Commodity Stocks are too Damn Cheap, Nvidia, India & Bitcoin's Ascent

The Exchange ETF Conference in Miami was dominated by the spectacular launch of the Bitcoin ETFs. There is an unprecedented full court press to convince investment advisors to integrate Bitcoin within their client portfolios as a ‘store of wealth’ asset class.

The asset inflow numbers have been nothing short of staggering. Since the January 11th launch the total net inflow into the Bitcoin ETFs is $5 billion, and $2.3 billion of that came in last week alone.

Prior to the ETF launch Grizzle’s view was that the consensus numbers on the first year of asset inflow were far too conservative ($10-$15 billion); we believed $50 billion was a far more realistic target using the 1st year BTC ETF penetration levels observed in Canada.

We’re currently on a 1 year run rate in excess of $50 billion, this is enough capital flow to send Bitcoin well above all time highs. In this backdrop owning equities with operational exposure to Bitcoin is the optimal way to play the price squeeze - we highlighted our preferred 5 names in our Bitcoin ETF Blitz report.

Unloved Commodity Stocks Getting Attention

Last week SEC filings highlighted that Stanley Druckenmiller’s family office was rotating out of tech bellwethers Alphabet and Amazon into gold miners Barrick and Newmont.

Additionally, Jeremy Grantham of GMO stated that commodity stocks are one of the few deep value opportunities remaining in the global market. He believes we’ve run out of the cheap commodities and prices will have to rise to incentivize new supply - while the resource equities have been smashed and are wildly cheap.

When heavy weight investors put their flags in the ground it brings broader investor attention to one of the few undervalued opportunities in the market.

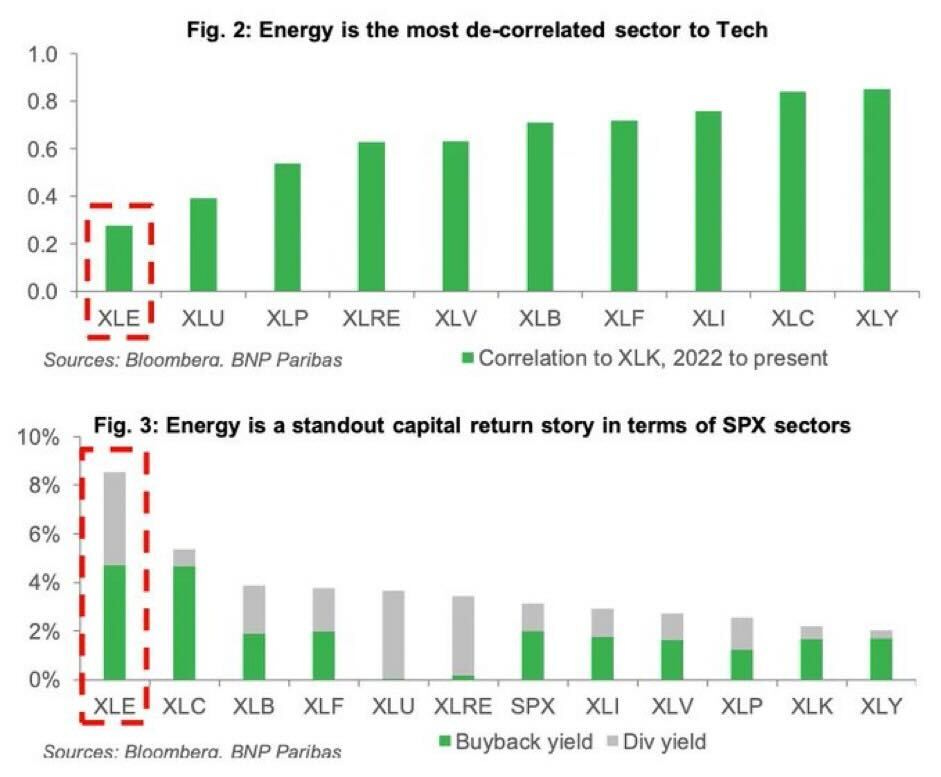

Resources also have the added benefit of being uncorrelated to technology and offer the most capital return. The chart below highlights the U.S. Energy ETF (XLE) as the sector providing the most diversification benefit vs. technology stocks and highest capital return (buybacks + dividends) in the market.

