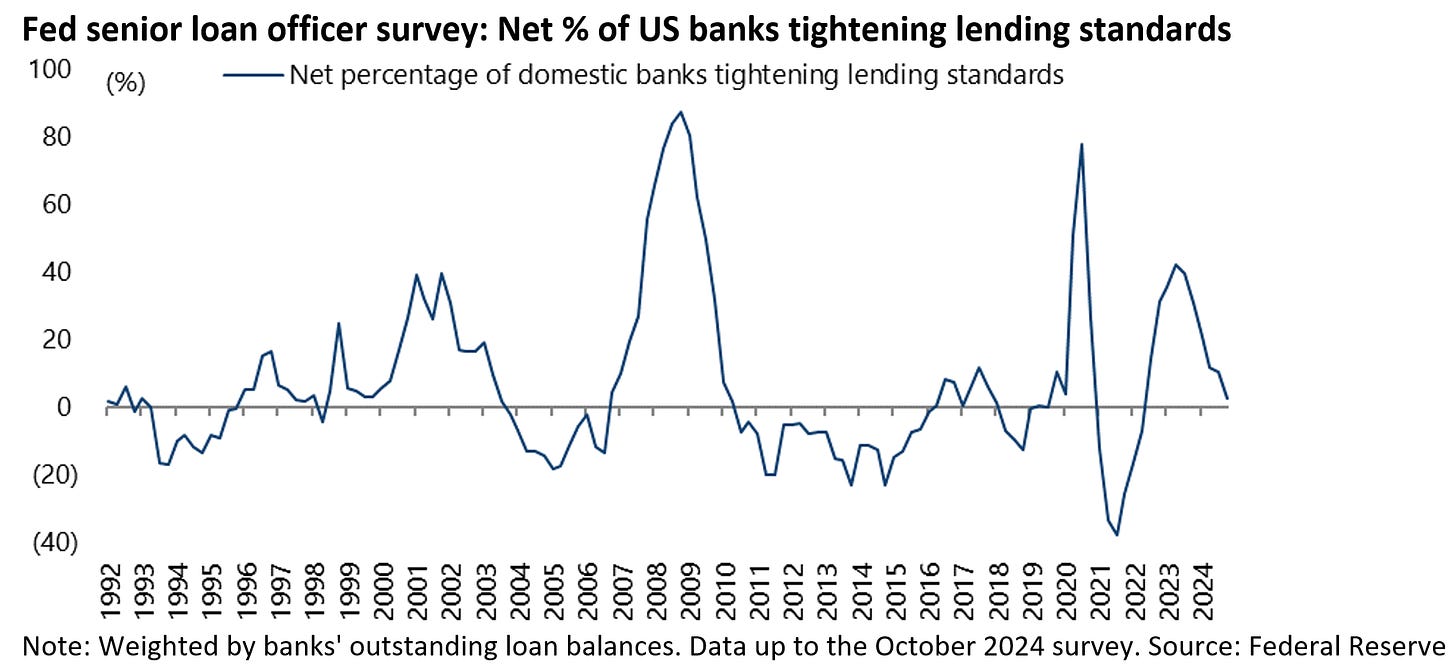

It is further the case that the last six Fed senior loan officer surveys have shown an easing of lending standards, or at least a consecutive decline in the net percentage of banks reporting a tightening of credit standards.

Thus, the net percentage of US banks tightening lending standards across all categories of loans has declined from a recent high of 42% in the April 2023 survey to only 2.5% in the October 2024 survey.

Budget Deficit is a Risk Factor to Watch

Then there is the reality that the Federal government continues to spend a lot of money which, in the short term at least, is a stimulus to growth.

Moreover, the spending is accelerating as reflected in the chart below showing Federal government spending in the post-pandemic era.

US Federal government outlays rose by 33.2% YoY in the three months to October, after rising by 34.5% YoY in the three months to August, the highest such growth rate since the three months to March 2021.

The continuing surge in Federal government spending is the reason why the fiscal deficit is running so hot and why government and healthcare/social assistance jobs have accounted for 65% of the increase in nonfarm payrolls in the 12 months to October.

Meanwhile, net interest expense and entitlements are running in the 12 months to October at an enormous 94% of total government receipts.

What about the breakdown of government receipts in terms of tax revenues and the like? The details are as follows. Federal government receipts in FY24 (October 2023 – September 2024) totaled US$4.92tn, of which personal income taxes and corporate income taxes accounted for US$2.43tn and US$530bn respectively, accounting for 49.3% and 10.8% of total receipts, while social insurance and retirement receipts accounted for US$1.71tn or 34.8% of the total.

Emerging Markets are Hoping for More Fed Easing

Clearly, from an Asian and emerging market standpoint, it would be fantastic if the anticipated Fed easing cycle takes place, and the US dollar weakens accordingly.

For this would allow emerging market central banks to cut rates in the context of their currencies appreciating.

But Trump’s election has triggered renewed dollar strength on the view that his policies will be pro-growth. The US dollar index is up by 4.1% since the election.

If the Trump victory has been so far predictably risk-on for US equities, given the combination of tax cuts extended, a renewed deregulatory drive and the adoption of supply side policies such as not taxing overtime or tips, the US dollar strength is also not so surprising given the pro-growth agenda.

