Are US Small Businesses Ok?

Author: Chris Wood

The small business sector has become very important to monitor as regards the state of the American economy. The National Federation of Independent Business (NFIB) small business survey is the key data point.

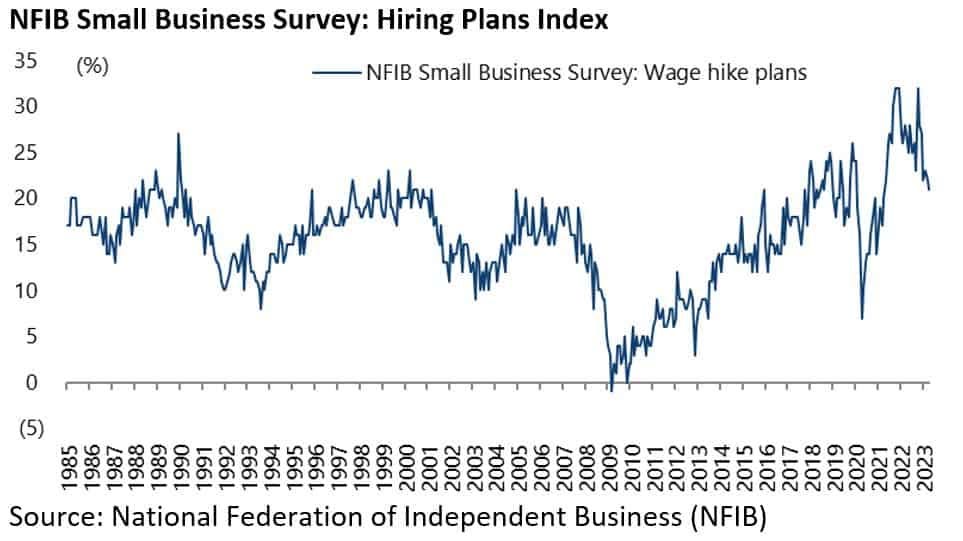

The latest small business hiring plans index showed that a net 17% of small business owners are planning to create new jobs in the next three months in April.

This is up from 15% in March which was the lowest level since May 2020, but well down from the recent high of 32% in August 2021.

Meanwhile wage hike plans are also in a decelerating trend.

A net 21% of businesses are planning to raise wages in the next three months, down from 22% in March and a recent high of 32% in October 2022.

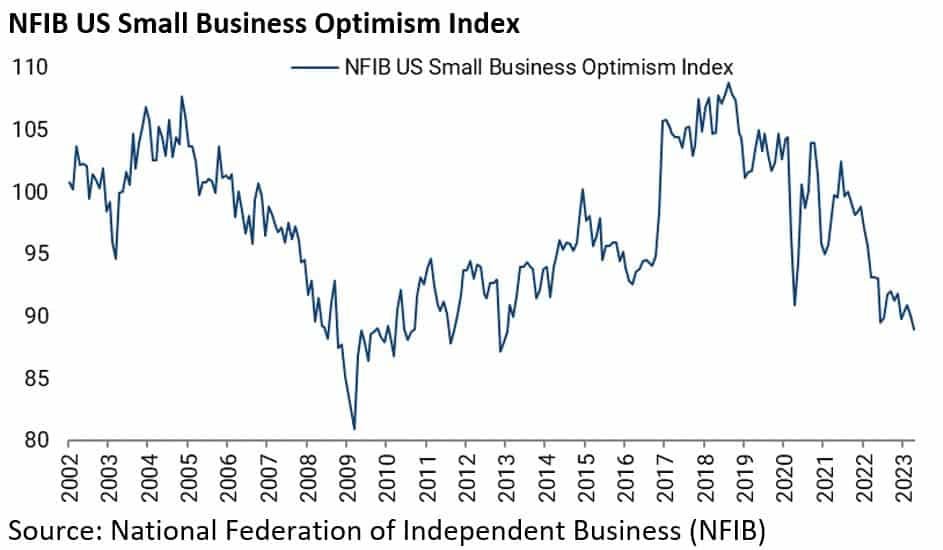

As for the NFIB small business optimism index, it fell from 90.1 in March to 89.0 in April, the lowest level since January 2013.

While the small business capex plans index also declined from 20% in March to a three-year low of 19% in April, down from 31% in October 2021.

