An Emboldening Trump is a Risk to Future Stock Gains

Author: Chris Wood

The US stock market continues to celebrate the AI capex trade while ignoring the tariff noise based on the TACO viewpoint, or what is otherwise known as the Trump put.

But it increasingly looks like the TACO trade has run its course as a positive factor for markets.

To this writer, the 47th president has been exhibiting growing self-confidence of late that the rallying stock market is sending the signal that his tariff agenda will not damage the US economy or indeed the global economy.

Or in other words that he should feel free again to indulge in his tariff obsession, which is clearly what has been happening.

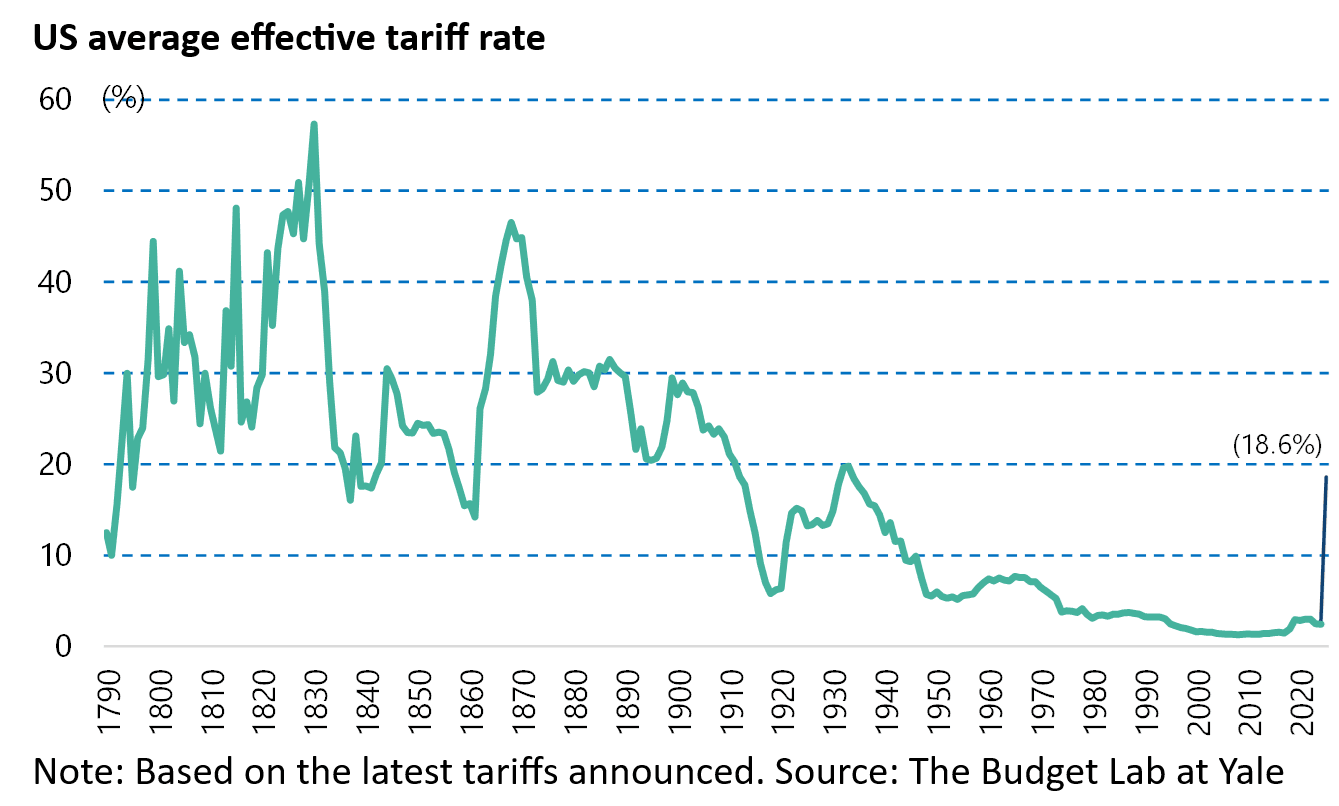

If this is indeed the case, then it is going to take a market correction to force him to back off again, just as was the case post-Liberation Day. It is also the case that tariffs are already high enough with the average effective tariff rate estimated at 18.6% by nonpartisan policy research center The Budget Lab at Yale, based on the latest tariffs announced.

This is the highest level since 1933.

It is surely the case from a market standpoint that it is only a matter of time before the negative impact of tariffs starts to show up in the data as existing inventories are depleted.

