An Exploration of Trump's View on Crypto, Short Term Treasuries and Yield Curve Control

Author: Chris Wood

“Trump and hubris” is a phrase that has come to mind of late.

It in part refers to the American president’s undoubted growing confidence that his tariff agenda will not derail markets.

It could also refer to Donald Trump’s misplaced confidence in his ability to negotiate a peace deal with Russia.

Still there is also another political thought in mind.

Will the Epstein Case Splinter the MAGA Movement?

That is whether the MAGA (Make America Great Again) movement, which is the foundation of the Trump political phenomenon, has the potential to splinter if not fracture.

In recent weeks it has become clear that the issue of the Trump administration’s stated refusal to release the FBI files on the death of financier Jeffrey Epstein has the potential for the first time to alienate the 47th president from his support base, or at least part of it.

That this has become a live issue was already clear from the fact that Republican House of Representatives speaker Mike Johnson on 22 July shut down the chamber one day early for the summer recess in order to avoid a vote on releasing files on Epstein.

It was also interesting to watch a network TV interview in mid-July with former Vice President Mike Pence on CBS News where he stated that he saw “no reason” all the files relating to Epstein should not be released (see CBS News article: “Mike Pence says ‘the time has come’ to release the Epstein files”, 16 July 2025).

Two months on and the issue has not gone away with Congress returning to business this past week.

Why is the Epstein case potentially so politically important?

In this writer’s view it goes back to the origins of Trump’s appeal to his supporters.

That is that he is perceived by the MAGA faithful as an outsider who has taken on the “Deep State” and the related “Washington swamp”.

Yet to the MAGA movement, or at least some of it, the Epstein case, with all the speculation regarding the prominent names thought to be in the Epstein files, represents a classic example of elites covering up for or defending other elites.

Indeed, this is why Trump himself brought up the Epstein case, and the alleged cover-up by his political opponents, during last year’s presidential election campaign.

If Trump’s image as an outsider has been a huge part of his political appeal to his base, on top of his undoubtedly superb marketing skills, this writer continues to believe that the origin of his political movement lies in the popular revulsion with and reaction against the bailouts of Wall Street back in the 2008 financial crisis.

The lesson drawn by most ordinary Americans, particularly those living in the so-called “flyover states”, from these events was that there is one rule for Wall Street and another rule for main street.

Trump has superbly exploited this phenomenon since he emerged as a political force more than ten years ago, and also staged one of history’s most remarkable comebacks in his presidential victory last November while at the same time effectively taking over complete control of the Republican Party.

Still there are potential market implications from the MAGA support team splintering, one of which being that it has finally given a recently toothless Democrat opposition a point of weakness to seek to exploit.

At the very least it makes continuing Republican control of Congress next November less likely.

Rising Crypto Prices Support the Government's Continued Reliance on Short Term Funding

But this in a way gives all the more reason for the 47th president to pursue his agenda aggressively now while he still controls Congress.

And this is what is happening as reflected in the recent passage through Congress of the OBBBA and the GENIUS Act.

As regards the latter, this legislation has created a regulatory framework for US dollar-pegged cryptocurrency tokens known as stablecoins.

This legislation should have the hugely practical benefit from a federal government perspective, given the Treasury’s reliance on short-term funding, of increasing the demand for short-term Treasury bills since the bill requires stablecoins to be backed by liquid assets such as Treasury bills.

Indeed Treasury Secretary Scott Bessent has openly referenced the demand for Treasuries that should be derived from this source.

This legislation has also brought the regulatory clarity the crypto industry has been looking for.