However, longer term fiscal deterioration remains the key risk to the dollar.

Meanwhile, where this writer has most conviction is on the continuing structural bearish view on Treasury bonds.

If the US economy surprises by its resilience, or geopolitics escalates, Treasury bonds sell off given that wars are inflationary.

But if the economic downturn finally happens, long-term Treasury bonds will not perform in the way many might anticipate because the fiscal arithmetic will simply become unsustainable.

Personal and corporate income tax revenues in the last five US recessions declined by an average of 13% or 2.1 percentage points of GDP.

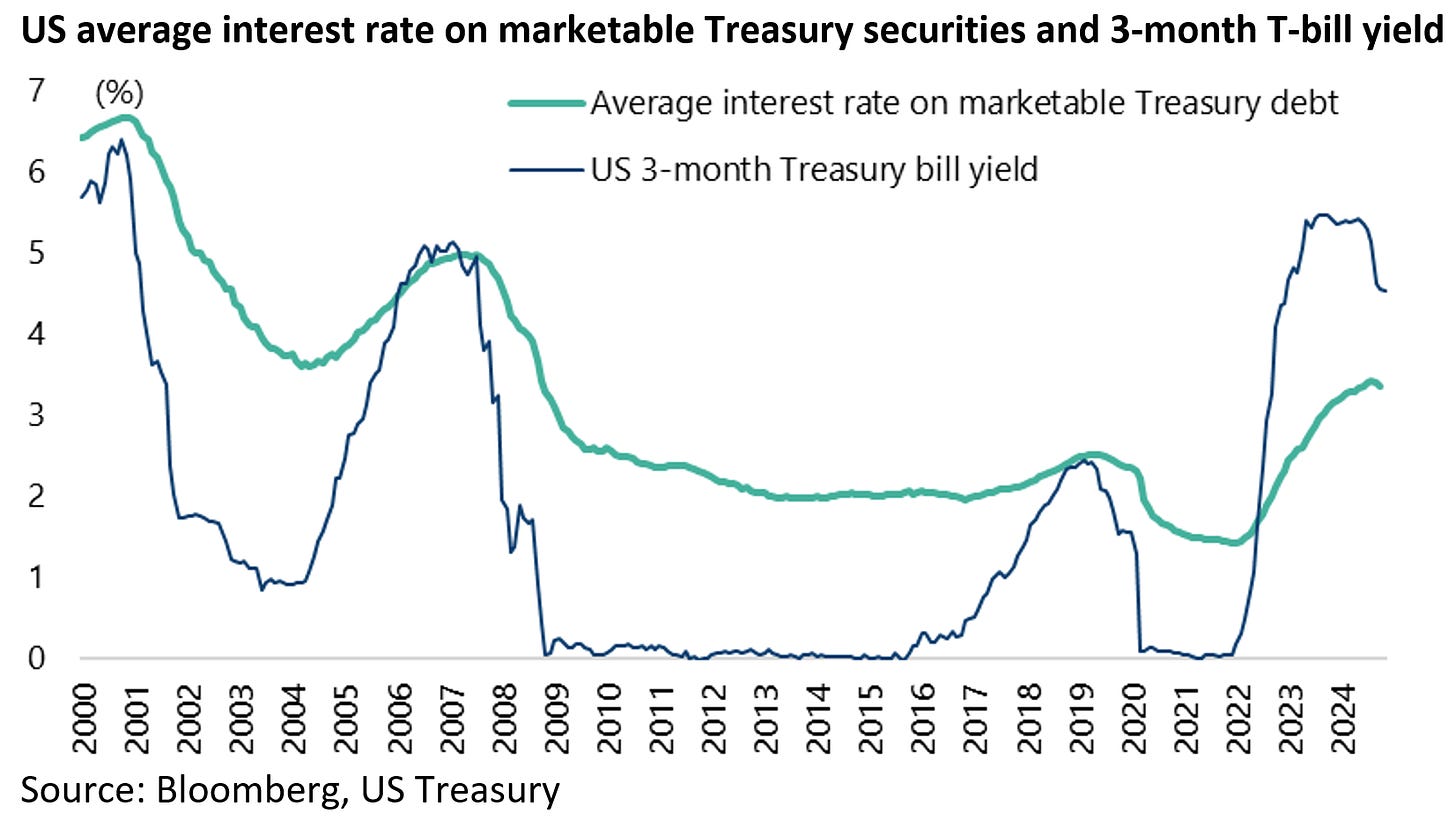

It should also be noted again that US$15.1tn, or 54% of outstanding marketable Treasury securities, will mature in the next three years, including US$9.3tn or 33% of the total maturing in the next 12 months.

The average interest rate on marketable Treasury securities is now 3.36%, compared with the three-month Treasury bill yield of 4.53% (see following chart).

This is why one unacknowledged reason for recent Fed rate cuts is to get the federal government’s cost of debt servicing down.

Thank you for the as always excellent analysis. It seems that regardless of Doge and improved growth thanks to reduce regulation, a return to QE or yield curve control will be necessary thanks to the debt dynamics ?

It would seem that this remains unpriced while it's the base case for Europe/UK/Japan leaving the door open for a dollar air pocket