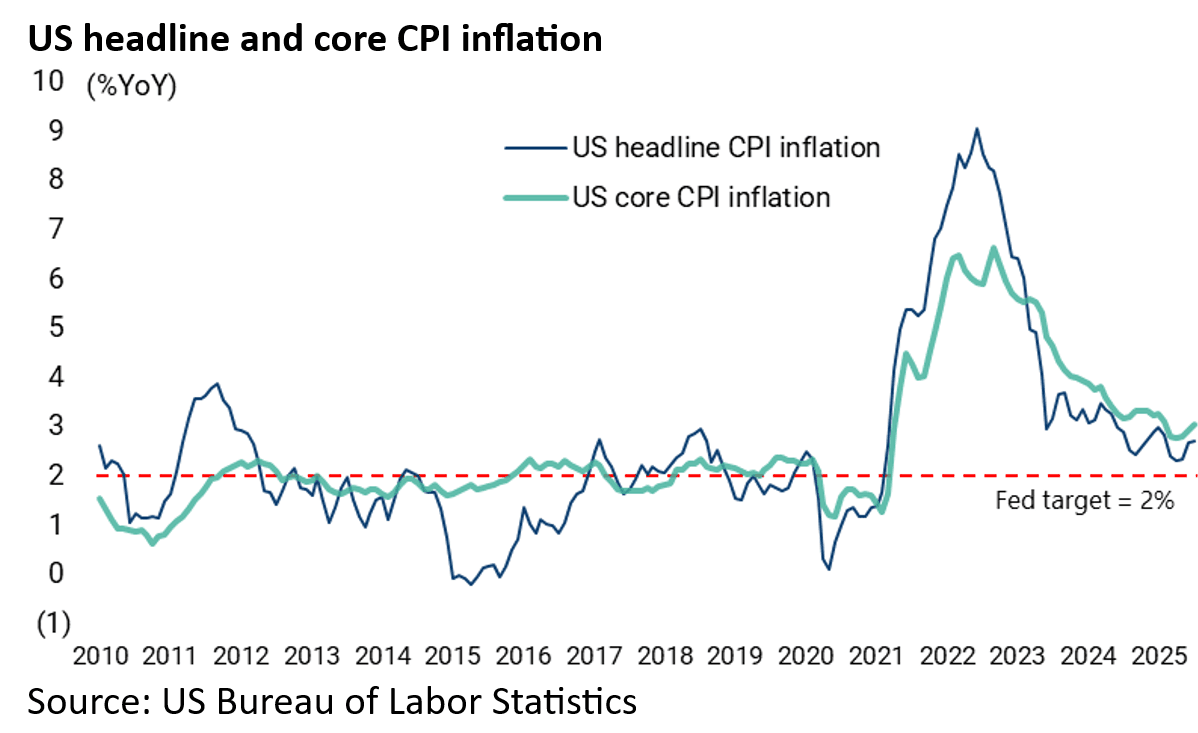

Indeed, this has begun to happen with the June and July CPI data. Thus, US headline CPI rose by 2.7% YoY in both June and July, up from 2.4% YoY in May, while core CPI inflation has risen from 2.8% YoY in May to 3.1% YoY in July.