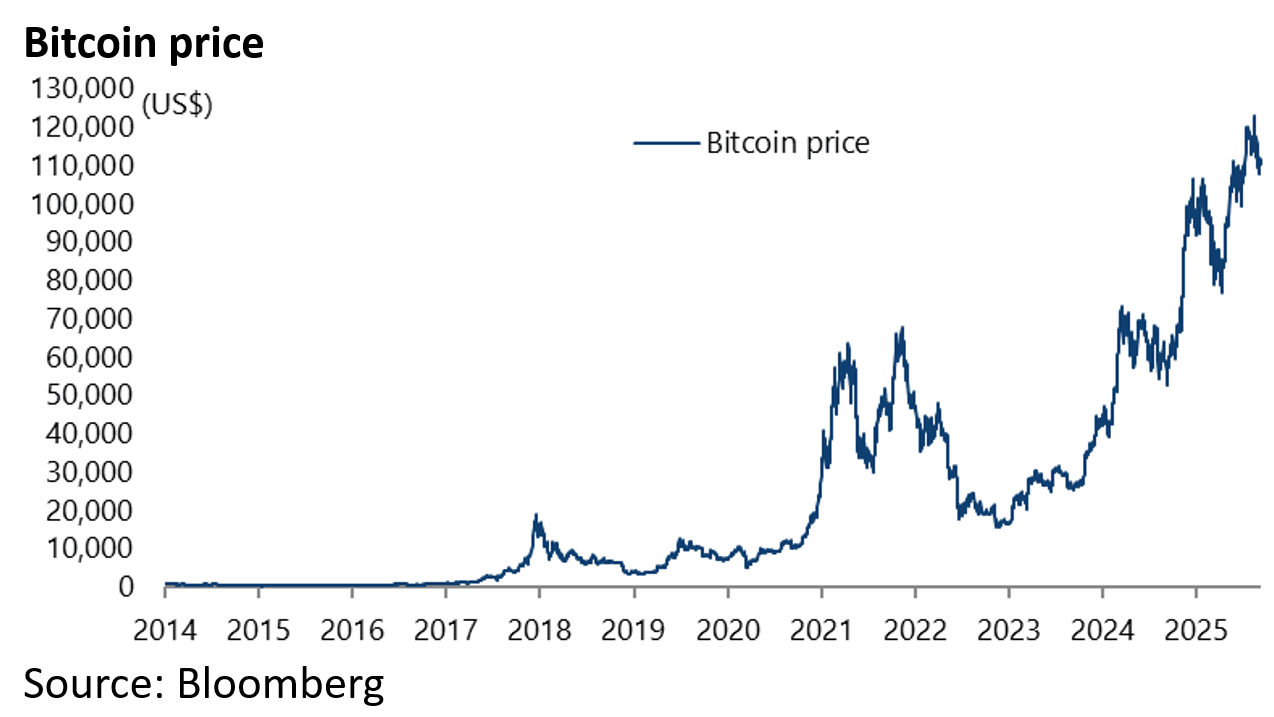

Meanwhile, the other positive for crypto assets is the already mentioned championing of stablecoins by the Trump administration as a way of funding America’s fiscal excesses.

Indeed the higher Bitcoin rises in price, and the prices of other crypto assets, the more it should create demand for stablecoins.

All of this presumably creates an incentive for the US Treasury to maintain the current reliance on short-term funding rather than risk upsetting the long end of the bond market by increasing supply.

