Chinese Stocks Need a Catalyst, but Where Will it Come From?

Author: Chris Wood

The Economist cover syndrome is always a potential contrarian signal as history has demonstrated.

And sure enough this writer noted the “Peak China?” cover on a recent issue though, to be fair, there is a question mark (see The Economist: “Peak China?”, 13 May 2023).

There are certainly some plausible arguments for the peak China point of view.

Indeed, when it comes to demographics or indeed household formation, the argument that China has peaked is not controversial at all.

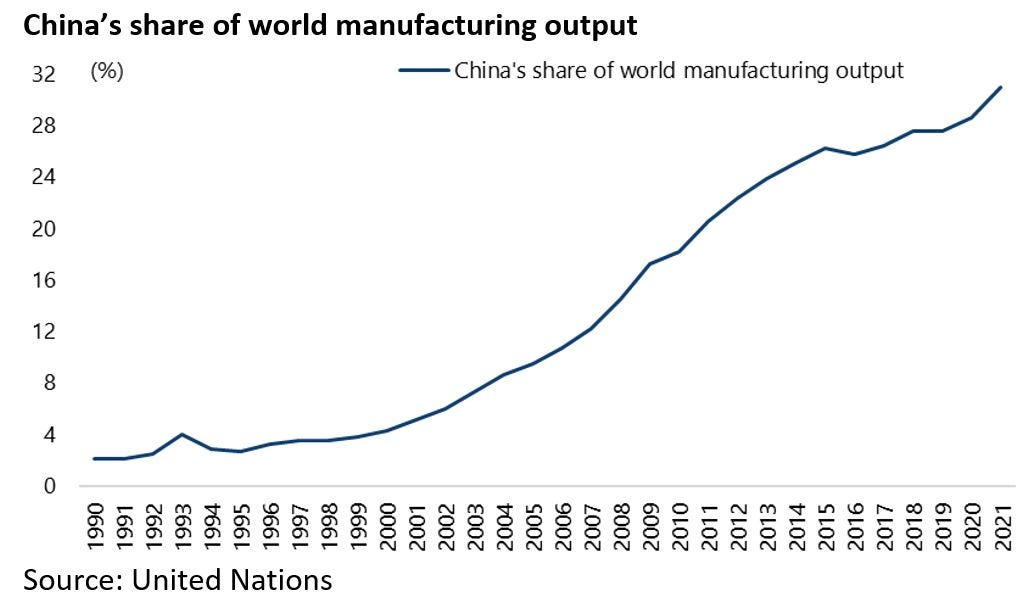

It is also the case given the US attack on globalisation, reflected in last year’s bizarrely named Inflation Reduction Act, that China’s share of world manufacturing output has also likely peaked at 31% in 2021.

Still when it comes to the more narrow subject of investing in Chinese stocks, the issue is not whether China has peaked but whether global investors will ever buy Chinese stocks again since this year they have only seemed to want to buy so-called China shadow plays such as European luxury stocks.

