Big Changes are Underfoot in Eurozone Politics

Author: Chris Wood

For understandable reasons, media focus remains primarily on US politics with a presidential election due to be held in November amidst all the drama driven by America’s divided electorate.

Still news reports this past quarter of farmers in the Eurozone demonstrating with their tractors against the impact of “green” policies on their livelihood highlight that the European Parliamentary elections in June could turn out to be much more interesting than usual.

This is because there is a real possibility that in a growing number of European countries anti-EU parties could top the polls in the parliamentary elections.

On this point, a study by the European Council on Foreign Relations published on 23 January found that “anti-European populists are likely to top the polls in nine member states and come second or third in a further nine states”.

There are 27 member states in all.

This would certainly constitute a powerful rebuke to the policies being driven by Brussels of late, with the EU leaders on 1 February approving a €50bn package of further aid to Ukraine.

If green policies are one contentious issue and Ukraine another, the most contentious for the populist right remains immigration, where Ukraine is also a factor, with 4.2m Ukrainians now having effectively gained EU residency because of the conflict, though technically they are benefitting only from “temporary protection”.

All the above means that German politics has the potential to become the key fault line in Europe in the coming years.

With a gross 14m immigrants having entered the country since 2015, when then-Chancellor Angela Merkel opened the borders to Syrian refugees, the evidence is that a backlash is building.

In this respect, this writer came across the other day an earnest discussion on the official English language German TV channel on whether the Alternative für Deutschland (AfD) should be banned.

This is the political party which was recently polling up to a 20% support rating and which has a real possibility of winning power in the three state elections of Saxony, Thuringia, and Brandenburg, due to be held in September.

Banning the Far-Right AFD Party Isn't Practical, or Smart

The German political establishment, given the country’s history, is naturally ultra-sensitive to the rise of a perceived “far right” political party whose chief focus of late has been on immigration and the related focus, in the eyes of its growing number of supporters, on law and order.

For this reason, the established political parties have continued to refuse to engage with it.

But it has to be wondered how long this position can be maintained, particularly for the nominally conservative Christian Democratic Union (CDU), which risks ceding a growing portion of the conservative vote to the AfD, which seems to be doing a much better job than its long-established rivals at building networks on the ground.

Meanwhile there is a certain historical irony in terms of the arguments being made by those pushing for a ban of the AfD.

For the Nazi Party government of Adolf Hitler banned all political parties in July 1933.

For such reasons, the German Constitution of 1949 makes it extremely hard to ban political parties.

The other point is that efforts to ban the AfD are likely to have the same counterproductive effect as the four indictments and 91 charges levelled against Donald Trump have had, in terms of increasing support for the likely Republican presidential candidate.

A Weakening Economy in Germany Favors the Far-Right

Meanwhile, if the immigration and law-and-order issues are vote winners, the downturn in the German economy can also only be to the advantage of the likes of the AfD.

Real GDP declined by 0.3% QoQ in 4Q23 and was down 0.3% YoY in 2023, compared with a 1.8% YoY increase in 2022.

Real household consumption and gross fixed capital formation also declined by 0.7% YoY and 0.6% YoY respectively last year.

Exports of goods rose by only 0.4% YoY in January while imports fell by 8.2% YoY.

In this respect, it is worth noting that the AfD was launched in 2013 as primarily a Eurosceptic party.

That tradition has now been revived with growing talk in Germany of “Dexit” (i.e., the equivalent of Britain’s Brexit).

Such a development would be massive given Germany’s central importance to the Eurozone political project.

In this respect, it should be made clear that the current German political establishment, be it comprising the SPD, Greens, or CDU, remains fully committed to the Eurozone political project.

This is why the direction of travel remains towards de facto fiscal union, as reflected in the €724bn EU Recovery Fund, where 72% of the €648bn in allocated grants and loans is being extended to Southern Europe to the benefit of the likes of Italy and Greece.

Still the cost of this so-called “transfer union,” as its critics call it, is borne increasingly by the German taxpayer.

For this reason the move to de facto fiscal union is increasingly unpopular with German taxpayers, which is also a vote winner for the likes of the AfD.

When all of the above is combined with the existential risks facing the Germany’s auto sector and its related suppliers, the recent energy price shock which has hit German industry since it can no longer access cheap Russian energy and the growing evidence of production being moved from Germany to the US to take advantage of the uncapped subsidies from the US Inflation Reduction Act of 2022, then the potential for a massive political reaction against the polices of the current German coalition government becomes self-evident.