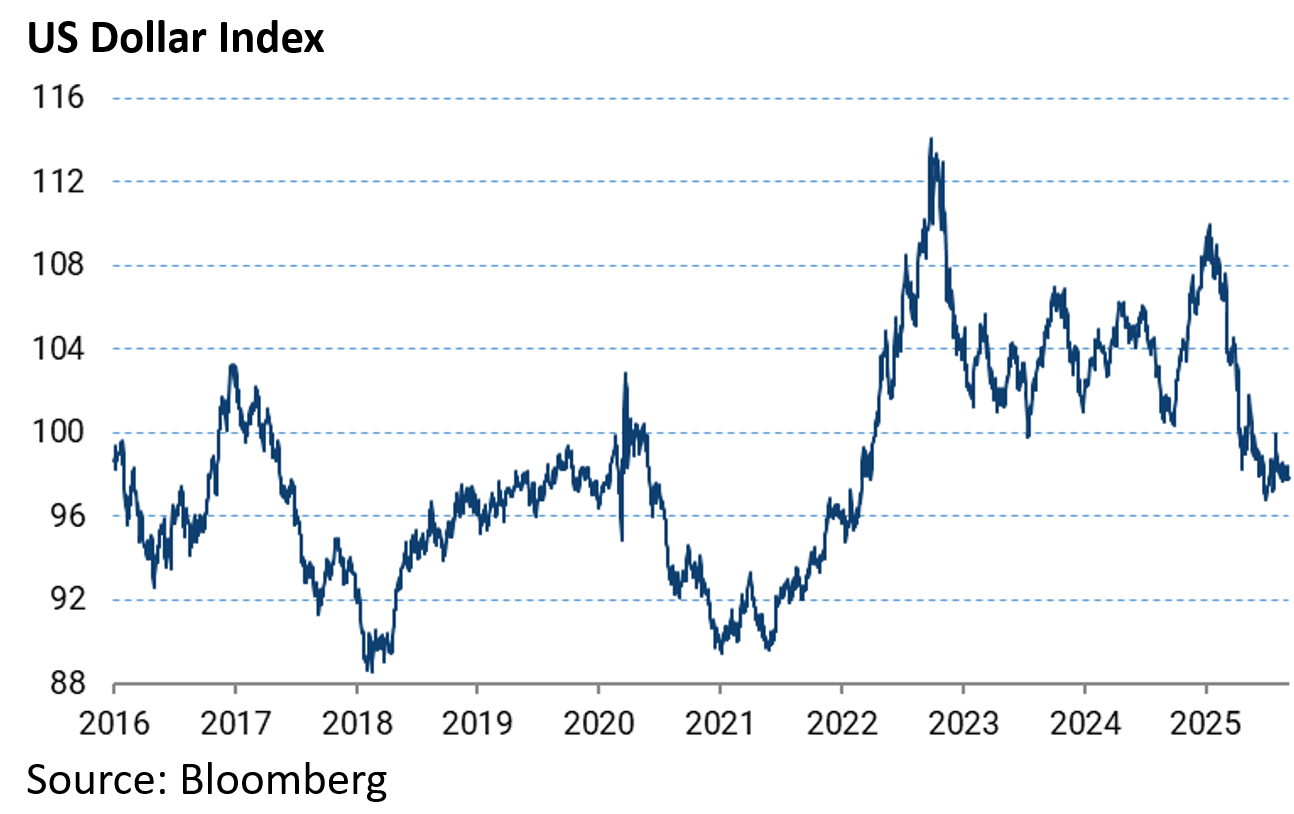

If all of the above is crypto bullish and dollar bearish, a weak US dollar is not such a problem for the US stock market.

Indeed it is a positive for many US companies’ earnings, including Big Tech.

Evaluating The Impact of Accounting Changes for CAPEX

The other recent positive for Big Tech, and in particular the hyperscalers, is changes in the accounting of capex resulting from OBBBA.

Thus, OBBBA makes permanent the 100% immediate expense of domestic R&D, while also allowing eligible short-life capex (such as servers and networks) to be 100% immediately expensed.

These deductions will have almost no direct impact on EPS but can boost near-term free cash flow by reducing the immediate tax burden.

When Do Rising Yields Matter?

Meanwhile the weak dollar only really becomes a problem for the stock market if the long end of the bond market revolts.

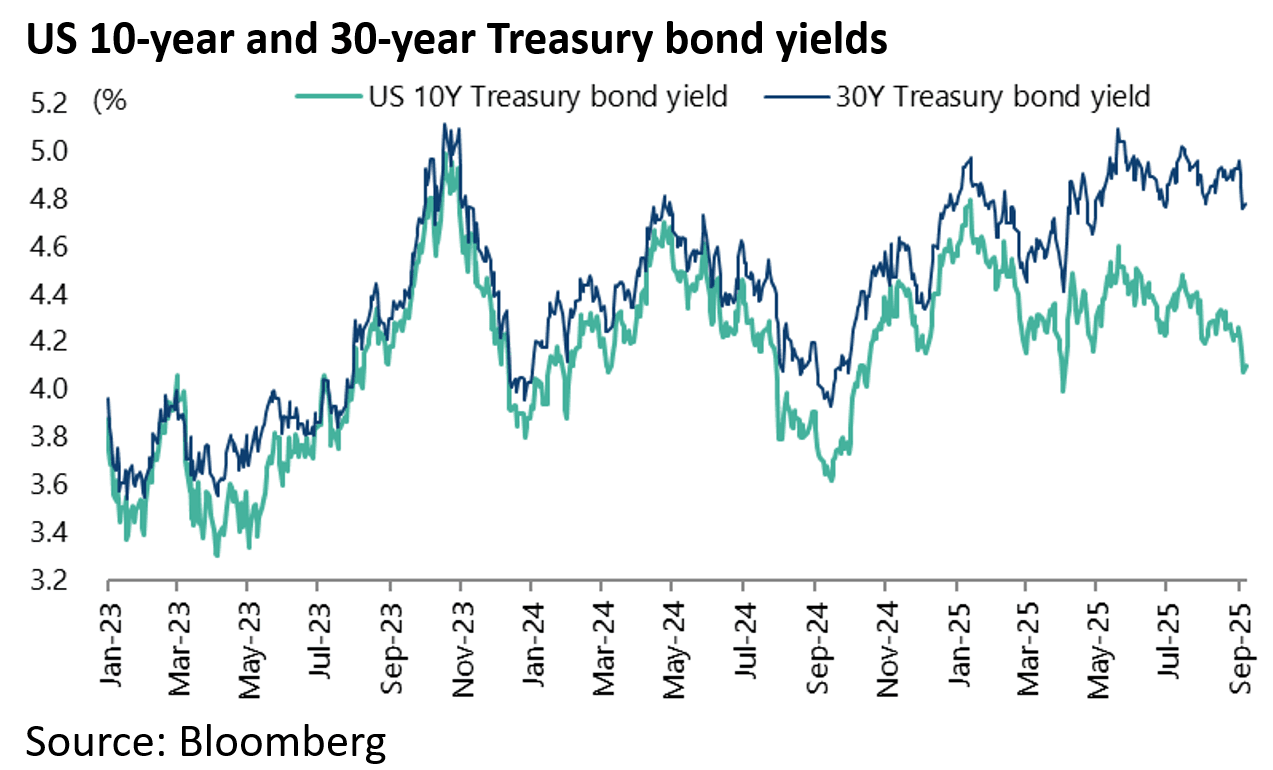

Still the 10-year and 30-year Treasury bond yields are now 53bp and 37bp below their recent high seen in May post Liberation Day which is a positive for the Trump administration, though they still in this writer’s view reflect a certain supply premium, especially the 30-year.