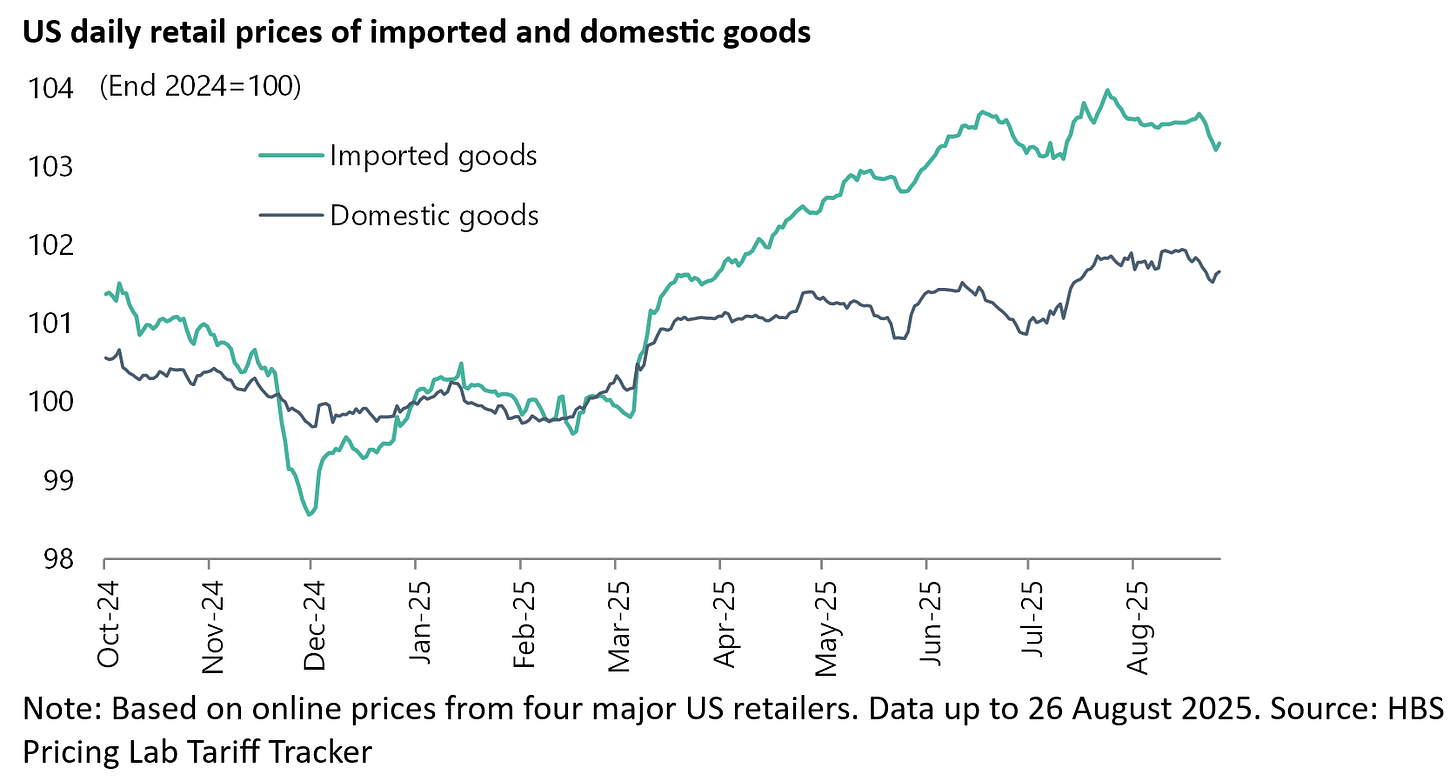

A more narrowly focused data point, namely daily prices charged by online US retailers, also shows rising prices of imported goods.

According to the daily retail price indices of prices from four major US retailers, constructed by HBS Pricing Lab, prices of imported goods have risen by 3.5% since early March, while prices of domestic goods are up 1.5% over the same period.

In addition to hard numbers, there is also the increase in uncertainty among businesses, which is the natural consequence of the ongoing negotiations regarding tariffs.

So the risk is that the market’s renewed confidence of late in the AI capex trade could cause Donald Trump to overplay his hand as regards tariffs.

Indeed, this could already have happened.