With respect to yield, Grizzle’s quality dividend yield strategy in the energy sector continues to standout among commodity equities. Since the publication (April 25 ‘23) of the ‘Hunting for Elite Dividend Yields in Oil & Gas’ the top decile of quant study has returned +6.5%, outperforming global commodity stocks (S&P Global Natural Resource ETF) by 8%.

Text-to-Video AI = More Chips. Long Nvidia

The rate of change in artificial intelligence is nothing short of staggering, last week OpenAI unveiled Sora it’s text-to-video AI tool that instantly makes short videos based on text prompt.

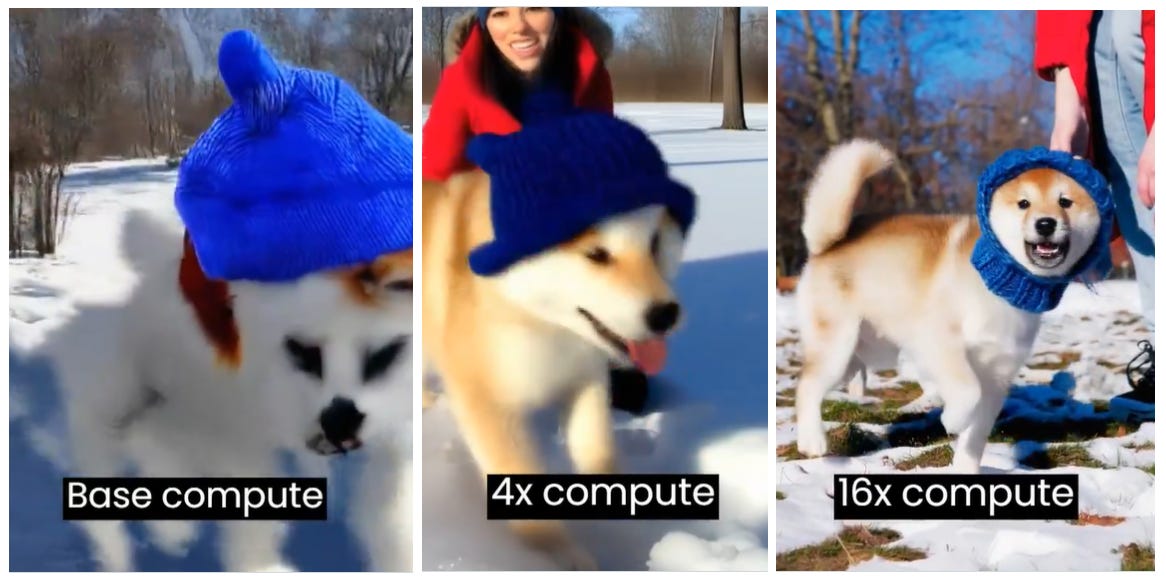

The speed and quality of the output is unbelievably high; categorizing it as a “gamechanger” feels very understated. What we’d like to highlight to investors is the rate of change of AI, this has a direct impact on the demand for chips from Nvidia.

The images below are the from this video that highlights the change in video quality at varying levels of compute.

In 2018 Open-AI highlighted that since 2012 the amount of compute used in the largest AI training runs has been increasing exponentially with a 3.4-month doubling time (vs. 2 years for Moore’s Law).

To understand the high barriers to entry for any competitor to enter Nvidia’s arena we strongly recommend watching this short video by Ben Gilbert of the Acquired Podcast. Simply put, increasing compute demand from applications like text-to-video will drive increased demand from the leader in the space: Nvidia.

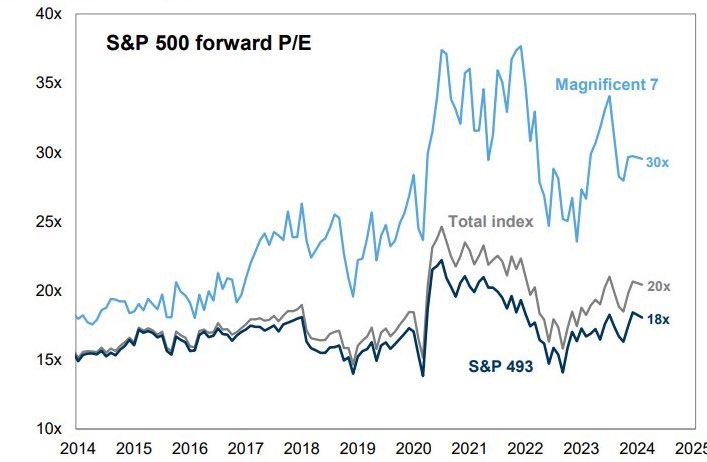

The biggest push back is valuation; let’s look at the Magnificent 7 - currently trading at a forward P/E of 30x is reasonable if we view AI as internet-light in disruptive terms (and it certainly could be in-line if not greater). At the peak of the dot-com bubble the Forward P/E of the Nasdaq 100 was 80x.

