Disruption Edge: Our Bull & Bear Take on AI, Key Metrics We Watch & Meta Earnings

The Research & Quant team is coming to you this week to discuss our current views on a few topics:

The AI Investment Theme - Both bull and bear arguments

Meta’s earnings and why we cut our portfolio weight.

The best risk reward in AI: Picks and shovels & three names we own

Key metrics to judge if AI is a fad or a true revolution in productivity and intelligence

1. Meta’s Earnings and Mark Zuckerberg’s Leadership

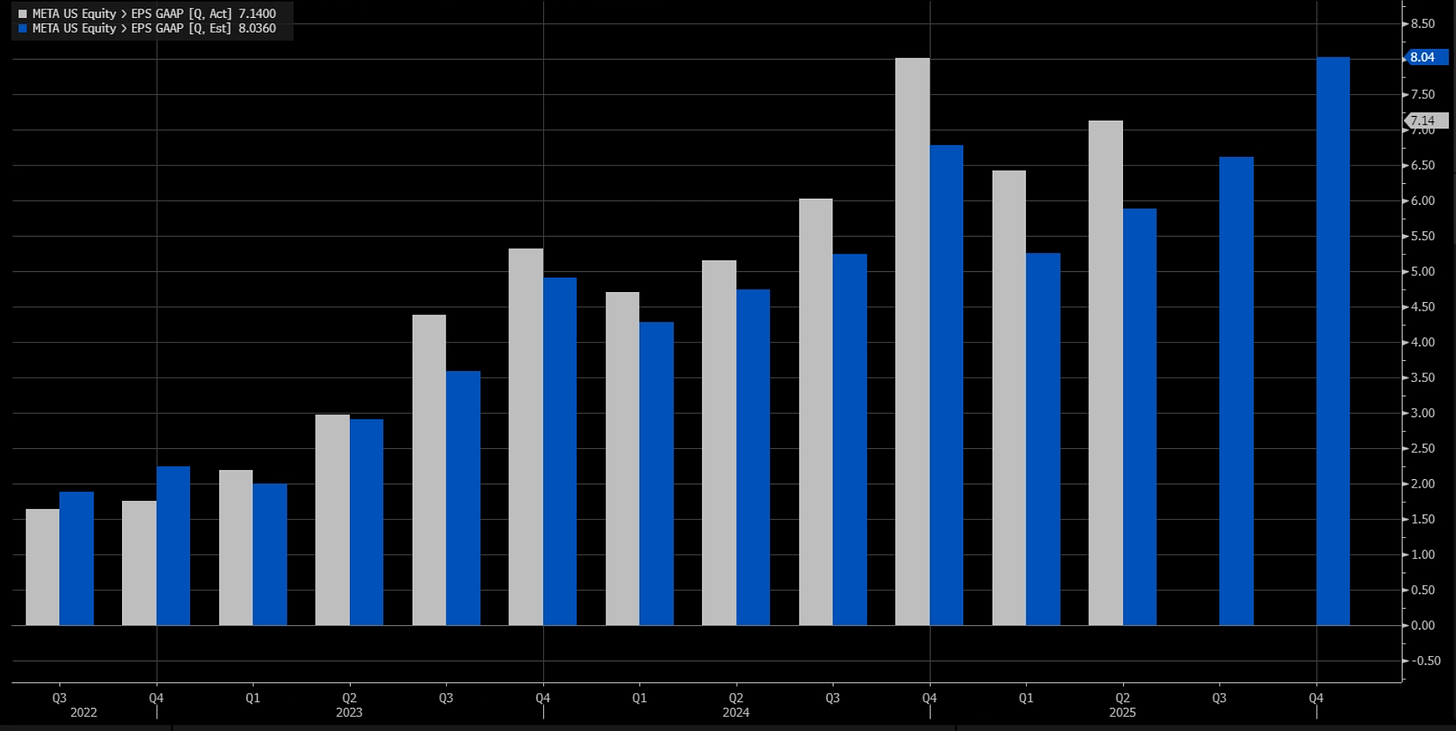

Let’s kick it off with Meta’s strong earnings the resulting rally in the share price. The rally was driven off both the impressive top (revenue +22% y/y) and bottom line (eps +36% y/y) growth; large-cap technology stocks are among the most underweight for active US institutional fund managers - we believe many have been forced to cover off their underweight portfolio risk.

We view Mark Zuckerberg as a uniquely driven CEO in today’s big tech landscape. Unlike Jeff Bezos, the Google founders, or other former leaders who have stepped away, Zuckerberg remains deeply engaged and hungry to grow the company. We also see his level of control through Meta’s share structure as a key advantage, allowing him to pivot faster than peers such as Tim Cook or Sundar Pichai. There’s no big tech leader who’s as hungry as Mark Zuckerberg left. He’s going full tilt every day.