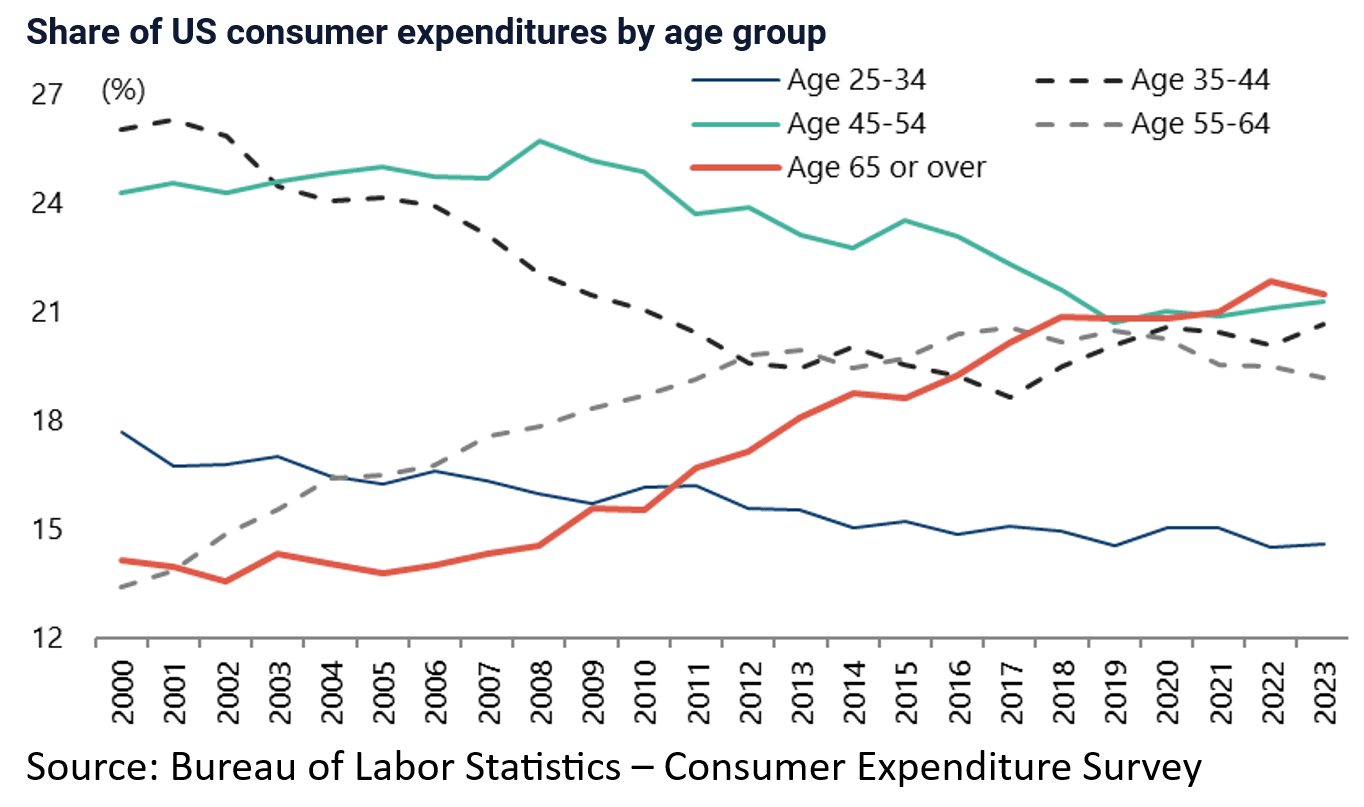

It cannot be stressed enough that tariffs amount to a regressive tax hike, though this will take longer to hit the overall American economy given the extent to which consumption has recently been driven by aging Baby Boomers who are now earning a positive real return on their money market funds.

Remember that based on the latest data, the over-65 age group accounted for 21.5% of consumer spending in 2023.