With respect to Nvidia, looking out 2 years the stock trades at 29x forward P/E - we believe consensus is behind the curve and when we look out a year from now that 29x will fall to 19x. We’re firmly in DARP territory with the stock - disruption at a reasonable price.

Let’s have a look at the 2024 EPS upgrade trajectory, in a matter of 6 months the street went from $4.30/share to $12.30/share.

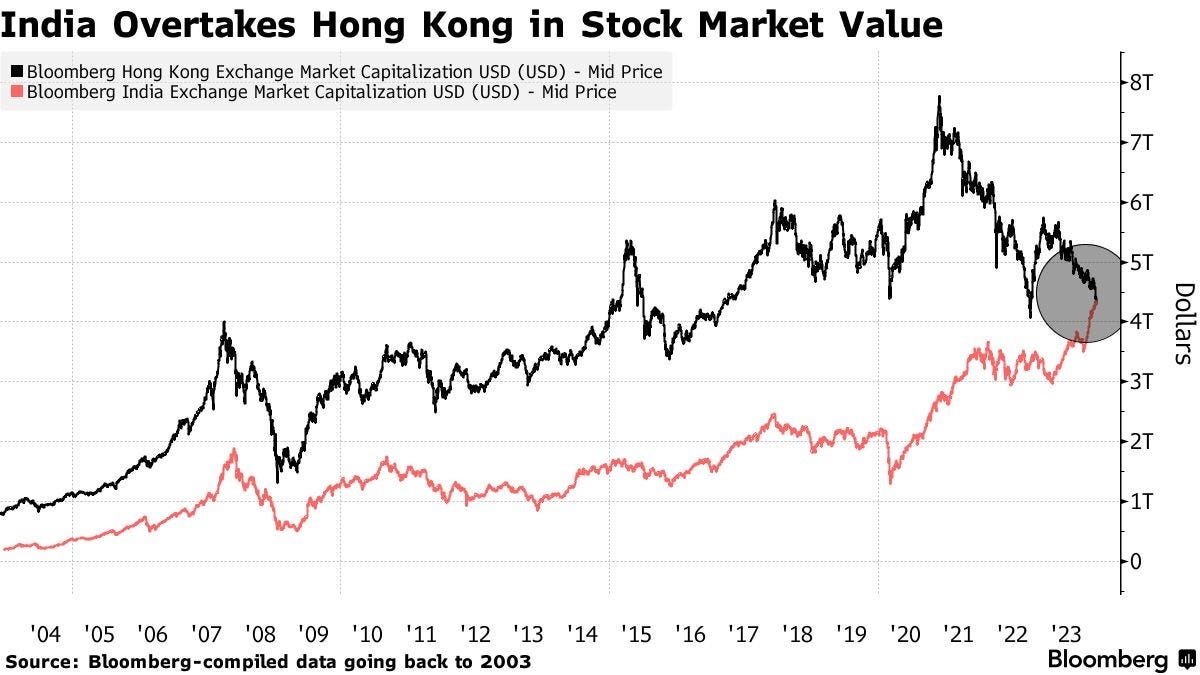

India the Emerging Market Powerhouse

Jeff Gundlach during his keynote at that Exchange ETF conference stated that the Indian market is one of best structural longs for investors. As capital flees the Chinese stock market, India has been the primary beneficiary.

Grizzle’s Market Strategist Chris Wood is a longstanding structural bull on the Indian market, you can find a great summary of the bull thesis he wrote for Grizzle (June, 2022) here: “Why India is the Best Growth Story in Asia - Grizzle”.

The residential property and broader capex cycle are just beginning an upward trend in India, making it our preferred emerging market to own globally. Housing affordability is the highest in 20 years while Indian consumers only have 5% of their net worth in stocks, a tailwind to local markets.