Finally, the average interest rate paid on small businesses’ loans surged from 7.8% in March to 8.5% in April, the highest level since October 2007.

This writer’s recommendation is for investors to keep a close eye on the NFIB small business survey in coming months since it may well provide the best insight into growing recessionary pressures in America or the lack of them.

Banking Pressures are Easing, But Not Totally Gone...

Meanwhile a positive point is that banks are taking less money from the Fed’s new funding facility than was the case after it was initially set up in mid-March in the wake of the Silicon Valley Bank (SVB) failure.

Advances from the new Bank Term Funding Program (BTFP) totaled US$91.9bn as of 24 May, though the weekly increase in lending has declined from US$41.7bn in the week ended 22 March to US$4.9bn in the week ended 24 May.

By contrast, the Fed created the Term Auction Facility (TAF) in December 2007 to provide emergency lending for banks during the financial crisis, and the TAF balance ultimately peaked at US$493bn in March 2009.

The banks also tapped US$4.22bn from the Fed’s traditional discount window lending facility as of 24 May, though down from a peak of US$152.9bn on 15 March after surging from US$4.58bn in the previous week prior to the SVB failure.

This compares with the previous peak of US$111bn reached in October 2008 during the global financial crisis.

The Fed as of 24 May has also lent US$192.6bn to the “bridge banks” established by the Federal Depository Insurance Corporation (FDIC) in March to resolve SVB and Signature Bank, though down from US$228.2bn on 3 May.

These loans are booked in the Fed balance sheets as “other credit extensions” and are fully collateralised and guaranteed by the FDIC.

As a result, the balance of the above three credit facilities peaked at US$343.7bn on 22 March and was US$288.7bn as of 24 May.

This compares with the peak combined balance of the TAF and discount window of US$560bn reached in March 2009.

Problem's Emerging in Commercial Real Estate

If this is the state of play in the banks, this writer’s base case remains that, if there really is a recession in America as remains the base case here, then the real “surprise” factor to hit financial markets in terms of credit problems will come from the “private” area of credit as previously discussed here (When Will The Recession Start? The Answer May Surprise You, 3 May 2023).

Still, as one of the consequences of the ripple effects from SVB, there has of late been renewed focus on the downturn in commercial real estate in the US.