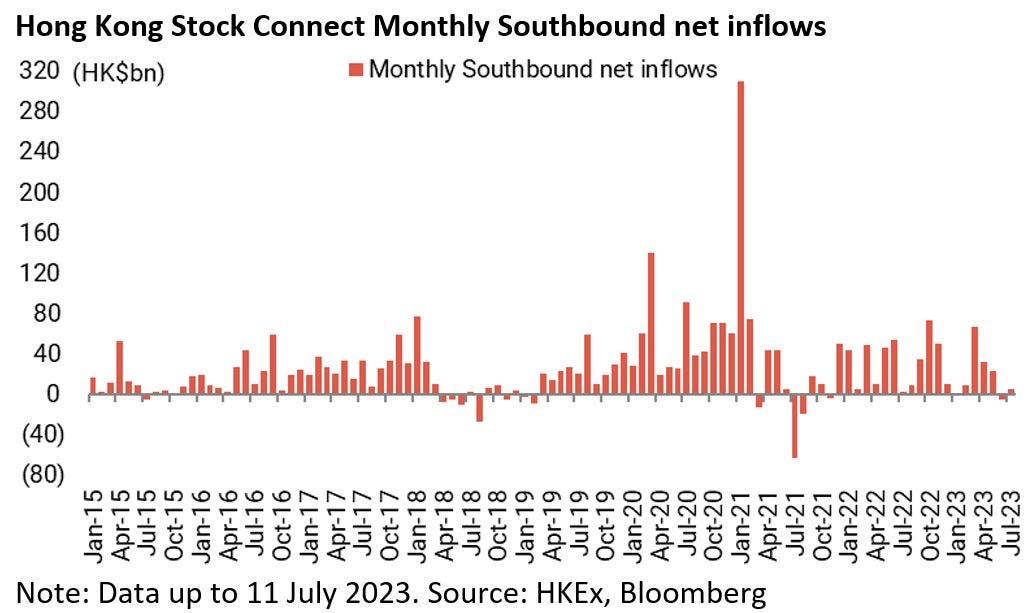

The above means that Chinese stocks require a catalyst to perform in absolute terms which probably means, among other things, an increase in Southbound flows on the Hong Kong Stock Connect.

That is mainland money investing in Hong Kong quoted stocks.

For now there is no such sign.

Hong Kong Stock Exchange Southbound flows declined from a net inflow of HK$67.1bn in March to a net outflow of HK$5.8bn in June, though it has turned into a net inflow of HK$5.1bn so far in July.

China's Investor Sentiment is Getting Worse

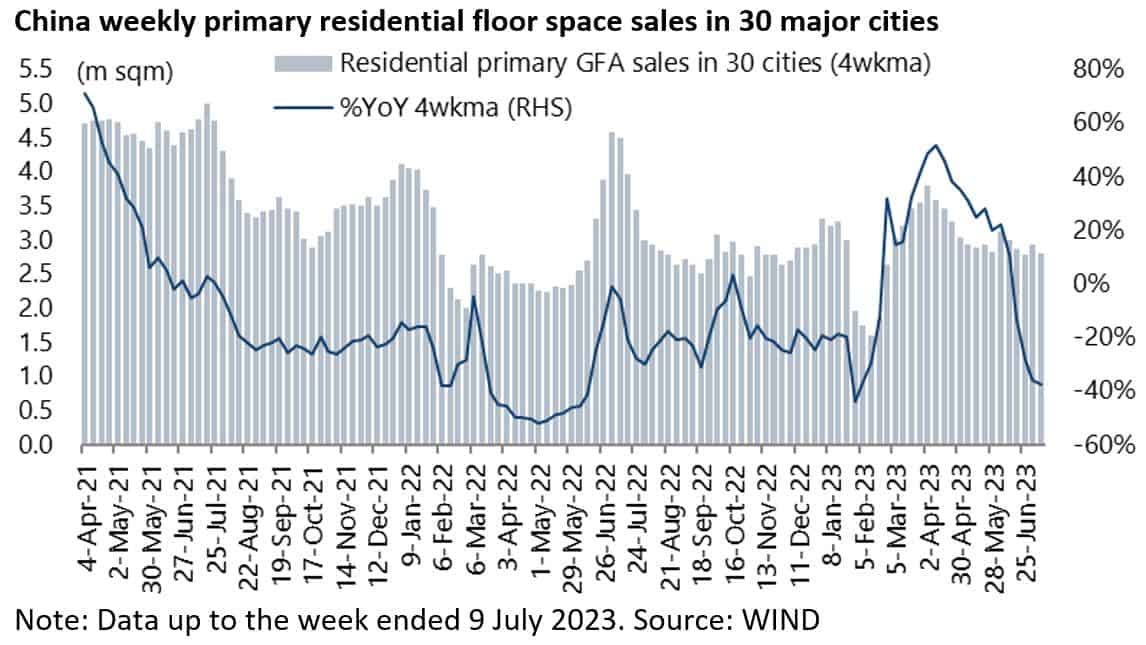

In the meantime, investor sentiment towards China has grown progressively worse as reflected in a renewed downturn in residential property sales last quarter.

This suggests that the pent-up upgrading demand seen on the re-opening of the mainland economy has initially been satiated.

Average weekly residential primary floor space sales in 30 major cities declined from 3.78m sqm in the four weeks to 2 April to 2.79m sqm in the four weeks to 9 July, down 38% YoY.