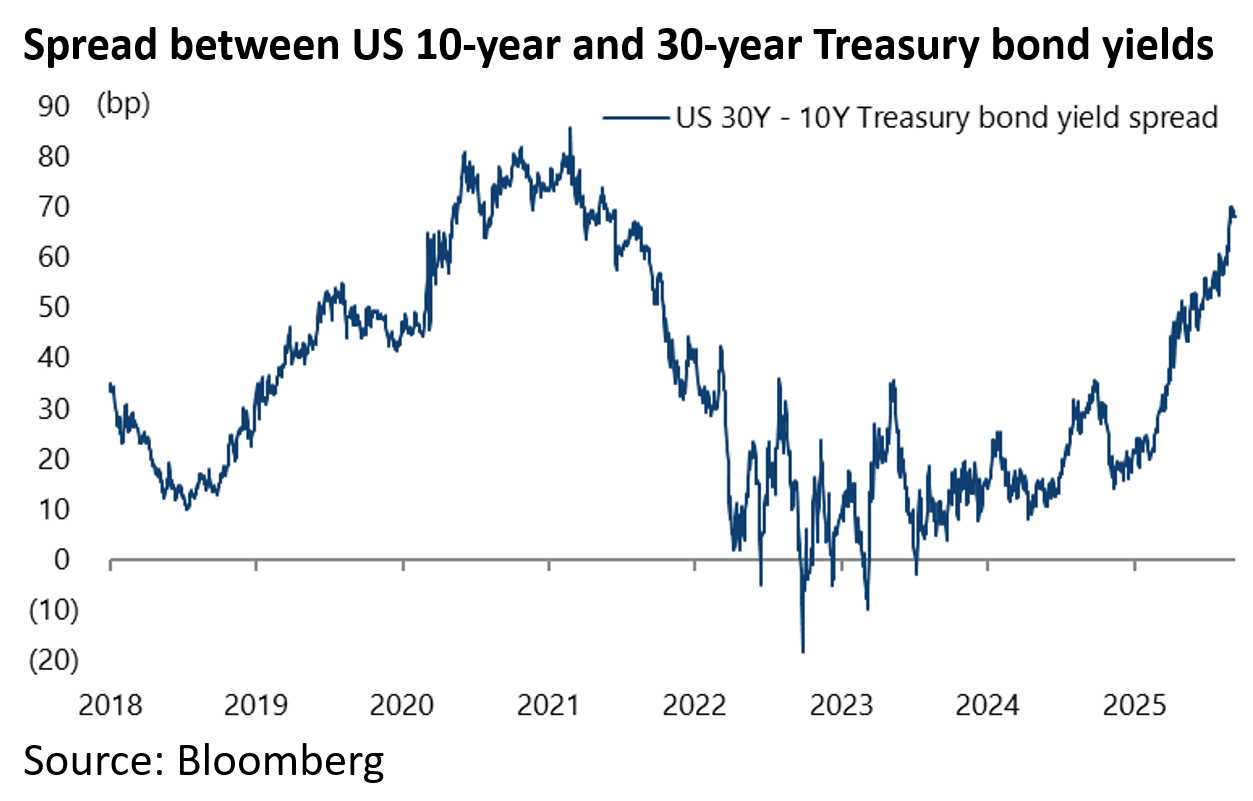

The divergence between the 10-year and the 30-year Treasury bond yields is now a wide 68bp after reaching 70bp on 2 September, the highest level since May 2021.

Is the Fed Leaning Towards Yield Curve Control?

It is also the case that it is not clear whether the 47th president understands that jawboning the Fed to cut rates risks triggering the opposite reaction at the long end of the bond market.

But that will certainly not have been lost on Treasury Secretary Scott Bessent.

On this point, it is interesting that former Fed governor and Fed chairman candidate, Kevin Warsh, publicly called in July for a greater partnership with the Treasury.

He said in an interview on CNBC: “We need a new Treasury-Fed accord, like we did in 1951 after another period where we built up our nation’s debt and we were stuck with a central bank that was working at cross purposes with the Treasury” (see CNBC article: “Kevin Warsh touts ‘regime change’ at Fed and calls for partnership with Treasury”, 17 July 2025).

Warsh was referring to the last period when the Treasury and the Fed combined to control the cost of funding the federal government.

Indeed the US had yield curve control between 1942 and 1951.