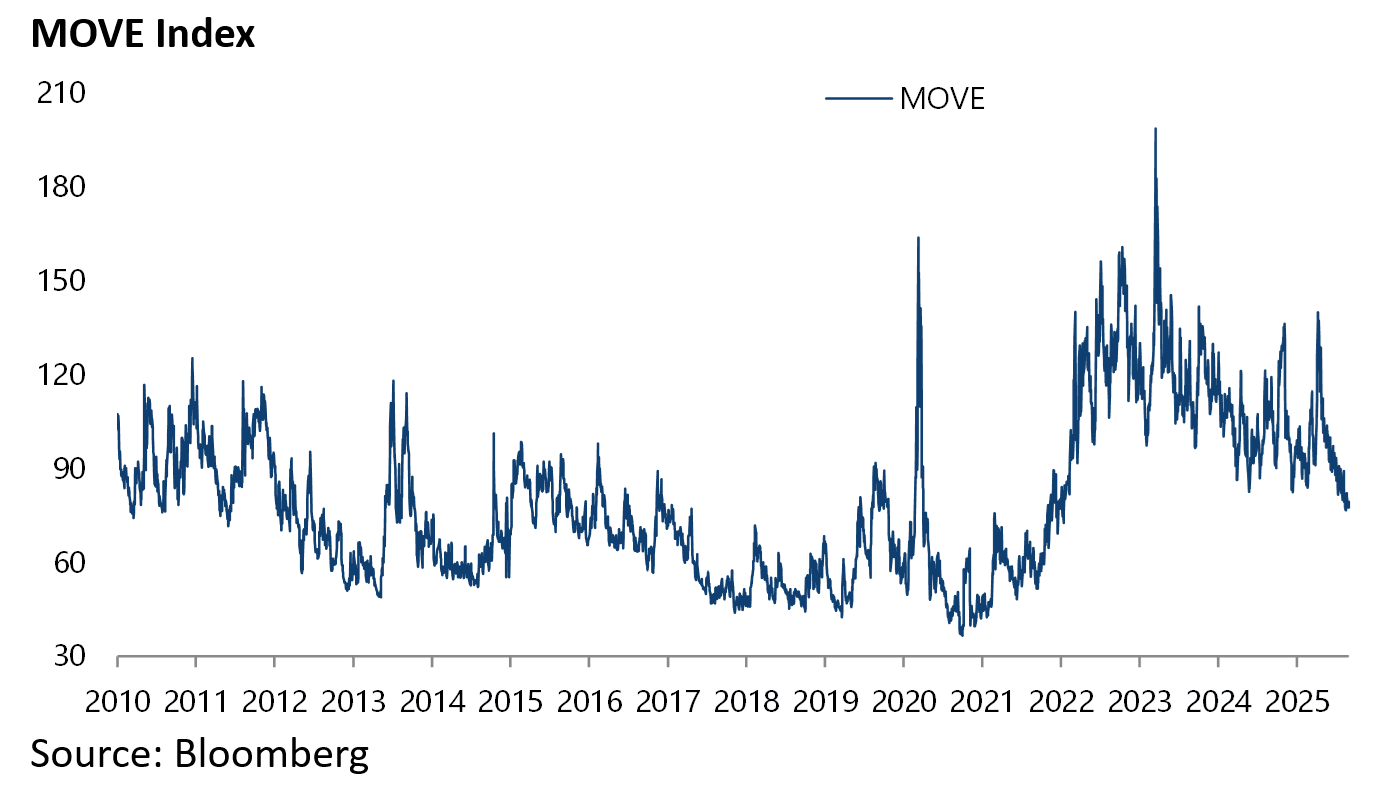

The Collapse in Treasury Bond Volatility is Good For Markets

Meanwhile, if it is the case that the recent stock market rally has been driven by the AI thematic, which has almost nothing to do with the Trump policy agenda, it is a positive for the stock market that the 10-year Treasury bond market has been behaving of late with a collapse in volatility.

The so-called MOVE index, which measures implied Treasury bond market volatility by tracking a yield-curve weighted basket of options, has declined by 43% from a recent high of 139.88 on 8 April to 76.66 on 15 August, the lowest level since January 2022, and is now 79.39.

Trump Misread Putin

If Trump is demonstrating overconfidence as regards the impact of his tariff agenda, the same applies to the pivot in July as regards Vladimir Putin.

The American president has been clearly upset that what he thought was a special relationship with the Russian leader has not resulted in a ceasefire deal as regards the conflict in Ukraine.

In this writer’s view, such a hope was always unrealistic, since Putin has been entirely consistent on what Moscow’s demands are in terms of any peace deal.

That is that it will agree to a deal very quickly on Ukraine based on four non-negotiable positions. First, acceptance of Ukraine’s neutral non-bloc status (i.e., that it will never join NATO).

Second, a cessation of all Western arms shipments.

Third, a recognition of the new territorial reality (i.e., that the four regions now occupied by Russian forces in eastern and southern Ukraine remain in Russia).

Fourth, that Ukrainian troops completely withdraw from all these territories.

The risk now remains, despite the recent meeting between Trump and Putin in Alaska, that Trump’s personal pique results in Ukraine getting more offensive US weaponry which would allow for a meaningful escalation in terms of attacks on the Russian heartland and the resulting increased risk of World War III.

China and Europe: Changes are Afoot

Meanwhile, the US decision in mid-July to allow Nvidia to sell its H20 chips to China looks like a clear victory for Beijing’s strategy of linking the rare-earth issue with US semiconductor controls.

It is also testimony to the diplomatic skills of Nvidia CEO Jensen Huang, who was in Beijing in mid-July meeting with Chinese Vice Premier He Lifeng.

Amidst all the Trump-triggered news flow, it also would have been easy to miss the latest sign of changes afoot in Germany.

That is a reported pledge by a group of German blue-chip corporates that they will invest €300bn domestically through 2028, equivalent to nearly 7% of national GDP. Still, the pledge is conditional on structural reforms.

The corporates are, quite sensibly, demanding regulatory streamlining, tax incentives, and increased labour market flexibility (see Reuters article: “Germany Inc weighs joint push to boost investor confidence, sources say”, 8 July 2025).

It will be interesting to see if the CDU-led coalition government can deliver.

Certainly the trading partners are feeling the downturn.

Sad to see all the Walmart closures.

More bad news to come with increased prices and costs for companies.

The uncertainty is the worst. No one can plan their budgets.