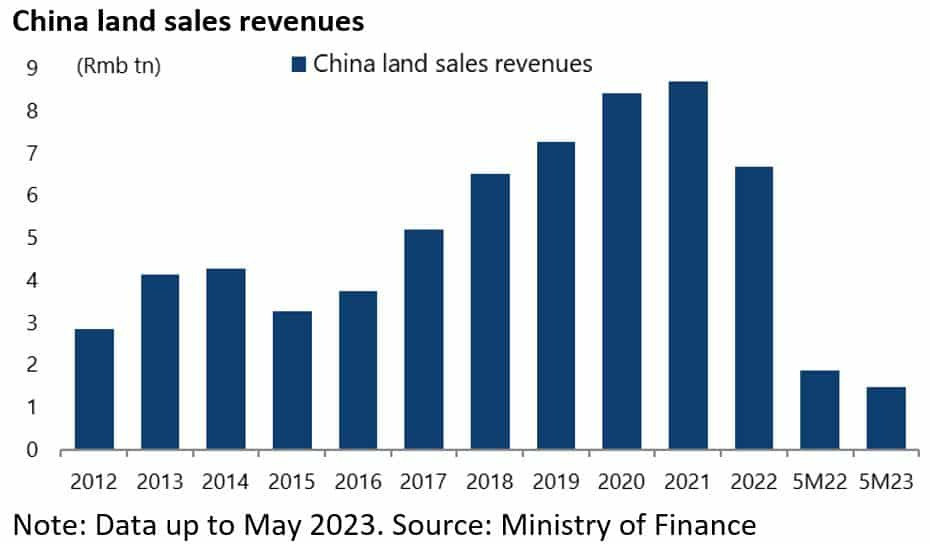

As for land sales, it normally takes three quarters after the commencement of a new property cycle for land sales to pick up.

But given the renewed decline in property sales last quarter, investors have now given up on any pickup in land sales.

This has ominous implications for local government finances given their historic dependance on land sales.

China’s local government land revenue declined by 20% YoY to Rmb1.49tn in the first five months of this year

Land sales accounted for 42% of local government revenue in 2021 and 37% last year.

What is a "Shantytown Redevelopment Policy"?

Meanwhile, if the property market continues to disappoint in coming months, the prospects will grow for some new version of the “shantytown redevelopment” policy introduced in 2015 which had the effect of absorbing a lot of inventory in the smaller cities.

Thus, the central government began in 2015 to encourage local governments to allocate money directly to so-called shantytown residents for the purchase of existing private housing inventory.

Interestingly, the inventory in smaller cities is now back at around the same level as it was then (24 months) when the original scheme was launched.

Meanwhile, investors’ negative response to other recent data deemed to be disappointing needs to be put in some context.

Retail sales rose by 18.4% YoY in April and 12.7% YoY in May.

This is hardly a disaster.

Meanwhile, the China services PMI reached an all-time high of 56.9 as recently as March, though it has since fallen to 52.8 in June.