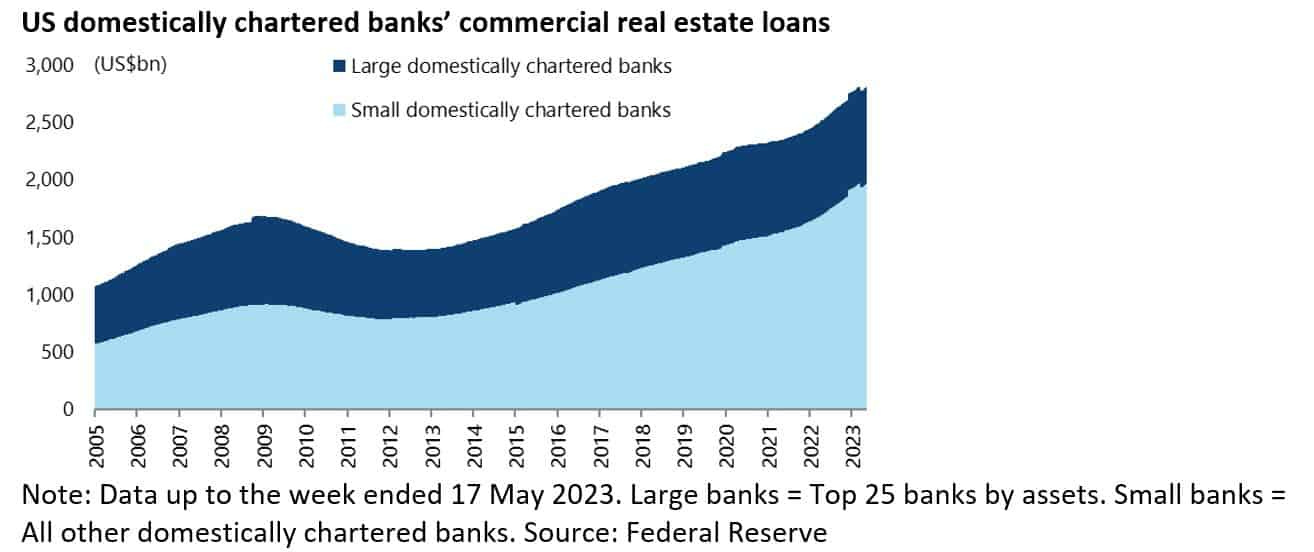

This is entirely understandable given the structural threat to office property represented by the work-from-home phenomenon, which seems most entrenched in America, and given that small regional banks account for 70% of domestically chartered commercial banks’ commercial real estate loans outstanding which totalled US$2.81tn as of 17 May, according to the Federal Reserve.

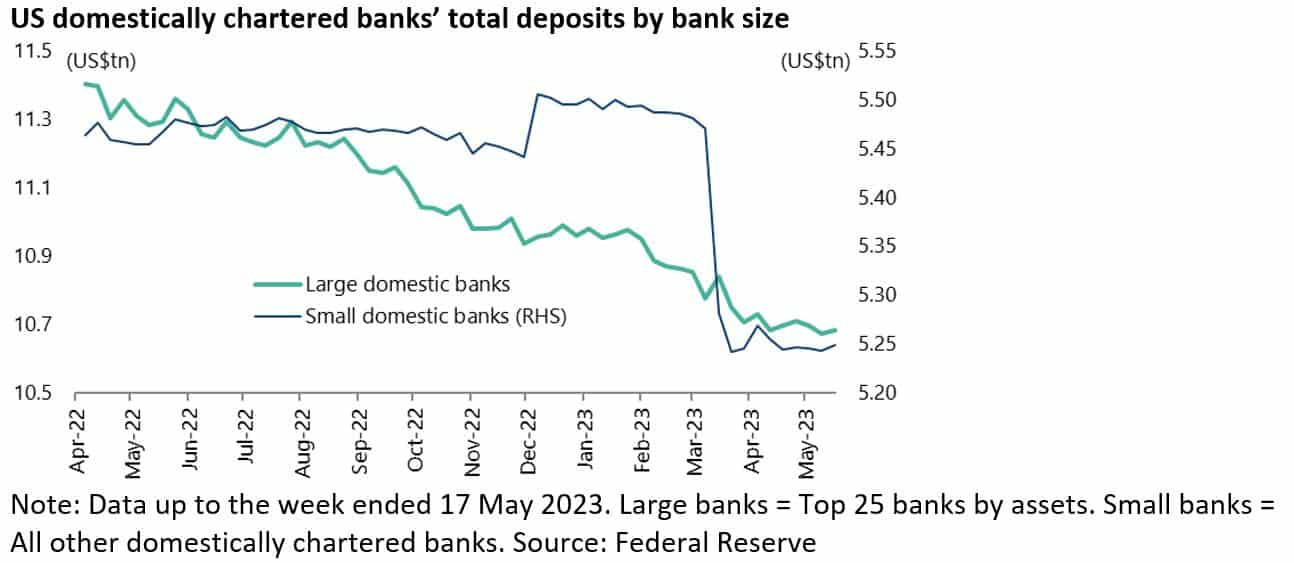

And it is, of course, the regional banks which have of late suffered the biggest outflow of deposits.

US small domestically chartered banks’ deposits have declined by US$221bn or 4.0% since 8 March, while large domestically chartered banks’ deposits have fallen by “only” US$91bn or 0.8% over the same period.

It should be noted that small banks are defined by the Fed as all domestically chartered commercial banks excluding the top 25 largest banks by assets.

While commercial real estate loans include construction and land development loans and loans secured by farmland, multifamily properties and nonfarm nonresidential properties.

The above deposit outflow means a seemingly inevitable tightening in regional banks’ lending standards is coming.

Still the positive point is that commercial real estate loans are usually financed long-term unlike leveraged loans which have been geared to a rising Libor.

Still US$728bn commercial and multifamily mortgages will mature this year, or 16% of such total loans, and another US$659bn next year or 15% of outstanding loans, according to the latest annual survey by the Mortgage Bankers Association released in February.

The other point is that there is a potential linkage between private equity and commercial real estate since the latter may have been used as collateral in many private equity deals.

.