The next federal election in Germany will take place by October 2025.

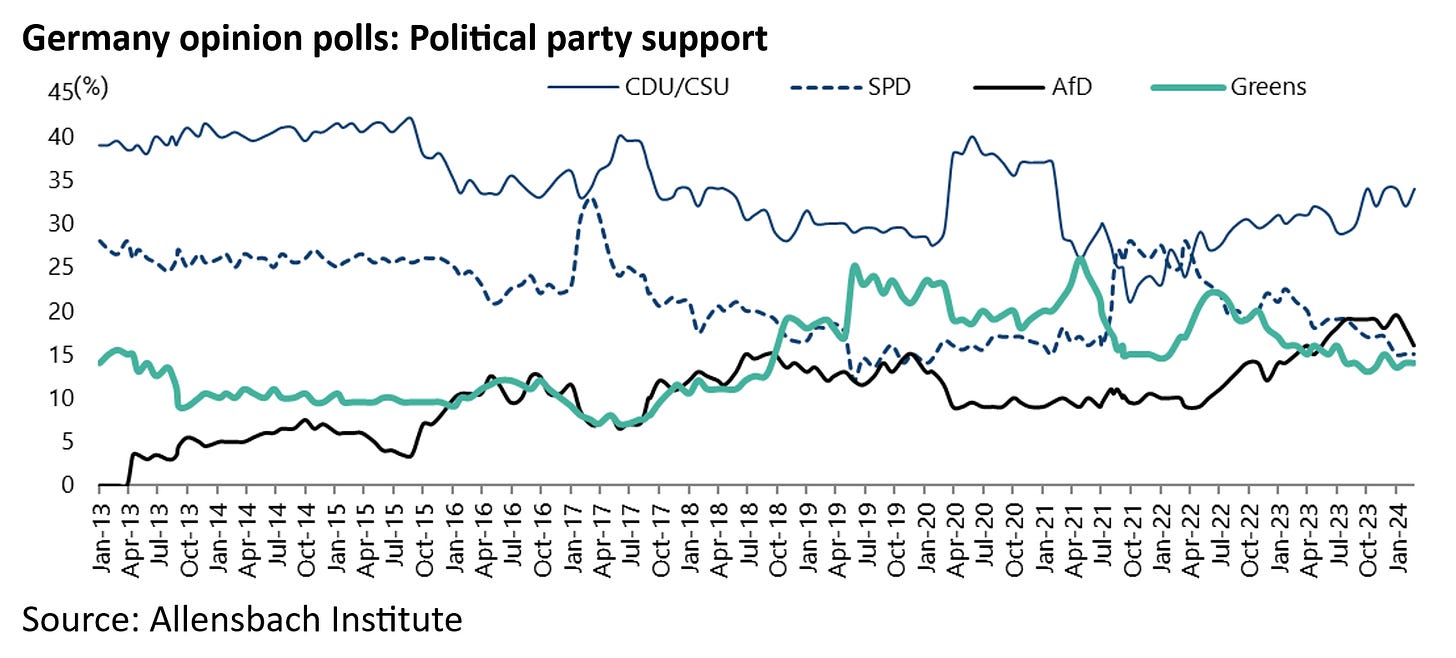

The current polling results for the major political parties are as follows: 31-34% of Germans support the CDU/CSU, with 16-19% for the AfD, 15-16% for the SPD and 13-14% for the Greens, based on two major opinion polls published in late March.

Still the polls are probably underestimating support for the AfD as voters may not want to admit to supporting it.

Politics Could Push the ECB To Cut Rates Sooner Than Expected

Staying on the subject of Europe, a word is due on the topic of monetary policy.

The base case has been that the ECB would make a move on interest rates after the Fed, most likely one meeting after. But based on the actual data, the ECB should be cutting first.

The Eurozone economy grew by only 0.1% YoY in 4Q23 compared with 3.1% YoY real GDP growth in the US.

Still, from a monetary policy perspective, the ECB has only one mandate, namely inflation, not, as is the case with the Fed, full employment.

That said, the potential for rising concerns about a right-wing populist wave in the forthcoming European parliamentary elections could just trigger a more proactive approach to rate cuts in coming months on the part of the ECB.

Very interesting! It could mean that the Euro could come under pressure in the forex markets.