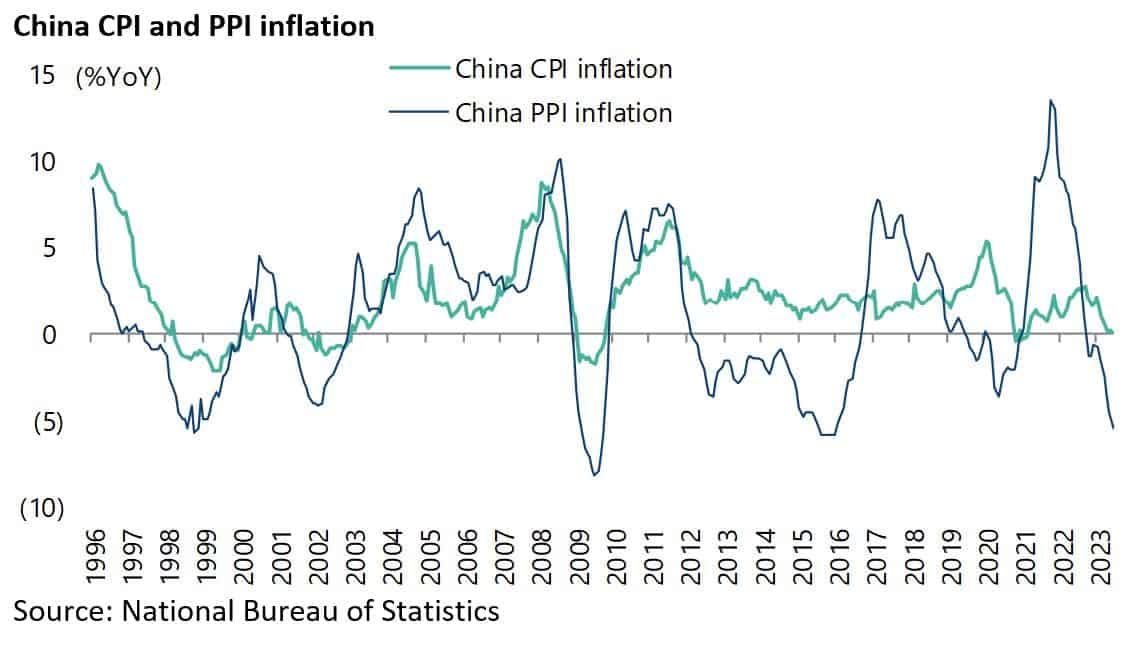

The other point is that, with CPI running at 0.0% YoY in June and PPI declining by 5.4% YoY, there is plenty of scope to ease more should the authorities wish to.

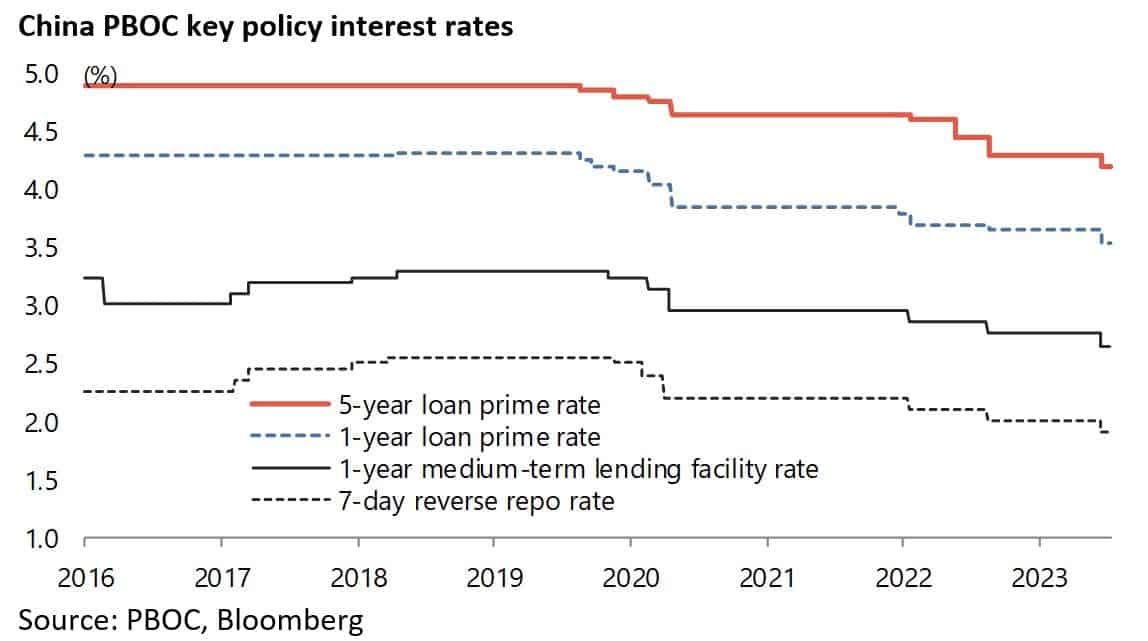

Still the base case remains for now no aggressive stimulus but rather continuing incremental easing.

The PBOC cut the 1-year medium-term lending facility (MLF) rate and the 7-day reverse repo rate by 10bp each to 2.65% and 1.9% respectively in mid-June.

The central bank then on 20 June cut the one-year loan prime rate (LPR) and the five-year loan prime rate by 10bp each to 3.55% and 4.2%.

Chinese Consumers Remain Cautious After a Nightmare 2022

The re-opening recovery in China this year was always likely to be focused primarily on the consumption and services sectors.

Still there is also no doubt that the dramatic build-up in household bank deposits during the pandemic also reflects an increase in precautionary savings and a more cautious Chinese consumer, which is not surprising given what happened in 2022 as regards Covid policy and given the growing talk and indeed evidence of factories moving out of China.

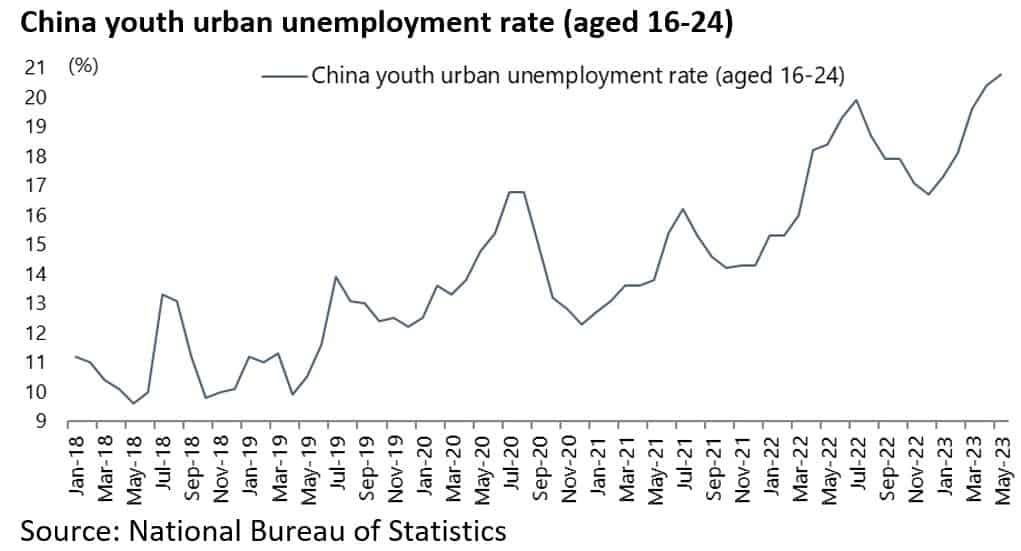

Unemployment also remains a real issue.

The youth urban unemployment rate (aged 16-24) rose from 19.6% in March to a record 20.8% in May.

The question now is whether the Chinese have turned Japanese on a permanent basis, in terms of a reluctance to spend, or only on a temporary one.

In this writer’s view, it is still too bearish to assume the former outcome at this juncture.

Still there is no doubt that the Chinese people have lost their unabridged confidence in the future, which was so manifest prior to the pandemic.

They are also much more aware of the country’s negative demographics than they used to be.

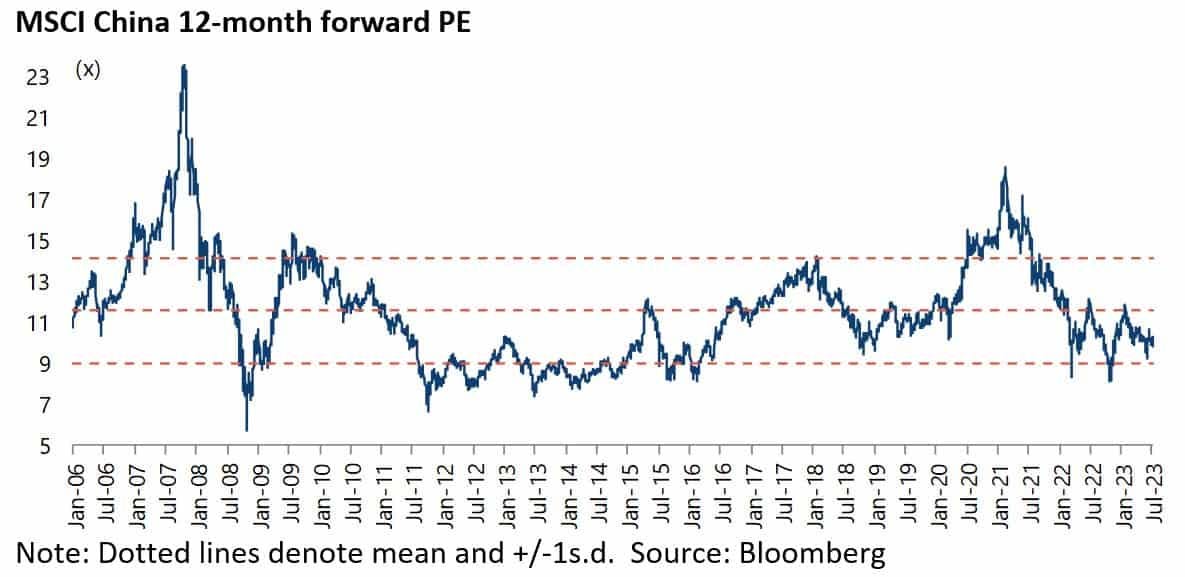

Chinese Stocks are Cheap Once Again

Meanwhile, Chinese stocks are cheap again but not quite as cheap as they were last October before the sudden re-opening of the economy.

The MSCI China now trades at 9.8x consensus 12-month forward earnings, though up from a low of 8.1x reached in late October 2022.

This compares with the long-term average of 11.6x since 2006.